Earlier last year, Inland Revenue conducted a policy consultation on tax matters relating to charities and not-for-profit sector. At the time, there was a fair bit of speculation that there would be changes announced in the May budget in relation to the taxation of charities and in particular what was seen perceived to be the unfair tax advantage given to charities which owned businesses.

That actually didn't play out, but instead Inland Revenue pushed forward with consultation on the taxation of mutual transactions of associations or not-for-profits, including clubs and societies. Behind the scenes it began targeted consultation in November with around 50 persons and organisations who had provided feedback on the previous consultations. This consultation covered donor-controlled charities, membership subscriptions, and other matters.

A Christmas surprise?

On 15th December, just before Christmas, Inland Revenue then released what it called a ‘Targeted policy consultation’. This explained what had happened in November and that it was now seeking more feedback because of wider public interest in the issue. The thing was, though, the initial deadline for submissions was 24th December. However, Inland Revenue added it would be prepared to extend this submission deadline on request, but it plans to review all submissions by late January.

The surprise part of the consultation is in relation to membership subscriptions and related matters. The consultation makes clear that membership subscriptions charged by tax-exempt not-for-profits, such as the 29,000 registered charities and 19,000 amateur sports clubs, are not taxable currently and will not be taxed under the proposals out for consultation.

Are membership subscriptions taxable?

But the question under consideration is around membership subscriptions for most not-for-profit organisations. Currently, the accepted treatment is that trading with members, such as conferences and sales of merchandise, are considered taxable income, but membership subscriptions were not as they were covered by the ‘mutuality principle’. However, Inland Revenue has drafted an operational statement “…indicating that it is likely to formally change its view and state that under current law many membership subscriptions would be taxable.” Needless to say, this would be an unwelcome surprise for quite a lot of groups. Although there may be a trade-off in that some other expenses which are currently not deductible may become deductible.

The consultation also suggests the current annual tax-free threshold of $1000 could be raised to $10,000. There are also suggestions to simplify the income tax filing requirements for taxable not-for-profits, but Inland Revenue also wants to require banks and other financial institutions to provide it with financial information for those not-for-profits who use the tax-free threshold.

This is a surprising and for many organisations unwelcome development estimated to raise perhaps $50 million annually. From what I've seen there's no clear explanation given as to why Inland Revenue thinks the mutuality principle no longer applies in relation to the subscriptions. I imagine there will be quite some pushback on the membership subscription issue. It will be interesting to see how this plays out and what changes are announced in the 2026 Budget.

“Don’t look back in anger” – 2025 in review

Talking of Budgets, the 2025 budget on 22nd May contained a pleasant surprise with the announcement of the Investment Boost allowance. This enables businesses of any size to fully deduct 20% of the value of any new assets in the year of purchase. Interestingly, it also includes new commercial and industrial buildings and would also cover earthquake strengthening in some cases. Perhaps surprisingly, there was no cap put on the amount which could be claimed by a business.

The Investment Boost initiative is designed to boost investment and productivity, a theme in common with other tax initiatives, for example, proposals for digital nomads and changes to the Foreign Investment Fund regime included in the Taxation (Annual Rates for 2025−26, Compliance Simplification, and Remedial Measures) Bill currently before Parliament. It’s actually a on long-standing principle of our tax policy to enable investment in New Zealand and remove barriers to doing so.

The investment boost was a big surprise. Whether it's had the hoped for impact is not clear yet. As everyone is well aware, economic activity was bumpy in 2025, but it could be that the groundwork has been laid for a stronger recovery this year.

Boosting Inland Revenue’s compliance activities

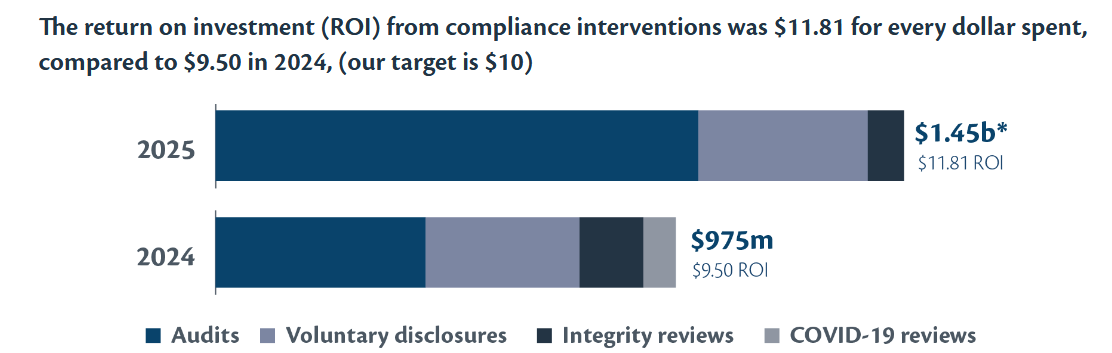

Another constant theme for the year, was more money in the 2025 Budget for Inland Revenue to boost its compliance activities. On top of the $116 million it was given over 4 years in the 2024 Budget it got another $35 million in the 2025 Budget. Consequently, 2025 saw great degree of investigative work by Inland Revenue. According to Inland Revenue’s 2025 Annual Report, it has achieved great returns from its increased compliance activities.

(Source Inland Revenue 2025 Annual Report, page 47)

Closing loopholes

In addition to investigation and review work, Inland Revenue is also trying to close off what it considers loopholes and areas where there appears to be seepage in the tax system. The not-for-profits consultation we discussed earlier is one such example. However, arguably the biggest single example, and which was such a bolt from the blue, I called it a bombshell, was the recently announced consultation on the taxation of shareholder advances. It’s one of the most significant changes to the taxation of small businesses in recent years, potentially worth several hundred million of additional tax revenue annually. We're therefore going to see a fair bit of lobbying and feedback about the proposals which are almost certain to be as part of the 2026 Budget and the annual tax bill. Watch that space.

Targeting crypto-assets

The taxation of crypt-assets is one specific area where Inland Revenue is currently very active. In November I discussed Technical Decision Summary TDS 25/23 where investors in crypto-assets lost the argument that gains were on capital account and therefore non-taxable. This case is probably the tip of the iceberg as according to Inland Revenue’s 2025 Annual Report “As at 30 June 2025, more than 150 customers were under review, with total tax at risk in the tens of millions.”

We'll also see ongoing activity from Inland Revenue reviewing property transactions. Everyone tends to underestimate how much access to data Inland Revenue has and the information sharing which goes on with other Government agencies and tax authorities around the world. I’m sure I'm not the only tax agent seeing increasing numbers of inquiries from clients and Inland Revenue relating to investigations or reviews covering overseas income which may or may not have been declared properly.

Tax debt - a $9.3 billion problem

The other big area for Inland Revenue is managing the debt book, in late November I had a very interesting discussion with Tony Morris from Inland Revenue about how it is approaching the management of its debt book, which is over $9.3 billion and what steps are being taken to reduce this.

I'm seeing a much more forceful attitude from Inland Revenue around earlier interventions and debt collection. In some cases, that's well merited. Other cases, I think it's been a little ham-fisted. There's also work to be done in managing companies which fall behind on GST and PAYE. Much earlier intervention is needed there. But one hopes that the extra money that Inland Revenue has received from the government will aid that. Getting the debt book under control is obviously very important for Inland Revenue and for the Government.

One area I think actually needs a fundamental redesign, is the question of student loans where only 30% of overseas-based debtors are making repayments at this point. Now, Inland Revenue does have the power in many double tax agreements to ask overseas authorities to intervene on its behalf, but it seems to have been a bit reluctant to do so. 2026 may see a change in this approach.

Overall, we can expect to see Inland Revenue gathering using all its available tools to collect the maximum amount of overdue debt and bring the debt book under control. That's been a big theme in 2025 and it's going to be a continuing theme this year.

The Trump effect

Internationally, the second Trump administration has caused all sorts of upheaval across the world order geopolitically, but also in the tax space where progress on the already grindingly slow Organisation for Economic Cooperation and Development/G20 multilateral tax proposals, the so-called Pillar 1 and Pillar 2 proposals, has basically ground to a halt.

The Trump administration made it clear early on it is hostile to what it considers unfair taxation and regulation. Its National Security Strategy released in November spelled it out bluntly.

(National Security Strategy of the United States of America, page 19)

Against this background it’s hardly surprising the Government in May decided to withdraw (“discharge”) the Digital Services Tax Bill.

Big Tech, Little Tax

The multilateral Pillar 1 and Pillar 2 deals seem dead in the water, but as the Tax Justice Aotearoa noted in their report, Big Tech, Little Tax that still leaves the problem of the tech companies’ apparently extensive use of transfer pricing methodologies to minimise their tax bills.

One of the examples the Tax Justice Aotearoa report considered was Oracle New Zealand, which according to its 2024 financials, earned revenue of $172.7 million, but paid licensing fees of $105.3 million to an Irish-related party company. It ultimately finished up with taxable income of just $5.3 million. It's apparently paid royalties representing between one third and three-fifths of its total revenue. Oracle, incidentally, is currently undergoing an audit in Australia and there's a related tax case going through the courts, which I expect Inland Revenue will be watching very closely.

And then there's Microsoft, which earned revenue of $1.32 billion, but then paid over a billion dollars in purchases to another Irish located related party company.

The Digital Services Tax might have had some impact on this, but a more likely tool to try and recover additional tax would be to start applying non-resident withholding tax on the royalty element of any cross-border payment. The payments should remain deductible, but subject to a (typically) 5% withholding tax. Such an approach should be acceptable under most long-standing international agreements, but it will be interesting to see what pushback emerges if Inland Revenue adopts this approach.

Tax policy highlights the rising cost of demographic change

In the tax policy space in general, it's been an interesting year with the Inland Revenue's long-term insights briefing somewhat controversially looking at the question of the tax base. This was alongside Treasury's He Tirohanga Mokopuna, statement on the long-term fiscal position which took a 40-year view of the Government’s fiscal position. A common theme was the demographic pressures on pension funding. Unsurprisingly that, together with the rising costs of climate change, was also a major theme the OECD's review of tax policy in 2024.

Capital Gains Tax – a never-ending story?

The seemingly endless debate about capital gains tax continued through 2025. The International Monetary Fund paid its regular Article IV visit and suggested it might not be the worst thing in the world. The more interesting IMF report to me was about New Zealand productivity, where it directly suggested that the lack of a capital gains tax has meant excess capital has been gone into property rather than into productive investment, and it could be a factor in our low productivity. That's not an unreasonable conclusion in my view.

Then we had the Labour Party finally announcing its somewhat limited capital gains tax proposal, which will apply to all residential investment and commercial property. That's a little less bold than what Labour Party members wanted, but on the other hand is in line with our practice of incremental changes. It’s also pretty much in line with what the minority group on the last tax working group suggested, a comprehensive capital gains tax wasn't needed, but expanding it into the taxation of residential property was certainly recommended.

The Tax Policy Charitable Trust brought down former IMF Deputy Director Professor Michael (Mick) Keane for a couple of lectures, one of which was in Wellington at Treasury. He made the interesting observation that most tax jurisdictions which do have a capital gains tax, and remember we're in the minority, approach it from the basis that everything is in unless it's out. Presently, our approach is the flip side, everything is out unless it's in but the problem is there's a lot more in than people realise and so there’s seepage of potential review. In terms of conceptuality, I think his approach is to be preferred. Include everything and then carve out exemptions (such as the family home). That is what we see around the world as he noted.

Looking ahead as always, there will be a huge debate going on around what are the best tax settings for New Zealand as we head into the second half of this decade. With 2026 being an election year, we're going to hear a lot about capital gains tax. I'm afraid non-tax geeks will probably be heartily sick of it by the end of the year.

Thank you

Finally, I've been very fortunate with the guests I've had this year, so thank you all, you've been most interesting and generous with your time. A special shout-out to Tony Morris of Inland Revenue for a fascinating discussion on where Inland Revenue is working in the debt space. (Transcript coming soon).

And on that note, that’s all for 2025, we’ll be back in late January to cover all the latest developments in tax as always. I’m Terry Baucher and thank you for reading and commenting. Please send me your feedback and requests for topics or guests. In the meantime, best wishes for 2026!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.