Guest

Latest articles

Helen Clark, Peter Gluckman and Rob Fyfe issue a conversation paper looking at how and when New Zealand could step up its re-engagement with the rest of the world

Mariana Muzzucato and Antonio Andreoni show why governments can and should attach mandatory conditions to state aid to private businesses

Zhang Jun says pandemic-inspired efforts to stifle China commercially reflect an outdated view of its growth model

Saadia Zahidi argues that governments'emergency measures must continue to have strings attached - and more should be added

A new survey by Stickybeak for The Spinoff shows the popular assessment of the government response to the Covid-19 crisis at its lowest level yet

James K Galbraith says expectations of a sustained US economic rebound ignore three major long-term structural changes

A recent court ruling on trustee accountability is raising some legal eyebrows with a court setting aside a discretionary decision of a trustee. Anthony Grant reviews the situation

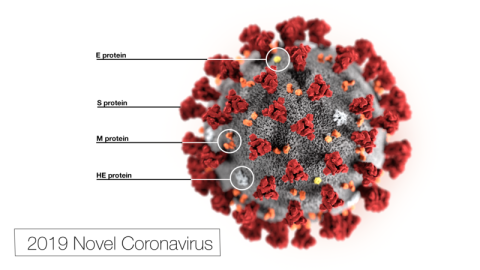

Klaus Schwab views the COVID-19 crisis as an opportunity to build healthier, more equitable, and more sustainable systems

Massey University's Teo Susnjak on how Covid-19 broke machine learning, extreme data patterns, wealth and income inequality, bots and propaganda and being primed to believe bad predictions

Paola Subacchi cautions against relying on central banks to lead the economic rescue and recovery effort

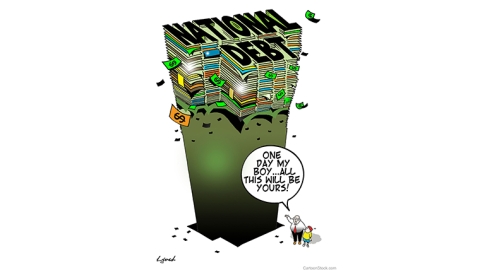

Tony Burton reminds us that while Covid-19 loads us up on public debt, there is little that is 'kind' about repaying debt. But it is what has to be done for kindness to be more than a gesture

By enhancing the quality of financial disclosure, listed firms may command a higher stock price, and reduce their costs of capital. When that happens, investors and Chinese private-sector firms will all benefit

30th May 20, 11:09am

by Guest

By enhancing the quality of financial disclosure, listed firms may command a higher stock price, and reduce their costs of capital. When that happens, investors and Chinese private-sector firms will all benefit

The Productivity Commission's Hamed Shafiee says the goal should not be simply to rebuild the economy we had, but to shift gear and find new ways for the economy to reach its full potential

Rebecca Caroe tries to imagine how business marketing will be different post COVID-19. Understanding how clients will respond in the 'new normal' should give some companies a head start

Mariana Mazzucato and Giulio Quaggiotto show why countries that embraced a proactive state have fared better against COVID-19

The latest dairy auction brought a realignment in category pricing and revealed important changes in regional demand. Although overall prices were flat, global pricing volatility hasn't gone away says Rabobank

20th May 20, 10:29am

by Guest

The latest dairy auction brought a realignment in category pricing and revealed important changes in regional demand. Although overall prices were flat, global pricing volatility hasn't gone away says Rabobank

The hugely successful coronavirus response means NZ is well-placed for an export-led recovery, writes Charles Finny in this paper for the SSANSE Commission for a Post-Covid Future at the University of Canterbury

Benjamin Cohen suggests that escalating US leadership failures will further erode the greenback's global standing

Brendon Harre sees the Ministry of Works as a template for how we should develop our national infrastructure, updated to the SOE model, and led by professionals

The Spinoff's Duncan Greive on how Jacinda Ardern, Ashley Bloomfield & communications workers accomplished what we would have thought impossible just weeks ago

The NZ Initiative's Roger Partridge says NZ should leverage opportunities to attract foreign students and sports competitions from its virus subduing strength

Massey's Christoph Schumacher asks: Is now the time to re-examine our attitude towards sharing?

Pinelopi Goldberg shows why the pandemic has not strengthened the case for domestic production over global supply chains

The Productivity Commission's Jo Smith says increasing the productivity of Māori firms presents an opportunity for supporting the wellbeing of Māori, and all New Zealanders

A blueprint to reverse a long-running decline that has consigned generations to unwelcome, and unnecessary, economic and social hardship