The Government's been given yet another loud wake-up call from the business community, with the influential NZIER Quarterly Survey of Business Opinion showing another drop in business confidence.

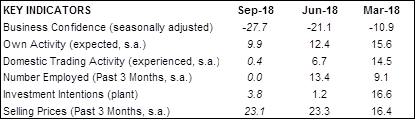

The survey released on Tuesday revealed that a net 28% of businesses expect economic conditions to worsen. This is the lowest level since March 2009. The New Zealand dollar dropped after the survey results came out, from US66.15c to US65.95c.

The most watched measure in the survey is that for firms’ own domestic trading activity. This is bad too. The NZIER said firms’ own activity for the September quarter and expectations for the next quarter both fell, indicating a slowing in economic growth over the second half of 2018.

A net 0.4% of firms reported higher demand over the September quarter, which is the lowest level since September 2012.

Unsurprisingly, the Opposition seized on the survey results.

National's Finance Spokesperson Amy Adams said the Government should "stop experimenting with the economy and cease being the biggest source of uncertainty for business".

"It is arrogance to ignore the impact of bad policies." (Adams' full statement is at bottom of article)

ASB senior economist Jane Turner said the survey contained "some very weak details", which confirms that economic activity has likely decelerated heading into the second half of 2018.

"We will likely revise our H2 2018 GDP growth forecasts in light of this weak outcome."

ANZ senior economist Liz Kendall said Tuesday’s data from NZIER are consistent with a softening in GDP growth, which casts considerable doubt on the Reserve Bank's expectation in its August Monetary Policy Statement that annual GDP growth will accelerate from here.

"Today’s data will add to concerns about the current degree of economic momentum, providing a timely reminder that OCR cuts remain a distinct possibility. The RBNZ stands at the ready to support the economy should they deem it necessary to get inflation sustainably back to the midpoint in an acceptable timeframe. Accordingly, today’s data have the potential to move the RBNZ’s rhetoric further into dovish territory.

"We continue to believe that on balance the next OCR move is more likely to be a cut than a hike, though more “hard” evidence of a slowdown would be required to shift us from our flat track. Uncertainty persists regarding the degree to which firms will follow through on their downbeat intentions, Kendall said.

Kiwibank chief economist Jarrod Kerr said the uncertainty generated out of the Beehive had persisted over the year.

"Firms’ concerns have yet to translate into materially weaker activity, however," he said.

"We believe there may be an element of protest, anti-reform, voting taking place, especially in regard to labour market reform, tenancy reform and taxation reform (capital gains). There’s a lot for businesses and landlords (often one and the same) to get their heads around.

"It’s uncertainty that kills confidence. And it’s uncertainty that kills growth. So far we assume a large amount of posturing, and (hopefully) a limited amount of pass-through. But the risks are clearly down, not up. Today’s survey is exactly what keeps the RBNZ awake at night, and justifies the central bank’s dovish tilt."

NZIER quarterly survey of business opinion

Select chart tabs

This is the statement from NZIER:

The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows a further deterioration in business confidence. A net 28 percent of businesses expect economic conditions to worsen – the lowest level since March 2009.

Firms’ own domestic trading activity is a better indicator of GDP growth than business confidence. Firms’ own activity for the September quarter and expectations for the next quarter both fell, indicating a slowing in economic growth over the second half of 2018.

A net 0.4 percent of firms reported higher demand over the September quarter – the lowest level since September 2012.

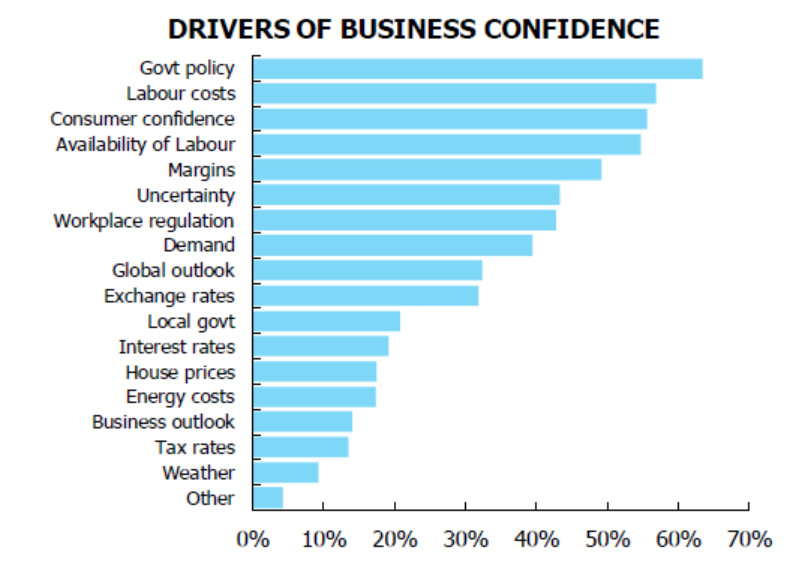

Firms are worried about Government policy, labour costs and availability, margins and consumer confidence

Through the 50-year history of the QSBO, businesses have tended to be more downbeat about general economic conditions than their own domestic trading activity. The difference between headline business confidence and firms’ own trading activity tends to be larger under a Labour-led Government.

This quarter, we added a supplementary question to delve deeper into the key influences on general business confidence.

We found Government policy, labour costs, consumer confidence, availability of labour and operating margins were the key considerations for businesses when it came to an assessment of general economic conditions.

Larger firms were more influenced by Government policy when assessing the general business outlook. Retailers, manufacturers and builders were more influenced by concerns over labour shortages and costs and consumer confidence.

This suggests uncertainty over the effects of new Government policies and higher costs have contributed to the decline in business confidence over the past year.

Further decline in profitability leads to softer hiring and investment intentions

Profitability continued to worsen, reflecting intensifying cost pressures for many businesses. Businesses remained pessimistic about an improvement in profitability.

This continued deterioration in profitability has made businesses more cautious, with a net 3 percent of businesses reducing headcount in the September quarter.

Businesses were also more circumspect about new investment, particularly for buildings. If profitability was to continue to worsen, businesses will likely hunker down and reduce investment and hiring.

Manufacturers now most pessimistic

Although the downbeat mood was broad-based across sectors, manufacturers have overtaken retailers as the most pessimistic sector. Weaker demand and rising costs have seen manufacturing sector confidence fall sharply.

Rising cost pressures also weighed on building sector confidence, with over half of firms in the sector reporting higher costs. Building sector firms reported some softening in demand in the September quarter, but architects’ measure of work in their office points to a pick-up in the pipeline of residential and commercial construction over the coming year.

Source: NZIER

This is the statement from Amy Adams:

The Government can’t continue to cling to policies that are harming the economy while trying to ignore the growing body of negative indicators, National’s Finance spokesperson Amy Adams says.

“The latest Quarterly Survey of Business Opinion shows the percentage of firms expecting economic conditions to deteriorate is at the highest since March 2009 and the important own activity measure is the lowest in six years.

“NZIER says the survey points to GDP growth of just 2 per cent in the year to September 30, well below the levels touted by the Finance Minister. Significantly, the survey found that Government policy was the biggest driver of business confidence, followed by labour issues.

“Instead of taking credit for the strong foundations built up by National, the Government should stop experimenting with the economy and cease being the biggest source of uncertainty for business. It is arrogance to ignore the impact of bad policies.

“National wants New Zealanders to keep more of what they earn. It believes in sensible, consistent economic policies that encourage businesses to grow, invest more, create more jobs and lift incomes.

“The QSBO shows this Government is doing the opposite. More firms cut staff in the latest quarter and they expect to reduce investment in the coming three months.

“These findings from NZIER are in line with other indicators. The Business Central survey this week shows businesses across the lower North Island remain broadly pessimistic and most ‘don’t think the Government has a plan to raise the country’s economic performance.’

“Business Central says businesses are ‘most concerned about uncertainty around the Government's policies, finding the right staff, and future employment law changes.’

“New Zealand needs to maximise its opportunities not squander them or our ability to cope with external global shocks will be diminished and we will fall further behind comparable economies like Australia.

“The realities of overseeing an economy are being learned too slowly by this Government. It is clinging to a high-cost, feel-good wish list but offering little substantive policy to drive economic growth and deliver more opportunities for New Zealanders.”

54 Comments

Here they come. After spending more than a year talking about nothing but good things ahead for the global economy, Economists are beginning to sound worried. In 2017, there wasn’t anything that could stand in the way of synchronized growth. In 2018, there’s no longer any synchronized growth, so now we can talk about what was standing in the way.

The latest is the IMF’s Managing Director Christine Lagarde. From earlier today:

Six months ago, I pointed to clouds of risk on the horizon. Today, some of those risks have begun to materialize.

https://www.alhambrapartners.com/2018/10/01/rolling-over/

Right on again.

Is this survey result about lack of confidence in the government or more about global sentiment such as:

- access to easy credit

- property prices/growth

- inflation fears

- fuel price increases

- strengthening USD vs NZD

- US vs China tariff wars

- general Trumpism

I say all the latter above. Labour costs have barely moved and govt policy is almost unchanged from the last lot.

if you are running a confidence game, then confidence matters

Oh, come on.

" Labour costs have barely moved and govt policy is almost unchanged from the last lot."

- Minimum wage increase 1 April and two more to follow.

- Strikes occurring over teacher and related employment which will have the effect of jacking relativities everywhere and could well cascade into other labour sectors entirely

- Oil and gas exit sans any official advice whatsoever/

- Employment law changes imminent which will advantage labour over employers.

- Zero Carbon a'comin' down the track.

- Foreign capital not welcome no mo' - vide the Tegel decision just out

Cognitive dissonance, much?

Why do people mistakenly conflate welcoming of foreign capital into land speculation with foreign capital in business investment? The example of China highlights just how absurd this conflation is, and it's been the inviting of foreign speculation in NZ land that has been a major factor in issues NZ now faces.

Now we see people pushing for more money because housing costs are so out of whack. Who woulda thunk? Economic short-termism coming home to roost.

'Rock n Roll' to 'Rock and rolled over'

But we all enjoyed John and Bill's excellent adventure. The question is was GDP just debt growth in the non-productive sector of the economy?

https://www.google.co.nz/search?q=bill+and+ted%27s+excellent+adventure&…:

Excellent!!!

agree

When an idiot council slashes supply and creates a land price speculation bubble, blaming speculators is pointless.

The business of building houses in Auckland with appallingly high land costs requires a lot of capital, we need bucket loads of cash. In the absence of foreign cash the taxpayer is being forced to prop up the Auckland property market with bucket loads of cash by building $650,000 small units.

I actually prefer idiot foreign investors chasing a bubble to government cash when it comes to building high cost housing. When the market corrects some idiots are going to get burnt and I'd prefer not to be idiotically paying high taxes.

(Obviously we could cut costs by removing the RUB restrictions, as promised by Phil Twyford prior to the election and build less costly housing. But that would be a sensible economic policy.)

Agree, the council is artificially limiting land supply and the RUB should go.

As we saw previously with Japanese investment, it is far better to let them spend all the money building things, then we buy them back off them after the crash at half the price.

So the problem I have with your opinion above is considerable. Interestingly I'd sit back and think that asking businesses is at at best questionable undertaking as it sems many seem to not show much of an idea in terms of economics. The very fact that it seems actual activity v outlook differs more under Labour points to a bias too significant to worry about.

Minimum wage - just how many employers reply on the minimum wage being as low as possible? generally I hear more like highly skilled people are needed these wont be on the minimum wage. Plus then as ppl on the min wage have more money in their pocket they spend it, so really this is a business taking a micro view not a macro view.

Strikes etc, yes more money into the economy, see macro above.

Oil and Gas, facing decline anyway, the growth in jobs is in renewables world wide.

Employment law changes. The present law(s) already greatly un-balanced in favour of employers, the minor changes, this merely fixes that a little. see macro above.

Zero carbon, that is coming, either as Peak oil anyway or CC avoidance. You can sit there kicking and screaming or move as first advantage.

Foreign capital - personally I consider that it has been NET more damaging than good. T

egal - http://investors.tegel.co.nz/media/1130/180924-oio-granted.pdf

so link please?

Given your distaste of foreign capital could you please offer your solution to financing our current account deficits ?

We only have three choices - More debt and already deep in the mire there.

QE as in rolling the presses a la Zimbabwe or selling assets to foreigners as in houses.

I await your choice with interest.

Given we have now run C/A deficits for 47 continuous years and August was the worst trade deficit ever on record - I don’t think C/A surplus are on the table anytime soon.

here are some solutions...

Encourage Kiwis to buy Kiwi made

Enforce GST on ebay and amazon purchases

Structural reform Richard Werner style, restrict non-productive lending to building societies.

Practice government mercantilism (buy kiwi made from kiwi owned companies)

Waymad, a pretty weak list - lots of “could have, might have, would have” but very little that is different govt policy.

Minimum wage moves under all governments.

Strikes are not govt policy and reflect low labour costs.

Oil and gas - agreed, score 1 to you but the oil companies were leaving anyway.

Employment law - thinking about it but still no change.

Zero carbon - thinking about it but still no change.

FDI not welcome - thanks for inventing fake news. Not govt policy.

So again, show me which govt policies already implemented have upset businesses so much?

I’m upset because immigration still hasn’t been reduced like they said they would. The tired old Nat’s game of importing warm bodies and their cash is a sad excuse for crap GDP growth.

@ Waymad

You are missing the point around labour costs businesses are very concerned about the continued ratcheting up of minimum wages and flow on effect plus the proposed employment laws changes people think about whats coming in the future and plan accordingly.

Can't argue with that. They've had a good number of years being able to rely on importing easily-exploitable low-cost wages, rather than having to compete in a local supply-demand equation by offering higher wages. I'd probably whine too if I'd built a business on cheap, exploitable labour.

Um, Colin, I was gently casting nasturtiums upon the questionable assertion upthread that labour costs are stable and policy is ditto.

You and I is on the same page here....

More like after 9 years of National the 'brain drain' is coming back. All the smart people in their prime working years will move to Australia, Canada, Germany, America, UK, etc. Housing is far too expensive in NZ compared to income.

As for immigration; the days of highly skilled immigrants coming to NZ are OVER. NZ will import more and more low skilled workers, many of whom claim to have skills they DO NOT possess. The education system here is a joke and not fit for the 1960's let alone 2018.

Businesses and the previous government have shot NZ repeatedly in the foot. I wouldn't be surprised if we see huge outflows of our best workers at the beginning of next year (January, February and March). These workers know they're paying all the tax and doing the heavy lifting, yet live in constant housing insecurity - RIDICULOUS!

@Zack you dont know how right you are .

My daughter is on the Novopay payroll .

She is resigning on 1 Feb 2019 to take up a position in Toowoomba , as her student loan will be paid up

She will almost double her takehome pay , petrol is way cheaper , housing is very cheap ( in fact its a rural school with lodgings provided ) and the Austrlalian Government is not hell bent on preventing young people from getting ahead financially through a raft of new taxes , levies and shakedowns as is this shambolic administration.

She simply cannot live in Auckland any longer when her rented accommodation and fuel/ transport costs absorb a massive portion of her take-home pay.

Boatman - my better half was raised in Towoomba, but we wouldn't go there for any money.

Ecologically, and near-term at that, it's stuffed. And Australia is dependent - both export-wise and electricity-wise - on coal, the stuff which is stuffing it.

But you fall at an earlier hurdle - talking of being 'ahead financially'. I keep pointing out that electronic digits held in expectation, are akin to Jack's magic beans. There isn't the underwrite anymore - it was a ponzi. When that penny drops, where is it better to be? Somewhere with rainfall, my guess...

Toowoomba is booming !

New airport and just got the Qantas pilot school located there. 250 trainees per annum - a big project.

Australia has massive coal and gas reserves and they will burn it when they come to their senses.

Don't worry about the lucky country - they are going well as always with Govt debt ratios actually less than NZ. It's just they had zero that they are in an occasional swoon but back to surpluses soon.

Been watching the brain drain for over a decade. The smart ppl started leaving over 20 years ago, what's left is a lot of management second raters. In terms of housing costs in NZ try looking at the housing costs in Australia and Canada and the UK as a comparison, hint its as bad if not worse. We employ a lot of skilled people from overseas, funny thing but they do the job fine. Its the NZers who whine about the work load and pace and quit in weeks that are more annoying.

Last sentence, indeed the rump of tax is paid by the PAYE, yet when TOP comes along wanting to change it they get 2.5% in the voting booth. But then I think many of the best have already left so the result shouldnt be that much of a surprise.

U still get a better deal with housing in Australia, Canada and UK - especially considering their wages are higher, their cost of living is MUCH, MUCH lower and their housing is healthier.

The Australians are screaming bloody murder at their petrol prices breaking AU $1.60. Australia has some of the largest homes in the world .. while rotten, old shoe-boxes here sell for $650,000+ AND there aren't enough rental properties to go around.

Eurozone didn’t admit a Lost Decade – France won’t admit austerity continues in 2019

https://thesaker.is/eurozone-didnt-admit-a-lost-decade-france-wont-admi…

Trust is like blood pressure. It's silent, vital to good health, and if abused it can be deadly.

Not my quote ......... but something our leadership should be aware of .

Here's an interesting observation . We are a professional practice with about 700 clients .We dont get into political discussions with our clients, but many clients are outspoken , and some want to express their views about the Government .

Not one of them has anything positive to say about this coalition.

The common thread when they bring up politics , is that there has been a breakdown in trust.

Government does not communicate properly , it does not engage the productive sector , its makes decisions regarding taxes without consultation , and their actions around OIL AND GAS exploration speak louder than 100,000 words .

John Key was right when he said he would never work with Winston because ........... you guessed it !

So you have a snapshot of a particular sector that I surmise was hard core anti-Labour anyway. The fact they cant see that the writing is on the wall for OIL and Gas in NZ anyway speaks volumes on their competence. The rest seems to be whining that this snapshot of yours isnt getting what it wants, personally I suspect its a good thing for the rest of us and NZ.

Isn't the govt just doing what they said they would do pre-election?

Doesn't sound like a communication problem to me.

Boatman - it's NOT the productive sector, it's the Extractive sector.

Horse, water, ideological baulk. How long, how long? (with apologies to Kipling)

Hussman -

Our view is that no form of investment risk is always worth taking without regard to valuations, fundamentals, economic conditions, or market action. The strategy of buying and holding index funds for the long run is essentially a strategy that says that market risk is always worth taking. Yet the iron law of investing is that a security is nothing but a claim on a future stream of cash flows. Valuation is a crucial determinant of long-term returns. The higher the price an investor pays for those cash flows today, the lower the long-term rate of return earned on the investment.

The corollary is also true. The lower the long-term rate of return demanded by investors, the higher the price moves today. So clearly, changes in investors' attitudes toward risk will strongly affect short-term returns. If investors become more willing to take market risk, it is equivalent to saying that they are demanding a smaller risk premium on stocks (that is, a lower long-term rate of return). Prices rise as a result. Now, the fact that current stock prices are higher also implies that future long-term returns will be lower, but that's part of the deal.

Are we really surprised?

No we arent!

Rudderless government that engenders absolutely no confidence.

This is a joke. In 2009 there was a global recession. This has just become a political statement and as such should be ignored.

Govt policy for example their proposed employment changes are from the last century, a complete failure. All this Govt has achieved to date is inflict misery, when they try a new policy or ideas they display incompetence in the process. To the business community this highlights they are simply are out of their depth which scares the hell out of people

More flouncing.

Time will tell

The only ones who truly know if it’s flouncing or not are those with the money and they are not COL supporters or I’d wager most of the commentators here. If you are not at the table or even in the room when budgets are being set and spent then you are just guessing based on your political bias. Ironic.

Business is clearly getting nervous about their futures and sending strong signals they are not prepared to take on further risk of investment & employment .

Irrespective of ones political leanings this is not good news for any one .

The first point about all this is that it's Business who make the hiring and investment decisions for the tradeable sector.

Not politicians, not common taters, not employees, not union bosses, not economists.

The second point is that it's impossible to count a negative. It can be estimated only with a huge amount of guesswork and a perhaps considerable time lag:

- the hires that were not made

- the expansions that did not happen

- the capex that was deferred indefinitely

- the product development that was cancelled or offshored

None, but none of such decisions have Gubmint or the aforementioned chain of affected parties, sitting at the table with voting rights.

And the effects, because they take quite some time to show up, cannot with certainty be traced back to this or that decision. So when the Board or the MD's meet, look around the table, and decide to Not do x, y or z, there's often not so much as a minuted note: just a quick glance ('are we all on the same page?') and then....nothing. The PO's don't get written. The consultants are told to drop the proposal(s) in the pipeline. The property broker gets told to stop looking for that new lease. The equipment supplier may or may not notice the dearth of orders. The offshore branch may suddenly see some new activity. There's no hires of sales crew.

One meeting, one quiet glance, it's done.

The consequences may take months or years to work through....

Confidence...an elusive beast.....

Confidence is measured very simply: cash flow. If a business has a good cash flow it can consider expansion. If a business has a weak, weakening or threatened, cash flow, it cannot.

No one who hasn't been there can comprehend how quickly the good times turn bad and the cash flow starts to haemorrhage.

Cash flow is a sign of good health, but if there are factors or political decisions made which may impact on future cash flow earnings then that's going to have an impact on confidence.

Can no one else say they didnt see an economic downturn coming ? Ive been talking to my non believer house spruiking friends since last year, what we have right now is simply unsustainable, no matter how much you want to believe it is.

Everyone jumps on these business surveys like its news. Maybe if your an idiot it is news. Its been a long time coming and it will hurt.

The End

Businesses should be worried.

Oil price is now on an upward climb ... the kind of stress trigger in the system that precedes a GFC

the US playbook...

The Fed is raising rates to attract dollars to the U.S. The money flow into the U.S is inflationary for the U.S, but deflationary for the world, which is experiencing a dollar shortage. In compensation the world is printin money in local currencies, which is causing destruction of their own currencies. The Fed is flexing its muscles. No other currency can do this. To not over heat the U.S economy by raising rates, the Fed has to do some QT as well( selling the securities purchased previously).

We are dealing with a “fixed sum” world. There is a total amount of energy products to distribute. There is a total amount of goods and services to distribute. The hope seems to be for the US to get a disproportionate share of the total, as the total fails to rise adequately. It may even begin to fall."

"There is a total amount of energy products to distribute".

Yes. indeed, the nuclear reserve stands fairly much untouched....as Indonesia, China and Russia well understand, and Australia, Germany, and Britain don't.

So South Australia foobars it's grid with intermittents, Britain ditto, and Germany burns lignite....

"the nuclear reserve stands untouched ".... because its of NO use to existing infrastructure / costly / comes with serious waste issues. And electricity is only part of the story ... the economy as it now works relies on a mix of (not too expensive) energy products which must increase ....

China is now looking at more coal ....

https://www.bloomberg.com/news/articles/2018-09-24/china-is-adding-more…

https://oilprice.com/Energy/Energy-General/The-Inevitable-Oil-Supply-Cr…

"There is no interest rate that will work anymore. Too low and retirement and insurance plans fail; too high and consumers stop buying things on credit. It is just like the oil price problem. The Goldilocks zone is gone. The feds job of setting interest rates is just theater. I doubt there is any real growth left to support interest rates at all.

The financial markets seem more like money investing in money that money investing in real, tangible projects. I think I read that the derivatives market is now in the quadrillions of dollars. There aren’t enough real resources in the world to back these kind of promises. I don’t see how this doesn’t just explode soon.

"

In their election manifesto the Labour Party gave a sound economic policy to remove RUB from Auckland. This will reduce land costs and improve profitability for entire construction sector and increase employment and spark wage growth and reduce the housing shortage and end widespread land speculation. A clear as day good for business policy that they promised to deliver.

And here we are a year later, nothing. That policy appears to have been forgotten by the government, who are now having the taxpayer fund massively expensive housing.

It turns out that governing, actually doing stuff, is harder than mouthing off in opposition, especially when you have no experience + loopy coalition partners to appease. I would rather have an all-labour govt than the mess that is this coalition

Overlaying the median New Zealand house price growth charts and the NZIER survey chart appear at a glance very similar over the past decade.

But but but, my baby is so cute! And my boyfriend is such a good daddy! And we're having a wonderful time doing the rounds of US tv shows, such fun! Who cares what all those sad sacks back home are doing. I didn't sign up for the top job so I could do actual work. I signed up to become a global media icon representing the hysterical left and making important changes like banning plastic bags and straws. That's all that is important, don't you know that?

So far, nobody has challenged Mr Hargreaves on his initial statement.

So I will.

Mr Hargreaves - what is it that makes you assume this is a 'wake-up' call for the Govt? I suggest it's a wake-up call for the media, especially the too-lazy-to-question media. The coming global downturn, which will happen soon enough in whatever stages (including collapse) is what is driving all fear, and has been since 2007-8. Govt's are powerless to do more than a little can-kicking to keep the corpse alive - with increasing degradation of the real world the results of doing so. There are the inevitable self-servers and hustlers here, but you in the media have to be - should be - above that?

Try asking how long 'economic growth' can be had on a finite planet. Then ask whether running into those limits might not cause a little downward trend in 'confidence'?

https://www.theguardian.com/commentisfree/2018/sep/26/economic-growth-f…

"I recognise that challenging our least contested ideologies – growth and consumerism – is a tough call. But in New Zealand, it is beginning to happen. Jacinda Ardern, the Labour prime minister, says: “It will no longer be good enough to say a policy is successful because it increases GDP if it also degrades the physical environment.” How this translates into policy, and whether her party will resolve its own contradictions, remains to be determined.

No politician can act without support. If we want political parties to address these issues, we too must start addressing them. We cannot rely on the media to do it for us".

Pity, that.....

It's a squeeze alright. It's been coming for a while but it's not far off now. Reselling debt is not the way to grow something, it's the way to save something from destruction. Yes, I hear you say, capitalism deserves destroying but even the communists are doing their own version of it now. And winning. Yes, i know we need to save the planet, and that's important, but if we don't win the next part then the planet won't be ours to save.

There's only one way to reset this grossly over-populated thing called Earth, one way that's quick & foolproof, and it's not pretty I'm afraid.

And please, don't go blaming the blokes. From what I'm seeing in America the women are as mean & nasty as the boys. And if Mr Han really gets going, they're going to have to be. We're outnumbered 3 to 1.

Things in the productive sector are not being helped by an oil price of US $85.00 a barrel

Wow the worst since 2009 ? So we are effectively in an unofficial GFC2 in New Zealand then ! This government is awesome - not.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.