By David Hargreaves

Well, it's supposedly all about the Reserve Bank, but perhaps the most long-lasting consequences of the current Government-led review of the Reserve Bank Act will be felt by the commercial banks themselves and their customers.

Phase 2 of the review was officially kicked off on Thursday with the release of a consultation document and other supporting background papers. Public submissions are now open till January 25, 2019.

As we are at the consultation stage there's no firm conclusions drawn in any of the literature - but it's clear at this stage that some form of deposit protection, probably via deposit insurance - is being favoured.

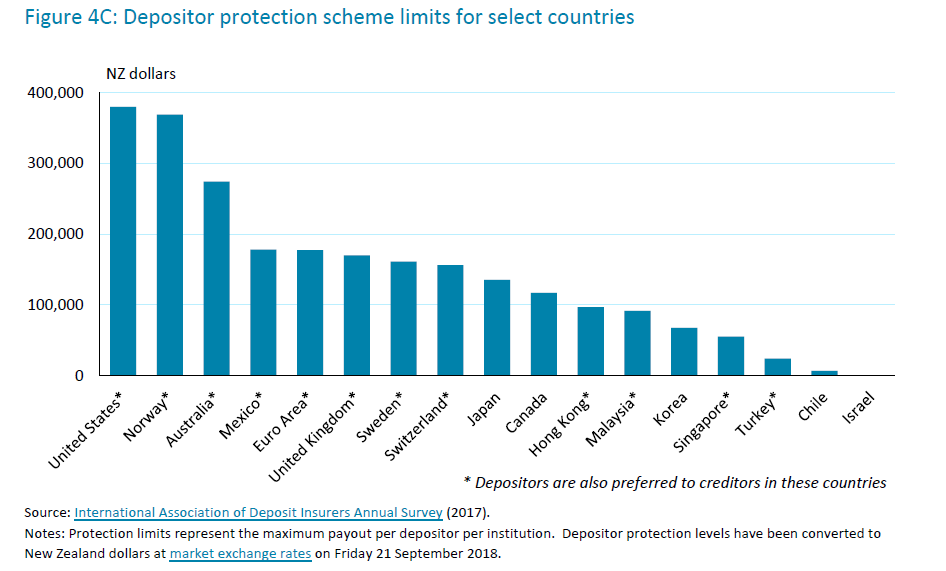

The consultation document points out that almost all advanced countries provide depositor protection of some sort, most often through insurance, also sometimes with a preference. It says deposit insurance is part of the Financial Stability Board’s Key Standards for Sound Financial Systems, which recommends a limited (i.e. capped) insurance scheme “to maintain financial stability by protecting depositors and preventing bank runs”.

New Zealand and Israel are the only OECD countries without depositor protection, and Israel has indicated that it will introduce deposit insurance.

In the 2016/17 Financial Sector Assessment Program (FSAP), the IMF recommended that New Zealand reconsider the merits of deposit insurance, and that if it were not adopted a small level of depositor protection should be provided in Open Bank Resolution (OBR).

And two of the main local critics of deposit insurance, the Reserve Bank itself and the National Party, have softened their opposition in recent times. Reserve Bank Governor Adrian Orr told interest.co.nz in April deposit protection, or deposit insurance, was "something that's going to be here in the future." And National's finance spokeswoman Amy Adams has said depositor protection is an issue “worth looking at.”

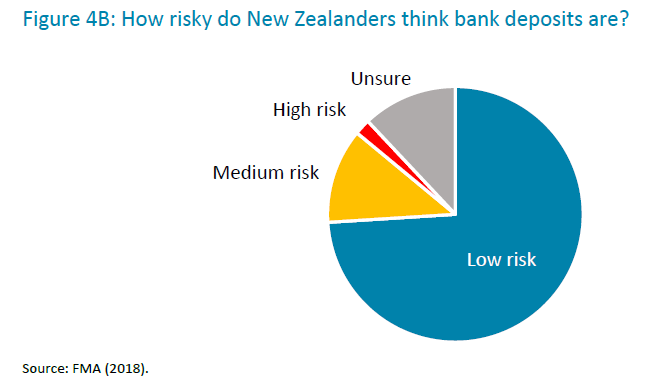

The document says most New Zealanders understand deposits to be low-risk investments (see Figure 4B), but the fact that they are not ‘no risk’ investments may be less well understood.

"Banks that take deposits (and the New Zealanders who have deposits with them) are exposed to special risks arising from the way banks manage and invest savers’ funds."

The document says without protection, depositors are treated like any general bank creditor. With protection, they have better financial outcomes than other creditors.

"Keeping depositors safe from loss (up to a limit) after a failure can only be achieved by shifting losses onto someone else. This kind of special treatment for protected bank depositors may be motivated by several public policy objectives that reflect the unique nature of depositors as investors and deposits as investments."

The objectives include preventing bank customers from loss and mitigating bank instability and wider economic costs of failure.

"These objectives present important choices and trade-offs for the design of any depositor protection scheme – for example, what protection limit should apply, and what account types and institutions should be covered?

"An insurance limit that protects most New Zealand depositors from loss (around $10,000 would protect 80% of people with deposits) may not be enough to shore-up depositor confidence in times of stress and prevent bank runs and contagion; many protection schemes proved inadequate in preventing distress during the GFC.

"The increased coverage limits ($100-300,000) that many countries have since adopted might promote depositor confidence, but could cause unintended consequences for financial stability and, if called on, generate payout costs so high that they are infeasible unless backstopped by the Government."

The document cites three main approaches to depositor protection around the world, namely:

- the status quo in New Zealand, with no formal protection,

- protecting depositors 'with a preference', which would mean some or all of protected depositors’ claims on a bank would be paid out before the claims of other general creditors and,

- protecting depositors with insurance, which would pay eligible depositors up to a pre-set maximum or ‘coverage limit’.

Core principles

The document doesn't go into depth on potential "design details" for any insurance scheme, but notes there are 16 international core principles of insurance scheme design (International Association of Deposit Insurers, 2014). And it says four in particular provide a guide to the design of a potential insurance scheme:

- Membership in a deposit insurance system should be compulsory for all banks (and other deposit-taking institutions).

- The deposit insurer is able to reimburse most insured depositors quickly (ideally within seven working days, a condition that many countries do not meet but are working towards. New Zealand would be well placed to address this challenge, as the OBR policy has already pre-positioned a possible payout mechanism for most banks).

- The insurer should be part of a broader crisis management framework (including resolution tools) that provides for the early detection of, and timely intervention in, troubled banks.

- Insurance coverage should be limited (i.e. up to a pre-announced set level), be credible, and cover the large majority of depositors, but leave a meaningful value of deposits at risk.

"The final point may be feasible because many deposit accounts are low in value, leaving a minority of high-value accounts holding a substantial share of total deposits (in New Zealand’s case, around 80% of all accounts hold under $10,000, but these make up only around 6% of deposits by value). The last two points are designed to make a bail-in of a failed bank’s owners and other creditors a feasible way to limit the costs faced by the insurance fund (or the taxpayers backing it). This again illustrates how resolution and depositor protection are interrelated."

The document concedes that depositor protection has an inherent trade-off.

'Moral hazard'

"On the one hand, it can reduce the severity and impact of a single bank’s failure on its depositors, the financial system, and the economy. On the other, it may encourage poor behaviour. This is because depositor protection, like any insurance arrangement, can distort the incentives and behaviour of those who benefit from it. Reducing depositors’ incentives to run may also reduce their incentives to monitor and manage risks properly. At the same time, banks shielded from deposit runs may have less incentive to act prudently.

"This is known as ‘moral hazard’, and can give rise to excessive risk-taking by protected depositors (who may invest in less financially sound banks than otherwise) and their banks (which may invest in higher-risk ventures). The risk of moral hazard when protecting depositors is particularly acute where bank supervision is not very intense or intrusive, as in New Zealand. If not carefully managed, moral hazard could mean that depositor protection put in place to help in times of crisis also causes a build-up of risks during normal times that crystallise a crisis."

The document points to the experience here with the Crown Deposit Guarantee Scheme as an example of moral hazard "allowing troubled and unviable investment firms to grow their insured deposit bases before ultimately failing".

"Depositor protection does not need to be explicit to create moral hazard.

"Depositors, bank managers, and New Zealanders more broadly may expect a CDGS in another crisis, which could be limiting their incentives to act prudently now.

"As with any insurance-type scheme, depositor protection can alter the magnitude, distribution, and timing of the risks and costs of failure. The impact and costs of depositor protection will probably extend far beyond depositors."

Timely review

The document says it is timely to review New Zealand’s depositor protection framework.

"This consultation is the first stage of that review. Whether deposit protection achieves the policy objectives and/or generates the costs outlined above depends on scheme design and context, so any recommendations that result from this consultation would be subject to detailed design work."

In the document the three options, that is, the status quo, a 'preference' system, or a deposit insurance system, are compared. The deposit insurance idea ticks the most boxes in terms of protecting the depositor, but the consultation document does point out that this approach carries risks, including:

- Insurance could create the most moral hazard of all three options. By shifting costs externally, insurance could cross-subsidise riskier firms and investments (particularly at smaller banks subject to less-intensive supervision).

- Any insurance scheme would require careful design to mitigate moral hazard and support the incentives of non-deposit stakeholders to monitor risks.

- For a one-off bank failure, deposit insurance could enhance the credibility of resolution options that impose losses on creditors (e.g. OBR, bail-in), particularly if accompanied by depositor preference.

- If multiple banks are failing at the same time, deposit insurance could be very costly, increasing the risk of a taxpayer-funded bail-out of the banking system. This risk is reduced if insurance is accompanied by depositor preference.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

69 Comments

The easy answer to Depositor Insurance is...let New Zealanders with an NZ passport be able to bank directly with the RBNZ; have a Call Account with the Central Bank.

That way if anyone wants protection, they can get it with the Government - like Government Bonds are.

If anyone wants more than the, say, OCR rate of 1.75%, less a margin, and want to 'risk it' with a commercial bank, and get 4% or place it on Term, then that's their choice and their risk.

We all have a tax number or some other sort of Government identity, so what's so special about having a call account with the RBNZ ( NB: it would be a doddle for them to oversee) and they get to use the funds in the meantime.

And what the RBNZ is to do with the deposits? lend it to government at the same rate?

huh? and what does the RBNZ do with it? does the depositor expect interest? in which case the RBNZ / tax payer is left carrying the risk? like why?

This is purely a civil transaction, why does the Govn need to be financially involved beyond legislating it has to be insured? All that has to happen then is the bank can offer 2 rates, the insured rate and the un-insured rate and the depositor can then choose which they want.

Even then how do you stop it being abused? say I have my $s in the "safe" account 100% of the time so I am paying the insurance premium over that period. You on the other hand put it at 11% (say) with a finance company. OK but we both see OBR coming due to whatever reason and you then jump into the safe place but you have not been paying that insurance premium for the preceding periods. How do we avoid this?

The RBNZ can lend out to the commercial banks if it chooses. That's what it does with the OCR after all; the OCR being a simple clearing account that the banks draw on to balance their books. There is no need to involve the commercial banks in a Guarantee of any sort. The Government is the Issuer of Last Resort of our currency. Central Banks were always supposed to be the Lender of Last Resort, after all, to mitigate bank runs etc. So having them maitain any funds that any citizen may wish to lend to them ( make a 'deposit' in other words) is a choice they should be able to make.

This is probably no different to what many of us do already today. How many of us have multiple bank accounts with multiple banks as protection against a 'what it Bank X " looks like it's in trouble? Lots, I'd wager., So just give us all one Bank of Last Resort to be able to access. The RBNZ. ( NB: This would not be a transactional account; a cheque account etc. Day to day banking would still require a commercial bank. The RBNZ would simply be a low cost/benefit, no risk place for any funds any of us might wish to lend out.)

Take away any risk factor from a commercial bank ( guarantee ANYTHING they do!) and what are we left with? Moral hazard. And hasn't that worked well!

The RBNZ then has to "make" the OCR rate for you? why? If you want to deposit money with the RBNZ at zero interest, well not so bad. However if you expect the RB to make money for you, for no risk, uh no thanks.

The RBNZ can offer whatever rate it likes to either attract or discourage deposits. Just like the commercial banks do. (NB: I actually disagree with the OCR mechanism, but that's another topic!).

Arguably, we all already have an account with the Government. It's called the Tax Payable account. Any of us could lend surplus funds to the Government by pre-paying $X amount of anticipated tax due; Y Years of tax, that could then be drawn down as our liabilities to the IRD fall due. So why not formalise it?

Give us all an RBNZ account, to be used to pay tax or just park funds, for whatever reason, at whatever rate the RBNZ decides on at any time.

If the Government wished to fund a project, it could call on any surplus funds the RBNZ had etc. It wouldn't just sit idle, "Making money for us' as you note.

Makes absolutely no sense, the RB isnt a commercial bank, its a control mechanism. if you want to put money with them then they have to undertake banking services which costs money and for which we already have commercail banks doing this. You can take out a Govn bond already if you want a very low risk investment.

This is hilarious BW

It is not the Reserve Banks business to deal with individuals and their savings

Australian bank deposits protected up to $250K They have a list of all their protected deposit banks online.

If you have more you simply deposit anything over $250K with a different Aussie bank ( just have to make sure it’s not a subsidiary of your other bank I.e; is a completely different bank )

Will be interesting to see the level of NZ protections

yeah but it's the RBNZ's job to ensure stability in the banking system. The OBR in my opinion virtually guarantees a bank run at the slightest hint of trouble. It's simple game theory. You base your actions on how you anticipate other people reacting. I anticipate that if the banks get in trouble then other people will withdraw their money, thereby preventing me from withdrawing mine, so I must withdraw mine first.

.

Totally agree.

As a deposit insurance scheme the government should issue retail sized ($1000 & up) government treasuries or bonds through the commercial banks which can take a clip of the interest rate for administering the sales & repurchases.

There is then no need to insure commercial bank deposits.

about time, might be able to bring some money back from aussie.

and are all the board seats taken on the banks for the current national party to do an about face

How has NZ not had any bank deposit protection for so long?

Surprising that are Australian (American owned) banks are no.3 and no.1 in the OECD for deposit protection but when it comes to little old NZ are happy to over look this customer benefit to line their own pockets.

For those of you that think we don’t need any protection just look at Northern Rock or Lehman Brothers and how that decimated confidence.

Yes agreed, though since most of us bank with Australian banks here in NZ, do they not allow or enable coverage for deposit protection here if requested?

Aussie banks in NZ are merely subsidiaries separate entities and offer 0 deposit protection because the NZ govt under Mr Key decided having deposit protection would cost $ and hence the fairytale was presented that would mean less interest as I recall ?

Anyway there is no excuse

If Kiwibank was in trouble I expect deposits might be supported but again they do not state they are protected either

depends on who is guaranteeing the money. If its the tax payer, hell no, if its an insurance policy, fill your socks.

Insurance is no definitive protection on bank deposits either

Witness American Insurance GFC

Concerning that the discussion of Moral Hazard is equally balanced between the depositor and the bank. The huge power imbalance makes this presentation unfair. There needs to be a way for the banks to be held fully accountable for the practices and consequences of their actions. Depositor insurance moves this responsibility away from banks, so will unlikely impact on their behaviour and actions, as they will simply pass any cost onto their depositors, who they already rip off. Making the deposited funds the property of the depositor, not the bank, would be one way of achieving this. This whole article seems to ignore the fact that banks are private companies, and somehow there is a severe reluctance to properly regulate them to protect the public.

Nice. If most NZers really understood the extent to which banks can "lend money into existence", most would probably be horrified. They would be amazed at the power and privilege that they hold. The banking system only really exists as it is becasue of public ignorance as to how it all works.

Yet it works and lending into existence is perfectly Ok as long as its not lent out stupidly which is the real problem.

Nothing is a greater contributor to inequality, destroyer of savings and asset inflator. I'll beg to disagree.

When bank gives out a loan, that loan is repaid and that loan money is then in effect "destroyed" it is not printed into permanent existence.

Disagree all you want but this is how the system works. Anything else "suggested" is pretty much a guarantor of even bigger losses.

When bank gives out a loan, that loan is repaid and that loan money is then in effect "destroyed" it is not printed into permanent existence.

Well that misses the whole point. The loan may be extinguished, but the "money" is now reflected in the target of speculation like house prices. The point is that most people would like to think that lending is funded by "savings". Most people will be aware that banks are not necessarily solvent in that they would be unable to deliver if everyone withdrew their cash, but most would be unaware of the extent to which can leverage, particularly for mortgage lending.

@ Steven. Yes and no, if that was all there was to it our M3 money supply wouldn’t be anywhere as large as it is. What happens is money is created for a loan, that loan gets paid to someone else who deposits it, that deposit goes towards an increasing reserve in the banks which allows them to loan more, another loan is created etc... Credit appears faster than it disappears.

This is how our money supply exponentially increases - check historical graphs of our money supply as it skyrockets after 1971 when the US de pegged from gold and by proxy we did too enabling money to be created much more freely.

Knowing one part of the monetary system doesn’t give you the full picture unfortunately.

Especially when people are borrowing $500k+ over 25 - 30 years. That credit creation is instantaneous. It’s gotta be paid back though......

"It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning." - Henry Ford

and what stops you removing your money? absolutely nothing.

where are you going to put it?

and like who cares? it is you money you look after it.

I can buy a house but then whats the person do I purchased the house off? He could have debt in which case it just gets cancelled out, or he may need a bank.

Doesnt matter, the point is it is your money to look after so its up to you to look after it by which ever means you wish.

Opportunity cost. I have most of my savings in a safety deposit box in physical cash. Sadly and ironically, it's value (if i leave it there long enough) will be eroded through inflation caused by the banking system's money creation/lack of a full reserve requirement which is the reason I don't have it in there for starters.

Damned if I do, damned if I dont. They have us all by the short 'n' curly's.

Withay

Sympathies with you

You will at least have real local currency to use after GFC2 hits

However do not be sure the bank will let you open your deposit box ( if it’s held in a bank that is ) after the next

financial collapse

I know people who’ve buried gold but won’t be able to easily trade it as the government will undoubtedly make that illegal too & want it. It will be alright though The government will give you a nice IOU

Haha I had that thought too about gold. Safety deposit box outside of a bank luckily enough, now if only GFC2 would hurry up...

Your deposit is just a figure on the banks ledger with IOU beside your name

There is no money gold oil or diamonds backing your bank deposit it’s just ether and like ether when you leave the bottle open it evaporates

Your houses will simply be saddled with higher property taxes / capital gains taxes / new taxes / after GFC2

There is no escape holding gold either The government will want all gold Witness the USA history on the subject

Best to buy whiskey .......& drink it you’ll need it

Totally Agree murray86. Get the Banks to sharpen their Act. Deposit Insurance would only allow the Bank's greater leverage to take on more risk. However that said why should they be able to securitize some Deposits against certain Mortgages, Preferential Creditor status

How would deposit insurance let them leverage up? They still have to meet the same capital requirements under NZ law or the RBNZ would take their banking licence off them.

Deposit protection could still be effective even if it only covered a small amount. I'd say Singapore and Korea's settings look about right for NZ.

You don't need a depositor insurance because the banks can create money out of thin air, just like Barclays did after the GFC.

Listen to Richard Werner 25 mins in

https://www.youtube.com/watch?v=8FT-zyTX2nE&feature=youtu.be

https://www.theguardian.com/business/2018/oct/26/barclays-avoids-trial-…

"The latter allegation related to a $3bn (£2.3bn) loan from Barclays to Qatar, which the UK’s anti-fraud agency said was then used to invest in the bank. The charges were the first in Britain to be brought against a bank and its former executives for their actions during the financial crisis."

creating nothing from nothing equals nothing

MS

Cost of deposit insurance? A few Million? Cost of banks actually holding your money unless you say otherwise? Priceless

huh? so you give your money to the bank, but they cant do anything with it unless you say so? why would they take your money at all?

Funny thing is, that's how it used to work and that's how the overwhelming majority of the population still think it works. Maybe if you had a look, history would provide the answer for you.

Yeah, i thought a bank was a safe place for people to store money. You know, in a vault with a heavy door and a lock.

Vast majority, not everyone. Ask around, most people look at you with a strange expression if you let them know that the bank loans out their deposits.

really? you must live in a town full of retards then.

Yes, Auckland is full of retards. Remember, this is interest.co.nz so most contributors are more on to it and I imagine that will extend to their social circles.

I think not. No institution would take in money and then be unable to do a thing with it and then pay you interest as well. Safe deposit box? yeah sure OK otherwise no.

Who said pay interest as well? That’s why I said they couldn’t loan it out without your permission. Seriously though, have a look though the history of banking, surprisingly interesting.

but banks don't lend deposits, watch Werner in the link above.

"It follows then that what enables banks to create credit and hence money is their exemption from the Client Money Rules. Thanks to this exemption they are allowed to keep customer deposits on their own balance sheet. This means that depositors who deposit their money with a bank are no longer the legal owners of this money. Instead, they are just one of the general creditors of the bank whom it owes money to. It also means that the bank is able to access the records of the customer deposits held with it and invent a new ‘customer deposit’ that had not actually been paid in, but instead is a re-classified accounts payable liability of the bank arising from a loan contract."

https://www.sciencedirect.com/science/article/pii/S1057521914001434

I see the link above and I think creating money to cover money lost is again a terrible idea. That would be an extreme moral hazard, more speculative loans would follow. Think of all the CDO’s that lead to the GFC and that was without banks knowing they would be bailed out.

It’s actually ok for things to fail, it helps weed out the bad ideas and practices. A few people will be burned yes but a much much smaller proportion than what we are in for now.

We come up with these elaborate monetary solutions to fix little issues and all that does is create a bigger issues. Keep money simple and keep it safe, it represents our hard labour for the most part. Enough of these Keynesian utopian fantasies, it’s doing more damage than good.

Need to improve banks capital ratios, which drive risk, especially if deposit insurance is offered, and especially if it isn't!!

www.interest.co.nz/saving/bank-leverage

So far, Withay has the inside running.

Money is spun into existence as debt. Even repaid, it got levered-off and interested-off. Yes, AJ, you could issue a whole lot more, but the ownership is different - you've disenfranchised a cohort. And if you QE (alle-same Weimar Germany) then the numbers must eventually 'buy' less. Back down below the value of Withay's boxed cash, is my guessing at this point.

at present we have too much debt on the wrong things, so it will get shaken out by some kind of 'event'. After that everything is up in the air.

Leadership doesn't look like a strength in the West.

Having to watch out the mad man: IMF chief warns Trump's tax cuts could destabilise global economy

https://www.theguardian.com/business/2018/jan/26/imf-chief-warns-trumps…

Thanks PDK :). Just trying to actually learn from history for a change.

Was it Monty Python did the buried treasure skit? Stagger stagger, roll,roll or something?

Nobody yet has addressed the problem with exponential growth and insurance - yet we've already seen the problem with AIG. It couldn't cope with 2008 - and won't cope with the next GFC either. And it was only 'bailed-out' with taxpayer debt - from a nation which will never again be solvent. Who believes that next time? Who buys the bonds which back the Govt which bailed out the ........... ain't going to happen.

can you charge an electric bike with those PV panels?

We only run 200 watts - run the whole house on that and a micro-hydro producing 70-80 watts 24/7. That's too frugal to charge a bike.

But with more panels, the answer is yes yes yes. 200-400 watts more and it would be entirely practical, and it's the next move on the list. We know a fellow with one 3kw windmill, runs house and car(s) off it, using the grid as a battery. Always on the high side of the supply.

Lots of my friends are looking at options, looking at EV cars bikes etc. Interesting changes in the air.

In a truely globalised world the US$ was always going to face difficulties, but all you see here, is Anglo finance and banking.

I don't have clue where it all ends up but countries with energy will do best, food won't be an issue for the foreseeable future, inflation could be it, or perhaps just a major hit to confidence. Lets hope it doesn't end in destruction.

This is the way thing get adopted:

https://ondigitalmarketing.com/learn/odm/foundations/5-customer-segment…

I'm not sure we have the time this time. Recon we're into group two - just.

Firstly.. not a fan of deposit insurance due to the moral hazard issue... will lead deposits to Heartland and TSB... ultimately more risky than ANZ /WBC etc yet as risk has been removed from the equation.. becomes all about return.

What should be happening is the RBNZ should be insisting and challenging the banks on the amount of capital held and prosecuting directors where they have been found to be coming up short. The recent Westpac experience was farcical.. telling the bank to hold $1billion more capital teaches them nothing.... it penalises the shareholders. The directors should have been charged.... think any bank would play fast and loose with deposits and capital requirements after that?

Perhaps the RBNZ and FMA should have a look at the UK and upcoming BEAR regime in Australia (Bank Executive Accountability Regime) which has directors and executives personally liable.

I don't begrudge the banks lending out deposits... that's how they pay me interest... but I think they will have a vastly different perspective on their role as custodian of our deposits if they were personally liable.

deposit insurance isn't really the problem, it's the %10 crash in values and the banks capital has gone. Deposits are only at risk if banks have poor lending practices.

If we had clear separation of commercial and investment banking then none of this would be a problem.

And about bl.....y time too. How come that every other country has decided to put depositors' interests above the 'moral hazard' issue?

With proper regulation,the issue of poor lending practices by authorised banks can be managed. What those who take the moral high road forget,is that a bank failure here would just occur out of the blue-apparently solvent one day and bust the next-but would see market rumours potentially leading to a run on the bank,as happened in the UK with Northern Rock. In that event,to prevent contagion,the Government would almost certainly have to wade in and guarantee deposits.

I have long advocated depositor protection with a max. of say $25,000 per person. That is only 10% of the Australian figure.

Good news and was about time to line up NZ with the rest of the world. Between $200k and 300k would be a reasonable level.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.