By Roger J Kerr

All the lead indicators appear hunky-dory for the NZ economy this year, a continuation of free consumer spending, job security/opportunities on the income side, dairy prices rebounding and fairly robust confidence all round.

All too good to be true?

So what can go wrong?

As has been seen with the changes in the US and the UK over recent times, the world can deliver up totally unexpected outcomes and with that come unintended consequences, uncertainty and volatility.

What we do know is that inflation is no longer dead and the doomsayer commentators on this front have had to go back into hibernation for a few years.

Trumponomics coupled with higher oil prices could mean the Federal Reserve lifting short-term interest rates in the US sooner and by more than the current 2017 dot-plot of three 0.25% increases.

On the domestic front, the potential risks in 2017 that could disrupt the good times the NZ economy is enjoying right now, centre around:-

- NZ inflation increases at a faster clip than the RBNZ expect (as highlighted in last week’s commentary), resulting in earlier OCR increases and thus higher mortgage interest rates slowing spending from highly indebted homeowners.

- Chinese demand for Auckland residential property assets slows up considerably compared to recent years due to new regulations in China and NZ.

- Dairy prices reverse back down as global demand softens and supply has not really reduced that much.

- Local political risk starts to creep in from mid-year as business owners/investors postpone decisions on new projects as they do not know what a Labour/Greens coalition government could mean for the NZ economy. The markets will be watching the political opinion polls with keen interest over coming months.

- Global share markets tank on higher US interest rates and Chinese economic worries (similar to what occurred at the start of 2016).

- Our booming tourism sector gets hit by some unexpected event and confidence is lost.

I would not give any of these risks a high probability of occurring. However, investors and borrowers with interest rate risk need to be aware of them.

You know the world is upside down when the Premier of the Communist Chinese regime strongly advocates free global trade and the President of the largest open-market economy in the world is pushing anti-free trade and protectionism!

Any changes globally away from free-trade and more border protectionism are not good news for an economy like New Zealand’s, being so dependent on exports.

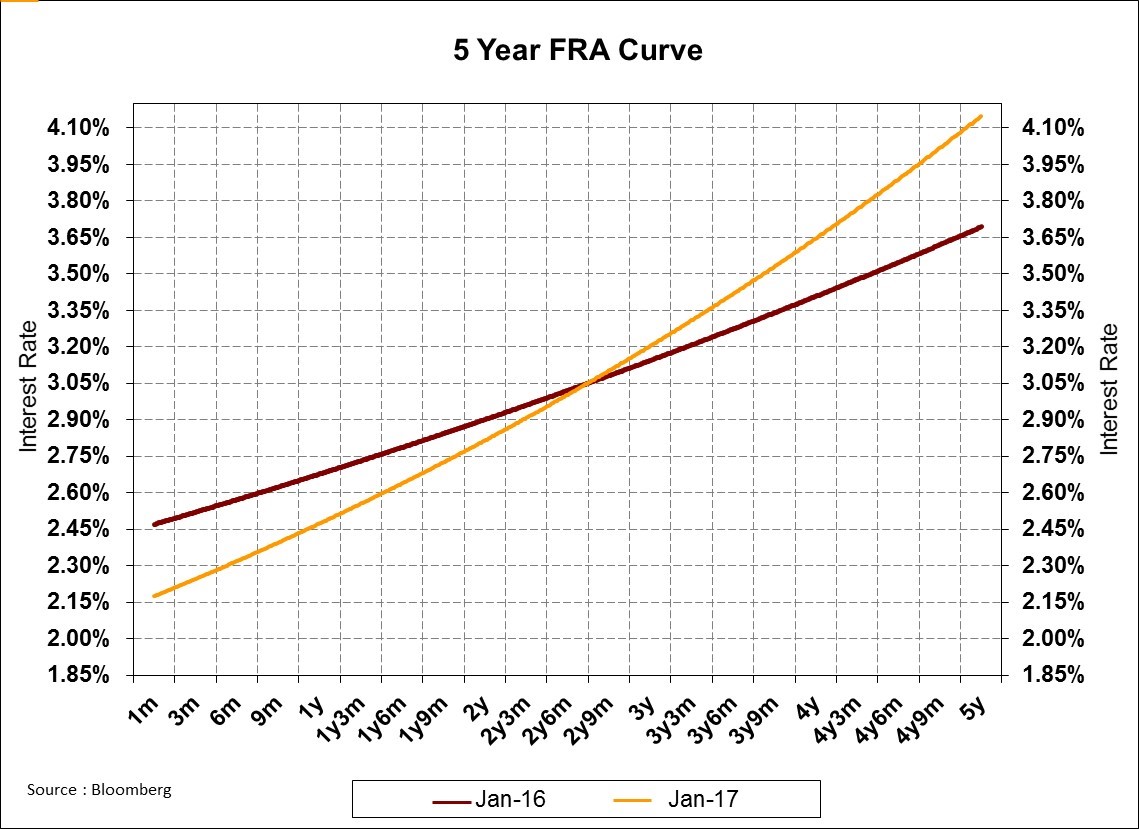

The forward curve on NZ 90-day wholesale interest rates has certainly changed from a year ago.

The moneymarkets are now pricing 90-day rates to be at 2.50% in 12 months’ time i.e. two 0.25% OCR increases. Perhaps the markets have gone too far with the speed of increases, or are they expecting higher inflation outcomes this year well above RBNZ forecasts? (Refer chart).

Daily swap rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

8 Comments

Even in this article it is mentioned Chinese and Housing.

If Chinese are not responsible, why the mention.

Everyone knows the truth but follow the national government policy of Denial, lie and Manipulation.

Election approaching.

Yes I have to agree with you Exper1, it would be really nice to see the real figures on Foreign Buyers from Oct 2015 to now.

We will never know the real figures of foreign buyers. These figures are deliberately distorted by many factors.

One being mainland Chinese sending money to Chinese residents in NZ to buy housing on their behalf. They then do not have to have a bank account in NZ or be registered with IRD.

This occurred with a house we sold.

An additional risk is that Trump enforces his tariffs on foreign countries who will no doubt retaliate with similar tariffs for US goods. A trade war ensues, we all loose.

Also odds are that at least 1 unknown/unexpected major event will happen to destabilise economies.

It's fair to say 2017 will be a highly volatile year, mostly attributable to Trump

Not as volatile as if saber rattling Hillary was at the helm. She wanted to pick a fight with Russia and was threatening Iran.

The current mess in the middle east is mostly all due to US foreign policy going back to their invasion of Iraq and Syria saying no to a gas pipeline going through their country that would have undercut Russian gas exports to Europe.

Trump has said he wants to change US foreign policy and bring their troops home. History might look back on Trump one day and celebrate his time as president.

Globalization has been a disaster for most countries as jobs move to subsistence wage countries such as China.

It is a pity the NZ Government did not put NZ interests first such as house prices and massive immigration instead of looking after other countries.

Good on Trump!

This will not stop globalization in the long run, isolationism has limited benefits, however, having said that, there were many aspects of globalization that I understood were very negative. To be successful, the world needs to be singing off pretty much the same songsheet. One thing people will get very upset about with what is going on is how difficult things like an OE in England and elsewhere is going to get.

I think back to the drawing board, myself.

Thanks Roger,

It is clear there are multiple risks to the economy, perhaps especially to housing.

How can the average kiwi mitigate these risks? reducing debt must be high on the list.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.