Local demand usually drops in winter, but mills report structural lumber sales are slightly up on last year while clear wood sales are flat. Log supply remains balanced around most of the country.

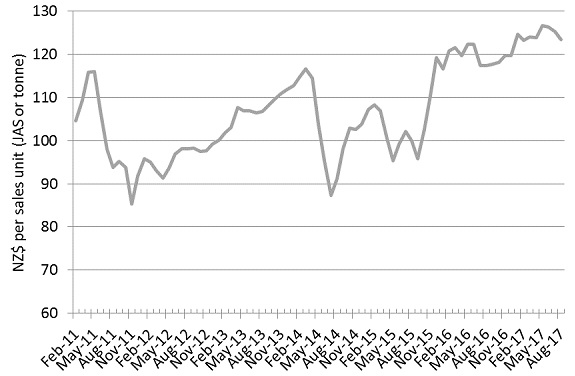

Due to the drop in export prices the PF Olsen Log Price Index for August has dropped two dollars and is now at $125. (See PF Olsen Log Price Index below). The average sale price is still $13 per tonne above the three year average.

Domestic Log Market

Pruned

Domestic lumber demand is flat. The Australian and American markets have strong demand at the moment. The European demand has been slightly depressed as a couple of the large mills that purchase NZ clear wood boards to remanufacture for the local markets are undergoing significant up-grades. Most mills report a well-balanced supply of logs.

Non-pruned

Export lumber prices are flat across all markets. China and Australian demand is strong but the mills generally find these markets difficult to predict. Domestic demand for lumber is up slightly on this time last year. Domestic lumber suppliers have indicated to the merchants that they are looking for price increases to offset increased log prices over the last six months. Most mills report log supply is good.

Export Log Market

China

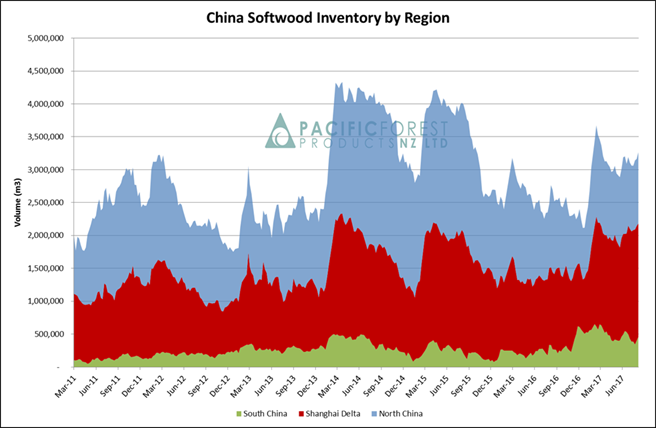

Log exporters had a slight increase in prices for logs sold into China, and the market remains well balanced between supply and demand. Last month we reported China stock levels at 3.1-3.2M m3. Due to some adverse weather events in China over the past month, the inventory has risen to approximately 3.3M m3. This slight increase is of little concern as demand is still very strong across all log grades. The inventory by region is shown below.

China Log Inventory Chart (Courtesy of PFP)

PF Olsen’s Chief Marketing Officer Peter Weblin made the following observations on a recent trip to China.

Resin

We visited one processing facility located about 100km from Xiamen. The logs and lumber are imported via Zhangzhou port. We were told it costs about NZ$8/m3 to transport logs from Zhangzhou to the mill (about 100km). This is a fraction of the expected $21/m3 for equivalent cartage in New Zealand.

Log grades imported are pruned, A40 and A with focus on flat sawn wide boards. We were told recovery is 75%. The larger log size will assist with recovery and productivity. We were told K grade is tending to be used more for peeling/plywood (along with the traditional KIS). This reinforces the greater interest we have been seeing this year for consignments with a high proportion of A grade.

Products included blanks for baby cots, blanks for other remanufacturing factories and lots of different sizes of EGP (edge glued panels). The mill is a big supplier to the Chinese furniture industry which is centered in the nearby Shenzhen/Guangzhou area. As a consequence, they do not experience the demand downturn during the hot season, as do wood processors supplying the construction industry. Some product is exported (e.g. USA and South Korea).

During the tour, we were shown repeated examples of high levels of resin in the wood (the Chinese call it oil). This affects gluing and the ability of the wood to take surface finishes such as paint and varnish.

Resin in unpruned logs is causing considerable downgrade for visual appearance uses of Radiata pine in China.

As usual, there was plenty of sapstain observable and this also downgrades the wood. We were told that sapstain resulted in a 15% lower (end product) sales price as compared to sapstain-free product. This could represent a discount of around $30-100/m3 depending on the product.

|

|

| Less severe but more widespread resin in freshly cut boards - same downgrade issue for visual end products. | Sapstain in Radiata pine clear blanks downgrades visual end-use products and necessitates paint finishing or dark staining to hide or mask the sapstain. |

When asked what the mill’s number one issue/concern is we were told it was consistently getting log grades with the right quality and characteristics. Interestingly, they didn’t mention price!

Two clouds on the horizon

Due to much tougher smoke and dust emission standards, one Chinese manager believes that 1,000’s of sawmills could be forced to close. This is a result of a recent clamp down by officials. Already this has put some downward pressure on log price and it could reduce near-term demand of logs. It will affect the older mills most - the ones that are using coal for firing their kilns and that don't have sealed/concreted sites. Short-term the move it is also expected to put upward pressure on lumber and plywood price and (possibly) stimulate more imports of these products. Medium-term (and in China this response can be quick), the industry is expected to respond by either renovating old wood processing sites, or constructing new ones that meet the emissions standards.

Burning wood waste to fire wood drying kilns is fine but the past practice of burning coal or lignite will not meet new emission standards in China’s biggest wood processing region, Shandong.

Monetary tightening

The second discussion was fascinating, if not a bit disturbing. We were told that banks (almost all Chinese government owned) were prematurely calling in business loans including those of wood processing businesses. One example given was a loan call-in by a bank of 300m RMB (about NZ$ 61m). In this case it created a working capital shortage for the business and the wood processing factory was not able to run at full capacity.

Whilst this story is consistent with what we know about the Chinese government objective of de-leveraging the economy (reducing debt), we didn't realise that it was being applied to existing loans and to the wood products sector. Hopefully it won’t trigger what the policy is designed to avoid - a domino-effect or run of business failures.

India

Indian packaging-related timber (e.g. pallets) demand is up and strong. Construction sector demand has been marred by the implementation of a unified 18% GST on timber products by the Indian Government. The Indian construction sector utilises NZ Radiata pine for formwork and scaffolding and was conducted as a relatively informal trade. With the introduced stringent requirements of GST registration for both buyers and sellers, it has dulled the market sentiment as previously mentioned in recent Wood Matters.

To get logs released from port, an Indian log importer has to deposit cash of 18% GST (landed value of logs) + 5% customs duty and 1% landing fee = about 25% of CFR USD value of logs. The GST paid can be recovered using an ‘offset method’ on GST of sold lumber (or logs) by importer saw mills. GST regime was implemented from 1 July 2017.

This has limited the ability of Indian Customers to open more LC’s and most importers are now working on ‘just In time’ inventory and avoiding cash outflow at time of getting cargo released from ports.

Satinder Singh of Aubade recently returned from India where he witnessed this, and believes “this is a short term correction and in about two months, the business cycle would be back to normal in Q4 of 2017”.

Ocean Freight

The ocean freight price has remained steady with rates to China and Korea remaining in the low US$20’s while India is around US$30. Market forecasters continue to predict a range of flat freight rates for the remainder of 2017.

Foreign Exchange

The NZD relative to the USD has risen from 0.6880 mid-May to 0.7355 in mid-July with a slight easing to 0.7283 in the last week. The exchange rate continues to have the biggest impact on AWG prices for logs.

PF Olsen Log Price Index to August 2017

The PF Olsen Log Price Index for August has dropped two dollars from the July index figure and is now at $123. The index is now $7 higher than the two-year average, $13 above the three year average and $16 higher than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – August 2017

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| Aug-17 | Jul-17 | Jun-17 | May-17 | Apr-17 | Aug-17 | Jul-17 | Jun-17 | May-17 | Apr-17 | |

| Pruned (P40) | 183 | 183 | 188 | 188 | 188 | 175 | 175 | 180 | 180 | 185 |

| Structural (S30) | 120 | 118 | 112 | 113 | 113 | |||||

| Structural (S20) | 108 | 107 | 104 | 103 | 103 | |||||

| Export A | 134 | 139 | 141 | 141 | 136 | |||||

| Export K | 127 | 131 | 133 | 134 | 129 | |||||

| Export KI | 119 | 122 | 125 | 126 | 121 | |||||

| Pulp | 47 | 47 | 50 | 50 | 50 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only..

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.