A surprise rise in retail sales volumes for the June quarter is casting real doubts on the Reserve Bank's forecast that GDP will have shrunk by 0.3% in the June quarter.

By implication the retail figures call into question whether an imagined 'stall' in the economy has really happened and therefore the wisdom of the RBNZ pushing concerns about rising inflation into the background.

The GDP forecast by the RBNZ made last week was based largely on extremely soft high frequency data for the June quarter. And the forecast was presumably a key driver in the central bank making a sharp 'dovish pivot' and, along with making a cut in the OCR from 3.25% to 3.00%, switching to forecast two more cuts, likely leading the OCR to 2.5% by the end of this year.

Bank economists had been expecting the June quarter retail figures to go backwards (market consensus -0.3%), in line with what more timely monthly electronic cards transactions data has been indicating.

However, retail sales volumes showed a surprise 0.5% rise in the June quarter according to official figures released on Monday.

The retail sales data, released by Statistics New Zealand, is the first 'partial indicator' for GDP June quarter figures that are due to be released on September 18. The retail sales volumes figures are adjusted for price inflation and seasonal effects.

BNZ head of research Stephen Toplis said the retail figures "provide more evidence there may be life in the old economy yet".

"...today’s data put upward pressure on our Q2 GDP expectations [which are for a 0.2% fall], but we’ll wait to see a few more partial indicators before we make any move."

HSBC's Australia and New Zealand chief economist Paul Bloxham said the big question for New Zealand economic observers of late has been how much to read into the weakness that has been apparent in the timely partial indicators.

"Our own reading has been that the growth upswing will continue, that the recent wobbles will prove to be temporary, or measurement issues, and we expect growth to be supported by two key drivers: sharply lowered interest rates (250bp of cuts) and a substantial rise in dairy prices to very high levels that is boosting agricultural incomes," he said.

"We are not convinced that the economic growth upswing has genuinely stalled and we have a close eye on the pickup in CPI inflation and inflation expectations over the past quarter.

"We also note that given the RBNZ’s mandate is now a sole inflation focus (it had previously included employment and housing conditions), it seems interesting to us that the central bank has been prepared to so avidly play down the inflation risks, to trust its own medium-term inflation forecasts and publish a lowered cash rate pathway despite acknowledging that inflation is set to rise to the top edge of its target [1% to 3%] band in the short run."

Westpac senior economist Satish Ranchhod said the latest quarterly retail trade result was "well ahead of our own forecast and the average market forecast for a fall in spending over the June quarter".

However, according to Stats NZ there was a 0.5% rise in retail sales activity, following on from a 0.8% rise in the March quarter.

Stats NZ economic indicators spokesperson Michelle Feyen said retail activity "recorded a modest increase" in the June quarter, with growth seen in most industries.

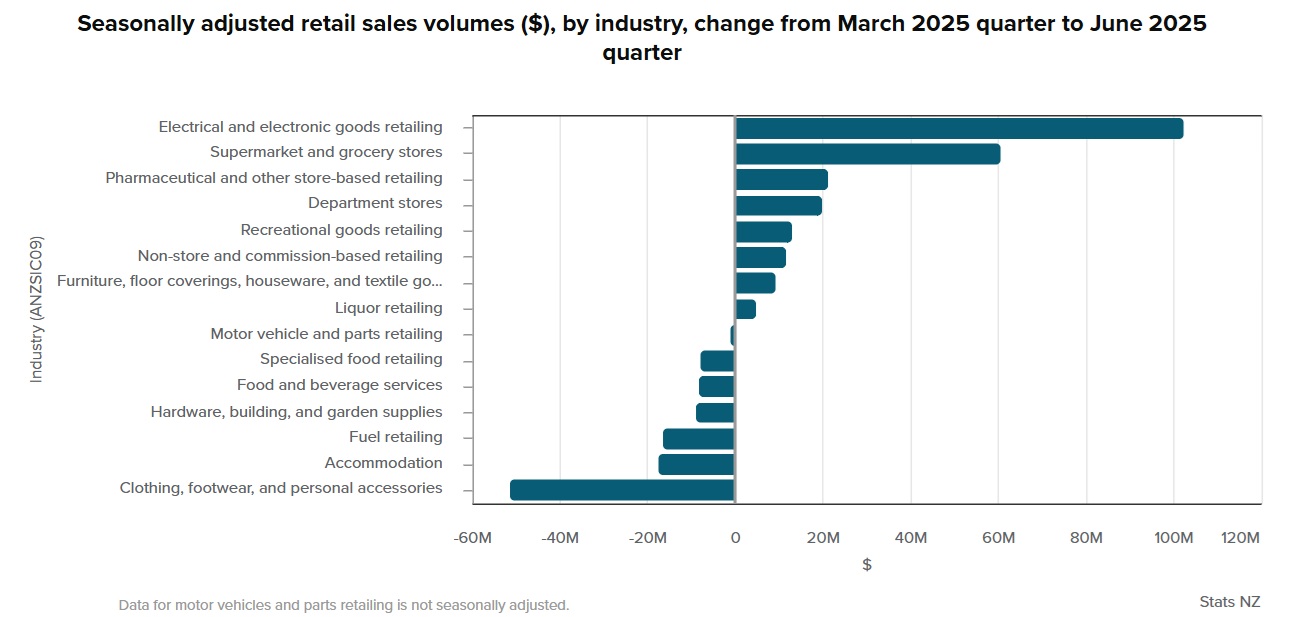

"Electrical and electronic goods, supermarkets and grocery stores, and pharmaceutical retailing saw the largest increases this quarter," she said.

Eight of the 15 retail industries had higher retail sales volumes in the June 2025 quarter compared with the March 2025 quarter, after adjusting for price and seasonal effects.

By industry, the largest movements were:

- electrical and electronic goods retailing – up 4.6%

- supermarket and grocery stores – up 1.3%

- pharmaceutical and other store-based retailing – up 1.2%

- department stores – up 1.0%

- clothing, footwear, and personal accessories – down 4.3%

Westpac's Ranchhod said the latest quarterly retail sales update is "an encouraging sign for spending over the remainder of 2025".

"Spending levels are already pushing higher, and the full impact of the large reductions in interest rates over the past year is yet to be felt."

Ranchhod said over the coming months, increasing numbers of borrowers will be rolling on to lower borrowing rates. The related lift in disposable incomes "could be sizeable in some cases", and that’s set to boost spending through the latter part of the year.

"There are still some headwinds for the retail sector. Most notably, unemployment is likely to rise around to 5.3% before the end of the year. Even so, it looks like a recovery in the retail sector is now taking shape."

The Westpac economists are forecasting "flat" GDP growth over the June quarter (IE 0.0%).

"Today’s result was ahead of our expectations. However, we’ll take a closer look at how our forecast for GDP growth is shaping up over the next couple of weeks as additional data on June quarter activity is released."

5 Comments

Great news, we're on the way up.

The DGM's will have to slink back into their closets.

Somebody has taken Nicola's criticism to heart

I know someone in health and beauty business, couple of locations, says things have picked up over the last two months with reasonable forward bookings. hard time to be an economic forecaster.

Reading this article, I am reminded of the two quarter growth in property values last year that the pundits called a turnaround to a new property growth cycle. We know what happened with that.

Ranchhod said over the coming months, increasing numbers of borrowers will be rolling on to lower borrowing rates. The related lift in disposable incomes "could be sizeable in some cases", and that’s set to boost spending through the latter part of the year.

That's what said this time last year.

I'm not sure what this article is suggesting - that because there has been a miniscule rise in retail sales that the RBNZ should immediately kill of any nascent recovery in the economy?

All the recent news stories have been of mills and manufacturing being shut down in provincial towns due to high electricity prices and price spikes. Maybe instead of trying to micromanage inflation expectations it might be better to try and save what is left of productive industry in NZ. Rather look at the faulty electricity reforms and the long term impact they are having on regional development.

Currently inflation is being driven by council rate rises, insurance and the prospect of tariff driven price increases. The govt has some tools it could use for the first two items. It looks like the US tariff story may have the possibility of being deflationary if a fall in oil prices and interest rates can't be engineered to cushion the blow of tariffs on US consumers.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.