Inflation not seen since the eve of the creation of our independent, inflation-targeting Reserve Bank in 1990 (7.3%) has unleashed a blame game that has yet to really target the central bank responsible for keeping inflation around 2%. The Opposition is blaming the Government, which is complicit, but it is the Reserve Bank that should be first in the firing line and subject to an independent and full review.

So far, neither the Reserve Bank or the Government have acknowledged they are at least partially responsible or started to talk about what they would do differently in future.

The Reserve Bank’s only self-reflection has been to self-justify and run its own regular five-yearly review of its monetary policy mandate. Meanwhile, Finance Minister Grant Robertson’s arguments have been all about deflecting blame overseas. The Opposition has chosen largely to focus its attacks on the easier political target of Labour’s ‘addiction to spending,’ rather than break the habits of political lifetimes and criticise the independent central bank. Neither of those three strategies is credible in the long run, and all three players only need to look to their colleagues in Australia to see that a truly independent and deep review is needed.

The new Labor Government of Australia launched a bi-partisan and independent review of the Reserve Bank of Australia’s money printing on Wednesday, which did go on for longer than our central bank’s, but has had broadly similar effects on house prices and inflation.

Also, we now have credible and trenchant criticism from establishment figures of the Reserve Bank such as former Reserve Bank chief economist John McDermott, ex-Reserve Bank Deputy Governor and Acting Governor Grant Spencer, and former Reserve Bank Board Chairman Arthur Grimes, who was instrumental in building our independent inflation-targeting regime in the first place.

There must be a serious, deep and independent review of the Reserve Bank’s actions in 2020 and 2021, if only to win back the trust of the generation of renters (without generous parents) who are now fleeing to Australia to find renewed hope of home ownership and family lives.

So how did we get here?

The Reserve Bank decided in mid-March of 2020 to throw the kitchen sink at the economy to reassure borrowers, home owners and banks that there would not be a depression because of Covid lockdowns. It said at the time it wanted to pursue a ‘least regrets’ policy.

However, within months it was clear the panic was past and the economy was bouncing back into the shopping centres and open homes with a surprising rapidity, along with house prices, jobs and spending. In retrospect, the Reserve Bank should have stopped money printing within a few weeks of the end of the first lockdown in June, or even once the bond markets were unfrozen in May. It should never have removed the LVR controls in April 2020. It should never have started the cheap loans to banks in December 2020, let alone continued expanding them to the present day.

In my view, the Reserve Bank’s mistakes were not made in that momentous week of March 16 to 23 of 2020 as the Government collectively decided on hard lockdowns and the Reserve Bank launched a $30b money printing and bond buying programme, as well as slashing the Official Cash Rate by 75 bps to 0.25%. Least regrets and the kitchen-sink-throwing were appropriate then, in the fog of fears about about 30% unemployment and a global financial collapse. But within a couple of months, the fog was clearing.

Now the regrets equal (some of the) 7.3% inflation

The biggest mistakes were to remove the LVR controls at the end of April and to go on expanding the money printing plans to $100b by August 2020, even though it only used just over half of that capacity in the following year.

Now, after yesterday’s record-high 7.3% inflation data for the June quarter from a year ago, it’s clear the central bank should have at least a few regrets and should be held accountable for them, along with Finance Minister Grant Robertson, who was asked for and gave his approval to the biggest things thrown into that kitchen sink and left there: the money printing; the LVR removal; and the cheap bank lending.

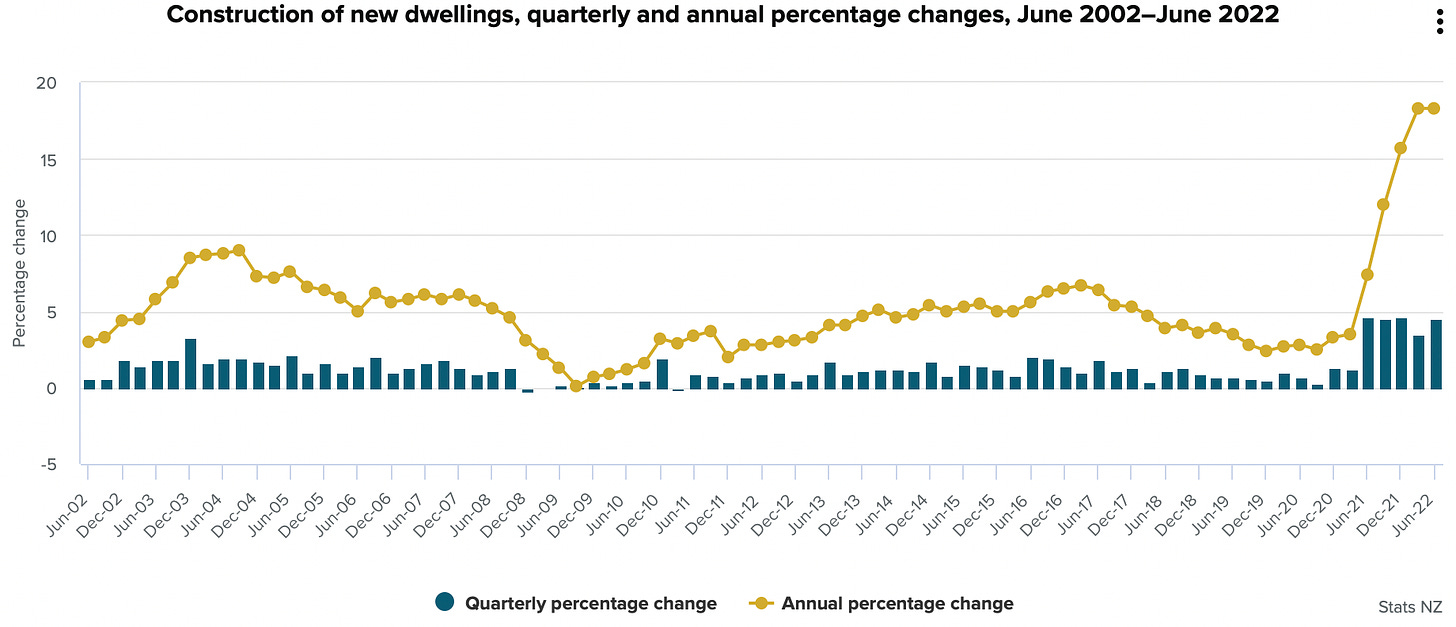

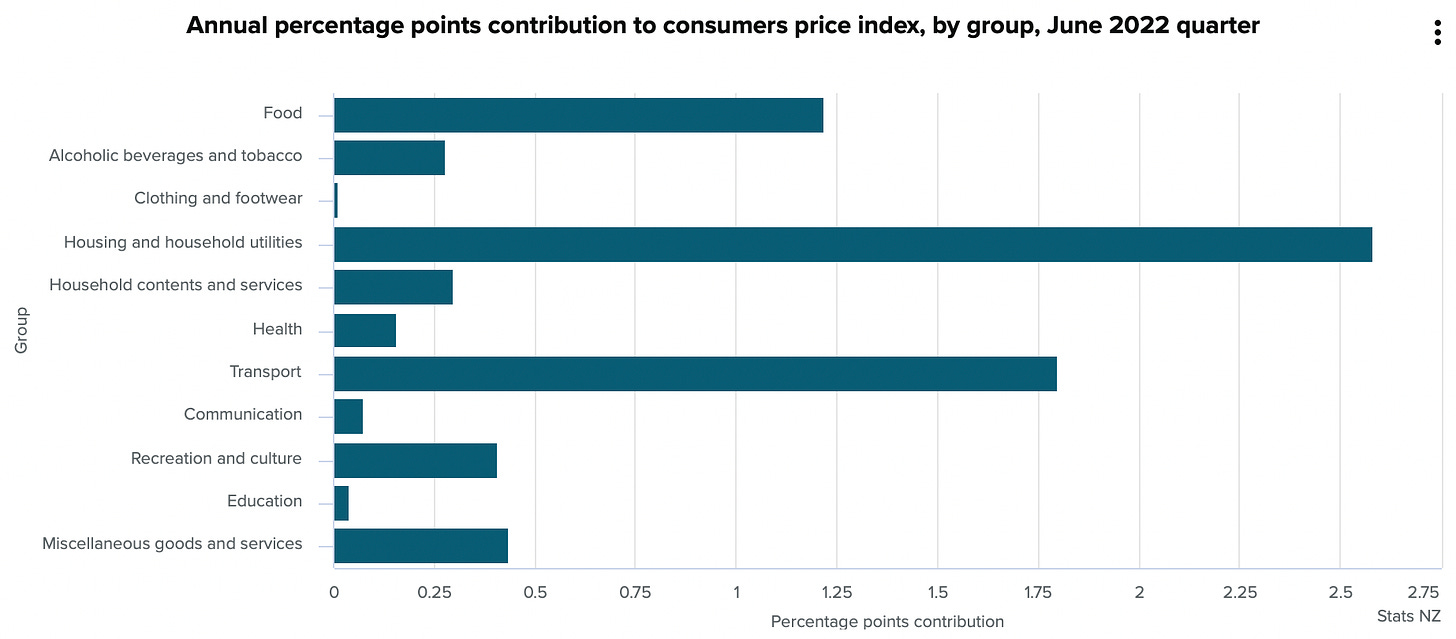

The political blame game over the inflation has so far pussy-footed around the main issue. The money printing, (ongoing) cheap bank loans and LVR removals fired house prices 45% higher by November 2021, and is now being reflected in the demand-driven inflation in building materials, construction costs and rents.

The massive expansion of lending and the sharp rise in house prices was clear by mid-to-late 2020, but it took until June 2021 to explode into the real economy of rising housing costs.

The kitchen sink of monetary policy and prudential policy loosening was done with the clear knowledge of a restrained housing supply and the risk any demand stimulus would have a leveraged effect on house prices, and eventually rents. That is exactly what has happened.

How much of the inflation was domestically generated?

Just over a third of the 7.3% annual inflation reported yesterday can be blamed on that monetary policy loosening. The rest can be sheeted home to higher global food and fuel prices, although that at least partially is due to the massive money printing also done in the United States, Europe, Britain and Australia over the same period. Aotearoa-NZ was not alone in printing money to buy bonds to lower longer term interest rates.

Our Reserve Bank can rightly claim credit for stopping the printing sooner than the rest (July 2021) and starting rate hiking (October 2021) sooner than the rest. Although by then, the Reserve Bank had already printed as much, if not more, in proportionate terms to GDP, than those other central banks, and took the extra step of relaxing LVR controls.

By late 2020 the local genie was out of the bottle

However, within four months, it was clear the worst was over. Instead, the Reserve Bank went on printing and did not properly impose lending controls, stop printing and hike interest rates for another year. That was when the genie got out of the bottle, although it’s still worth saying the domestic demand-driven inflation genie is only responsible for about a third of the inflation.

Even if the Reserve Bank had kept the OCR at 0.25% until October 2021, simply not starting the cheap lending to banks, stopping the printing immediately, and re-installing the LVR controls ,would have reduced much of the damage, especially to house prices and rents, which, for example, are now rising at the fastest rate in history outside of Auckland (5.8%).

It’s time the Reserve Bank and Labour had at least a few regrets and acknowledged them. The Opposition also needs to front up and call for that review, which would at least separate the politicians from the process.

What to do now (and not to do)

The temptation for the Reserve Bank now would be to over-react and hike much, much higher than its current plans. Financial markets priced in a rise in the OCR to just over 4.0% yesterday, which is in line with the Reserve Bank’s forecasts from May. If it wanted to do more, it could start by ending and unwinding the $12.7b of cheap loans to banks through its Funding for Lending programme. It could also further tighten LVR settings and unravel its bond-buying programme much faster.

From a fiscal policy point of view, enacting some sort of angry, fast spending crackdown would be counter-productive and too painful for those who can afford it least. If the Opposition were being intellectually honest and wanted to do the least damage, it would propose a windfall profits tax from those businesses who retained the $20b in wage subsidy cash in their savings accounts, and some sort of wealth or land tax to reduce house prices and pressures on rents.

No, I didn’t think so…

44 Comments

This is undoubtedly the most sorry period of Central Banking in my lifetime. Is it enough to point to other Central Banks? I don't think so, if we are just following everyone else we don't need entire departments withing the RBNZ. They are just going to have to ride it out, they cannot raise rates further without causing wholesale annihilation in the construction industry and condemn more NZ'ers to inferior accom.

Every CPI print Orr and Hawkesby should be marched around Wellington naked while the public yells shame.

So should the so-called economic journalists who refuse to address the real issues. This one is away back parroting Grimes - who is of the problem, not of the solution. And who is still, unless I miss my guess, controlling some of what is discussed.

Real resource-scarcity-driven inflation, with no 'replacement at some price-point' nonsense, is biting globally. There is no reversal of that process; Limits to Growth here we are. But there may well be demand-destruction - all the way to starvation, and a roller coaster thereof on the way down.

I'm looking for Hickey to say 'mea culpa'; I could have reported - but ran a mile.

But I'm not holding my breath.

To be fair PDK, most of us don't look through the "we're all doomed" existential crisis lens that you do.

There is plenty more energy we can tap into while we transition to solar/wind/hydro/tidal/fission/fusion.

Short of exterminating people or forcibly neutering them, we are on a trajectory that will not be avoided. Have you noticed it's really only the wealthy that obsess over climate change?

Yep. First step to solving environmental problems is to reduce poverty.

Have you noticed that it is the very wealthy who are, by a huge margin, the greatest per capita emitters of ghgs?

"Just over a third of the 7.3% annual inflation reported yesterday can be blamed on that monetary policy loosening. "

Which is telling, absent of the internationally caused inflation, the RBNZ would have been almost perfectly on target (2.4% inflation). Really the issue is fuel/food prices, but food prices are somewhat a function of fuel prices given how much fuel is required to create/harvest/package/transport food. And fuel prices are almost completely out of our control, so not much we can do about this level of inflation really.

I think the best thing NZ could do is accelerate away from fossil fuel usage for transport, particularly heavy.

How much of that 2/3rds international inflation is attributed to a 13% drop in the NZD against the USD in 9 months?

Yes and no - we already had NZ inflation hidden by imported "deflation" with the Reserve bank doing not much because the net result was within their mandated limit

Now we have even higher local inflation compounded by imported inflation

In my view it shows that actually Orr has been asleep at the wheel for far to long

Yes and no - we already had NZ inflation hidden by imported "deflation" with the Reserve bank doing not much because the net result was within their mandated limit

Yes. And if you index wage inflation, the CPI, and house price inflation over say 20-30 years, you understand things much better. The RBNZ are in some ways accidental puppets, but you'd be naive to believe that they serve the commercial banks in their money-for-jam credit creation.

Let's ignore the statutory independence of the RBNZ for a moment, and point finger at the Government. It's a convenient attack vector for those in opposition and their ignorant partisan following.

That would hold some water if the Government hadn't made bewildering changes to the RBNZ mandate creating a low-interest rate environment by default with the inclusion of employment as a consideration. The RBNZ governor also functionally serves at the pleasure of the Finance Minister, to the best of my knowledge. Or is acknowledging this an example of 'wrongthink' and marking me out as ignorant and partisan?

Well they didn't force these changes onto the RBNZ.

See whose signature is the bottom right of the document:

https://www.rbnz.govt.nz/-/media/f0cbac9a30904b7aa115549e5ca01b16.ashx

So because the RBNZ governor signs a document in a perfunctory capacity to acknowledge a decision from the government of the day, you want to totally excuse that government from the consequences of the decision it made, presumably which involved a cabinet vote?

I could go one further and say our current malaise is apparently acceptable to Robertson because Orr still serves as RBNZ Governor. So clearly this is a level of performance he is happy with, or else Orr would have been given the arse. Instead, they chose to write letters to each other.

The fact it’s convenient doesn’t make it wrong. The cost of living payment is the latest mis-targeted effort. We will get it even though our household is in the top 5% of income earners. We will have a nice dinner in Paris. Thanks Robbo.

What's wrong with the cost of living payment? Sure, a token gesture, but a pittance when compared to what a household would have saved over the last 10 years if tax brackets were inflation adjusted.

Enjoy your dinner in Paris, try not to spend too much time bemoaning Labour while you're gone, although temptations and all.

The pittance is another $735 million being pumped into circulation by the government. This payment will hit bank accounts in 3 lots over a span of 2 months, making up roughly 1.26% of NZ's average economic output over the same period. That could do a fair amount of damage on the inflation front.

Awesome, it'll help offset the $700 million ASB will siphon out of the country.

This is the type of sandwich where you want the bread sliced thick.....

Bernard Hickey is making the other paid contributors to interest.co.nz look like journalistic sloths! The man is an article machine since he returned!

He has to work harder to pay the mortgage now that interest rates are up

Interesting article from a guy who publicly advocated for the reserve Bank to print money, give it a race based name and distribute it in helicopter fashion.

He also believes that the answer to NZ's problems is for the state to print more money and borrow vastly more and then the same state to allocate this capital to produce the goods and services we need.

Communism and economics do not mix.

Both communism and economics (capitalism, I suspect you mean) - are quite capable of rendering the planet uninhabitable. No that there is communism anywhere; it very quickly gets autocratic via no checks and balances. But my statement stands; both are capable of rendering us extinct - because neither account properly.

This is great analysis, and fair conclusions.

I'd add that while knee-jerk spending cuts aren't appropriate, this governments issue is more quality rather than amount of spending, and big initiatives like consolidating state media both fuel inflation, and are of poor cost benefit. If they were ever appropriate, they aren't now in the context of the recession we are heading into.

It is all very well being clever now well after the event. Where was the outcry from all these wise economic commentators at the time. I seem to remember being a pretty lonely voice.

Its not really the point though. At this point its clear to everyone the RBNZ made some terrible calls. They need to show that have learnt from their mistakes. Unfortunately the RBNZ attitude is "we made the best decisions possible, none of this is our fault" which means they are prone to repeat their failures.

"... and some sort of wealth or land tax to reduce house prices and pressures on rents."

I feel lost, how can more tax will reduce pressures on rents?

By removing distortions in the investment playing field/treating different investment classes as fairly as possible.

We've had lots of cash being pumped into property (and away from investment in productive sectors) due to the favorable tax treatment of property.

LVT is not easily passed through in higher rents, as reflected in economic analysis and real world experience. Free up zoning, LVT on the unimproved value of land, reduce income tax to match...and watch what happens.

Is this Bernard Hickey season(?) or is he on the payroll?

I have had to stop listening to Bernard because every time he talks about money printing I get cross. Money printing (or more accurately QE / yield curve control) is the simple act of central banks buying bonds at a given price with the express purpose of holding market interest rates (which move inversely with price) at a given level. When RBNZ buy bonds, Govt deficits do not change at all - no money has been created. 'Money' has simply changed form from bond to bank deposit. In fact, QE is more like a refund - the Crown buys back a bond it previously sold.

What caused the house price explosion was the shift down to lower borrowing rates (which were held low by QE), the removal of LVR, and the fiscal stimulus, wage subsidies, and lockdowns that left many middle class home buyers flush with equity and cash and bidding up the price of homes with more home working space etc.

Just because the RBNZ outsources the money printing to private banks, the impact is still the same. When private banks create new debt, it creates new money - hence why RBNZ creating conditions for an explosion of private debt, it was simply money printing by proxy.

Just because the RBNZ outsources the money printing to private banks, the impact is still the same. When private banks create new debt, it creates new money - hence why RBNZ creating conditions for an explosion of private debt, it was simply money printing by proxy

You are on the money. Love Jfoe's work but I feel that it misses this reality.

I haven't got my head around this..

So what are you saying J.C/Miguel,??

Govt debt vs private debt are both 'money creation' , contributing to inflation?

Please explain . Thanks

When govt spends more than it taxes, people get richer. Who gets richer depends on where the injected govt money ends up (normally in the bank accounts of landlords, Pak n save owners, Woolworths shareholders etc).

When banks lend new money into the economy - the same happens, however the person who took out the loan has to pay it back so you get an ongoing drain of money back to the bank from that person / company.

Govt spending creates new money, govt taxes destroy it. Bank lending creates new money, loan repayments destroy it.

Explosion of private debt?!? Private sector credit growth during the QE period slowed down considerably to around 3% per annum. Private sector credit was running at 14% during the years before the GFC and was 6% per annum pre-Covid. You don't have to have reckons when there is real data to look at - it's here: https://www.rbnz.govt.nz/statistics/series/lending-and-monetary/deposit…

I am not disagreeing with the main point though - private sector credit running at 160% of GDP is not good. But, private debt has basically been around that level since the GFC. It's a millstone.

In fact, QE is more like a refund - the Crown buys back a bond it previously sold.

Good point. So here , by 'Crown' u mean RBNZ?

Thanks

Yes. RBNZ is wholly owned by the Crown.

I doubt our inflation number would be much different had the RBNZ not made the mistakes you outline, however the difference would have been the impact...debt loading, house prices and rents would have been considerably lower than current meaning the scope for supporting the currency would be expanded...sadly we are where we are and have to deal with what cards we have.

Hindsight is a wonderful thing.

Normally we blame people for the stupid things they have done sometime after the fact. It is still going on.. the funding for lending program is still giving cheap NZ money to foreign banks. Would someone please phone Mr Orr and give him a verbal slap on the ear.. Stop the madness.

Humble pie is a dish best self served... and if it's not self served it will be served by others eventually.

Pity 'the govt' and RBNZ don't realise this yet.

To the culpable Govt and RBNZ I'd add the punters who piled into the Ponzi (for any reason) when its been an obvious Ponzi for years. If the former two were the meat and potatoes, the latter were the secret sauce that were necessary to top off the whole lousy meal.

This whole "it's been obvious for years" seems to assume people can sit on the sidelines forever for a family home while prices outpace earnings by more and more each year.

Yes, I do assume that. I have been renting for many years before and during having a family. We are getting by with not really enough space - kids getting older and still sharing a bedroom. I was pessimistic and expected the shtf at some stage. Waiting was doable, but not as exciting as piling in and hoping. My expectations of life are low, and it has met my expectations.

The currency is crashing as history tells fiat currencies last approx 50 years because of the money printing as the dollar is not backed against gold anymore so its only backed now by peoples confidence which is pretty low at present. So start those printing machines up because thats the only way out of this Ponzi Scheme. There no more tools in the toolbox to use Mr Orr your FKD

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.