Business confidence as measured by ANZ's Business Outlook (ANZBO) survey for October "jumped" to its highest level since February.

"Green shoots are emerging, particularly for interest-rate sensitive sectors such as retail and construction," ANZ senior economist Miles Workman said.

"The question is, will firms trust them to thrive and not to wither, as they did earlier this year?

"The pieces are in place for a cyclical recovery, though we are expecting growth to be modest; recovery takes time," he said.

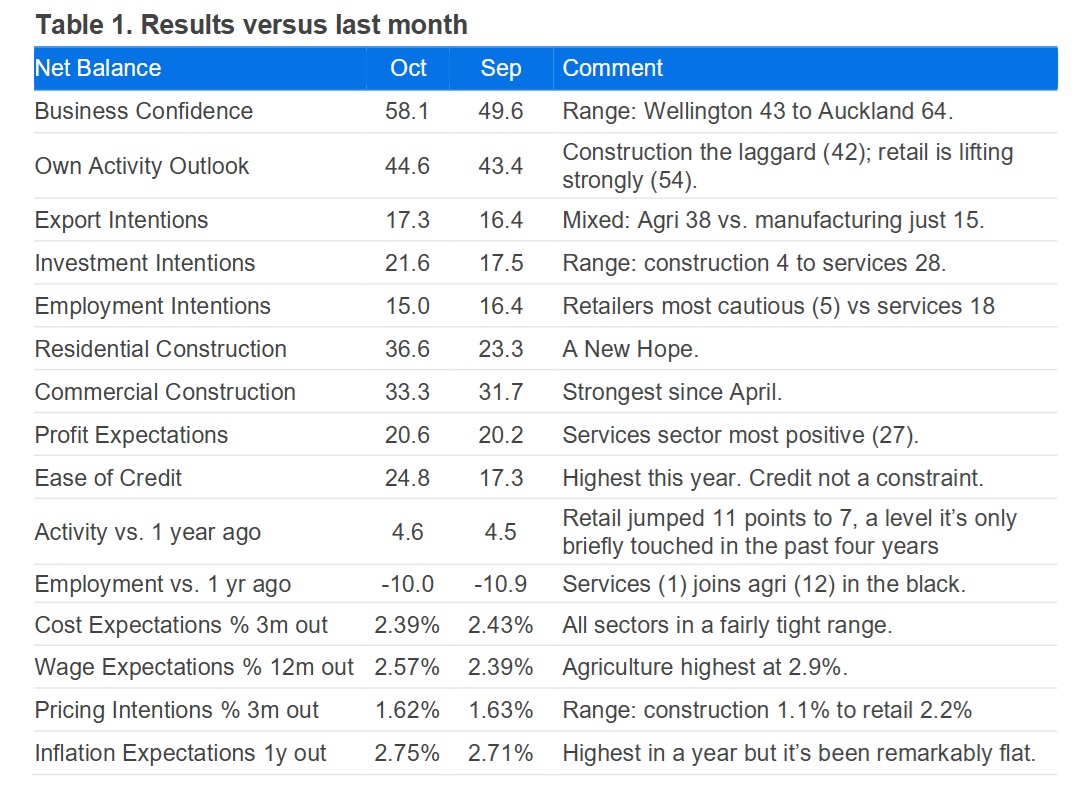

Business confidence as measured by the survey rose 8 points to a net 58 positive in the month. Expected own activity lifted 2 points to net 45%, the strongest since April. Past own activity was little changed at +5, while past employment lifted 1 point to -10.

Inflation indicators were little changed: the net percent of firms expecting to raise prices in the next three months eased from 46% to 44% while those expecting cost increases rose 1 point to 76%. One-year-ahead inflation expectations were little changed at 2.75%.

"Forward-looking activity indicators generally lifted in October," Workman said.

"Reported past activity is suddenly looking much brighter for retail, with its highest read in four years, but construction remains under significant pressure.

"Reported past employment remains negative for every sector except agriculture but seems to have found a floor in aggregate.

"Firms’ expected average costs and price changes over the next three months were little changed, while the wage measures were slightly higher."

Workman said there is "marked regional divergence" in the ANZBO survey results. Canterbury stands out, with its strong agriculture backbone, while Wellington has lagged for more than a year.

Workman said it shouldn’t be forgotten that the slowdown in recent years, while painful, has achieved a lot in terms of clearing the decks for the next upswing.

"Real house prices have unwound their bubble, household and firm debt is now lower than pre-Covid as a share of GDP, inflation has been beaten down, and external balance with the rest of the world has been restored as imports have reduced and exports grown.

"The pickup in retail sentiment underlines that as the weather warms the economy is set to do the same, with significant monetary easing working its way through and high rural incomes supporting activity and confidence in the regions."

The Reserve Bank made its jumbo-sized 50 point cut to the Official Cash Rate on October 8, which means that the latest survey results include responses from both before and after the cut.

Workman said it was not clear from looking at the results both before and after the OCR announcement that the cut had boosted confidence.

"But we’d caution that there has been a pattern for the past five months of early responders being predominantly more positive than late-month ones, so one needs to be cautious about ascribing the difference to mid-month events."

Westpac senior economist Michael Gordon, commenting on the latest survey results, said overall, the results "may not seem like a ringing endorsement of the RBNZ’s efforts to provide a 'circuit breaker' to get economic growth moving again".

"But this particular survey was always at odds with the idea that businesses had fallen into a funk in the first place – confidence in the outlook for the year ahead has remained high over 2025, and was only slightly dented by the US tariff announcement in April," Gordon said.

"...We expect the pace of economic growth to remain subdued over the second half of 2025 (notwithstanding some seasonal distortions in the reported figures). Lower interest rates, robust commodity prices and contained inflation pressures should support a return to more consistently above-trend growth in 2026," Gordon said.

BNZ head of research Stephen Toplis said the survey "continues to foretell a marked improvement in economic activity. It’s been doing so for over a year now".

"We are comfortable with our view that activity will soon turn the corner but we can’t help but think the initial pace of the expansion will disappoint many. Consistent with the ANZ survey, we do believe annual GDP growth can climb to around 3.0% but that’s likely to be towards the tail end of 2026 rather than any time soon."

Toplis said following "a really nasty period in New Zealand’s economic history", he will take all the positive news that he can get "and this survey is, unequivocally positive in its core messages".

"And these are messages delivered by businesses themselves so should be given some credence."

Business confidence - General

Select chart tabs

11 Comments

Wow - NZ commentators still have the balls to say - "the green shoots of recovery". That is embarrassing - a little self-reflection would be helpful.

My prediction is ongoing stagnation in 2026 - at best - despite the panicked activities at the RBNZ.

Remember, after a couple of years of downwards confidence, summer is coming as usual and all business needs is a whiff of positivity and they'll start building on it. How else can one run a business if they aren't able to weather the tough times and hold on to hope for better times.

Can we please stop mistaking higher export income for increased exports? We are currently in a sweet spot for exporters - the global price of the basic goods we export is high and our currency is weak. Look at how much we are exporting - what do you see?

Why do you think we're not when we are making production gains. Am interested in your views

Production gains are really energy efficiencies.

Economists know exactly zero about those - even 'Nobel' prizewinners.

But energy efficiencies are governed by the 2nd Law of Thermodynamics (again, economists know zero, etc.)

And therefore, follow a path of diminishing returns. So they plateau. And every next wee increment takes so much more - usually complexity (so lack of resilience).

And that is all atop a best-first extraction regime. And compounded by an entropy load which has never been bigger, and is trending...

Put another way, society can no longer afford itself. It was inevitable, and only by believing - economists took over from priests - could we choose to avoid the physical limits/facts. Mentally avoid, that is; you cannot physically do so...

Look at the graph...where are the 'production gains' over the past decade?...it is all price/currency movement.

Ok productivity gains, such as the average cow producing more MS, ewes having more surviving lambs and more grass /crop yields per hectare

Likewise we have more environmentalists than we know what to do with

Exactly my point.

The cow doesn't produce milk out of thin air.

You can trace that milk to solar energy, to fossil energy (via Haber Bosch, and transport/tractors/mining) and to the grid.

There is a law of diminishing returns. A limit to what the cow can convert. Malthus (and I bet you diss Malthus, who I bet you also haven't read) put it very well: No man can say what the tallest height is that a tree can grow, but he may easily state a height to which it will never grow. In all these cases, therefore, a careful distinction should be made between an unlimited progress, and a progress to which the limit has not yet been reached'.

Typed from memory - probably not perfect, but that's the gist.

Always an upper limit with thermodynamics - and a cow is just a thermodynamic equation, as are we all.

The average cow may well be producing more MS etc but in aggregate the economy is not increasing output despite the increase in a key component of input....labour. Those individual efficiency gains are being offset by other factors within the economy....excessive property values perhaps or in the case of MS a limit on that production due to waste streams? Either way our total (real as measured by volume) output has stagnated for the past decade while our population has increased....same size cake but more mouths.

I'm tired of the "greenshoots" BS. All I can think of is the stopped clock scenario.

My company has 10 branches. This month, only 3 will make budget and none of those 3 will exceed 105% benchmark the company aims for. This performance pattern has played out over and over for the last 12 months.

All the banks do is keep rambling about greenshoots on the back of falling interest rates, knowing they'll eventually be right. Just like the stopped clock. Pathetic.

Mike - What industry or sector are you involved in.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.