Quantitative easing

Nouriel Roubini and Stephen Miran see a debt-issuance strategy at the US Treasury that is working at cross-purposes with the American central bank

25th Aug 24, 2:31pm

1

Nouriel Roubini and Stephen Miran see a debt-issuance strategy at the US Treasury that is working at cross-purposes with the American central bank

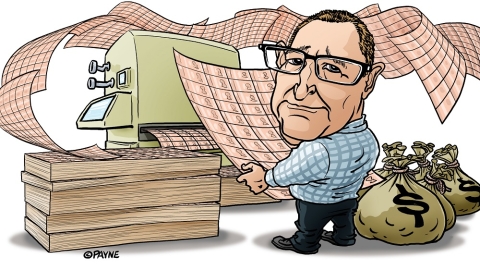

Chris Leitch argues the RBNZ's $53 billion government bond buying programme has proven to be nonsensical madness favouring commercial banks over taxpayers

8th Mar 22, 11:25am

20

Chris Leitch argues the RBNZ's $53 billion government bond buying programme has proven to be nonsensical madness favouring commercial banks over taxpayers

British evaluation of central bank quantitative easing says it's now a core part of monetary policy, meaning public trust in and understanding of QE is important

21st Jan 21, 5:00am

56

British evaluation of central bank quantitative easing says it's now a core part of monetary policy, meaning public trust in and understanding of QE is important

Reducing house-price inflation depends on identifying the drivers. Right now, that means interest rate policy and quantitative easing must change. Everything else is band-aid as the fireball grows

26th Dec 20, 6:02am

128

Reducing house-price inflation depends on identifying the drivers. Right now, that means interest rate policy and quantitative easing must change. Everything else is band-aid as the fireball grows

The Reserve Bank drives economic policy with officials, rather than elected Government, in the driver’s seat. But the Reserve Bank mandate provided by the Government is where it all starts

3rd Nov 20, 7:37am

87

The Reserve Bank drives economic policy with officials, rather than elected Government, in the driver’s seat. But the Reserve Bank mandate provided by the Government is where it all starts

Quantitative easing is surely driving down interest rates and in time will most likely lead to inflation. Whether it will stimulate the economy is much more problematic

25th Jul 20, 9:35am

114

Quantitative easing is surely driving down interest rates and in time will most likely lead to inflation. Whether it will stimulate the economy is much more problematic

The flooding of capital markets with massive new money from the RBNZ's quantitative easing program calls for a fuller debate of what the central bank and the Minister of Finance are trying to achieve, says Keith Woodford

21st Jun 20, 6:02am

130

The flooding of capital markets with massive new money from the RBNZ's quantitative easing program calls for a fuller debate of what the central bank and the Minister of Finance are trying to achieve, says Keith Woodford

Koichi Hamada predicts that economies like Japan will have little choice but to pursue post-pandemic monetary expansion

9th May 20, 10:42am

5

Koichi Hamada predicts that economies like Japan will have little choice but to pursue post-pandemic monetary expansion

Economist Brian Easton points out that a fiscal deficit creates a liability for the government. Somewhere outside government in the private sector there is a private asset matching this public liability

3rd May 20, 9:21am

36

Economist Brian Easton points out that a fiscal deficit creates a liability for the government. Somewhere outside government in the private sector there is a private asset matching this public liability

RBNZ to buy more government bonds, as well as corporate and asset-based securities to support liquidity in the corporate sector

30th Mar 20, 8:35am

28

RBNZ to buy more government bonds, as well as corporate and asset-based securities to support liquidity in the corporate sector

Raf Manji urges the RBNZ not to make the mistake of previous overseas QE programmes by focusing entirely on supporting the financial markets

23rd Mar 20, 12:19pm

16

Raf Manji urges the RBNZ not to make the mistake of previous overseas QE programmes by focusing entirely on supporting the financial markets

The RBNZ will buy up to $30 bln of Government bonds as the negative impacts of the emergency intensify in New Zealand and financial conditions tighten 'unnecessarily'

23rd Mar 20, 8:23am

96

The RBNZ will buy up to $30 bln of Government bonds as the negative impacts of the emergency intensify in New Zealand and financial conditions tighten 'unnecessarily'

David Hargreaves takes liberties with metaphors as he ponders the uphill task RBNZ Governor Adrian Orr has as he tries to get New Zealand spending and investing

1st Sep 19, 6:02am

98

David Hargreaves takes liberties with metaphors as he ponders the uphill task RBNZ Governor Adrian Orr has as he tries to get New Zealand spending and investing

Reserve Bank Governor Adrian Orr puts in a plug for the Government and businesses to invest more to take advantage of low global interest rates

28th Aug 19, 12:16pm

42

Reserve Bank Governor Adrian Orr puts in a plug for the Government and businesses to invest more to take advantage of low global interest rates

Lobbyist and think tank the NZ Initiative is concerned the Reserve Bank's role could 'morph' once it starts using unconventional monetary policies and it might feel required to align itself with the Government's fiscal policy

14th Aug 19, 1:05pm

38

Lobbyist and think tank the NZ Initiative is concerned the Reserve Bank's role could 'morph' once it starts using unconventional monetary policies and it might feel required to align itself with the Government's fiscal policy