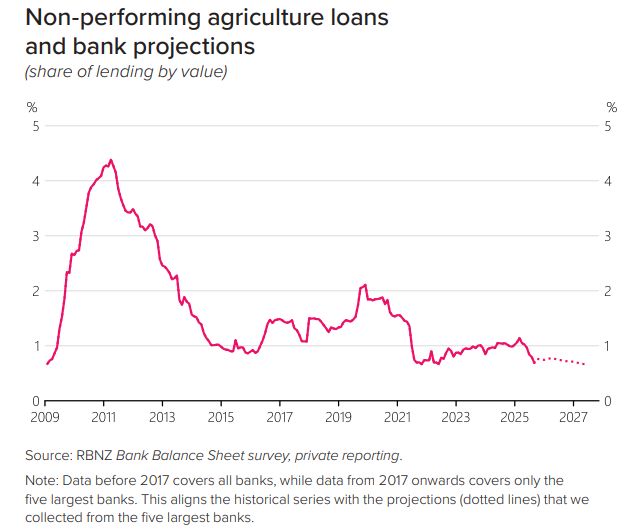

Non-performing loans in the agriculture sector are near a 16-year low thanks to strong milk and meat prices, the Reserve Bank says.

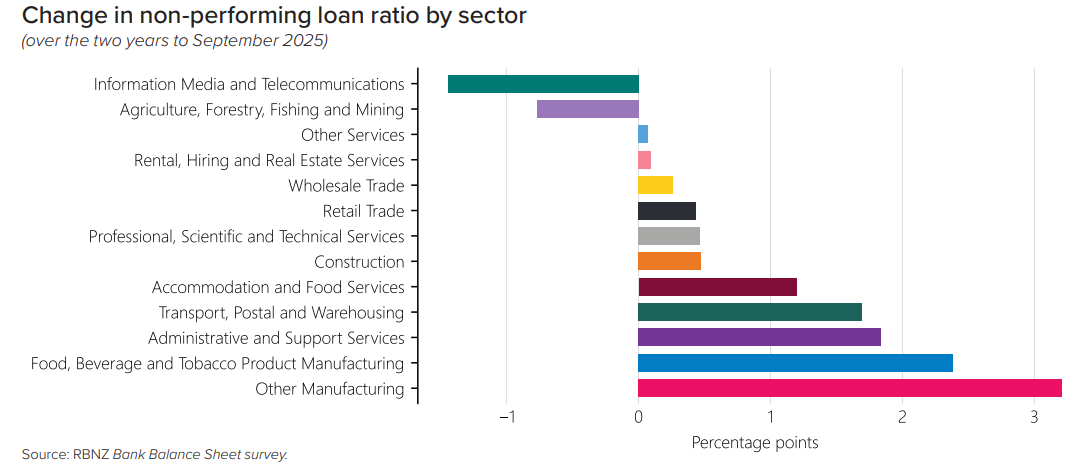

In its latest bi-annual Financial Stability Report released on Wednesday, the Reserve Bank says in contrast to increases in most other sectors, non-performing loans in the agriculture sector have fallen.

"Elevated milk and beef prices, improving sheepmeat prices, and stabilising, albeit high, farm costs have supported strong financial returns for the rural sector. Lower interest rates and debt repayment have improved interest coverage ratios, bringing agriculture non-performing loans close to a 16-year low, particularly in the dairy industry," the Reserve Bank says.

It points out, however, that the sector remains exposed to global and domestic risks.

"Rising geopolitical tensions could increase volatility in input costs and commodity prices, while dry weather in parts of the North Island has weighed on production for some farms. In addition, the meat-processing sector continues to struggle with excess capacity and low profitability. A key risk to the outlook that remains is the impact of tariffs on global demand."

The Reserve Bank notes strong cashflows in the agriculture sector are primarily being used to pay down debt and for farm maintenance.

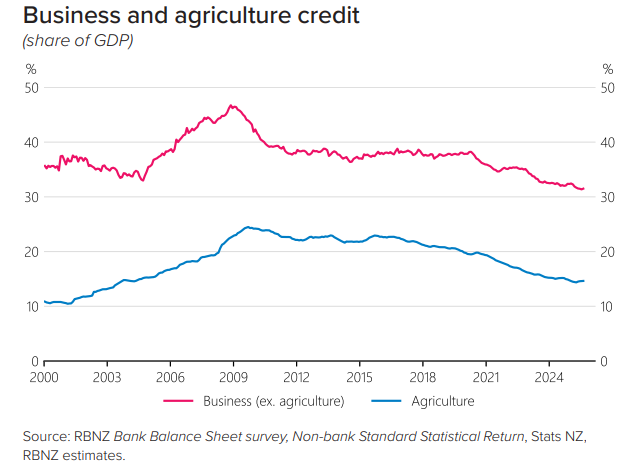

Meanwhile, it points out aggregate business leverage has reduced since 2009 with business, including agriculture debt, dropping to 46% of gross domestic product from 69% in 2009.

"In particular, the dairy sector has significantly reduced its debt since 2015. Over the past decade, banks have maintained stronger lending standards, and business borrowers have become more resilient as a result," the Reserve Bank says.

Tariff watch

The Reserve Bank also weighs in on tariffs, implemented by the United States.

"The direct impact of US tariffs on our exports is expected to vary across products. The US imports around 30% of our beef and sheepmeat exports. These are relatively standardised commodities that can be diverted to alternative markets fairly easily, and currently have high global prices."

"A 50% tariff on US goods imports from Brazil [versus 15% for New Zealand], one of the largest beef producers, may enhance the competitiveness of New Zealand beef in the US. In contrast, the wine sector, which also sends around a third of its exports to the US, is more exposed. This reflects the more differentiated nature of the product and its dependence on brand recognition, which make diversion to alternative markets more challenging in the short term," the Reserve Bank says.

"A key risk is that the broader impacts of US tariffs and retaliatory measures negatively impact growth and incomes in our key trading partners. This could affect the financial performance of New Zealand exporters and could have negative spillovers to the financial system."

1 Comments

If any farm is under financial pressure because of over leveraging or the owner is just close to retirement age this season would be a great time to get out.

Banks are flush with funds and their lending criteria has loosened up. Interest only terms are back on the table. Match that with an upsurge in townie investors wanting a share of the rural market and I can see record land prices between now and Christmas, especially for dairy farms.

This heightened enthusiasm comes as the 6th dairy auction in a row records a fall in prices. I still believe there was a real effort by Fonterra management to keep the $10 figure in place to keep farmers confident in Fonterra's strategy during the divestment vote. Now its approved watch that $10 slowly slip away.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.