A new report largely exonerates New Zealand businesses from causing inflation by pushing up profits.

The report by consultancy Sense Partners was commissioned by business lobby group Business NZ.

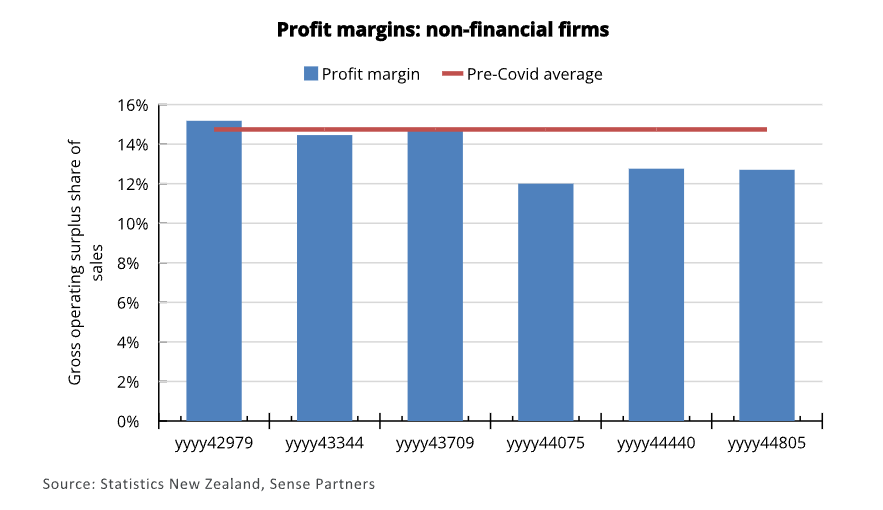

Business NZ says it wanted to know if so-called profit margin-led inflation, sellers' inflation or greedflation was a problem for NZ. The team used data from Statistics NZ and found that instead of rising, profit margins are generally lower than in pre-Covid levels.

According to the theory, businesses can use existing inflation and disruptions as cover to raise their prices even further than necessary, thus making inflation worse and boosting their margins.

In a stubbornly high inflationary environment this argument has gained traction overseas, especially in Europe and North America, including with academics, economists, political leaders and even some central bankers such as European Central Bank President Christine Lagarde.

The Bank of Canada said last week in assessing the dynamics of core inflation it will be evaluating whether "the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour" are consistent with achieving its inflation target. And the Reserve Bank of Australia says it's paying close attention to "both the evolution of labour costs and the price-setting behaviour of firms."

'Evenly split between wages & profits'

Sense Partners' report says 75% of NZ inflation in the three years to 2022 came from the increase in the cost of inputs, with the remainder evenly split between wages and profits.

“We found no evidence of widespread increases in profit margins driving up inflation in New Zealand. (Greedflation) is an imported narrative not supported by the evidence.”

The Sense Partners team say actual figures prove that.

They say profit margins for the measured non-financial sector averaged 14.7% before Covid and were 12.7% in the 2022 calendar year.

The team then go on to look at it another way. They examine price increases over the three years from the December quarter 2019 to the December quarter 2022.

They say that over those three years, prices rose by 14%, at an average of 4.6% per year.

But 71% of that price increase comes from higher input costs, while 15% stems from increased labour costs and 14% from higher gross profits.

“International experiences of increasing profit margins through increased mark-ups are not well supported in the New Zealand experience,” Sense Partners says.

“This indicates caution in importing international narratives without local context.”

How Sense Partners did it & why banks were excluded

In explaining their methodology, the Sense Partners team say they did not look in detail at particular companies, but instead looked at the economy sector by sector. In total, 14 industries were examined, such as agriculture, mining, construction, healthcare and retail.

The team looked at these sectors using a tool supplied by Stats NZ known as Infoshare. This enables researchers to drill down and acquire quite detailed information at a sectoral level, covering things like sales, wages, and purchases.

The survey excluded the financial sector based on advice from the Sense team, which says other sectors can have their sales data backed up by checks against GST returns, but this is not possible with banks, as financial services to not incur GST.

"We can't include the financial sector because that is not how it works and we don't have the information," says the chief researcher for this project, Shamubeel Eaqub.

The Reserve Bank recently said the strong profits of NZ's banks put them in a good position to earn their social licence by supporting customers through taking a long-term perspective in times of stress in their lending books.

Greens' Julie Anne Genter sceptical

But not everyone is happy with this verdict. Green Party finance spokesperson Julie Anne Genter says many sectors such as banks and supermarkets and fuel companies are making huge profits.

“It’s a moot point whether it is deliberate or not. The point is that during this time of inflation, some corporates are making record profits,” she says.

“There is a case then to make sure that some of this excess profit comes back to the public good.”

Genter adds in some cases, companies might have expected their input costs to rise quickly, and put up their prices in anticipation of this, only to find inputs levelling out, leaving them with higher profits at the end of the day.

Genter goes on to cast doubt about the latest study.

“Of course, Business NZ are going to say it is nothing to do with them. They always point the finger and blame government, but that is because they are quite happy to keep making as much profit as they possibly can.

“It is our job as representatives of the people to change the system to make sure that it works for everyone.”

And she says there are credible reports coming out of the US, the UK and Australia, that corporate profits have been a driver of some of the inflation that we have seen."

What does the RBNZ say?

Genter says she asked the Reserve Bank to look into this, and got a favourable response.

Asked about this issue last month, Reserve Bank Governor Adrian Orr said the data on this matter was "as poor as ever."

The bank's chief economist Paul Conway then explained further.

"We have had a good poke at the risks of a profit-price spiral," he said.

"At the aggregate level, we don't see any evidence of an increase in profits feeding into inflation. It doesn't rule out the possibility that there are markets in New Zealand which do suffer from a lack of competition, where profits are above normal levels.

"But we haven't seen that increase at the aggregate level and where there are markets that suffer from a lack of competition, the Commerce Commission are into that sort of space."

Genter’s reference to supermarket profits is partly supported by the Commerce Commission, which found they appear to be making higher profits than expected and prices seem to be high by international standards.

But the main thrust of the Commission’s report was aimed at roadblocks to proper competition, such as restrictive covenants.

Various responses are underway to that report, such as requiring unit pricing at supermarkets and installing a code of conduct.

46 Comments

While I'm sure Genter means well, and someone has to be seen looking out for the little guy, they also probably haven't been anywhere near the price establishing side of a business.

I've been pricing goods and services for a couple decades now. You get the odd time where exchange rates might be having a run in either direction, or there's a new legislation come about you may not not the full pricing ramifications of until put into practice, but this has to be the loopiest environment to try and establish a sales price in I've experienced by a long shot.

Some of that's due to erratically escalating costs, but most is due to the ramshackle way business has flowed over the past 3 years.

Tough environment, because I'm assuming the economic sky is falling so want to secure enough business going forward, but the way it ends up panning out it's almost dartboard stuff making sure the price is secure enough to come out in the black.

I don't see this situation improving in the short term.

When I saw the headline earlier I was hoping you would make comment. Thanks painter

And next week....

"A new report largely exonerates gangs from having any role in the meth trade.... Commissioned by a consortium of leaders from the Mongols, Comancheros, Mongrel Mob and Black Power, the report states ...."

While you always need to be sceptical of an industry measuring itself, the great thing is with a small amount of effort you can access the financials of publically traded companies. If there were a case of actual margin % increases being widespread it'd make for a very good news story.

Some companies have done really well from this environment but most are plodding along or going backwards.

The research is a total joke ignoring the financial sector.

The profit margins on the banks, who create the money they lend out of thin air by a trick of accounting have driven asset inflation immensely.

The ridiculous way that inflation is defined only by a basket of consumer goods, WHICH EXCLUDES MORTGAGES, is rigged from the start to ignore asset price inflation and only concentrate on consumer inflation. But even that doesn't actually matter because the basket of goods used to adjust CPI can be 'adjusted' to reflect whatever the hell you want.

The low inflation of the globalizing world that existed between 1990 and 2020 is a byproduct of simply outsourcing production combined with ever more tight, immense transport networks. It isn't coming back and instead of consumer deflation offsetting asset inflation, we are going to have both consumer and asset inflation. It isn't hard to understand.

They are pissing on your leg then telling you that it's raining.

Yup.

How do rebates factor in to the equation? A supermarket for example could be making "higher than normal" profits as the report suggests, but does that include any rebates they may receive later on down the track?

When I did my short stint pricing in retail building supplies many years ago, often our shelf ticket price was only a few percent above landed cost, but we knew that an agreed healthy rebate would come through from the supplier later on to bolster our margins. Does an independent audit look at just the supplier's invoice/packing slips & sales prices?

Spot on, grocery is built on display money I.e. that end costs $500 per week as well as generous rebates at the end of the year. Another trick I have seen to keep pricing “transparent” is list pricing but with extra money paid for “displays” or “promotional support”….so not off invoice. Different budget you see.

While I fully understand the cynicism expressed by the other commenters, I personally am not really surprised. NZ has very little manufacturing industry really so most of the goods traded in NZ are imported, thus the 'greedflation' will have been applied before the goods got here.

On the other hand where food is concerned, i would suggest the supermarkets and big corporations stack their 'greed pricing' for local consumers. But as that has been going on for quite a while now it is not being noticed as a 'blip'. Pity that cannot be regulated better. i don't accept competition is the complete answer in our small, highly distributed market.

This is my feeling also - we are subject to global forces and the ‘greedflationary’ element in pricing is added long before goods reach our shores.

These ‘studies’ seem often strangely naive and almost always seem to find in favour of the commissioning body - strange that.

While I fully understand the cynicism expressed by the other commenters, I personally am not really surprised. NZ has very little manufacturing industry really so most of the goods traded in NZ are imported, thus the 'greedflation' will have been applied before the goods got here.

The only thing I'd say to that is that indigenous food and construction sectors have also faced big increases.

Bottom line is it's a lot more expensive to do things in 2023 than it was in 2019. Few are going to be happy with that and if you're far removed from a P and L sheet you're probably going to assume you're being fleeced

Did you read my second paragraph? Yes those sectors have faced their increases, but the issue around food prices is more about how the supermarkets and major primary producers (like Fonterra) operate. It is well accepted that they pad their pricings. Fonterra refuses to provide dairy products at a price to local markets that reflects the cost of production, but instead sells at the price gained from it's auctions, but then the supermarkets rort the public by over pricing as well. Individual farmers get shafted as well when the bulk buying chains drive down what they are prepared to pay, so the money they make at retail is more. I understand that there are more than a few farmers who no longer supply into the major chains for that reason. That part of the market needs better regulation.

Did you read my second paragraph?

I did, but the vast majority of increases to food pricing we're experiencing currently is simply because the cost to supply is just that much higher. All the same issues with supermarkets are years old, split them out, foods still costing you a lot more.

While I accept that the current market economy, especially that supply chain costs have increased, means businesses have increased their prices accordingly, as consumers we bear the brunt of those higher costs. It's not so simple for us to up our revenue by x% to cover the y% in increased costs.

For many of us, our wage/salary is our only source of income, and with rising unemployment, forced on the population by the RBNZ to counteract their overly generous monetary support during the COVID pandemic, negotiating a pay rise is becoming more challenging.

As the squeezed middle, we're not on minimum wage, so those increases don't help us. We're also usually not on any kind of benefit, so those additional handouts don't help, as we're not supposed to need them. We're also generally owner occupiers facing increased mortgage repayments.

So that leaves us with cost cutting as our main resource for meeting this crisis, and it seems many of us have lowered discretionary spending, according to the recent reports. That puts pressure on the businesses that rely on consumer purchases, which feeds into the whole cycle as they shed staff to reduce their costs, since increasing their prices further is only going to reduce sales.

As the verse in the song by Savage Garden says; "I believe the struggle for financial freedom isn't fair. I believe the only ones who disagree are millionaires."

What a shame the majority of this countries political leadership are millionaires.

Inflation is split into tradeable and non-tradeable inflation. The Government initially blamed inflation on tradeable inflation (including what you identify as "greedflation") - remember, "inflation will be transitory" lol. However, this only makes up part of our inflation number and has come down. The amount it has come down does not equate to our current inflation figure, so the conclusion is that non-tradeable inflation (that sourced in NZ) has gone up. The study by Sense shows that there is no evidence that increased profit margins are affecting non-tradeable inflation.

a few points

1.A smaller profit margin on goods that now cost more can give you the same profit (or more see point 3)

2.wages and profit were almost equal factors

3.you can't say it 'doesn't impact inflation' and also '14% (of inflation is due) from higher gross profits.'

how do you get higher gross profits from lower margin? see point 1.

The use of rebates should be banned in New Zealand.

I know this data backwards - it's the Business Financial Data. The article is correct - profit margins are down a bit relative to pre-COVID. What the article fails to report is that import costs dropped significantly in 2020, but our prices stayed the same, thus wholesale profit margins went up by from around 8% to 10% on average and retail from around 6% to 8%. Higher profit margins in these key sectors (which have a huge impact on CPI basket) were sustained for 6 - 9 months. Some individual companies would have made a killing. In March 2021, import prices started to rocket and CPI started moving up fast. Profit margins dropped back to normal slowly - noting that profit in nominal terms goes up as prices increase if even if the margin stays the same.

CPI increases in 2021 were therefore exacerbated by those higher margins, but their effect receded quickly. As I have said repeatedly on here - what drives prices in NZ is the cost of the things we import - particularly critical goods like food, fuel, fertiliser etc. Monetary policy is completely ill-equipped to tackle imported price shocks. We need much smarter tools, which is actually what Isabella Weber advocates for.

Thanks, Jfoe. Great to have that insight/information.

Interesting Joe. So even though imported inflation went down and non-tradeable inflation went up, the driver is cost of imports? Has printing money had anything to do with inflation in NZ? In terms of the majority of your comment, I'm not sure what you are getting at. Inflation was low in 2020 even with increasing profit margins. From what I can see, the study is about proving that Webers view holds or doesn't hold in NZ, that is all. Not whether profit margins have increased, but whether they have contributed to inflation, which Sense concludes they have not.

Corporate profits mean more money for CEO's via bonuses, and for shareholders which in turn will spend more en masse, be it on goods, services or further investments. Bumper profits for corporations therefore would flow through to the economy at some scale, as not all of the profit, dividents etc will be spent, some may be saved, but on aggregate it can be argued that this is inflationary. The business world will always argue that it is not, as they want people to keep borrowing, keep spending, the times were too good for them the last few years.

Corporate profits mean more money for CEO's via bonuses, and for shareholders which in turn will spend more en masse, be it on goods, services or further investments.

You have to ask yourself why the Aussie banks are not doing far better given that they're making out like bandits. Let's look at the stock price for CBA for ex (not accounting for div of approx 4%.

YTD : -6.7%

Past 3 years: Stock price basically flat

In fact you can argue that the stock price has gone nowhere for 8 years.

To really beat inflation by owning this stock, you would have had to buy in 2012.

Has printing money had anything to do with inflation in NZ?

Depends what you call 'money printing'. If you're talking about growth in the broad money supply, there is no doubt a positive relationship with CPI growth + asset price growth (housing being the obvious). For ex, if you look at the broad money growth of the U.S., EU, NZ, and Australia compared to Japan, it is far higher. And inflation in the prices of goods and services + house prices is far higher too. In fact, with JPY weakening so much over the past 12/24 months, you would expect Japan's CPI inflation to be much higher.

I think the Truflation index is quite interesting. Right now, yoy CPI inflation in the U.S. is running around 2.7% (govt reported at 4%) while the UK is still up around 13.3% (govt reported at 8.7%).

The tradeable vs non-tradeable inflation data is completely worthless. The method used to produce it hasn't been updated since 2003. The world has changed fundamentally and RBNZ would love Stats NZ to update it. For example, do we really think that the price of jet fuel has no impact on domestic airfares?!? Or, that the price that our food producers can get for exports doesn't impact domestic prices?!?

Inflation was basically static in 2020 - but the cost of imports *fell*. In other countries, CPI dropped or went negative as a result, but in NZ, companies held prices and pocketed the extra profits. They then held the higher margins as prices increased and CPI went up. It is therefore simply wrong to say that higher profits did not contribute to CPI inflation during. CPI would demonstrably have been 1 - 2 percentage points lower in the second half of 2021 if wholesale and retail margins had remained at pre-COVID levels. Sense conveniently compare pre- and post-COVID but the hot profits inbetween are obvoius in their report, which is worth a read.

In terms of 'money printing' - I presume you mean the extra money flowing into the economy from higher Govt net spending (expenditure - tax) and commercial bank net lending (the growth rate of outstanding loans)? Yes, this stimulus, coupled with people not spending on other stuff, meant households and businesses had more spending money during 2020 and 2021. You could argue that this enabled companies to charge higher prices because people could afford to pay. But does this mean that the only way to regulate prices is by making sure everyone is poor?!?

By coincidence was rereading this article on Costco purchasing and pricing last night. The pricing model seems to be quite different with a focus on supplying in goods in volumes that provides the best valu3 for its members ie the shoppers.

https://www.interest.co.nz/business/117796/costco-economics-make-bigger…

I've been that employee, at the computer, typing in the updated greedflation opportunistic pricing. Don't tell me it's not out there. I've seen it first hand.

How much did the companies' net margin percentage increase annually?

And this companies input costs didn't move? Youve not had a payrise in 3 years?

Company sounds bad, get out, there's a labour shortage.

Do they pay you to constantly shill the trash that you spruik on here or do you do it for free?

I'm not spruiking anything, that's your flippant way of ignoring aspects of my views that aren't palatable for you.This the system we have, so a full understanding of it is far more beneficial to how one navigates their financial life than just focusing on contempt.

Returning net positive cashflow is no easy feat. It's one thing to print more expensive price stickers, but it's another to fully understand the mechanisms between selling something and creating it in the first place, and this is something most people are in the dark about.

If you just want to be outraged there's enough in the news cycle to keep you there.

Unfortunately I didn't have insights to annual margins. They certainly went up I know that much.

Payrises were abysmal, I've moved on since.

I've seen building materials merchants margins go up 25% (1st hand, cost vs trade vs public rates) and stay there.

FWIW markup went from about 13% to 17% on common products.

Also, not all merchants were practicing this, the ones that were did not get the work.

Further, competitive (carpentry) building supply merchant rates peaked about May 2022 and have retracted across the board approx. 10-15% since then.

A friend of mine is an Insurance broker and his margin % hasn't changed, but he earns more and more as the premiums skyrocket - he loves it.

There has to be an element of opportunism during times of increased inflation when retailers raise prices just because they can, knowing customers have been desensitised to climbing price rises.

Whilst I agree that supermarkets are at the mercy of producer costs, as well as their own overheads, they definitely have the ability to make a profit independent of their actual cost of sales.

Example: My local big chain supermarket stocks a common over-the-counter brand of pain relief. I purchased a pack for a certain price, then two weeks later bought another pack from exactly the same shelf pile but had to pay 10% more than the first pack. On checking the two packs the batch numbers were exactly the same and I have to assume that the stock shipment for both packs all came into the supermarket at the same time. This looks like an example where there is no real increase in the retailer's costs that is being passed on to consumers via a higher price but is simply the supermarket changing the shelf price to make a greater profit on the item. Perhaps the price increase on the item was necessary to cover the cost of changing the shelf price itself???

Before April 1 and after April 1, the difference is a 7% increase in the cost of someone delivering that pack from the warehouse to the supermarket, putting that pack on the shelf, and swiping it through the checkout. Then the cost of insuring the warehouse and the supermarket buildings where the packs are stored increased 30%. Just because the cost price of the pack didnt change, doesnt mean that the cost of everything else around it stayed the same.

So the data is in, and Genter says no. We have data that shows "no evidence". On the other hand, Genter relies on "appears to be" and "seems to be". Here's some news Genter, the Government you are part of caused the majority of price increases in this country. It's your bloody fault.

Really?

And the Pootin driven energy shocks had nothing to do with it?

And the RBNZ's throwing cheap money at the economy for far too long - when NZ's government had it covered with fairly targeted support - had nothing to do with it either?

The Labour party destroyed many businesses' finances during Covid with all the lockdowns and border closures. I don't blame any business that is trying to increase profits now in order to make up for the losses they suffered over the last 3 years. Many didnt survive at all and were forced to close. I have a friend whose business blew through over a decade of retained earnings, and was forced to increase the mortgage on their house in order to get enough cash to keep going. That money has to be paid back. Just because the supermarkets got to stay open, and the banks made out like bandits during Covid, doesnt mean the other 99% of businesses arent still suffering. The Greens are acting like Covid and Jacinda Ardern didnt happen at all.

Given it was the same or worse everywhere else in the world, it's a bit of a stretch to blame the Labour party.

The whole period has sucked commercially but there's a level of "it is what it isness" about things.

Disagree. In Australia (and pretty much everywhere else) the vast majority of businesses remained open. Construction sites still operated. Restaurants still cooked and sold food (as takeaway). You were allowed to buy a hot coffee for your walk in the park. Meat and vegetable sellers were allowed to sell their fresh food. Physiotherapists and other health practitioners remained open. Retailers were allowed to sell online (remember, Jacinda decreed that we werent even allowed to buy stuff online and have it delivered, all "non essential" ecommerce businesses were forced to close as well). Sometimes I am amazed at the collective memory loss of people in NZ, all pretending that lockdowns didnt really happen, and if they did, it was ok because everyone else in the world was locked down too. Well, they werent. NZ had the strictest lockdown rules on the planet, and as such, Jacinda Ardern is 100% responsible for destroying many people's livelihoods.

You're kidding yourself if you think it wouldve been any other way. People in other countries spent a lot more time locked up than NZ. With money from heaven or assistance.

The disruptive nature of covid meant other economies, whilst arguably not locked up as hard, suffered much larger falls in GDP compared to NZ. Because regardless of what the government was and wasn't doing, covid was immensely negatively impactful for business.

Construction actually spent one of the least amount of periods locked down, I think they let us out after 4 weeks and we kept working fairly solidly through. It's the business environment that's arisen that's been the challenge.

I'm no Labour supporter but on balance, they did it better than most, and definitely far from the worst.

Really? Show me where Australia's economy is doing worse than New Zealand?

And for the record, the friend I refer to above, his business supplies the building and renovation industry. So your "we did ok, werent impacted at all" belief might be true for you but clearly not for everyone else in the industry.

I'm not saying it's been ok at all. It's been the crappiest trading environment I've known. My revenue is out hundreds of thousands annually since 2020, and I have operations I've totally shut because they're not viable in this market.

I just can't blame Labour, and from what I've seen and talked about with peers overseas, our experience isnt special, and actually better than most.

Some of what I do involves agriculture, so I've tried to adopt a "prepare for a drought" mantra across everything I do. Probably the only reason I'm still above water.

Too many of the public are exactly the same, and we're all still waiting on any shred of accountability.

Business survey finds busness is great.

I don't follow StatsNZ releases but, regarding the NZX, January 2022 earnings where about $9bn and total revenue $98.3bn. By January 2023 earnings where $6.6bn with revenues at a $100.4bn.

So generally revenue growth was good, ahead of inflation, but companies did not escape inflation either which is why earnings are falling.

For context pre-pandemic (Feb '20) NZX earnings where $5.8bn and total revenue was $95.2bn so companies are still ahead of pre-pandemic levels even with falls in earnings.

yes, sure.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.