Well, house prices might not have moved much this year due to the abundant supply for sale - but it doesn't mean there hasn't been demand as well.

A crunch of the Reserve Bank (RBNZ) loans by purpose figures for the first nine months of this year show that the banks' mortgage pile is set to grow by easily its biggest amount this year since the pandemic splurge of 2021 when the amount of outstanding mortgage money surged by an astonishing $30 billion, a growth rate of $2.5 billion a month, or well over half a billion dollars a week.

After this massive pile-on came a perhaps inevitable pull-back, with the mortgage pile growing by only about $38 billion over the course of the next THREE years, including a 2023 low in there of about $10 billion.

For the first nine months of this year the bank mortgage pile has grown by $15.203 billion (to a grand total of $379.302 billion by the end of September 2025).

As some means of comparison, in the first nine months of 2021 the mortgage pile grew by $23.3 billion, while in the first nine months of 2024 it grew by just $9.3 billion and for the first three-quarters of 2023 by only $7.8 billion - so, the growth rate so far this year is close to double what we saw two years ago.

The participation, or non-participation, of investors has been a big part of the story.

In the second half of 2020, with the RBNZ having removed the loan to value ratio (LVR) limits, investors grew their share of the mortgage pile by $5.28 billion.

With the subsequent reinstatement of the LVR limits and with air escaping from the housing market bubble during 2022, investors very much took a back seat. Some months their share of the mortgage pile actually fell.

In 2023 just $340 million was added to the investors' mortgage pile.

However, by last year things were on the move again and the pile increased by over $3 billion.

And for the first nine months of this year, investors' share of mortgage money has increased by $5.2 billion to $98.672 billion as of the end of September. It seems a reasonable bet that the $100 billion mark will be reached by the end of the year.

As the RBNZ noted in its highlights summary of the September month, total housing lending stock increased by $1.8 billion (0.5%) in September 2025, down on the $2 billion (0.5%) increase recorded in August.

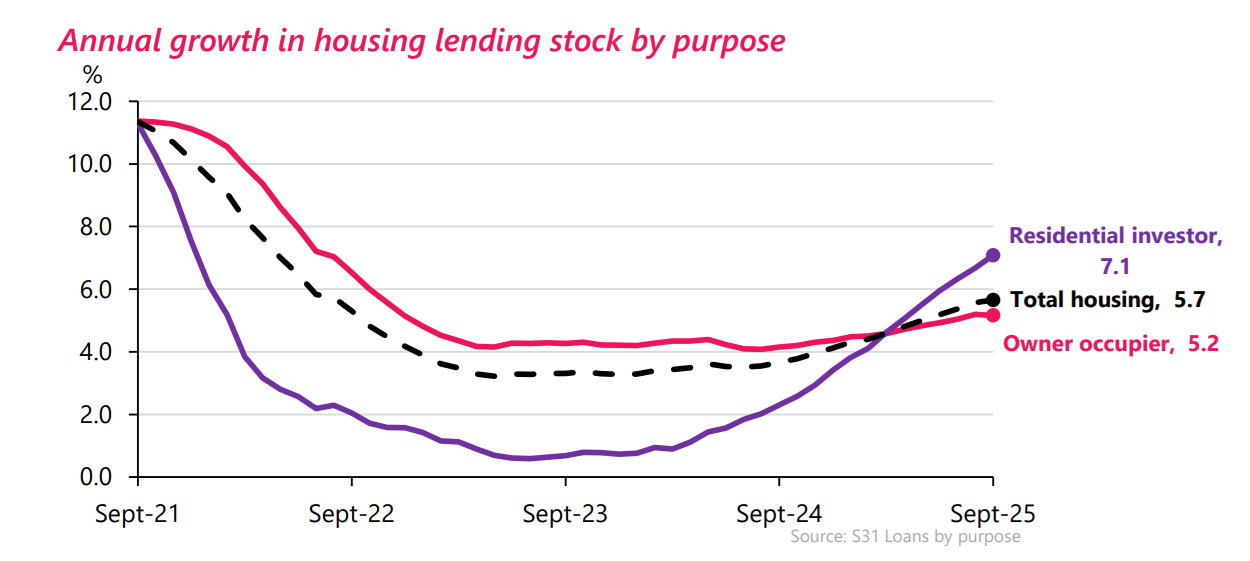

The annual growth rate increased from 5.6% to 5.7%, marking its highest rate since August 2022. Owner occupier lending increased by $1.1b (0.4%), while residential investor lending increased by $699 million (0.7%).

While the overall growth rate of the mortgage pile stands a 5.7%, the investors are actually outstripping that with 7.1%.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

27 Comments

Anyone hazard a guess as to the impact of the potential CGT on the residential investor curve? i.e. impact of the threat of CGT...regardless of whether it happens or not.

Close to zero, but not quite.

Residential investors are price takers.... the yields are so low they need capital gain or subdivision or some kind of value add to make decent returns. Its why low interest rates are not making much impact. It hardly moves the needle compared with prices gong up.

Thanks for your reply. So given prices net of inflation are going down for most of NZ why is the % of investors increasing?

Well the CGT has only being announced this month, its has had no impact on the past LHS of the chart, IMHO on the RHS the impact of CGT may well lower the rate of increase next read, or it could have just reached a steady state anyway.

It would be interesting to see what the composition of the "investor" mortgages looked like (ie small new builds vs subdividable) % in each quartile. As clearly a small new build has zero ability to generate much more then average yields, and you are the mercy of the environment to get any capital gain.

I suggest an investor mortgage is better then an OO as its interest is tax deductable.

If I owned a section i would want that owned as an investment, well would have before CGT maybe now I want to reconsider the implications of that.

Thanks for your reply. I wonder if the "investor" figures are distorted by the Queenstown new build developments of the super rich which are really just 2nd or 3rd homes registered as "investment properties" ? P.S. "OO" ?

OO = Owner occupied

Its why low interest rates are not making much impact

I thought it was because of 2 years of economic suppression via rising interest rates. We all learned by now also that there's a significant delay between rates changing and the effects being felt.

Our best clues are to look at these measures wherever else they've been implemented and observe the results.

Australia has a capital gains tax and lower home ownership rates than NZ.

Markets discount current situations and settings and normally trade on future expectations.... which is why its surprising that the big drops have not turned into reducing stock overhang, or competitive bidding.

IMHO this is because prices are too high and people cannot envision enough CG to enter, and now there is a possibility of losing 25% of that gain to tax

You seem to be applying day trader logic to something most people are doing over decades.

Thanks for your reply. Good suggestion about look at what happened in Ausy.

I'm interested in the immediate investor reaction on announcement of CGT as many other interventions were implemented in Ausy to inflate prices post CGT....

economic suppression via rising interest rates

Rates only returned close to the long term average. The world has been suffering from speculative oppression resulting from debt being to cheap.

The difference in thinking about this is telling.

100%. The only incentive is the promise of lazy unearned windfalls. Yields are now falling with interest rates so not much gain there.

If house prices keep up with CPI there is no capital gain, the house is still worth the same real value. In that scenario there is still good yield from property - lower than the riskier investments but still ok.

you sound like you are trying to sell me on gold... and i agree.

Gold makes no yield, it should just retain value.

I’m not trying to sell you anything, you do what you want.

Thanks for your reply. Why is that please?

I hinted at it above; there's little to no evidence of capital gains curtailing property investment.

Remember too we initiated a bright line scheme, and that had little to no measurable impact either.

Thanks for your reply. I'll try to find data of what's happened elsewhere with the immediate reaction to the announcement of CGT in different countries. Only us and Mexico that don't so have loads of countries to pick from!

I wonder if fears of a US stock market crash and few perceived safe local NZ investment options may be contributing factors towards people buying/building investment properties despite the ongoing losses against inflation?

The 10 year brightline had a massive impact. All flippers became hold for speculative growth players. Tax must be avoided at all cost. Agents commissions plummeted.

Have talked to several leverage "investors". All said removal in interest depreciation would be a massive factor in investment decisions. It would in each case require them to be paid from external income (real work that pays tax).

Pretty sure this means they overpaid and over leveraged in the first place.

I think there will be two camps. The medium leveraged will just pay the tax the same as profit on shares etc. Because the can.

The over leveraged (banks keeps the sale money to offsey other over leveraged positions) will struggle to pay due tax. It's ok...the IRD will let it ride....tui.

Thus the real question is how many are over leveraged with little to no supporting income...?

I've noticed the time to sell has fallen recently as vendors are finally pricing to sell.

Fussy point, but the mortgage pile grows simply because banks add interest to loan balances. Since May 2023, when the economy turned, interest added to mortgages has been well over 5% (peaking at 6.4% in late 2024). So, if you want to work out whether lending is really increasing (i.e. new loans > repayments) you have to exclude the interest. Here's a simple representation. My view is that we are at another turning point - new lending is about to start exceeding repayments, and that means stimulus.

On the money as usual.

My view is that we are at another turning point - new lending is about to start exceeding repayments, and that means stimulus.

Yes, even though that isn't necessarily represented in greater h'hold debt across the different anchors.

Aussie politician Andrew Bragg has publicly stated that house prices in Australia are too expensive, particularly for first-time buyers and younger Australians. He has criticized recent govt policies, claiming that initiatives like the expanded 5% deposit scheme have directly contributed to higher entry-level home prices by increasing demand without adequately addressing housing supply. Bragg describes the current situation as making it even more difficult for young people to enter the housing market, arguing that the surge in prices represents the highest growth in entry-level homes in recent memory.

Bragg believes entry-level property prices "must decrease" to restore housing affordability, a point he acknowledges is rarely admitted by other politicians.

https://www.abc.net.au/news/2025-11-05/bragg-housing-prices-first-home-…

NZ finally has the policies in place to reduce house prices, and the reward is people leaving to somewhere that doesn’t.

NZ finally has the policies in place to reduce house prices

It does? Outside of maybe the granny flat regulations, we only seem to be making house prices more expensive.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.