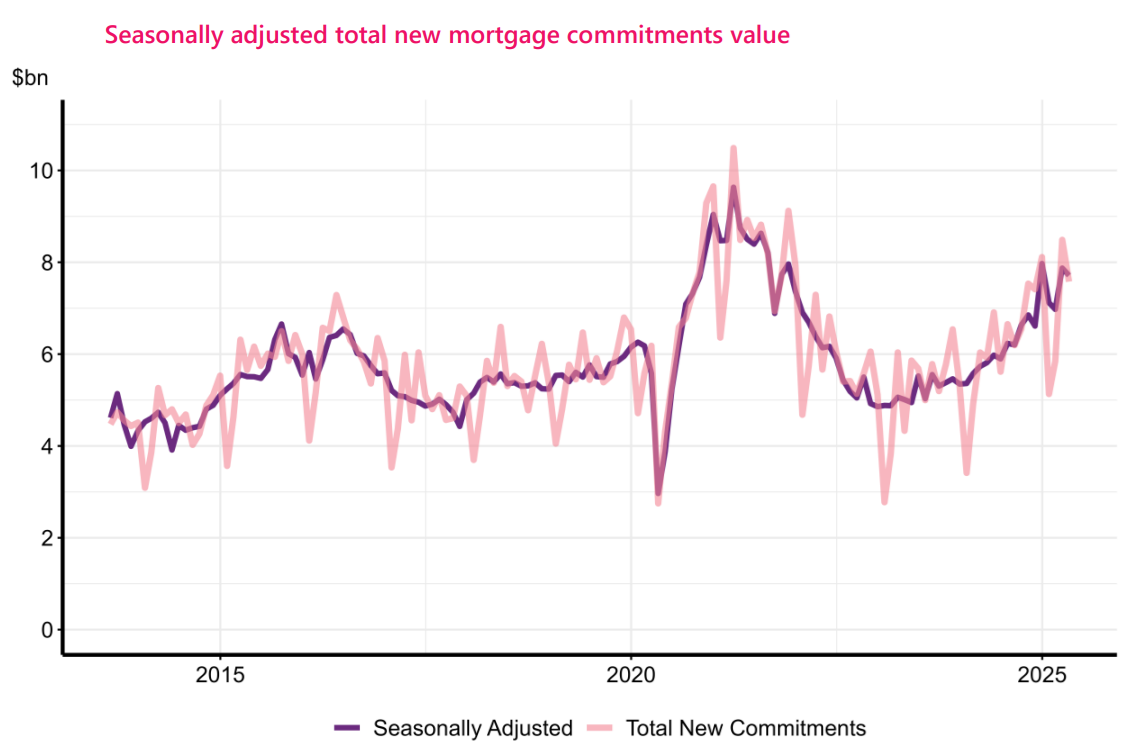

New mortgage commitments dropped slightly on a seasonally adjusted basis last month, according to the latest figures from the Reserve Bank.

The actual figures for total commitments, at $7.579 billion in April were well down on the $8.488 billion for March, although with summer housing season coming to a close that is to be expected.

However, the RBNZ says the figures, after adjustment for seasonal variation, were still down by 2% compared with the previous month.

Generally in recent times the monthly activity has been increasing.

But while the pace of new mortgage commitments might have taken a bit of a breather in April in seasonally adjusted terms, the actual figures were, nevertheless, the highest for an April month in four years.

And the April 2025 tally was 28% higher than the $5.919 billion of commitments in the same month last year.

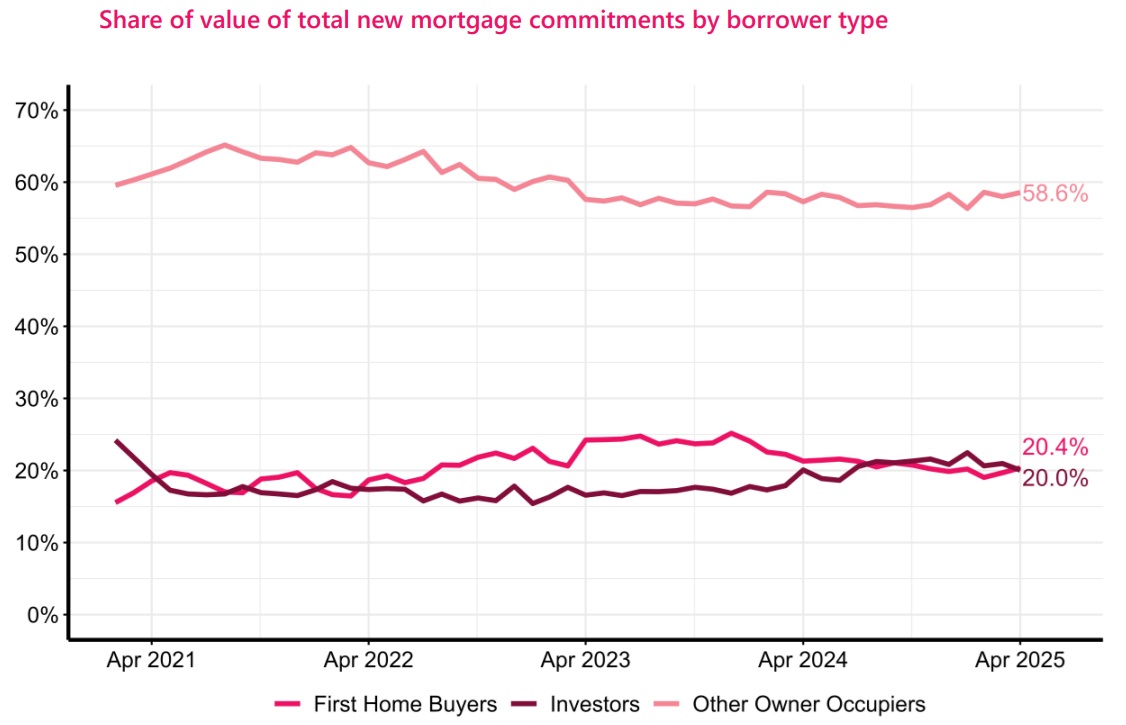

The first home buyers (FHBs) have been the most resilient part of the market in the past four years and they increased their share of the total commitments in the last month to 20.4%, up from 19.7% in the previous month.

The $1.543 billion borrowed by the FHBs in April was down 7.6% on the amount borrowed by this grouping in March. However, if we look at the overall figures not including FHB commitments, these figures were down 11.5% in April from March.

Additionally, if we look at the RBNZ's separate mortgage lending by purpose figures, we can see the total of mortgage commitments in April that was specifically for buying a property was $4.739 billion. So, making the assumption that all of the $1.543 billion borrowed by FHBs was for buying a property, this means the FHB's borrowed 32.6% of amount that was borrowed for this purpose, up slightly from 32.4% in March.

In addition, using the same assumption, the number of mortgage commitments by FHBs, at 2695 in April, made up 34.1% of the 7903 total commitments that were for buying a property. And that percentage for the FHBs was up from 33.3% in the previous month.

Notably also, the FBHs borrowing figure surpassed the amount borrowed by investors for the first time in April since July 2024.

The investors borrowed $1.519 billion in April, which was down on the $1.779 billion this grouping borrowed in March. The percentage of the total borrowed by investors dropped to 20.0%, which is actually the lowest percentage taken by them since June of last year. And the latest April percentage is also very slightly down on the 20.1% the investors took in April 2024.

In terms of the mortgage 'by purpose' figures, the $4.739 billion specifically for buying a property made up 62.5% of the total in April, up from 60.7% in March.

Changes of loan provider have been a big thing in the past year. However, the $1.744 billion of new commitments for this purpose in April made up just 23% of the total, down from 24.8% the previous month.

We'll still be keeping an eye on these particular figures in coming months though, as some $150.161 billion - just over 40% of the mortgage pile - was, as of March, up for an interest rate reset by the end of September 2025. That's about $25 billion worth of mortgages every month up for a reset, which is a lot.

In addition, $48.33 billion of mortgages was on floating and so could be reset at any time as well. Which means that nearly $200 billion, just over 53% of the total mortgage book, could have an interest rate reset - at lower rates - by September. And if all of that was reset, it would work out at well in excess of $30 billion a month - so plenty of scope for change of loan providers.

1 Comments

Stagflation tightens its grip. All the vested interests doing their best to keep the price not supportable by income as intact as possible. Heartland bank have already closed their residential loan book and refuse renewals. This is limiting/removing residential risk profile for their shareholders.

Popcorn.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.