An independent report prepared for Fonterra's farmer shareholders shows that the co-operative had an "opportunity cost" of $2 billion in foregone earnings in its first 17 years of existence.

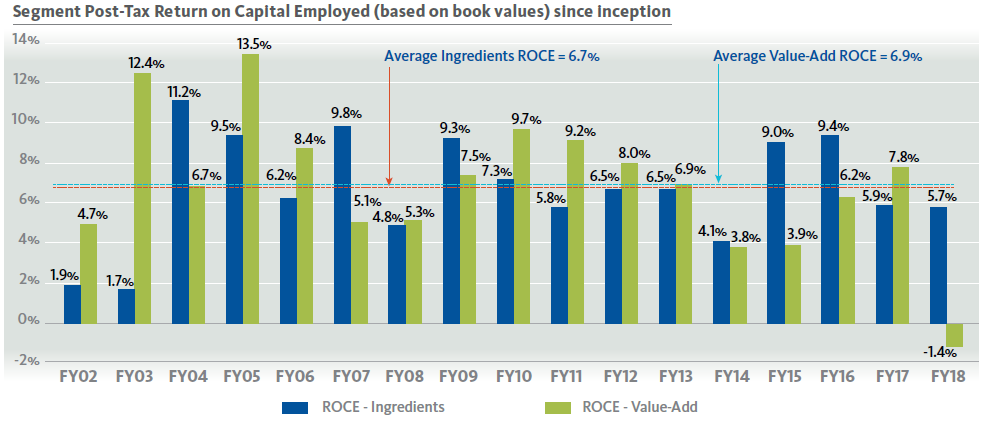

In addition, analysis of the returns on the 'value-added' part of the Fonterra business shows that this achieved on average just 0.2% a year more return on capital than the ingredients business, which was "significantly below" the 1.3% premium needed to justify the increased risk of the value-added business.

The findings in the report by corporate advisory business Northington Partners confirm the general, widely-held, belief that Fonterra as a business has substantially under-performed in terms of return on capital since its formation.

The report was commissioned by the Fonterra Shareholders' Council earlier this year.

Council chairman Duncan Coull says it was in response to "a heightened level of commentary within the supplier base, media and the broader financial community" in relation to the perceived performance of our Co-op since it was formed in 2001.

"The assessment clearly shows that Fonterra’s financial performance since inception has been unsatisfactory. When considered as a stand-alone investment, the average returns generated by Fonterra since inception are lower than relevant benchmarks," Coull says.

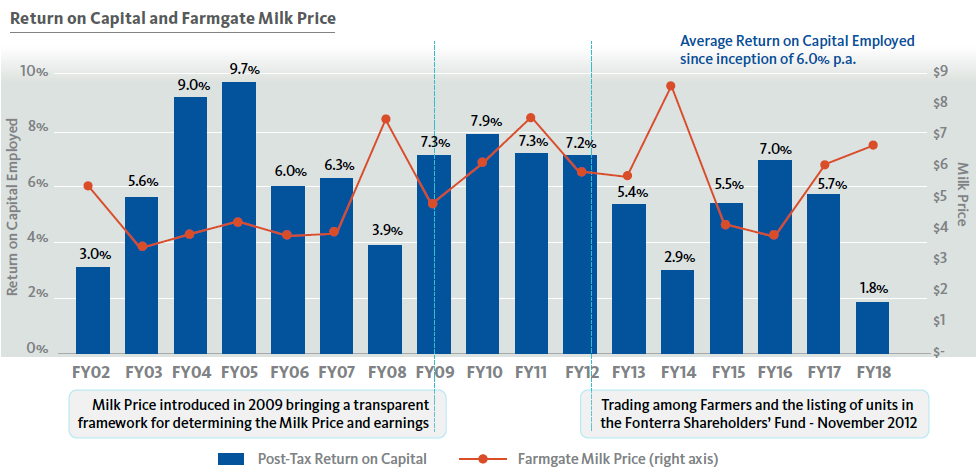

The report shows that Fonterra's return on capital averaged 6% a year, post-tax, which is below the accessed benchmark of 6.9% to 7.7% - and the returns for Fonterra have been lower in recent years.

"This differential is material when considered over the full 17-year period, amounting to an opportunity cost of over $2 billion in foregone earnings. In simple terms, this is the gap between the returns actually achieved by Fonterra and the benchmark cost of capital over time," the report says.

The council says: "The opportunity cost of around $2 billion is reflective of the Co-op’s inability to generate Shareholder value over and above the cost of capital for its owners."

The 'value-added' part of Fonterra's business has attracted a lot of recent attention, not least because of the disastrous investment in China's Beingmate Baby & Child Food Co, which is now up for review and likely to be exited by Fonterra.

The analysis in the report shows that the value-add segment of Fonterra’s business has generated a return that is only 0.2% p.a. higher than the Ingredients segment. This premium is far lower than the estimated 1.3% margin that is required to compensate investors for the higher risk profile associated with the Value-Add business

The shareholders' council says the analysis broadly illustrates that Fonterra has not generated sufficient additional return on its Value-Add business.

"This is important because the value-add business units are now using an increasing share of Fonterra’s capital.

"For the first five years since inception (FY02 – FY06), the Value-Add business accounted for 36% of Fonterra’s capital.

"This has increased to 50% of Fonterra’s capital over the last 5 years (FY14 - FY18).

"However, we should also note that recent investment in consumer brands and other value-add opportunities represents a long-term proposition that may take some time to generate the expected outcomes. For example, the initial investment in China was expected to be loss-making in its early years, before generating target returns after the business matures and reaches the required scale.

"Higher returns from these investments may yet be realised."

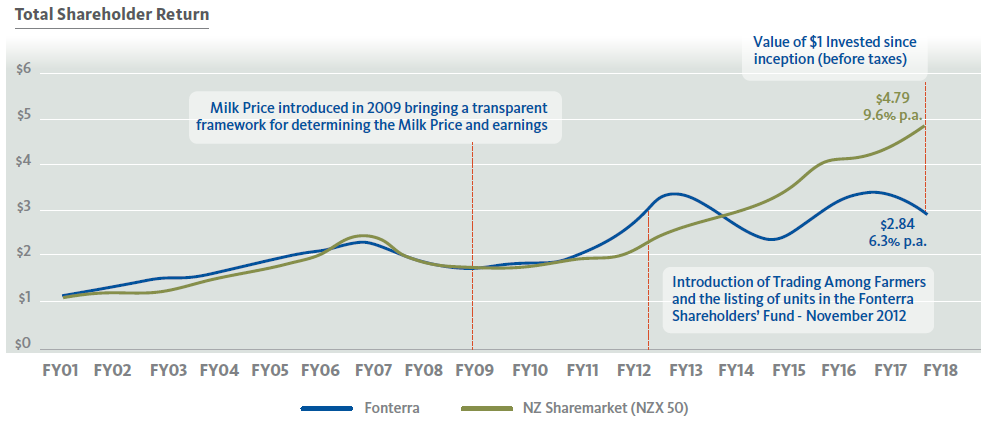

In terms of shareholder returns, the report has compared an investment in Fonterra with the return from the NZX 50 Index. Again this is not flattering, with Fonterra's shareholders achieving an average pre-tax return of 6.3% per annum, while the NZX 50 has averaged 9.6%.

Duncan Coull says the council’s view is that the information provided in the report "should inform a wider discussion between Board, Management and Shareholders around the continued evolution of our Co-op and in particular what can be done to ensure ongoing returns meet, as a minimum, the opportunity cost of Farmers’ capital invested in the Co-operative".

He says notwithstanding the findings of the report, the council remains firmly of the view that the co-operative structure "is the only structure that will provide for the enduring needs of our intergenerational farming families".

33 Comments

Luckily that they spent hugely over the years on getting the best people at the top levels.

Well, lucky for those people anyway...

If you pay peanuts you get monkeys. If you pay $5m per year you still get monkeys. Apparently there's no accountability.

I think the bigger issue is the next level down....there are 6,000 people on more than $100,000 at Fonterra.

Its a logarithmic scale.

As all offshore salaries are converted to NZD it doesn't take much to = $100kNZD. $70kUSD would get you around that mark on today's cross rate. 6000 is around 26% of the Fonterra work force. So alternatively 74% of Fonterra employees earn less than $100k.

It seems all you needed was a continental accent to impress dumb kiwi cockies.

Ah... 'dumb kiwi cockies'. What does that say about the rest of NZ when they rely so heavily on those 'dumb kiwi cockies' for export earnings? And that they feel they need to comment on those 'dumb kiwi cockies' privately held company. Perhaps it's not the cockies who are so dumb after all.

Was it not the dairy farmer co-operative shareholders who many years ago now voted down the Fonterrrrra proposal to borrow$$$ to finance a separate brand division for consumer oriented higher value packaged products ?

The whole plan was to concentrate on building consumer brands that would generate much higher revenues

& customer long term loyalties than mere huge bags of dried milk powder as a raw commodity for others to create value from

As for China all they do is steal intellectual property

That’s the CCP way & they’re totally unscrupulous about it

If anyone disagrees China will simply make life difficult doing business in China

NZ makes very fine cheeses better than Nth American in my opinion. My wife buys Welsh cheese that although good is not as good as NZs extra tasty cheeses I prefer.

It’s just so sad to see every other countries cheeses selling here at high cost

You are right and a friend of mine who is a food scientist with F was made redundant along with a busload of highly skilled collegues as F dived headlong into selling milkpowder to China because it was going to give short term results as opposed to longer term higher profits that the high value consumer approach would have delivered....

How long will the Fonterra mess continue? The bottom up approach whereby you pay farmers a farm gate price is completely at odds with a consumer market lead company – until this changes Fonterra will continue to flounder. Who in the private sector would set a up a company like Fonterra if they were starting out!?!?

Fonterra is a private company - it is a co-operative and not many people outside co-ops understand them. ;-)

Not that many inside co-ops understand them, even less when they become some sort of hybrid that cant decide year to year which is most important , milkprice, dividend or retentions.

It’s a Co-Operative of farmer shareholders who call the shots

The management are just expensive hacks who collect their salaries knowing full well they’re restricted in what they can ever implement

So the tragic paradigm continues

It’s NZs future riding on this dairy business sorting itself out

Branded Consumer Oriented PrePackaged Higher Value Products & shift away from shipping huge bags of dairy powder

Keeping doing the same thing will end in tears for this Co-Operative bungling corporation & China will buy it all up at rock bottom

Okay , so hindsight is an exact science, but imagine if they had invested that $2,0 billion in downstream value added factories ( making say cheese or butter or food additives or whatever ) in Provincial towns in NZ , instead of embarking on hare-brained investment schemes in countries that don't have the same business ethics, culture or values as we do ?

For starters Shane Jones would not have a job today.

Everyone knows its almost impossible for Westerners to actually make it in business, in China . We westerners are seen as fair game for every rort , sharp practice, or downright scam , and there are so many tricks up their sleeves we have not even seen yet

The Fonterra executive have been chasing short-term gains in a perverse incentive where bonuses are calculated annually .

Bonuses should be calculated and paid over a much longer time-frame of say a decade, to ensure the execs take a long term view for the benefit of the Company (co-op) .

I would like to see the Business Case that was put to the Board before it got involved in Beingmate .

I would also like to see the transcript of the meeting ( not the minutes ) at which the decision was taken to embark on this ill-fated venture.

It could make the perfect MBA course case - study for MBA grads

I would like to see the business case where exporting dairy cattle to to China was a "Win Win" in the words of Director (ex now thank god) Ian Farrelly.. Sell the produce, not the assets that make it. Was this another cunning idea dreamt up over the fence at the back forty?

https://www.tvnz.co.nz/one-news/business/live-cattle-shipment-boosts-fo…

What does the life to date return look like if you factored in the negative externality of polluted waterways?

this should have been split into two companies long ago, one the farmers owned that processed raw milk and value added that they could buy shares in if they wanted and was open to all investors.

the problem is the two agenda's conflict so you don't get the best of both but a compromise which is never good long term.

its a bit like the old saying , a camel is a horse designed by committee

If 'investors' want to buy a value add company, they should do that, but I don't think it would be wise for fonterra to compound it's losses by selling the bottom. Buy high and sell low is a quick ticket to the poor house.

Beingmate fiasco. Just like Mainzeal. Why not peruse these companies in the Chinese courts? Are there any Chinese courts?

Yes, there are courts. Judge only ruling on the case, and they have been told what the outcome of the case shall be before the start of the trial, by the CCCP.

The interesting thing here is the “new to farmer “ language in the report such as performance against capital , comparison to the Nzx50 etc. it’s a change of expectation by farmers of .Fonterra. Don’t forget we are only a couple of weeks away from the axing of Speirrings Volume, Value, Velocity shove everything you can into the market through any channels you can find or buy, so farmers can carry on expanding and make a capital gain on increased production - particularly the large farmers.

Fonterra was just doing what farmer directors wanted.

Dave2 - yes you are right, Fonterra's road was designed by the large shareholder/suppliers who became far to arrogant and believed they were the new kings. Very clearly they were good (or lucky) at making Capital Gains via dairy conversion but had a very poor understanding of the real commercial world and thus have lead the whole industry down the wrong track. Having operated in a number of industries including dairy I was stunned to see how arrogant we kiwi farmers were offshore as we tried to replicate the NZ Dairy game in Australia, Uruguay, Chile, USA and now China. Most of these kiwis's have been burn't in all these countries and now the chickens have come home to roost here in NZ.

Its going to take time but the industry will regroup and rebuild with the next group of leaders operating in a better informed position and no doubt without the arrogance weve had over the last 20 years.

Rod Oram nailed this - Fonterra is 2nd biggest in the world by production volume but 18th in the world by value.

Retards thought fonterra needed to be all about value add, now retards are realising value add isn't actually profitable, and certainly not worth the risks. No doubt though, that retards will ignore the obvious and continue to push for more 'value add',

Why not look at what is actually profitable for farmers and build on that? Why not indeed! The tiny portion of fonterra revenue that is 'value add' is the sole source of bonus for the CEO and the sole source of income for dry share shareholders.

Wow we are paying twice as much for milk in this country as we should be paying and they are still making a loss, how can that be possible ? Sounds to me like someone needs to open a fraud investigation.

It just boils down to the banks if you ask me. They finance the sectors dreams of riches and capital gains and encourage reckless decision making by farmers and Fonterra falls victim of that poor decision making because farmers are up to their eyeballs in debt. I don't hold out much hope for the sector in the long run as I think it is now a sunset industry that will only experience further declines in profitibility, which is a shame because it ought well to have been quite the opposite had the right strategic direction been struck from the outset.

Yes, "sunset industry" now when did I hear that last? Oh that's right, is that you again David?

TBF about the debt arguement, that is what is driving ALL of our economic thinking, mostly in the direction of more debt and lower marginal returns.

This should make pastoral farmers cough on their coffee.

https://www.theguardian.com/business/2018/nov/01/third-of-britons-have-…

And a report suggests taxing red meat as it may be carcinogenic.

Sell your Fonterra shares now.

The fact is 1/3 of the population in the UK cannot afford red meat anyway. General food items, i.e. the basics are however way cheaper than New Zealand which is even further incentive to drop meat. I looked at some receipts from my mothers recent trip two weeks ago, all the items on her bill were under 1 pound. Take a look at your supermarket receipt in NZ, everything starts with a "3".

The rate of change to vegan is interesting, four fold in four years according to Waitrose.

Protein from meat provides all essential amino acids (lysine, threonine, methionine, phenylalanine, tryptophan, leucine, isoleucine, valine) and has no limiting amino acids.

Try to find all of these in the Vegan Diet...........................

I completely agree Northern Lights- dairy farmers keep on calling for more dairy farmers on the board, of what is supposed to be a globally orientated company - they would be better off as contractors to a privately/publicly owned corporate that values their supply with incentives and bonuses, but whose bottom line is driven by maximising value add profit - can't hear too many suppliers to Synlait or Open Country complaining about their supply arrangements...

I know suppliers to Synlait and OCD who are happy too. But ask them two questions - does the industry need a strong Fonterra, and would you be happy to see open entry to Fonterra removed?

Aussie farmers are basically contractors that receive incentives and/or bonuses. You don't see too many of them singing from the rooftops about how great their processors are. The difference is in NZ Fonterra effectively sets the milk price - which many of the corporate processors argue should be lower (refer to submissions to ComCom on milk price manual milk price setting). In Australia there is no large dominant co-operative to keep the corporates paying an 'honest' price to farmers for the raw material.

It is going to be interesting to see how the new Fonterra board manages the tension of 'what is good for the co-op may not be good for the farmers' and vice versa.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.