By David Hargreaves

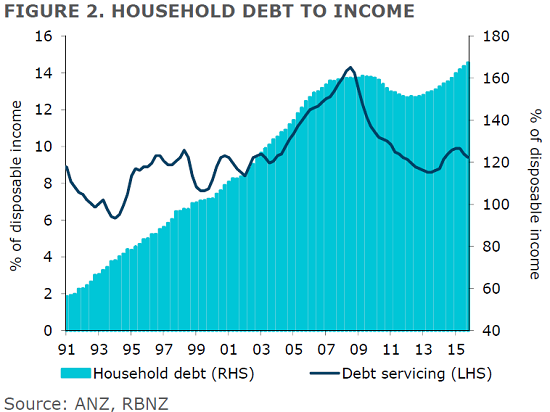

Economists at the country's biggest bank ANZ are expressing concern at the blow-out of household debt levels, which has seen household debt-to-disposable income rising to a record high of over 167%

To put this into some perspective, the ratio of debt to income, according to Reserve Bank figures, was just over 100% at the start of the 2000s. During the early to mid-2000s housing boom this blew out rapidly, peaking at just over 160% by the time of the Global Financial crisis in 2008.

Subsequent to that, there was a period of saving and consolidation, which saw the ratio dip as low as 151% by 2012. Since then, however, it's been rising again and tipped over the 167% mark as of December. And putting that into dollars and cents, the RBNZ figures show that for the year to December there was $144.869 billion of household disposable income against $242.421 billion of household debt - the latter figure having risen by over $16 billion during 2015.

In their weekly Market Focus the ANZ economists said that in New Zealand there has been "a clear deterioration in the structural side of the equation".

"Household saving has dipped and people are re-leveraging. The Auckland property market has everyone scratching their heads. Updated household debt-to-income figures show that borrow-and-spend style growth has returned. We knew that; it partly reflects monetary policy at work. We just didn’t realise that credit growth had accelerated and disposable income revised such that the ratio is now over 167% – some 7% pts above where it peaked in 2009," the economists said.

"Now, we never rely too much on individual statistics, but that got us musing. Many regional housing markets are now booming. Credit appetites look pretty good. And monetary policy is still easing. It’s not driving general inflation but it sure is lifting asset price inflation and appetites to borrow."

The economists said there was "the conciliatory rhetoric", namely:

- bank stress tests look okay;

- supply shortages are driving the housing market ("a partial truth");

- the debt-servicing burden still looks fine ("though looking at that in isolation is daft; it’s fine simply because interest rates are low"); and

- there is strong deposit growth too ("it’s when credit growth outstrips deposit growth that the net external debt position can deteriorate sharply"). And of course, a host of other structural indicators are still in a good position. The fiscal accounts are strong and we have a much lower net external debt position, with the latter expected to be evident in this week’s current account figures.

"So we can discount the household debt figures to some degree, looking at the broader picture," the economists said.

"Nonetheless, the data got us musing about policy trade-offs; cutting the [Official Cash Rate] further in this environment is not a free lunch; it’s called debt and it will need to be paid back! Debt levels are now in uncharted territory, at least in terms of the share of income (if not serviceability). The current price of credit does not appear to be an impediment to borrowing."

The ANZ economists said that "to be fair", monetary policy always comes with trade-offs "and no doubt the RBNZ’s macro-prudential and financial stability teams are on top of things. It’s just that we’re simply becoming more prickly and watchful over these issues now, relative to normal".

They said that it is then, "with a sense of trepidation and with a nervous eye over one shoulder" that they forecast the OCR heading lower still from the record low of 2.25% it hit after last Thursday's cut by the RBNZ.

In a world where China "issues" look set to persist, all central banks are struggling to hit inflation mandates (at least excluding the [US] Fed!), local interest rate cuts are not being passed on fully given international funding pressures, and currency markets are misaligned, there will be more pressure for the OCR to move down.

"All these factors will manifest into inflation and growth outcomes. We’re just not sure we like the end game, given re-leveraging behaviour in combination."

33 Comments

'We're just not sure we like the end game, given re-leveraging behaviour in combination...'

This leaves me speechless. We can see what is most probably going to happen, but hey it's not really in our control to do anything about it.

Sounds like they're taking the lead from our trusty PM.

Sure. If I'm interpreting this correctly, the RBNZ is admitting that they think something is going to give and it will be the individual with egg all over their face. I can't imagine any politician being able to get away with similar expressions of apprehension.

Can anyone point me in the direction of a graph or data showing long term AKL house prices versus NZ dairy farm prices?

Hmm, yes I believe they would look very similar as many got into the "farming" game on the basis of land value capital gains more than the farming side I suspect.

Appalling that Household debt should behave the way we encouraged it to...said a Senior ANZ economist.

People who don't even know what re-leveraging means are becoming experts in the practice as if by magic.

You gotta love this...""Nonetheless, the data got us musing about policy trade-offs; cutting the [Official Cash Rate] further in this environment is not a free lunch; it’s called debt and it will need to be paid back!"

What a tangled web we weave....eh?

Can we of the crowd say...

Look out, they're behind you!

It's panto season – and the D-listers (economickers) are everywhere surely. ..

Helicopter money is getting more and more coverage worldwide as the next logical step for central banks, as different countries address many key issues related to very low interest rates, low growth and high personal and government debt, while playing currency wars.

I still believe a dose of helicopter money here, either as tax cuts for all, or better still on infrastructure, would be better than reducing interest rates further.

The mechanics of which government entity wears the liability is not yet clearly defined. But since the lollipops are being offered to the banks at NZ depositors' cost, I wouldn't say no. Read more

A good link; reinforcing that a large number of countries are already using the practice, if sometimes in roundabout ways. In my view those countries, including NZ, that are not are losing out doubly. We are borrowing, either through our commercial banks or directly by the government, the money printed by other countries. That is lose lose as both a direct gift of our assets we sell or use as collateral, and on the impact on keeping our currency higher than our current account would suggest it should be.

I still contest the veracity of adequate foreign outcomes -

The only immediate silver lining may be in the end the most fruitful of long-term prospects. Central bankers have done us a profound favor by overplaying their hand time and again. The catalog of false statements and expectations is long and getting longer. The ECB then assured “us” that this was different and that the LTRO’s, massive as they were, did not work because they weren’t QE. Seeing it described then in countless articles and interviews as something like magic, the speed with which it has unraveled leaves little doubt. Read more

Putting $1000 in every tax resident citizens's bank account seems a lot fairer than the current system where money is taken from savers and given to borrowers. It will have fishooks no doubt, but the present system of trying to get inflation is manifestly unfair and it doesn't even work.

The current system subsidises those with high incomes and big mortgages; it causes asset price bubbles, housing shortages and preserves the awful state of our housing stock; in short the current system is a disaster .

What you are saying would increase spending more than any interest rate cut can achieve at this point.

We really need the central banks around the world to become competent, along with the Governments that are too lazy to take any action. Leaving the fate of your economy exclusively in the hands of the central bank is foolish. They don't have the tools to fix fundamental problems.

Nothing like selective reading and wishfull thinking, you missed "further in this environment is not a free lunch; it’s called debt and it will need to be paid back!" that rule NEVER changes.

Helicopter money's a dream, otherwise people with with medical needs would be fully funded and poor countries wouldn't work as slave labour.

Lol! So the culprits who actively encouraged our decades-long debt binge are now concerned about it.

It's akin to oil producers suddenly becoming concerned about global warming.

ANZ should be looking at their own debt levels.

ANZ should be looking at their own debt levels.

Others have and didn't like what they saw - hence the higher wholesale funding costs ANZ claim they are unable to absorb any longer. Shame the RBNZ forbids the domestic depositors imposing the same given they have the same exposure.

Wow, well I'm really surprised it's taken everyone this long to recognise this issue. Have you not noticed the retail stores closing? Even in the relatively well off areas of Auckland from Parnell to Botany, store are starting to go under as residence can't afford to purchase consumer goods. I can already see this happening with Electrical, furniture and smaller boutique clothing stores.

I see a recession looming.

It's worse than it looks. 167% based on current income and current asset bubbles. Deduct the dairy revenue and we are going to get reduced household income and logically reduced asset values. Best keep those migrant numbers up, building restraints in huh...gotta protect the property bubble at all costs...

What could possibly go wrong?

Why would people blame the banks for this ? personal responsibility seems to have gone out the window these days and we blame everyone else for our problems. Why has this happened ? wages have not kept up and everyone wants to live the dream. Borrow now and don't worry about paying it back. Hey sounds a little like Greece but on a smaller scale but hopefully we can avoid the same outcome.

From bitter experience personal responsibility gets you nowhere when everybody else is borrowing to the eyeballs. You just lose out.

That depends upon how patient you're willing to be.

In the age of instant gratification, borrowing seems to be the norm. But deep down we know it can't last. To me, that appears to be why everyone is so uptight right now. We know its not right, and we know it's not going to work, and we know it can continue.

Xelnaga; Yeah you might want to reconsider that tack tic when your property is repossessed by the bank.

Now with all of the usual westernised nations in a similar or the same debt cycle and depressed economies; the EU printing money and consumers not spending and there's very little demand, the US the same but deeper in the poo, China moving towards a domestic consumer economy .... next crash or "Correction" due in about 18 months to 3 years I reckon.

China is crashing right now.

Industrial production for the combined January/February period in China fell to just 5.4%, matching the lowest growth rate of the past fourteen years. Only the January/February 2002 IP rate was lower, but that was a single data point giving way to the rising financialization of the late eurodollar period. In 2016, these decelerations are commonplace, determined, and have no end in sight. At 5.4%, industrial production matches China’s worst level of the Great Recession, that of November 2008. Read more

China's move to a consumer society has failed. The Chinese don't want to rely on the Government because they know it will make changes at a moments notice. So they save heavily, something New Zealanders should do a little more of because we shouldn't trust the Government as much as we do.

Currently there are a number of bubbles collapsing or primed to collapse. No global economic recovery is likely to start for another 3 years, so the worst of it hasn't happened yet.

Yes, Egypt is closing down because it can no longer source USD credit for imports.

With nearly 90 million people, the Arab world’s most populous nation procures about 10 million tons of wheat a year to meet domestic needs for subsidized bread, making it the largest buyer of the grain globally. The cheap-bread program, for which around three-quarters of Egyptians qualify, has been in place for more than 50 years, but the cash crunch and a deficit are pushing the government to reassess the allowance.

The dollar shortage is affecting Egypt’s businesses as well. For the first time in four decades, Egypt’s largest assembler and distributor of passenger vehicles halted production at some of its plants as the dollar shortage limited its imports.

A nearly three-week suspension of its assembly units in September and October cost GB Auto SAE at least 20% of its quarterly sales, said Menatalla Sadek, the company’s chief investment officer. “We just didn’t have access to the dollars we needed to buy vital parts to keep the units running,” she said. Read more

Bread prices caused the French revolution. Bread is pretty central to a lot of historical riots and uprisings. I would say not a lot has changed even in the gluten obsessed western world.

There is a train of thought that the "arab spring" was predominantly caused by food prices/shortages.

Also I think Nixon said? take food off the political agenda?

Guess what we use oil to produce food cheaply and oil will be gone by 2050, so how will we feed 9billion?

So the next lot of forced migrants to join Syrians on the walk to the EU will be....?

Does this sound familiar?

With inflation at bay central bankers could not appeal to their usual rationale for spoiling the party. The long period of economic and price stability over which they presided encouraged risk-taking. And as so often in the history of financial crashes, humble consumers also joined in the collective delusion that lasting prosperity could be built on ever-bigger piles of debt.

aka the 1920s lead up to the 1929 crash and the Great Depression.

If people got their act together, society (not the banks) would be the thing that was too big to fail...

Why is anyone surprised?

With debt money some-one has to get into debt to create the money so it is either the government, foreigners, companies or the public.

The government is trying to run a surplus so that leaves the other three and we can't sell land to foreigners fast enough our companies have little to borrow for so that leaves the public.

When debt can no longer be stuff into households the recession begins.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.