WOW. Did somebody say shop around?!

A lot of New Zealanders had mortgages up for refixing in December - and big numbers of them changed banks to get what they perceived as the best deal.

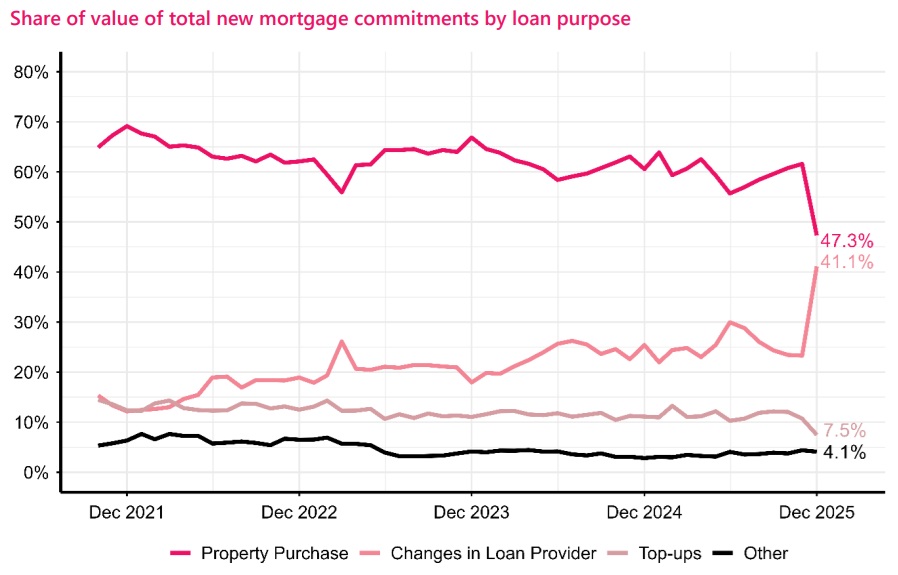

The Reserve Bank's new residential mortgage lending by purpose figures for the December month show a whopping $5.785 billion worth of mortgages, representing 41.1% of the $14.066 billion of new mortgages in the month, were for a change of loan provider.

Both the amount and share of the loan provider change figures are easily a record in a data series that dates back to January 2017. And it would be a fair bet that they are all time records dating back to before this series started too.

In addition, such was the flurry of re-financing activity that it drove the total month mortgage figure (of $14.066 billion) to a new all-time high monthly total - outstripping the $10.5 billion in March 2021 at the height of the pandemic frenzy.

The previous high percentage share for loan provider switching was just 26.2% back in July 2024, while the previous high figure was just $2.6 billion in July 2025. So, the December effort more than doubled that total.

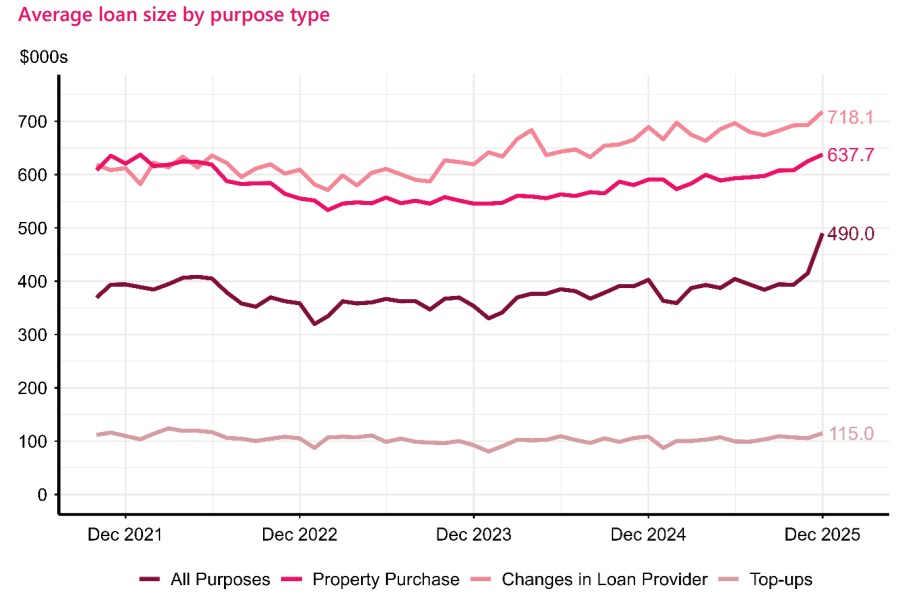

And in December 2025, it wasn't just small mortgages that were changing provider. The Reserve Bank figures show the average size of loan was over $718,000 - and that too is a new record high.

With loans worth $718,000 to refinance, no wonder people were shopping around.

The graphs are sourced from RBNZ's summary of the monthly figures.

6 Comments

Banks are competing hard for business at the moment. We received almost $10k cash-back from ASB recently for a reasonable sized loan (though not as high as $718k).

I just got approved for a large refinance. Goodbye BNZ hello ANZ lol

Not sure how to interpret this, but it seems that while prices have dropped, loans keep getting larger. What have I missed?

I missed on the point of the getting cash back. Maybe I'm wrong but it's not free money.

Ever-so-slightly less debt

Always thought some kinda of loyal customer bonus would be good - you've been a customer for 20 years, here's $100 voucher for something

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.