Well, it was another very slow mortgage month out there - and don't just blame it on the winter.

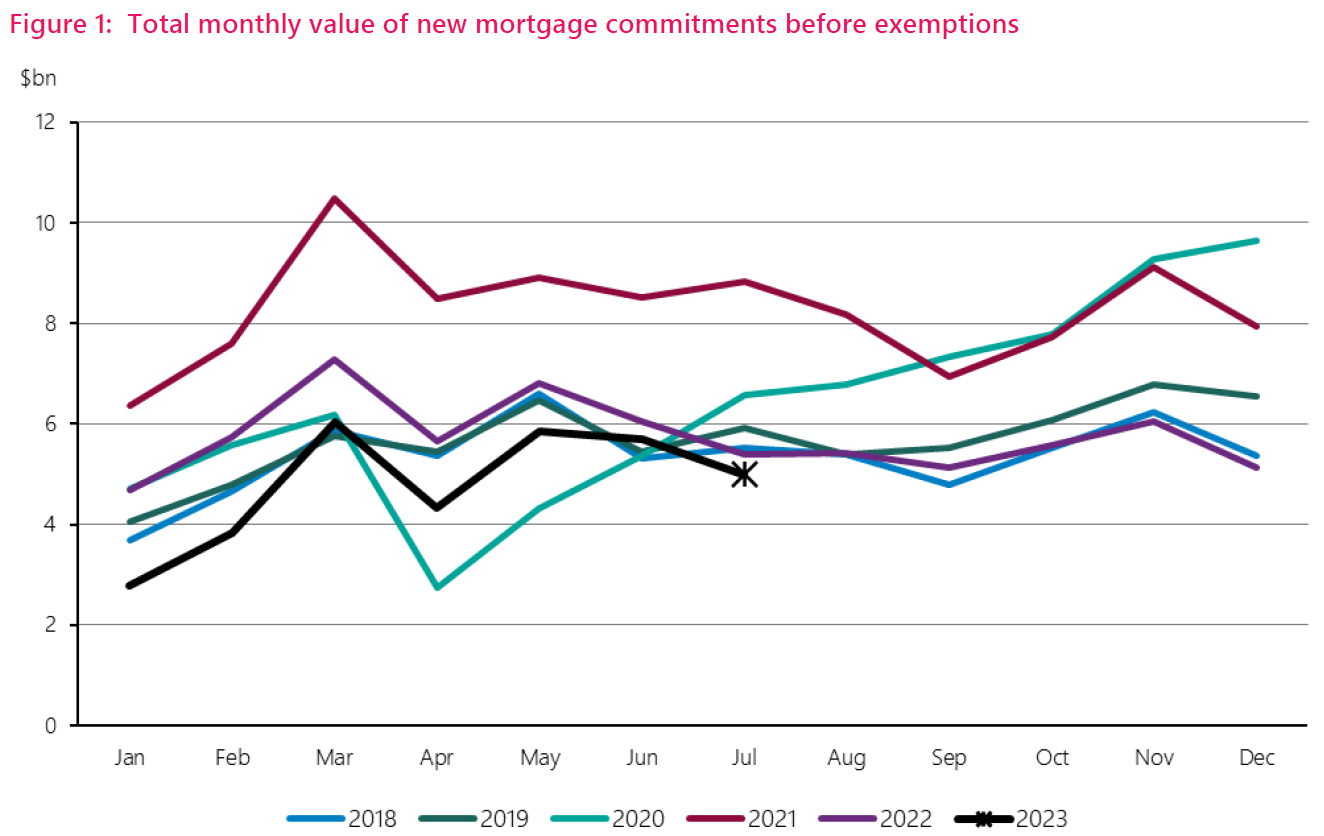

According to the Reserve Bank's July figures for new mortgages, total mortgage monies advanced during the month dipped under $5 billion ($4.997 billion to be precise).

This made it the slowest July month for mortgages since 2017.

The amount of mortgage money advanced dropped from $5.686 billion in June 2023. And while you might imagine it would be typical for the amounts to drop between the month of June and July - in fact the history of the RBNZ data going back to 2014 shows that the figures have actually risen in July from June more often than they have fallen.

And according to the RBNZ, on a seasonally-adjusted basis, the July figures this year were down some 8% on those for June 2023.

Compared with a year ago the latest July figure was down about 7.5% from the $5.402 billion in July 2022 and down a thumping 43.3% on the $8.818 billion in July 2021 when the pandemic housing frenzy was still on.

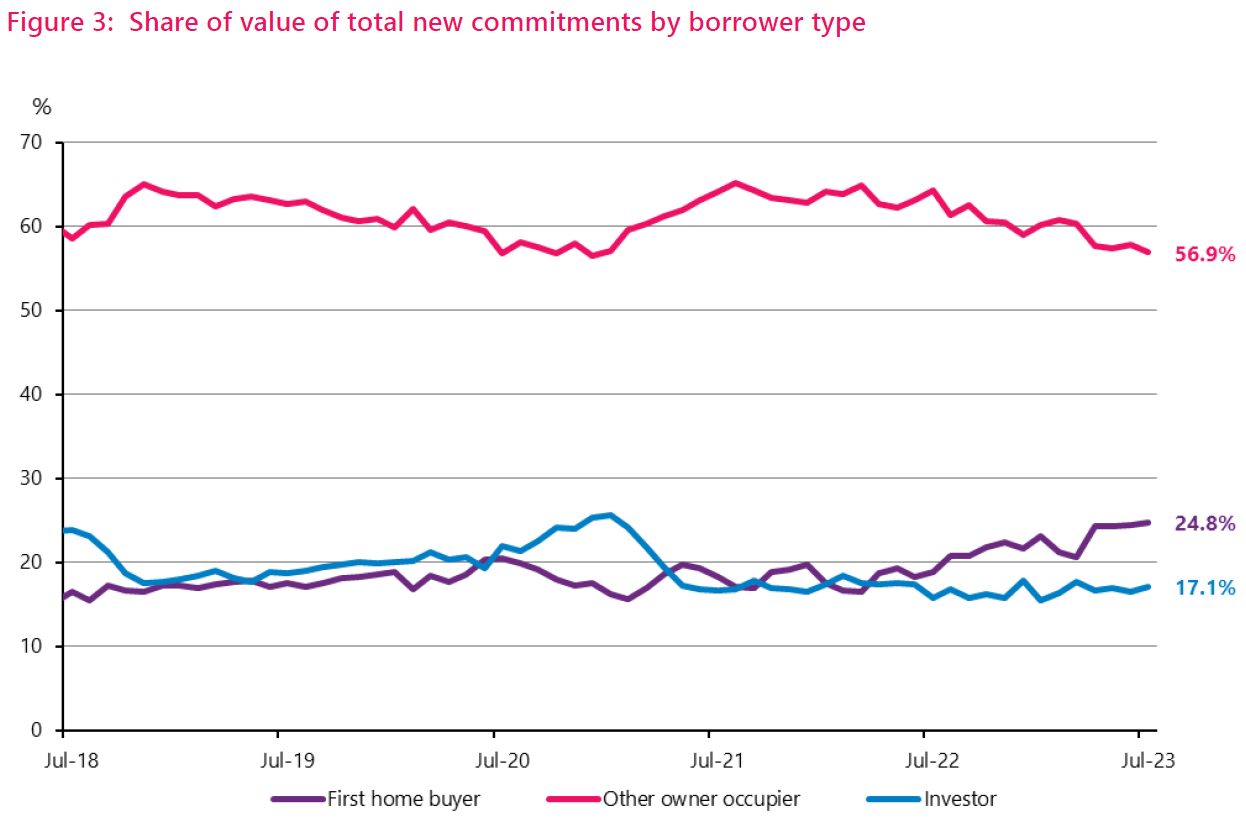

But the fire still hasn't gone out for the first home buyers (FHBs), who again hit a new record high (in a series dating back to 2014) in terms of their monthly share of the spoils.

The $1.238 billion borrowed by the FHBs in July 2023 accounted for a fresh high water mark of 24.8% of the total monies advanced, up from 24.4% in the previous month, which was the previous record.

Investors borrowed $854 million in July, which accounted for 17.1%, up from 16.5% the previous month.

The RBNZ said there were 13,795 new mortgage commitments by NZ registered banks in July, down 11% from 15,498 in June. In comparison to July 2022, the number of new mortgage commitments fell by 3.2% from 14,251.

The average value of new mortgage commitments across all borrower types fell to $362,200 in July, down from $366,900 in June.

The average value has fallen 4.4% from $379,100 in July 2022.

However, the average value for first home buyers was $562,500 - and that was up from $556,000 in July of last year, although down on the $566,000 figure for June 2023.

26 Comments

More of those," Tony the comb," green shoots spouting 💪✔️👍💥🤙

Good to see the FHB share exceeding investors for the past couple of years. Up until 2017 investors outnumbered FHB 2 - 3 x.

E.g. in 2014 the average monthly drawdowns for FHB were $488m. Investors $1.4m.

- 2015 : $600m vs $1850m.

- 2016: $734m vs $1805m

It helps when the Govt (a) grants permanent residency to 200,000 people simultaneously, turning them into FHB and (b) underwrites 5% deposit FHB with a Govt guarantee of the mortgage including all those immigrants with newly acquired PR.

But that's not entirely true. The monthly average number of FHB borrowers in 2020 was 2500,

- 2021 = 2700,

- 2022 = 1987

- 2023 = 2007

So there's no "uptick".

Imagine what the numbers would look like if you removed the 60% of FHB that are newly minted permanent residents (see my comment below for source)

Total number of 2021 Resident Visa applications

Total applications received 106,449

Total number of people included 217,682

Applications approved and visas issued 101,690

People approved and issued visas 206,635

Declined applications 476

The 2021 visa application only start gain residency since mid 2022 and then it was only around 10k people per month. There is around 10k left to process.

2023 is still in progress

The vast majority of immigrants are coming from China India and the Phillipines, and they are not wealthy (why would they move here if they were). Top professions include construction and aged care.

How many Chinese labourers and Philippino nurses can afford a house here? Very few.

Add in rampant migrant abuse and I am pretty confident they are not house buyers

Most of them send money back home and don’t buy houses. Just look at the sad case of the Vietnam man killed in car crash a couple of days ago in nz.

Not actually true. They do have money. And if they don't they just use the FHB Govt scheme with a 5% deposit.

"Kiwi Mortgages mortgage adviser Jatinder Singh has also seen an uptick in new residents accessing the First Home Loan. “Most of the new residents who recently got their residency are actually buying a lot of houses,” he said.

“I don’t say that no one [citizens] is buying, yes there are a few, but if you are talking about the ratio then yes the ratio for resident visas are buying more first homes than the citizens.”

Harcourts Mount Roskill business owner Nick Kochhar says that of the first-home buyers active in his area, more than 60% would be new residents with First Home Loan approvals.

“For them they are realising this is the next step, we are already here, we already have residency – what else, what’s next.”

They usually have between $800,000 and $1 million to spend and favour new-builds in West Auckland and South Auckland, he adds."

https://www.oneroof.co.nz/news/first-home-loan-scheme-is-open-to-abuse-…

Which Chinese 'Labourers' are gaining residency here? Under which visa category specifically?

Jacinda Ardern granted permanent residency to everyone who was on a temporary work visa in NZ in 2021. There was no requirement that you be a skilled worker. Over 200,000 people gained permanent residency.

Most only starting gaining residency 12 months ago and it is still ongoing. About 10k left to process and that is only from the 2021 visa application process. There will also be the regular process applications on top of that

I know quite a few Filipino and Chinese immigrant families who have bought houses, but usually it takes them about 5 years give or take to get there. So there's probably a lag effect going on.

Good let's stop feeding those fat cat bankers

Remember the scene in 'The Big Short' where they interview the ex-bartenders turned mortgage brokers?

America is in the midst of a housing affordability crisis, and saving for a down payment is one of the biggest barriers potential home buyers face. That’s why Zillow Home Loans is supporting eligible home buyers with its new 1% Down Payment program. Borrowers who qualify can now put just 1% down on a home, and Zillow Home Loans will pay the other 2%. The program aims to reduce the time some potential home buyers need to save and opens up the possibility of homeownership to those who are ready to take on a mortgage.

https://www.zillowgroup.com/news/zillow-home-loans-new-1-down-payment-o…

So Zillows are some kind of building society ?

who use money already in the system and finance homes instead of 'creating new money ' ?

Zillow originally set up as a digital solution to the real estate industry. It's well know in the U.S. It has obviously moved into financing.

So much for the FHB holding off for now, I guess they don't come here for the DGM's advice.

.. they have been fooled by the green shoots mantra .. cant say they weren't warned ..

Wow. Ticket clippers all looking very stressed as transaction volume plummet, hence the mass media about its all good now. Even the banks are complaining about volume. Sellers double down on greed with the standoff. Buyers retreat further with every rate rise wether they want or not.

Meanwhile the cost of everything is going up, as the dollar continues to weaken. This further eroding buyers borrowing ratios. Wait while the weight of leverage drives assets to the point of logic. Stagflation.

Who can bail out the speculative and...at what price?

This means existing customers are going to be the stuffee's, if you can't refinance then just watch your mortgage rate creeping higher and higher. You my friends are going to help the banks hit target and get paid and there is nothing you can do about it.

5 billion per month at 7% that 350 million per month interest. The banks love this but for those will million dollar mortgage’s rather than 40 k interest per year on 4% now 70k interest at 7% are people now waking up.

Well actually the banks aren't loving this as they are struggling to keep rates low enough to be competitive, but high enough to attract deposit/investment and make significant returns. Hence the raises from ASB, then ANZ and Westpac this week. Their return above wholesale rates is diminishing. Unless you mean central banks, yea they're loving it!

But if you look at most normal savings rates at banks, they are still very low, and many haven't been increased in line with the OCR. I remember prior to the GFC, online call rates with some banks were up to 8% and were often higher than TDs, but currently they are a good 100 points below TD rates.

Looks like MOFO FOMO got bounced. These types pop up every now and again. Burn hot and get extinguished. Oh well, good riddance. It's a shame because some of his opinions were good.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.