In Australia, the big banks are all singing with one voice: Wholesale money costs are rising, and 'we are having to reluctantly raise variable mortgage rates'.

In New Zealand, interest rates are falling, both at the wholesale level, and at the retail mortgage and term deposit levels.

This seems an unusual situation, and worthy of investigation.

One New Zealand question is, are our home loan rates falling fast enough to keep up with wholesale cost falls, or are banks taking the opportunity to build their margins even as they lower interest rates?

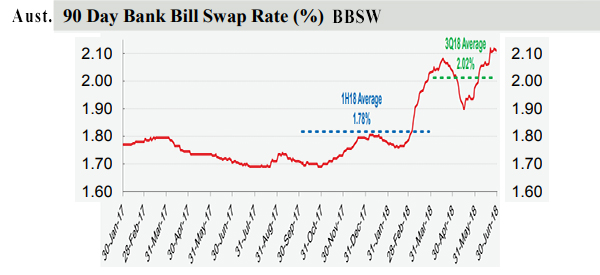

First, lets examine the Australian claims that wholesale money costs are rising.

The Aussie mortgage market is one based essentially on variable rate contracts. As such, it is their BBSW (bank bill swap rate) that underpins the funding of this A$1.6 trillion market.

The BBSW has been moving higher recently. And the risk premiums have also probably been rising and that is a direct result of risk perceptions coming out of the Hayne Inquiry. It is hard to know what bank treasurers face in terms of these risk premiums, but one thing is for certain - they have been going up.

An echo clue happened in the New Zealand market this week. ASB raised an impressive $450 million at 3.31% for an AA- rated unsecured note issue. But Toyota Finance, also rated AA- raised $100 million, but only had to pay 3.07%. That means ASB (a subsidiary of Aussie banking giant Commonwealth Bank of Australia) has had to pay 24 basis points more for its money than a car loan company. If you think about it, that is actually quite extraordinary. ASB is a few degrees away from CBA, so you would expect that CBA is suffering from a similar, and possibly larger premium. This is the type of reputational cost pressure Australian banks may be facing.

In New Zealand, wholesale swap rates are falling. Term deposit rates are falling. Benchmark government bond rates are falling.

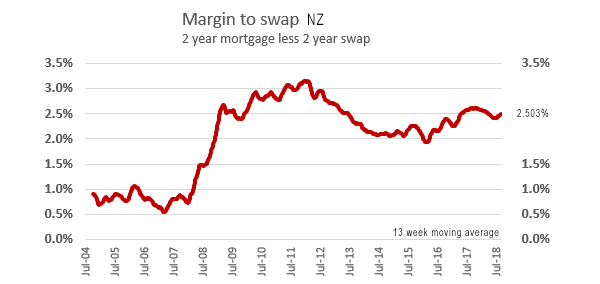

But are retail mortgage rates falling as fast? Are banks padding extra margin in a falling market?

This is something we can test - by looking at margins to swap.

So, yes, there is a tiny rise recently, but well within normal variations.

And the 2.5% margin is entirely normal in the perspective of the past eighteen months or so.

It is perhaps 20 basis points higher than the levels that existed between 2013 and 2016.

But current margins are 35 basis points lower than those between 2010 and 2013.

It is reasonable to conclude that New Zealand banks have not been using the current reducing interest rate environment to unreasonably pump margins. So far, it looks like they have been playing their pricing strategies with a straight bat.

Obviously ours is a test that only uses wholesale swap rates as the basis. Banks have three other funding sources - retail deposits, retail bonds, plus international private placement markets - and cost shifts will be different and more lumpy in all of those other markets. But swap rates are a useful proxy of public costs. If bank treasurers can win especially good arrangements elsewhere, they kind of deserve those non-market wins.

And while we are at it, we should note that New Zealand two year swap rates are at 1.97%. Australian two year swap rates are at 1.98%.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.