Many people taking up a mortgage in September clearly had October on their minds.

Latest Reserve Bank (RBNZ) figures showing mortgages that were uploaded in September paint a clear picture of a lot of people wanting to see what the RBNZ would decide to do with the Official Cash Rate (OCR) on October 8 before deciding to commit themselves to a longer term mortgage.

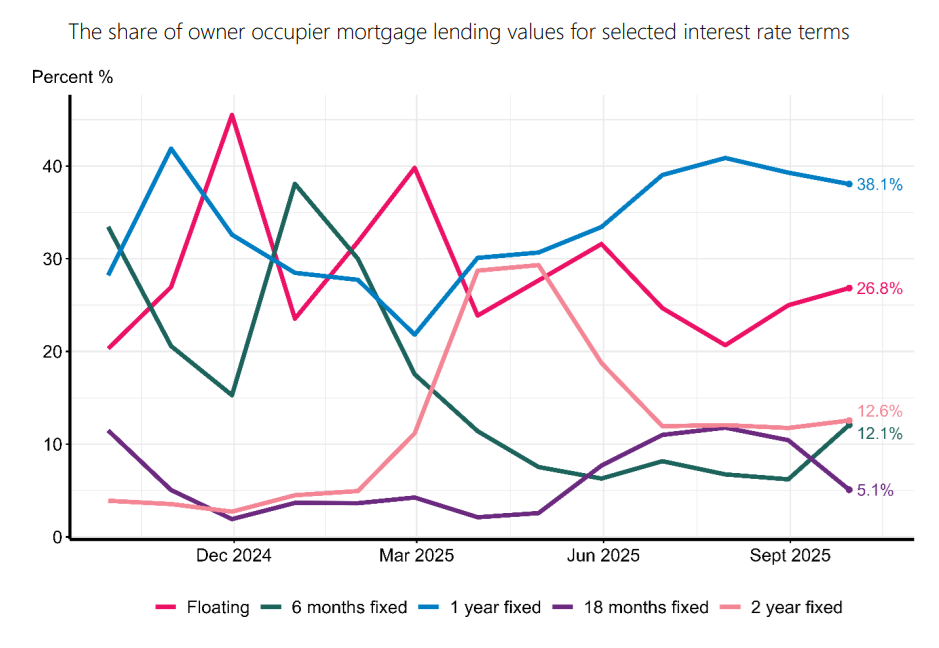

Looking at the owner-occupiers, there was $5.448 billion worth of mortgage money taken up in the month.

Of that $1.462 billion (26.8%) was on floating - up from 25% the previous month. Some $658 million (12.1%) was fixed for six months - and that percentage was up from just 6.2% of new owner-occupier mortgage money the previous month.

The most popular option for owner-occupiers remained the one-year fixed rate, with $2.073 billion (38.1%) on that term, down from 39.3% in August. The one-year fixed term has been the most popular now for the past seven months. Before that, in February, it was a big month for floating rates, with nearly 40% going on that option then.

According to the RBNZ's highlights summary of the September figures, 77% of new owner occupier mortgages were on terms of one year or less.

The RBNZ itself has actually cited the desire of home owners to wait for interest rates to drop further - and therefore staying on higher rates such as floating - as a reason why there has been a relatively slow transmission of OCR cuts into the economy.

In the event, those taking out mortgages in September with eyes on the October OCR were rewarded with a jumbo 50 basis point cut, taking the OCR down to 2.50%. Financial markets are now fully pricing in the prospect of another 25 point cut to the OCR in the last review of 2025 on November 26.

And what have the investors been up to?

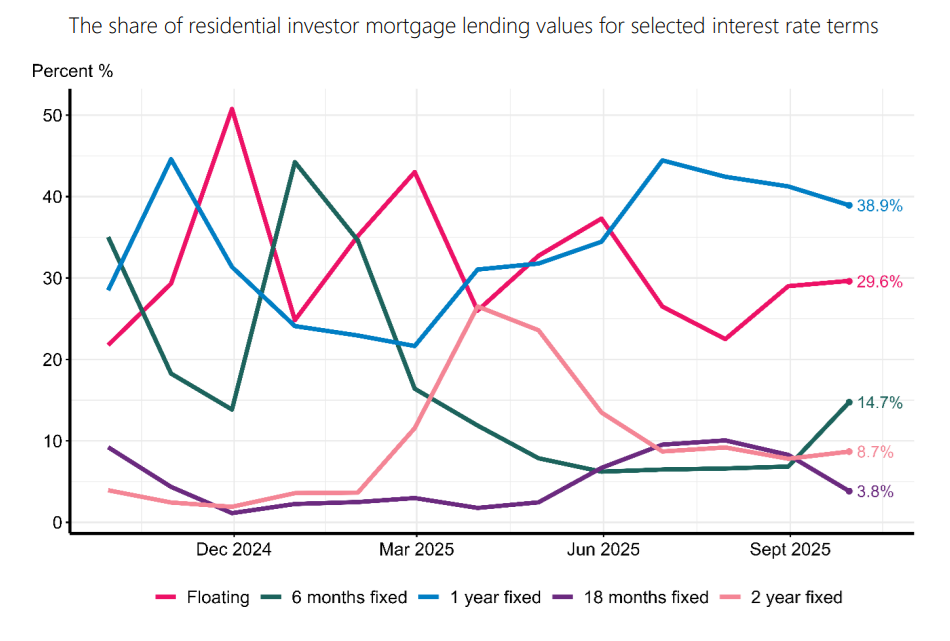

Well, pretty similar pattern.

Most popular term was, like for the owner-occupiers, the one-year fixed term, which accounted for 38.9%, down from 41.2% in August.

Floating terms accounted for 29.6%, up 29.0% in August. And investors also took a renewed shine to six-month terms, with the share of that moving up to 14.7% from 6.8% in August.

The RBNZ notes that in September 95.9% of investor new lending was on floating or at fixed rates of shorter duration than two years.

So, there we go. That's our home owners again showing a willingness to wait for what they see as the best (lowest!) deal.

With the likelihood that the OCR cuts are now finally coming near to the end, it will be interesting to see what sort of options are favoured by those taking out mortgages over the next few months.

5 Comments

It’s highly unlikely that mortgage rates from 2 years out will drop further from here unless 1 of 2 things. Banks start competing hard for business Or the economy drops into another funk and the cash rate needs to go lower than 2%. However in this scenario even if it did wholesale markets will price in a stronger recovery meaning the curve will steepen to compensate. So I’d hazard a guess VERY little downside to mortgages from here.

A few have said that over the last year or so and been wrong. But I agree though as the economy has now surely turned the corner, I don’t actually see them cutting next meeting, and if they do it will be 0.25 and done.

Once you get towards the end of the cycle it depends more as you go longer term on how the wholesale markets price things. As we go lower markets tend to price in a stronger recovery so that means expected higher rates later on. The average of this pricing means that every move down in cash tends to push expectations up by as much in the future so the net result is negligible when talking about term rates. So it’s not really about where cash goes now unless like I mentioned there’s another genuine downturn and cash had to go much much lower

With the likelihood that the OCR cuts are now finally coming near to the end, it will be interesting to see what sort of options are favoured by those taking out mortgages over the next few months.

The only consistency over the last few years is how wrong most predictions have been. It's still an environment where anything can happen. Sub 4 mortgage rates are still a possibility. All bets are off.

Do those graphs factor in split mortgages with different portions with different time fixes as a portion of the aggregate mortgage data?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.