Economists from ANZ New Zealand, the country's biggest bank and biggest home lender, are cutting their forecast for annual house price growth.

"Weighing up the economic recovery, higher interest rates, the lack of near-term momentum in the housing market, and election-related uncertainty, we have reduced our house price inflation forecast for 2026 from 5% to 2%. We have kept our house price inflation forecast for 2027 unchanged at 4.5%, which would see it broadly match income growth," ANZ NZ's Sharon Zollner, Matthew Galt and David Croy say in a new report.

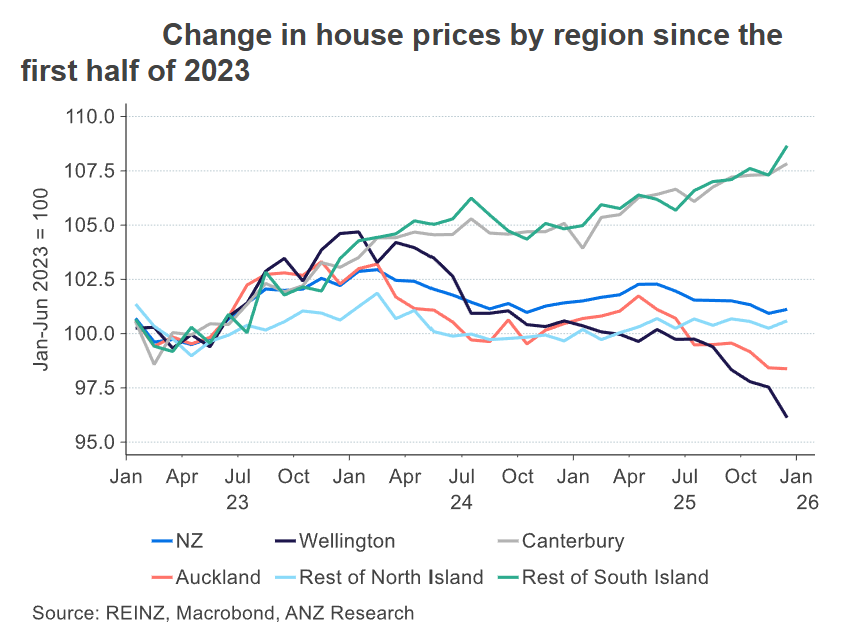

They note house prices have been flat for three years, and there's "clear evidence" the economy improved in late 2025, which will be a tailwind for the housing market.

"However, house prices are starting 2026 with little momentum, and uncertainty from the upcoming [November 7] election – including the prospect of a capital gains tax [if Labour win] – may keep some buyers on the sidelines this year."

"Moreover, the Official Cash Rate [OCR] looks set to rise sooner rather than later after growth and inflation have both come in hotter than the Reserve Bank expected," Zollner, Galt and Croy say.

Following Friday's release of the December quarter Consumers Price Index, showing annual inflation of 3.1%, the ANZ NZ economists have brought forward their expectation for the first OCR hike, from its current 2.25%, to December 2026 from February 2027.

"As OCR hikes draw closer, mortgage rates are shifting from a tailwind to a headwind for the housing market. Weighing it all up, we have reduced our house price inflation forecast for 2026 to 2% from 5% previously."

As of September 30 last year, ANZ NZ had total housing loans of almost $114 billion, and total assets of $210 billion.

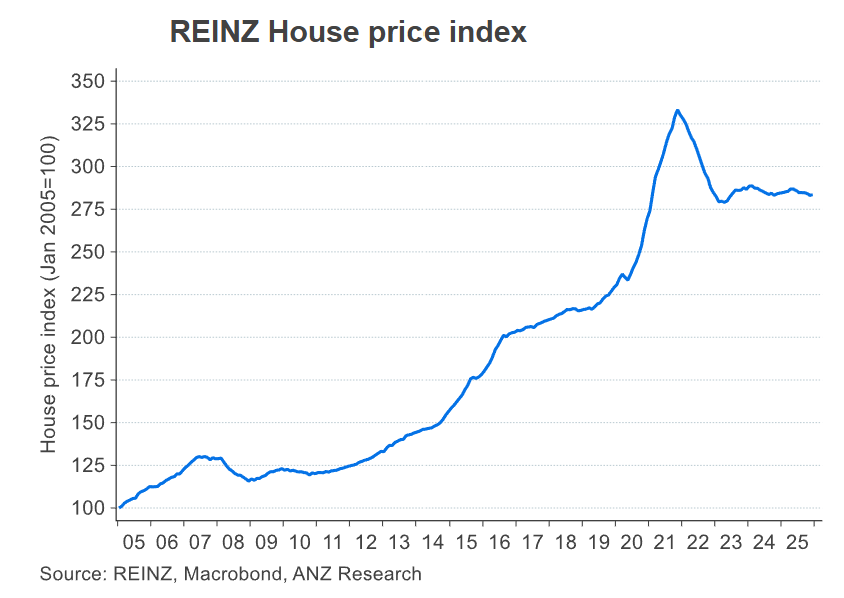

Zollner, Galt and Croy say average nationwide house prices are showing little sign of breaking away from a three-year flat trend, with the Real Estate Institute of New Zealand House Price Index down 0.1% from a year ago, on a seasonally adjusted and three month moving average basis.

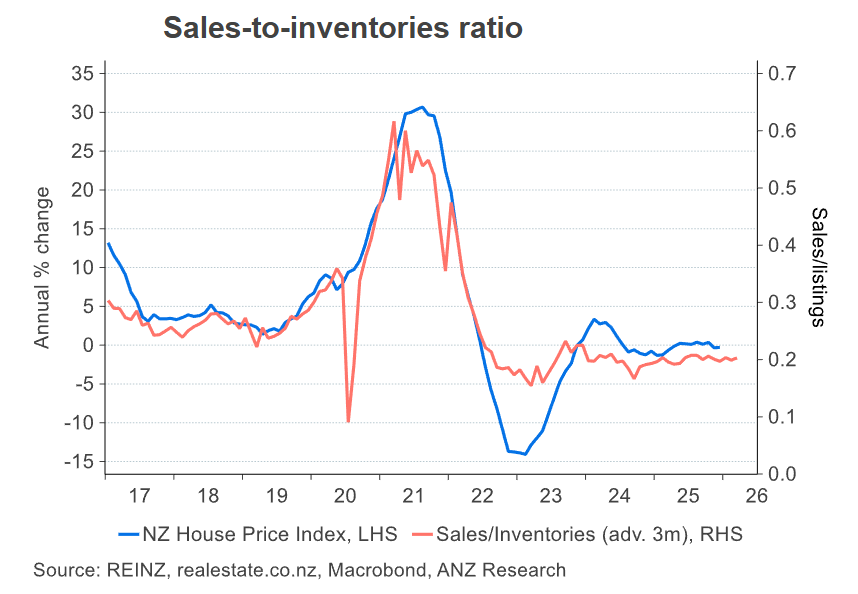

"Indicators of the balance between demand and supply suggest prices will continue to be flat through the early part of 2026. The ratio of sales to inventories is a useful indicator of heat in the housing market and tends to give a three to six month lead on house price momentum. It is flat as a pancake, suggesting prices will be too."

They also note median days to sell has been stuck at 45 days through October, November and December, which is above the long-run average of 40, signalling a market still tilted in favour of buyers.

"The weekly auction clearance rate also points to quite a balanced market, signalling little movement in prices either up or down in the next few months," the ANZ NZ economists say.

"Rising demand has been met with plenty of listings of new property for sale, helping to keep price pressures in check. Inventories of property for sale have oscillated around a 10-year high for over a year now."

"One factor supporting the number of listings has been resilient house-building activity through this economic downturn. While there has been a steep drop-off in the number of homes consented from its 2022 peak, the number of consents per capita has only dropped down to its long-term average, rather than dropping well below, as it did after 2008. In the past few months, consents have increased in response to lower interest rates, which will further support the supply of new housing over 2026," the ANZ NZ economists say.

A further factor keeping house prices in check is low net migration.

"Net migration is likely to increase as the labour market recovers, but it may only be gradual given ongoing strength in the Australian job market. The unemployment rate in Australia is currently 4.1%, versus over 5% here."

In terms of the potential for a new capital gains tax, the ANZ NZ economists say there were some signs property investors pulled back in earlier times a capital gains tax was proposed by politicians, such as 2014 and 2017-2019.

"The impact wasn’t large – not enough to disentangle from the bigger macroeconomic drivers of the housing market – and prices rose by around 2% to 8% per year during those windows. But debate about a capital gains tax may well restrain housing market activity somewhat until the policy landscape becomes clearer," Zollner, Galt and Croy say.

In terms of their forecast for an OCR increase in December, they note with a lot of water to flow under the bridge before then, there's "every chance" the first OCR hike could come either earlier or later than December.

*The charts below come from ANZ NZ.

27 Comments

Was it 7% growth forecast at the start of last year, and the year before that?

2% growth forecast now with inflation running higher than that, will likely see how prices fall again in real inflation adjusted terms this year. Better future buying opportunities await those willing to be patient.

No rush to buy folks.

Most wage rises will be lower than 3% this year... probably nothing

And I will have $1 each way on ocr moves please.

Inflation adjust the chart above and we've been through a pretty decent correction/crash. And yet I think we're only halfway through at this point.

To find the bottom you have to work out fundamentally what NZ Property is actually worth, if buying for yourself near Queenstown or on Waiheke the sky is likely the limit longer term, but if you are buying property as an investment it needs to be baselined against other investments and their yield based returns. Shit box investment is likely to disappoint as we can keep creating them as fast as RMA rezoning allows.

I think for the lower part of the market building costs provide a base, ie more FHBers want RMA allows and building costs limit price falls

at top end see above who knows

the risk IMHO is in trying to climb the ladder, you may well fall off the ladder, saddled with debt for no capital appreciation.

maybe the route to climb is via other investments ie climb for your own home after making money elsewhere.

entry level will be dime a dozen both nat and lab need affordable homes, but like who wants to live in the next Mt wellington

Yep, and now with interest rates looking to increase, an election year with a possible capital gains tax that they think is a drag on price increases they expect house prices to do better than last year? Just talking their book up.

ANZ once again make far too overly optimistic public predictions of house price growth in the face of all their brilliant data showing otherwise late 2025, only to finally revise soon after to less than 1/3 of their confident prediction. Translation: Banks try to influence potential buyers to take on ever greater debt, for the sake of their own profits and bonuses.

ANZ once again make far too overly optimistic public predictions of house price growth

Propaganda dressed up as research

Seems criminal given insider trading is a crime within the stock market, yet blatant jawboning of the public to curry them to load up on large volumes of debt has no consequence if they get it wrong, they simply claim user must do their own due diligence and banks hold no liability.

When many central bankers and policiticians own homes and rental property portfolios as well, then the people who should be regulating that behaviour just turn a blind eye - or worse, behind closed doors encourage it. The dirty little secret of how housing bubbles are allowed to (or actually encouraged to) manifest in a society 'free from corruption' such as ours. Any behaviour that pushes up house prices is good - while as the same time in their two faced personality, they will say they are elected into their position to either create financial stability (RBNZ) or want to make house prices more affordable (politicians) while secretly loving 7% annual capital gains on housing that was always completely unsustainable, dangerous to the overall financial stability of the country (a central bank failure), and creating social discord between has and have nots (ie a political/social failure for the country).

Completely agree IO. When will a real reporter corner a leading politician and hold them to account for the greed?

Anyway, it's now all unravelling at a rate of slow knots. With -18% inflation losses since 2021, this crash in REAL terms is massive and in the range of -20% to -45% loss of home values.

She is not done yet!

Come on ANZ, we're still in January, could have waited a bit. Positive growth in 2026 looks really compromised: stock is still high, banks are already raising rates, inflation above the top of the band, low immigration...

Auckland is down 19% from peak over 4 years and yet none of the majors have predicted a single falling year....

Even blind Freddi can see this release from ANZ REALLY signals yet another year of falls, but they cannot be that direct. So a 2% rise it is then.

The All Blacks have more chance of winning RWC 27 then house prices rising, and that's paying 5:1

I just don't understand how these people keep their jobs. But I guess they're really a marketing department rather than actual economic analysts/forecasters.

I just don't understand how these people keep their jobs. But I guess they're really a marketing department rather than actual economic analysts/forecasters.

Had a relative who worked in one of the bank's mortgage brokering businesses up to 2015. Those were the real foot soldiers. They should be the one's making the fat bonuses, not the top brass who've never really had to sell any of the bank's products at the coalface. It's broken really.

I know many of these people personally, they are great smart people and good economists.

But the fact that they have never predicted a falling housing market should be an indicator of the independence this data set.

I value the rest of their forecasts on interest rates and FX etc, I treat this data like a Barfoots or REINZ release, straight in the bin.

Yip the last few years all economic indicators were saying that there was almost no chance of house price growth and yet they still had to publish a positive growth forecast (most were saying 5-10% growth each year so way off the mark - they were forecasting what they wanted to happen to manipulate the market for their own benefit - ie a lot of buyers took their forecasts seriously and purchased based upon the banks predictions).

So as pointed out above, their economists are no better than used car salesmen - simply trying to push a product (mortgages) out the door for the profit making of the company.

If they were the real deal, they would have the balls to stand up to management and actually publish what they really think based upon the economic indicators they were seeing. But they've sold their souls to the company. ie slave to money, not truth and integrity.

A ballsy economist (or actually one with integrity and courage) working at any of these banks these past few years would have come out and said 'hey look we think its entirely possible there is no growth these next few years, actually we think house prices are going to be down and down by a reasonable amount'. That gives them real street cred as they are truth speaking - not propaganda speaking turkeys who have no back bone.

It was said on here yesterday that in these difficult times we should base our behaviour on morals and spiritual truths - where then do bank economists sit in our society if they open lie to the public in order to make money for themselves by misleading potential and actual buyers of their products? To me that is bottom of the barrel behaviour

Moses said in Exodus in the ten commandments - 'thou shall not bear false witness against your neighbour' and yet this is exactly what these bank economists have been doing. Its a sign of a corrupt corporate environment.

Maybe they have big mortgages themselves, in all parts of corporate life, I have seem great people keep their mouths shut to avoid attention.

big mortgages private school fees, great men and women look away. read the room and trade accordingly or you are a fool at best

But the fact that they have never predicted a falling housing market should be an indicator of the independence this data set.

But that is the question. Is it really the data set (given the swathes of information they have access to), or is it the work mindset engrained into them that housing cannot lose, as they print money and make margin regardless, and the vested interest they have given such a large portion of their lending is to residential housing. Is it blinkering them? Are they just fools? Or are they in too deep....

It'd be interesting if one of the journos from this site would hit them up on their track record of predictions and ask how they justify the current one based on past performances.

YES SNOW!

Interest team ?

This comment may be deleted and if it is it will highlight my point.

I pointed out on here circa 2017/2018 that a significant amount of the advertising was from banks and as such I asked how it was that they managed to keep their news feed regarding housing free from bias. Ie are interest.co.nz truth seeking or are they being influenced by their advertisers with what they could and couldn't write about (had to be mostly positive spin on housing to keep their advertisers happy). To me it was yet another sign we were in a housing bubble (large amounts of mortgage/bank advertising visible everywhere on the interest.co.nz pages). I was asking myself - is this site just a propaganda machine for the banks and the housing bubble?

You then have to ask yourself why would interest.co.nz write anything negative about housing/mortgages if it were to get them offside with those who were paying them and keeping them afloat? (banks). And how quickly would the banks remove their funding if interest.co.nz started writing opinion pieces that were negative regarding the outlook of the housing/mortgage market that might be the opposite of the banks marketing strategies?

Understand this, and understand how deep the rot became from the housing bubble in NZ. It captured everything - from politicians, central bankers, advertisers, news agencies. Everyone was influenced by the flow of money towards the housing market and banks new that power they had over those other groups and in my opinion thoroughly abused it. It may now completely backfire on them when people realise what was happening and their forecasting kis complete self serving rubbish (not saying interest.co.nz are complicit as they are in my opinion the best financial news platform we have in the country and were just doing what was most probably required to pay their staff and bills at the time).

editorial team play a pretty straight bat

no need for them to be any blunter than they already are, all us DGMer commenters on here do it for them! ;-)

To be fair to admin, I've said a lot of things about banks and the property Ponzi and never had any comments deleted.

This site also seems to platform articles from all persuasions, so I'm not sure if it's fair to say they're biased.

Having said that, I do remember some exchanges from some authors (admin?) where they said that the bank economists don't make "forecasts", which I did and do believe to be evidently false

Agree with above , they have to tread a thin line, they have not been DGM , but by being not positive they have signaled their intent... at least they not like the Herald.

and they still let us be as DGM as we want, hell almost no spruikers left, Yvil has converted to PMs and Cote de bore just pukes champs.

The readership understands that even now the value proposition for property is really bad, yields are low heading into a rising interest rate world. the only thing stopping quite serious further falls is the stupidity of current vendors to acknowledge their fate.

I face as much credence in current ANZ forecasts as their last 4 years... good luck to them

Not surprised. 5% seemed way too optimistic.

-5% will be closest prediction.

Burn

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.