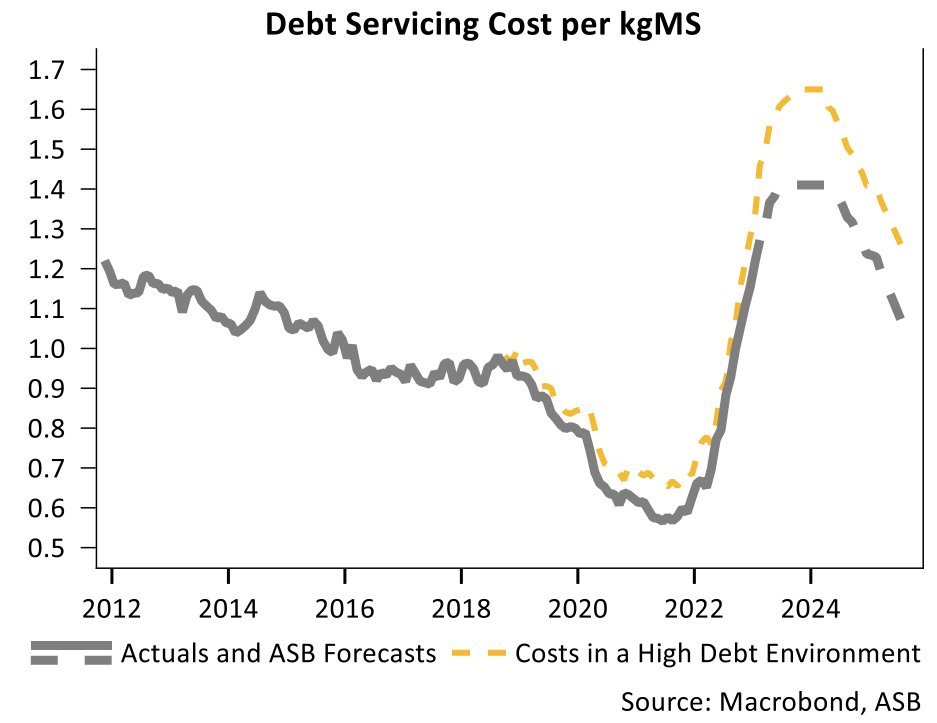

ASB economists are estimating that higher interest rates have added an average of 60 cents per kilogram of milk solids to the debt servicing costs of the country's dairy farmers.

In a Rural Economic Note, ASB economist Nat Keall estimates debt servicing per kgMS is currently running around $1.35- 1.40 per kgMS.

"That represents a lift of more than 75% over the last twelve months – i.e., about 50-60c. Unsurprisingly, almost the entirety of the increase comes from higher interest rates given overall debt levels have remained relatively stable as a proportion of output."

Keall's current forecast for the farmgate milk price in the season that's just started is $7.25 per KgMS, while the first official forecast for the season from Fonterra is for a price of between $7.25 and $8.75.

The increased debt servicing costs have come as the Reserve Bank (RBNZ) has cranked the Official Cash Rate (OCR), up to 5.5% - although it is indicating that it may now at least take a pause at that level as it has forecast the OCR to remain at 5.5% till the middle of next year.

Keall says with the RBNZ "potentially at the end of the hiking cycle", he estimates farmers' debt servicing costs will lift "only a little" further from now, by around another 5c or so to take average debt servicing costs into a $1.40-1.45 per kgMS range.

"But given we don’t expect any OCR cuts from the RBNZ any time soon, the risk is that debt servicing costs remain around these levels – circa twelve-year highs – until the end of the 2023/24 season."

While debt-servicing costs have undergone "a very lofty increase", however, the cost for farmers could have been a lot larger had they not used recent high payouts to reduce debt levels, Keall says.

"Our analysis suggests that if debt levels had remained at their 2018 highs, debt servicing costs would likely be set to peak at levels 20-25c higher than they currently are, in a $1.60-1.65 per kgMS range. That would have been a painful increase given how stretched margins already are, illustrating the degree of resilience farmers have delivered through those repayments."

Keall says that lately, reductions in dairy debt levels have stalled.

"After reaching $36.3 billion in early 2022, total NZ dairy lending has actually ticked up moderately. Sharp lifts in various working expenses (like feed, fuel and fertiliser) over 2021 and 2022 have left less room for debt repayment, and the regulatory burden has only continued to escalate.

"What’s more, the long-feared scenario of higher lending rates coinciding with a weaker milk price looks to be coming into focus. Dairy prices have fallen about 25% in NZD terms over the past twelve months..."

Keall suggests farmers should budget on lending rates "remaining elevated for some time".

"From the latter half of 2024, we expect debt servicing costs to ease progressively in line with lending rates, getting closer to the $1 mark by the end of our forecast track in mid-2025."

He says, however, the risk is that if this season’s milk price is lower – "as we expect" – some farmers may need to take on additional debt to ride out the downturn – in which case debt servicing costs can "start to move a bit closer to the high-debt scenario" plotted in the below graph.

Dairy prices

Select chart tabs

9 Comments

The inevitable symptom of endemic land banking taking precedence over the activity of dairy farming, now drowning in ever increasing costs.

Audaxes - I enjoy learning from your economic comments and feeds in the news section however I disagree with your above comment.

The article clearly shows the reduction in dairy farm debt over the past couple of years.

Where it once was over $20kg ms, using an average floating rate of just under 8% (including a bit of overdraft) the average debt according to this article is now down to $17.50 per kg ms.

The concern is that like the housing market the banks set the serviceability rates too low in their recent lending. Many were at 7% or just over.

Dairy farming is now going through a classic cost -revenue squueze.

Last of the large land masses to be settled by humans, and last of the agrarian societies.

Article should be "Excessive farm debt comes home to roost".

This is the sort of thing we all talk about regarding inflation "inflating away the debt" the dream is that farmers get paid more permanently in high inflation environments, if they don't and are in high debt, that leads towards a debt crunch.

Maybe we should be taking a leaf out of the OPEC playbook and reduce supply significantly? I guess if enough farmers with high debt go under, the problem will take care of itself?

Anyone who thinks the OCR is in anyway a sensible tool is deluded. (My professional opinion. Your's may differ.)

I guess its been milked for all its worth.

What would be interesting is what the spread of debt levels. I suspect young farmers and sharemilkers are heavily in debt, while some older farmers are low debt or freehold.

Its very difficult to be debt free on farm. Things need constant fixing or replacement. Some of these items are high cost, so debt is used to finance them. Dairy farms went through an era of expansion with combining farms and building new cowsheds. This required many additional things, raceways, worker accomodation, bigger tractors, feedout wagons, silos, effluent ponds, more cows. Sitting at the bottom of the list when being paid, pricetakers, one cant bill the client what one needs to cover these costs. So we turn to debt. Its a model that usually works well. Not so much at the moment. Difficult times ahead.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.