By Roger J Kerr

The important issues to watch out for in the RBNZ’s Monetary Policy Statement this Thursday morning (in my view) are as follows:-

The important issues to watch out for in the RBNZ’s Monetary Policy Statement this Thursday morning (in my view) are as follows:-

•Whether the RBNZ endorse current moneymarket pricing of four 0.25% OCR increases over the next two years, or whether the RBNZ stick to their November 2016 forecast of the OCR staying at 1.70%/2.0% through 2017 and 2018? Governor Wheeler should state that the interest rate markets are pre-mature in pricing-in such increases as monetary policy is already pretty tight with the TWI at 79.50.

•Whether the RBNZ revise downwards their inflation forecast for 2017 and 2018 as the exchange rate is now starting at a point substantially above the assumed levels in their forecast model. The TWI at 79.50 is well above the 76.0/75.0 assumed. Governor Wheeler would have to be disappointed that despite his OCR cuts in the second half of 2016 and the appreciation of the US dollar globally since November (both of which were supposed to depreciate the NZD value), the overall value of the Kiwi dollar is now 4% higher than in late 2016.

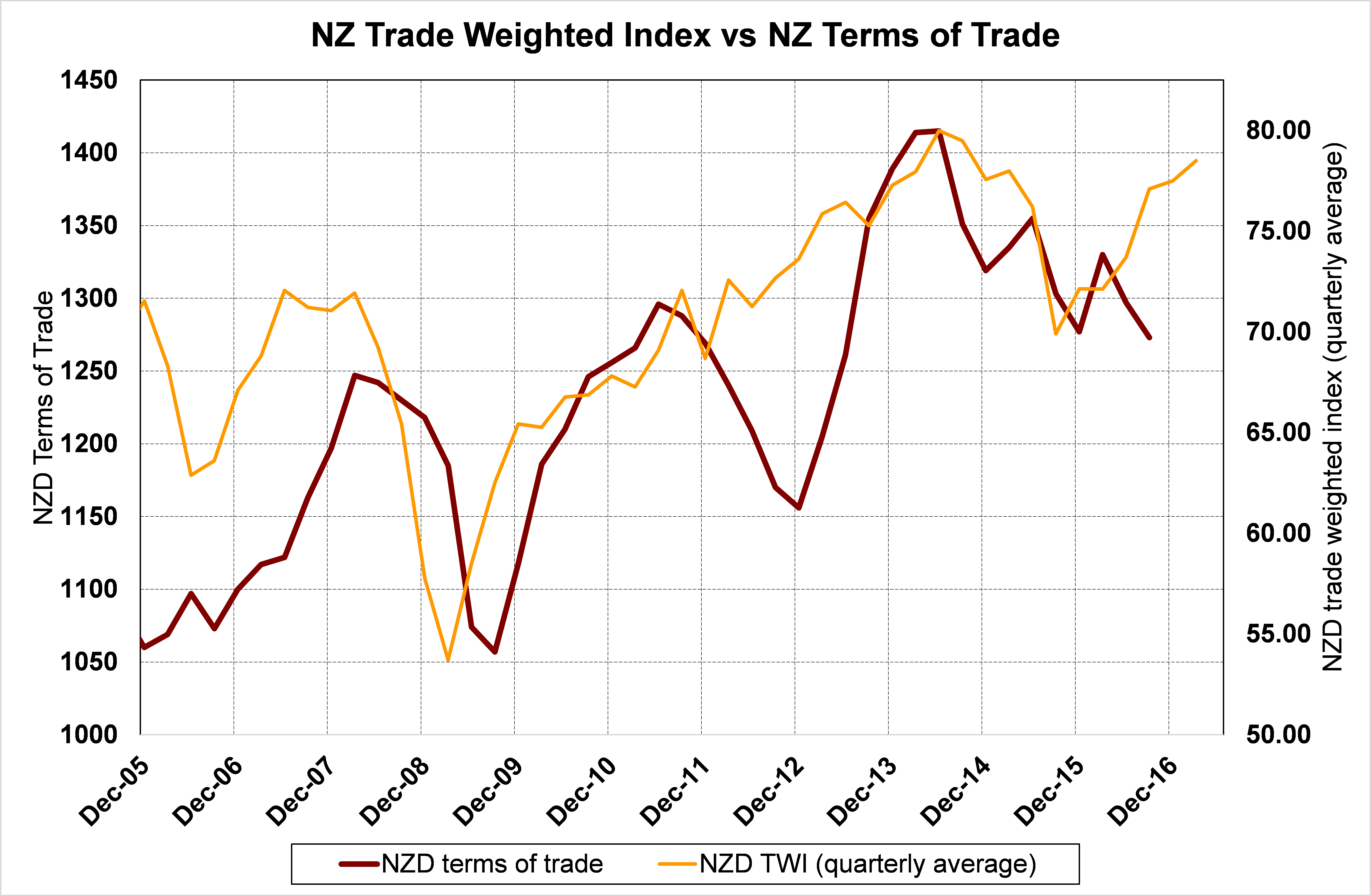

•Whether Governor Wheeler singles out and highlights the dramatic divergence of the TWI (higher) from the New Zealand economy’s underlying and fundamental measure, the Terms of Trade Index (lower). I do not think we are going to get a massive surge upwards in export prices this year, similar to what happened in 2012 when the TWI currency value ran well ahead of export price increases (refer chart below). On this ground alone the RBNZ should be stressing how the over-valued exchange rate will reduce both inflation and growth this year.

•Whether the RBNZ will be revising their predictions/forecasts on immigration and the residential property market, having been burnt somewhat on these forecasts in the past.

Daily swap rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.