At Wharf Gate (AWG) prices increased by 1 NZD, as lower CFR log prices in China were largely offset by reduced shipping costs. February AWG prices remain under pressure due to the strengthening NZD against the USD. While CFR log prices in China have lifted by around 2 USD, further gains will be difficult as the market moves rapidly toward the Chinese New Year.

Log demand in China remains stable in the near term but is expected to soften from the second week of February as mills prepare for holiday shutdowns. Port log inventories have continued to edge lower, although stocks typically rebuild as consumption slows then halts through the Chinese New Year period.

The New Zealand forest industry will be closely monitoring NZD movements and the pace of China's post-holiday recovery in log demand as key indicators for AWG price direction.

Domestically, sawmill managers and owners report a stronger start to 2026 than in 2025, with improved sawn timber demand and price increases, and there is growing optimism that this represents the early stages of a more sustained recovery.

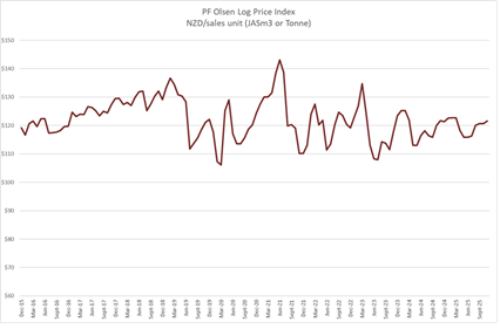

The PF Olsen Log Price Index increased $1 to $121. This is $1 above the two-year average and level with the five-year average.

Domestic Log Market

Sawmill managers are reporting increased demand and stronger sawn timber sales across all major product categories, with many describing the uplift as more substantial than the typical seasonal summer increase. This trend is reflected in price movements, with sawn timber prices rising by 3–5% in January and a further increase of similar magnitude scheduled for March.

This demand improvement is a positive development for the domestic market. Increased local sales mean less sawn timber is directed into export channels, where returns from sales are reduced due to the strengthening NZD.

Forward-looking industry reports suggest that domestic sawn timber demand may continue to firm into 2026 as seasonal demand from pallets and packaging transitions into broader residential and industrial activity later in the year. Early indicators point to a gradual pickup in construction activity from mid-2026, which would support structural and appearance-grade timber demand if realised.

Export Log Markets

China

CFR prices for A-grade logs for late January/early February vessel arrivals are currently in the range of 111–114 USD per JASm³, representing an average increase of around 2–3 USD over the past month. Daily pine log port offtake remains steady at approximately 55,000 m³ per day, and while softwood log inventories have been declining modestly, they are expected to rise during the upcoming Chinese New Year holiday period as consumption slows and port stocks build ahead of the break.

Recent import data continues to underline the subdued state of China’s timber market. According to customs data, from January to September 2025 China’s total log and sawn wood imports have fallen year-on-year, with log and sawn wood imports down 13.2% by volume, and down 15.6% by value.

Last year’s post-Chinese New Year period featured a very slow rebuild in log demand, with an extended period before activity returned to pre-holiday levels. Industry participants are hopeful that the rebound in log demand will be quicker this year, supported in part by stabilisation in some construction and manufacturing sectors.

Broader structural trends suggest mixed signals for China’s timber import markets:

- Log buyers continue to adopt a cautious purchasing stance amid economic uncertainty and slow housing activity.

- Sluggish real estate sector indicators, such as lower new housing starts and softer commercial floor space sales, continue to weigh on overall wood product consumption across construction and interior finishes.

- China’s domestic forestry production and downstream wood manufacturing sectors (e.g., plywood, fibreboard, furniture) continue to evolve, with production output remaining robust but export receipts from wood products down in some markets amid global trade pressures.

China has signed a five-year non-binding memorandum of understanding between British Columbia’s Forest Ministry and China’s housing and urban development authorities. The agreement focuses on promoting the use of modern wood construction in China’s urban renewal and rural revitalisation programmes, including greater use of mass timber and engineered wood products. The memorandum calls for cooperation on developing a wood construction “industrial chain”, including exchanges, joint research and technical collaboration on tall wood buildings and mass timber projects. Similar agreements between B.C. and China were signed in 2010 and 2015, but China’s regulatory framework has since opened further, allowing larger-scale wood buildings in cities such as Beijing, Shanghai and Haikou. This reflects China’s longer-term interest in diversifying construction materials and promoting mass timber in urban and rural programmes.

While short-term pricing and inventory patterns are highly influenced by seasonal factors and holiday shutdowns, structural headwinds in China’s log importing and construction sectors persist, continuing to influence import demand and pricing dynamics.

India

Around 12 bulk vessels of pine logs have arrived at Kandla during January, supporting some replenishment of supply for mills. Sawn timber prices in the region have rebounded slightly from recent lows, with current green sawn timber around INR 571 per CFT for material derived from New Zealand logs and INR 541 per CFT for material from South American origins.

Green sawn timber prices in the Tuticorin market in Southern India currently remain around INR 621 per CFT.

Currency headwinds and global trade tensions continue to weigh on the Indian timber market. A weaker INR against key currencies has amplified landed costs for imported logs and sawn timber, contributing to margin pressure for Indian sawmillers and price sensitivity among buyers.

Trade tariffs imposed by the US have dampened export demand from India, reducing demand for pallets and other timber packaging products used in international shipments. At the same time, India and the European Union have officially concluded a landmark free trade agreement (FTA) after nearly two decades of negotiations, aimed at reducing or eliminating tariffs on a broad range of goods. This FTA, which will require ratification and phased tariff reductions, will deliver unprecedented market access for more than 99% of India’s export by trade value. While this is not expected to immediately offset reduced exports to the US market, the long-term outlook for diversified export opportunities is more positive.

India’s broader timber consumption landscape also highlights structural import dependence. India imports a significant portion of its industrial wood supply, with imported logs and timber imports valued in the multi-billion-dollar range annually, reinforcing the strategic importance of access to competitive sources such as New Zealand. Once the New Zealand–India FTA is formally notified and implemented, demand for New Zealand radiata pine logs at Kandla could increase by an estimated approximately 80,000 JAS m3 per month. To that extent, demand for South American pine logs is likely to be displaced, improving New Zealand’s competitive position in the Indian market through lower transaction costs and preferential access.

Ocean Freight

Shipping costs have now stabilised.

The BDI is a composite index comprising three sub‑indices: Capesize (40%), Panamax (30%) and Supramax (30%), and reflects average daily USD hire rates across key ocean freight routes. Most New Zealand log exports are carried on Handysize vessels, which are not directly included in the BDI calculation, though broader freight cost trends can still exert indirect influence on this segment.

Baltic Dry Index (BDI)

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

Exchange Rates

The NZD has continued to strengthen against the USD, appreciating by approximately 4.3% over the past month. This stronger currency will negatively impact AWG returns by around 4 NZD per JASm³. The CNY has also firmed against the USD, rising by about 0.77% over the same period, which may provide Chinese log buyers with a modest improvement in purchasing power.

PF Olsen Log Price Index - January 2026

The PF Olsen Log Price Index increased $1 to $121. This is $1 above the two-year average and level with the five-year average.

PF Olsen Log Price Index - January 2026

The PF Olsen Log Price Index increased $1 to $122. This is $2 above the two-year average and $1 above the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – January 2026

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Jan-26 | Dec-25 | Nov-25 | Oct-25 | Sep-25 | Aug-25 | Jan-26 | Dec-25 | Nov-25 | Oct-25 | Sep-25 | Aug-25 | |

| Pruned (P40) | 175-200 | 175-202 | 175-200 | 175-200 | 175-200 | 175-200 | 194 | 194 | 194 | 190 | 190 | 185 |

| Structural (S30) | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | ||||||

| Structural (S20) | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | ||||||

| Export A | 123 | 126 | 126 | 125 | 125 | 125 | ||||||

| Export K | 114 | 117 | 117 | 116 | 116 | 116 | ||||||

| Export KI | 105 | 108 | 108 | 107 | 107 | 107 | ||||||

| Export KIS | 96 | 99 | 99 | 98 | 98 | 98 | ||||||

| Pulp | 46 | 51 | 51 | 50 | 50 | 49 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.