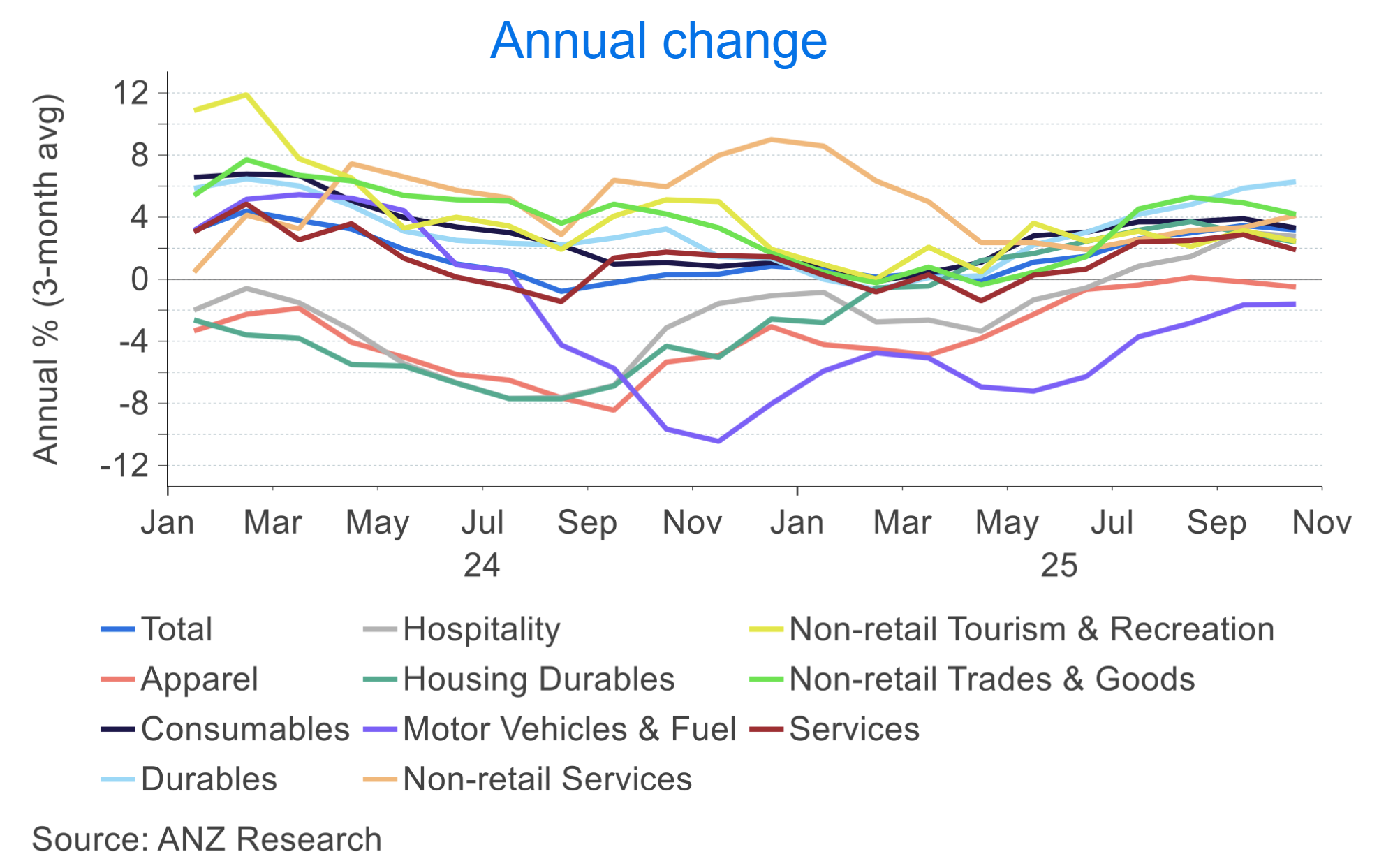

Card spending's still pretty flat out there - but there are now some encouraging signs, according to the country's biggest bank, ANZ.

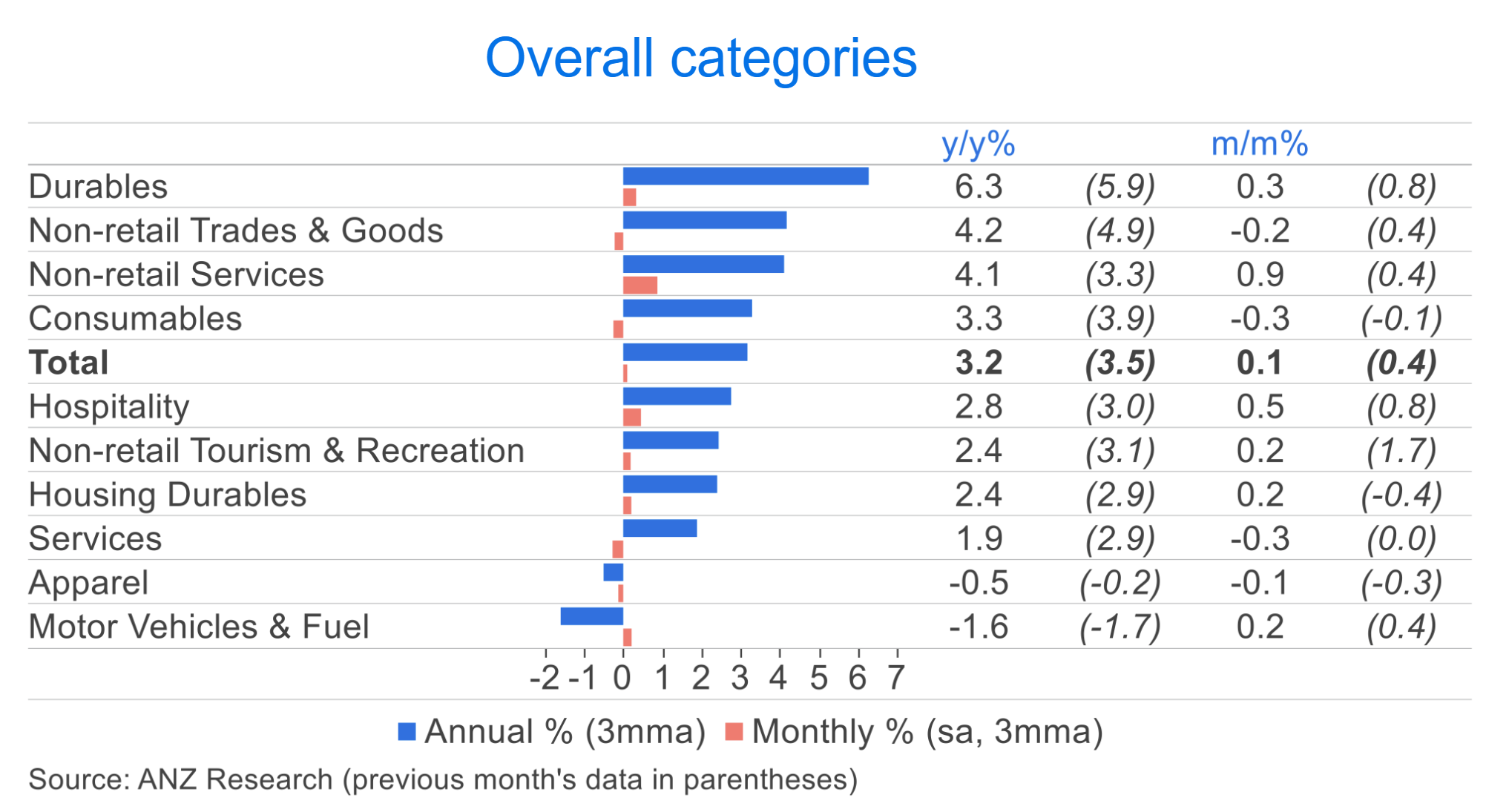

A detailed data pack for October compiled by ANZ chief economist Sharon Zollner highlights that the "very cyclical" durables spending is actually showing the greatest rate of annual growth, with 6.3%.

"Overall card spending was up 0.1% in October (note we report spend on a seasonally adjusted, 3-month average basis). Spending is up 3.2% compared to the same time last year," Zollner said.

She said that motor vehicles & fuel spending "has been dragged down" by lower petrol prices, and apparel spending is flat. "But all other store types now have annual spend growth back in the black."

Zollner says it's possible to create a "rough proxy" for "real" card spending by dividing total card spend by the Consumer Price Index (including ANZ economist's forecasts).

"The trend in this proxy for 'real' card spending remains flat, as it has been for 18 months," she says.

There are four sectors - apparel, motor vehicles & fuel, housing durables, and hospitality - that still have spending well below early-2023 levels.

"...Hospitality is showing the most signs of life, with a definite turn higher in recent months," Zollner says.

Hospitality spending is up 2.8% year-on-year, helped along by a 0.5% increase this month.

"There’s evidence of 'trading down' in the fact that fast food is outperforming other forms of dining out. The accommodation sector remains soft, though it saw a decent lift this month."

On the durables figures, Zollner said growth in most store-types in this category is trending higher.

"Second-hand stores are achieving the highest annual growth in this category. Cost-conscious households or is it just trendy?"

'Birthday presents' like musical instruments, bicycles, sports goods and book stores continue to have a tough time of it but most did see a lift in seasonally adjusted spend last month," Zollner said.

"Spending at vape stores is down 7.6% over the last 12 months after years of exponential growth."

Zollner said spending in the apparel category fell 0.1% in October (seasonally adjusted), which saw the annual change drop "further into the red" at -0.5%.

"Apparel is a clear outlier to the downside compared to other forms of discretionary spending. It’s possible data has been affected by spend shifting to general online retailers," Zollner said.

She noted, however, that within the category, jewellery is a strong outperformer, "possibly related to the recent surge in the price of gold".

6 Comments

Zollster looks like she's struggling [and grasping for a positive narrative as her employer relies on drunken sailor behavior] with the reality that real spending is actually negative. Inflation is much higher than 3.2%, despite what the pointy heads, banks, govt, and media try to tell you.

It does seem to me we are coming off the mat rolling into summer. Hopefully it’s more than just seasonal. However it’s also off a woefully low base so easy to see the numbers look relatively better. All points to the RBNZ overdoing it yet again.

RBNZ overdoing it yet again…? With regards to their hikes or cuts…or both?

IMO I don't think mortgage rates need to be lower from here to get growth going, other methods are probably better than pump priming housing again.

It will be interesting, like many on here I struggle to see housing going berko again…although a lot of economists, and the RBNZ themselves are picking slow growth on house prices, and, well, we know all their track record so maybe you’re right with your concerns 😂

If you drop durables prices low enough, people will buy them. Supply and demand 101.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.