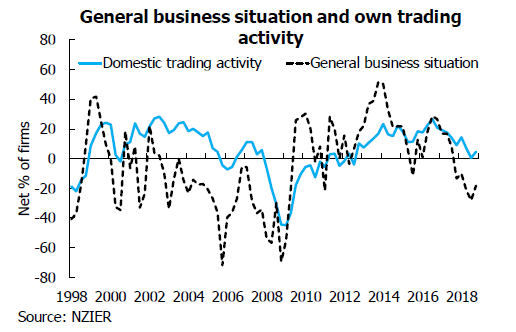

New Zealand businesses remained downbeat about the economy in the last three months of 2018, according to the New Zealand Institute of Economic Research’s (NZIER) latest Quarterly Survey of Business Opinion (QSBO).

A net 18% of businesses expected general economic conditions to worsen over coming months – an improvement from the net 28% that had a negative view in the previous quarter.

The NZIER says it’s a matter of businesses being “less gloomy” rather than “more happy”.

Looking at firms’ own trading activity – a better measure of economic growth – a net 4% reported an increase in demand in the December quarter.

While this was an improvement from the net 0.4% reporting higher demand in the previous three months, the September results were the worst since September 2012.

Cost pressures hamper profitability

The NZIER says businesses faced higher costs in the December quarter, but continued to struggle to pass these on to customers. This made them less profitable.

In fact, a net 22% of businesses (across most sectors) reported a deterioration in profitability.

A net 15% of businesses expected their profitability to decline in the next quarter – the weakest level since March 2011.

The NZIER says manufacturing remained the most downbeat sector.

Despite a pick-up in confidence and rebound in domestic and export sales, weak profitability continued to weigh on sentiment.

It was a similar story for the building sector, which was less profitable even though demand improved.

Firms looking to hire and invest

Nonetheless, the NZIER says improving demand made firms more optimistic about expanding.

There was a rebound in hiring in the December quarter. Firms’ hiring intentions for the next quarter also remained positive.

Businesses looked to increase new investment in plant and machinery over the coming year. However, they were more cautious when it came to new investment in buildings.

This caution was also reflected in architects’ expectations of commercial construction work over the coming year, with architects expecting no growth in this pipeline of construction work.

Economists divided over what will happen to interest rates

ANZ economists say the QSBO results are consistent with their view that the economy isn't performing well enough to achieve a "durable" lift in inflation.

They see the Reserve Bank cutting the Official Cash Rate (OCR) late this year to give the economy a pick-me-up.

They expect a further two cuts to bring the OCR down to 1.00% (from 1.75%) by next year, as reported in more detail here.

Kiwibank economists on the other hand believe the Reserve Bank will keep the OCR on hold this year, before gradually hiking in 2020.

They see rising cost pressures feeding in to underlying measures of inflation.

While they acknowledge an acceleration of growth is far from guaranteed this year (largely due to international factors, as well as banks in New Zealand likely being required to hold more capital), they say businesses have been expressing doom and gloom in protest to policy changes made by the new government.

“The lift in confidence suggests that firms have a little more certainty from government, with a number of policies now falling into place,” they say.

Westpac economists have stuck to their view that the RBNZ's next move will be to hike the OCR, but this won't happen for some time.

They say: "Today’s data, in conjunction with monthly surveys of business confidence, suggests business confidence has found a floor.

"And with our own projections for the NZ economy anticipating a modest pickup in growth from current levels over 2019, we expect the RBNZ’s concerns about the risks posed by very weak business confidence should continue to fade.

"That said, any hints of a further fall in confidence will see indicators such as the QSBO quickly making their way back up the RBNZ’s watch list."

According to ANZ's latest monthly Business Outlook Survey, business confidence rose by 13 points in December, but remained in the red with a net 24% of respondents reporting they expected general business conditions to deteriorate in the year ahead.

Meanwhile firms’ views of their own activity increased 6 points, with 14% expecting a lift.

NZIER quarterly survey of business opinion

Select chart tabs

35 Comments

NZ's economy will be just fine as long as she does not screw up economic relationship with China (a dangerous tendency for other five eye countries), and does not experience a bad drought nor a contagious disease for animals.

+10 social credit score for xingmowang.

If you have a chance, have a chat with people from dairy, red meat, forestry, tourism, sea food and etc sectors and see whether what I talked about making sense.

I agree we are very exposed to China

https://3.bp.blogspot.com/-v1zTAqcYGm8/W9EmVkj82lI/AAAAAAAAC4c/OjvHE8-K…

You will probably enjoy a short visit to

tradeintelligence.mbie.govt.nz

Go to Market Intelligence tab --> type China --> click on Build Report

Try reading Brady’s “Magic Weapons: China’s influence ...”

https://www.nzherald.co.nz/lifestyle/news/article.cfm?c_id=6&objectid=1…

Thanks for the link. I was surprised how balanced our trade is. Currently I am about to make many purchases: washing machine, TV, car, food, clothing and all could be from China or other countries. I cannot see how we are tied to China anymore than I am tied to Countdown where I do most of our grocery shopping - if Countdown closed down tomorrow we would go elsewhere.

The link for exports is more important - as Germany and France may discover if they lose UK as a market. We are not like Australia with its coal and iron ore. China buys plenty from us but it is milk powder, logs and tourism - which can be sold elsewhere if necessary maybe at a minor loss of profit.

I think quite the opposite, most of our trading partners trade heavily with china so by proxy we are quite concentrated and vulnerable to market downturn. Its as if we are back in the 60's and have replaced G Britain with China...look how that worked out a few years later.

Well we certainly depend on a healthy world market. If that crashes as per 1929 then it will be poverty and unemployment for NZ - but at least we can feed ourselves.

And China is the single most significant economic force in the world. But if China raised a bamboo curtain (unlikely) then we are no more at specific risk than any other small country (say Costs Rica or Slovenia or Iceland). Just because a big chunk of our trade is with China shouldn't cause us to panic.

xingmowang,

What you really mean is thNZ will be fine as long as we do nothing to upset our economic overlords.

I have some sympathy with whoever is in power in NZ,trying to maintain a balance between 2 superpowers;the US and China. We need one for our economy and the other for our defence. We remain very much a Western country by heritage and outlook,but geographically,we are a Pacific country and within the Asian economic orbit.

Beijing is actually closer to Europe than it is to us.

You thoughts are shared widely in NZ.

Let me ask you a question please.

Please just name only one thing/action that if NZ does would upset China and create real benefit to NZ at the same time.

NZ could criticise China's arbitrary detention of Canadian citizens. It would upset China but by joining most OECD countries it would help China realise the rule of law is important (the kind of unbiased arbitration that successful Chinese emperors used as governance of their provinces). A China that has sufficient confidence in itself to abandon arbitrary authoritarian actions would help the world economy and of course that would help both China and NZ. Our current inaction is kowtowing and in the long run does NZ little good.

The "Rule of law" in the western system has recently become a laughing stock especially since the illegal abduction of Huawei's CFO Meng Wan Zhou by the Canadian government.

Western rule of law is very flawed, but China does not have one. It's an authoritarian communist one party state that lacks an independent judiciary.

I don't think it is unreasonable to not trust a Chinese technology company. Given all the micro spying chips the Americans have found all over their server infrastructure recently.

That's fine it's what the big guys do right America and Russia and Germany are all no better. But it is ridiculous for China to be precious about it, it's the pointless childish posturing of a wannabe bully.

The toughest challenge facing China isn't a trade conflict or any other kind of outside enemy, it is a moral crisis from within...

Video by Serpentza, good.

There is a Huge MORAL CRISIS in China

https://www.youtube.com/watch?v=FfLnFVzfKBs

How is it that hundreds of thousands of Uighur people are not even the equivalent of one well-connected Meng Wan Zhou?

Was she not arrested under suspicion of fraud? I’m pretty sure that’s a nono irrespective of country of origin.....

Do you reckon if it were appropriate for a NZer being arrested by the Chinese government for violating North Korea law in New Zealand?

If your answer is no.

Then, why do you think it is appropriate for a Chinese being arrested by the Canadian government for violating the USA law (that is even very arguable!) in China?

Unfortunately the US claim extra territorial justification. If she was not aware of that more fool her. Even more fool her was to transit a country that has an extradition treaty with the US.

Your argument fails on the assumption of what is morally right and fair - life sucks. The only thing in her favour is that she is dealing with the Canadian judicial system which I believe is eminently fairer that the US or Chinese judicial system .

I heard she was on bail. If her arrest was illegal she will be able to put her case in public and win massive compensation. Can the Canadians who have been arrested in China say the same?

The rule of law in western countries has plenty of room for improvement. For example there are too many delays. It comes down to a simple matter of trust - as a foreigner I would consider running a business in Australia or UK or Canada; in France or USA I would do so once I had found some really able lawyers but in China or PNG or Russia I would need to go into partnership with a local who I can trust who has all the right connections and even then a sudden change of leader can destroy the value of your trusted contact.

- Cutting immigration

- Cracking down on illegal Chinese businesses

- Limiting the amount of foreign students

- Strict english language requirements for university

- Preventing chinese from owning land - a reciprocal law as we cannot own land in the PRC

Okay okay!!!! We get it!!! You're Chinese.

Xing, try failing to support China's unilateral annexation and militarisation of the South China sea, ignoring all the countries who also live on its edge, claims over it.

Everything I have been reading would pick that the Chinese economy is not in good shape at all. Based on that being the case, irrespective of our actions, we could be in the shizenhousen export wise unless we can magically find other markets.

I expect Trump will relieve pressure once they are a little more compliant.

If you have been following the pundits here on interest.co.nz for the past 9 years you will be aware that China has been designated a cot case for all that time - yet it keeps trucking along

The huge problems facing Chinese Govt:

https://www.theepochtimes.com/top-10-challenges-communist-china-will-fa…

Sheep, dairy, deer, arable farmers are doing OK, so they will be spending. Horticulture and wine industry seem to be doing ok so spending will continue in that industry. Plenty of tourists floating around spending. Plenty of debt to pay down out there though but I think the main economy will tick over with out any major disruptions, at least in the near future.

Cuts to OCR = cheaper mortgage rate. Even if prices do not go down I will win by waiting and saving and having a lower interest rate.

You asume that

a) it will get passed on.

b) it won't cause prices to rise further.

Neither is certain.

C) that depositors will be happy to see their rates reduced as well. A reducing OCR doesn’t increase a bank’s net interest margin spread.

We are most likely already in recession and just haven't figured it out yet.

There are a lot of comments on here about how agriculture is doing well so that will carry things on. Agriculture doesn't employ many people, so I don't see how it really matters much, except for the balance of trade. Most people in this country live in 5 cities. I live in the biggest one and I see very little evidence of deer farming expenditure here. The streets here are not running with cashed up farmers going out to dinner, the theatre, cafes, boutique supermarkets and buying up big screen TVs, the latest iphone while driving around in ubers. Like all of us they are mostly up to their eyeballs in debt.

It doesn't look like they aren't buying enough over priced houses either. At least in Auckland.

This is why business confidence is low. People have spent too much on their overpriced homes, and aren't out spending in the shops. It has reached a tipping point and consumption has fallen. Businesses feel this and they aren't optimistic. Even extending and pretending can't get the average person enough credit to buy a one million dollar rat hole.

Based on the extent and duration of the bubble it is easy to see houses as anything from 40-50% overvalued and as mean reversion always over shoots a 50-60% fall in house prices still seems reasonable to me.

Bank lending to farms has ground to a halt, what do the banks know that we don't?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.