By Roger J Kerr

Higher fixed term mortgage interest rates, higher bank lending margins to corporate/commercial borrowers and more stringent bank lending/credit criteria are a feature of the debt and interests rate markets in early 2017.

These tougher conditions and outlook paint a quite different picture to the benign interest rate and credit environment of recent years.

The utopian climate of record low interest rates and lower bank lending margins in 2014 and 2015 were never going to last.

However, it is always surprising to me that so many pundits believed they would.

Credit growth statistics for the NZ economy are now indicating a general slowing and levelling of the uptrends.

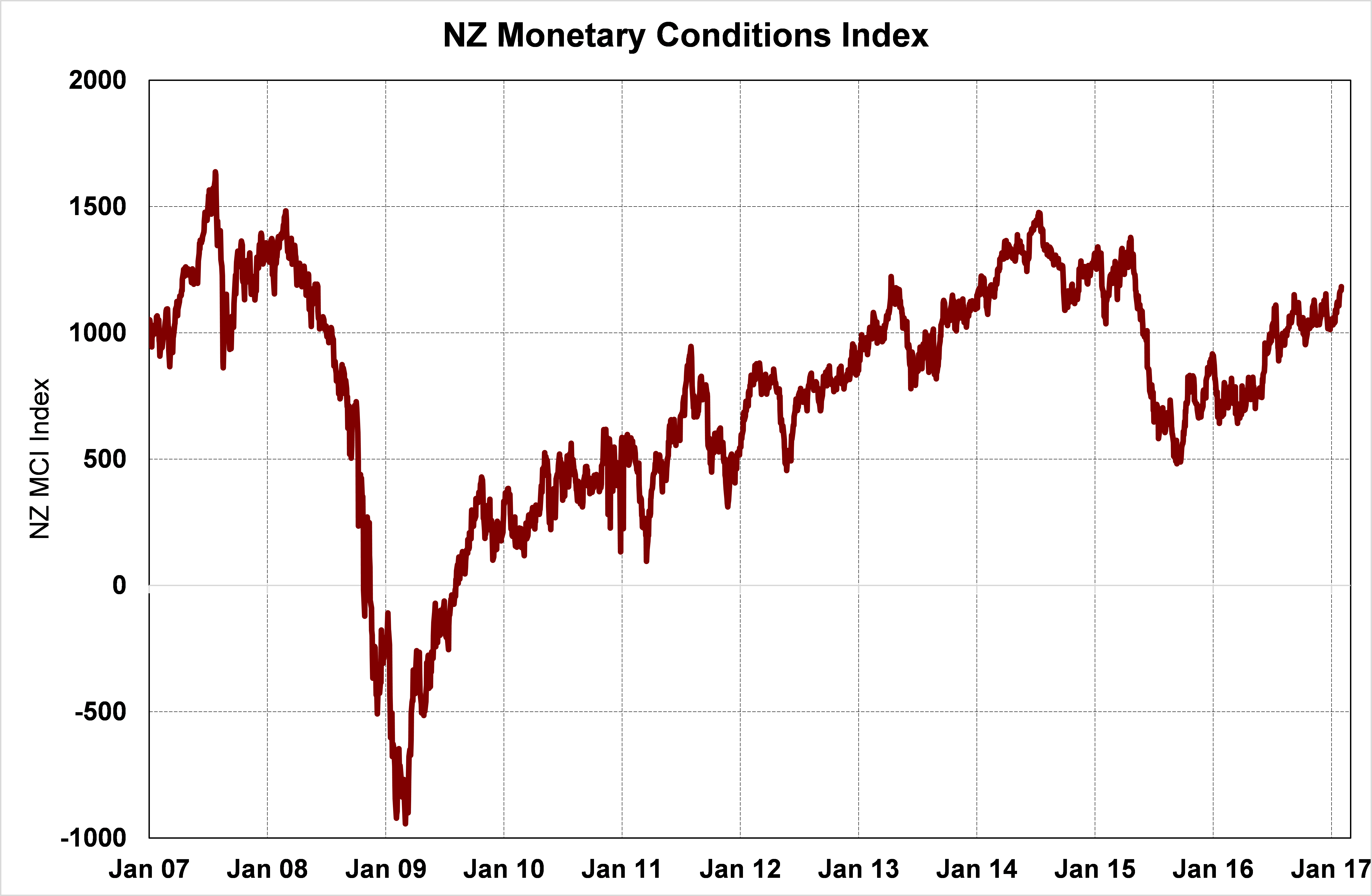

In addition to debt markets tightening up, overall monetary conditions have continue to tighten in NZ with an overall TWI exchange rate higher at 79.70 drowning out the low OCR at 1.75%.

The old Monetary Conditions Index (combination of 90-day interest rates and the TWI Index) confirms the tighter monetary conditions.

Therefore, the local interest rate markets will need to see a significant currency depreciation before their pricing of a higher OCR later in the year is fulfilled.

Daily swap rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.