safety

Driver assist technology saves lives. Why do so many people turn it off?

The World Gold Council's John Reade looks at the three underlying reasons gold has shed almost -6% in July alone

16th Jul 22, 1:35pm

The World Gold Council's John Reade looks at the three underlying reasons gold has shed almost -6% in July alone

More investors bought gold than cryptos in 2021. We are in another sharp retreating phase for cryptos just as inflation jumps. Louise Street says gold is doing its job as a safe-haven, and exhibiting its inflation hedging qualities

28th May 22, 10:46am

11

More investors bought gold than cryptos in 2021. We are in another sharp retreating phase for cryptos just as inflation jumps. Louise Street says gold is doing its job as a safe-haven, and exhibiting its inflation hedging qualities

The World Gold Council's Louise Street wonders if we are about to see a return of the positive stock-bond relationship, arguably the most important input into asset allocation. When bonds aren't asymmetric, gold can provide the balance portfolios need

19th Mar 22, 9:48am

1

The World Gold Council's Louise Street wonders if we are about to see a return of the positive stock-bond relationship, arguably the most important input into asset allocation. When bonds aren't asymmetric, gold can provide the balance portfolios need

The World Gold Council's updated monitoring of central bank gold activity shows they sold more than they bought in January. Most activity is by the central banks of autocracies

6th Mar 22, 1:18pm

The World Gold Council's updated monitoring of central bank gold activity shows they sold more than they bought in January. Most activity is by the central banks of autocracies

What makes gold a strategic asset? It has diverse sources of demand: as an investment, a reserve asset, jewelry, and a technology component. It is highly liquid, no one’s liability, carries no credit risk, and is scarce, historically preserving its value

24th Jan 22, 9:30am

18

What makes gold a strategic asset? It has diverse sources of demand: as an investment, a reserve asset, jewelry, and a technology component. It is highly liquid, no one’s liability, carries no credit risk, and is scarce, historically preserving its value

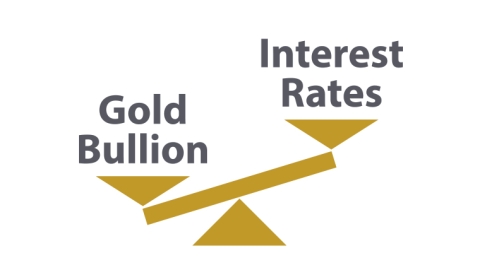

Despite coming rates hikes, real rates remain low. Rate hikes can create headwinds for gold, but history shows the impact is limited. High inflation and market pullbacks will sustain demand. Jewellery and central banks will give longer-term support

15th Jan 22, 1:41pm

8

Despite coming rates hikes, real rates remain low. Rate hikes can create headwinds for gold, but history shows the impact is limited. High inflation and market pullbacks will sustain demand. Jewellery and central banks will give longer-term support

A bright start, flat middle, and weak ending sums up a lacklustre quarter for the gold price in Q3-2021 as gold demand falls away

30th Oct 21, 10:13am

2

A bright start, flat middle, and weak ending sums up a lacklustre quarter for the gold price in Q3-2021 as gold demand falls away

Analysis by the World Gold Council finds that adding gold to an Australian superannuation portfolio will give downside protection, generate returns and protect against inflation

24th Oct 21, 12:38pm

2

Analysis by the World Gold Council finds that adding gold to an Australian superannuation portfolio will give downside protection, generate returns and protect against inflation

Even mild stagflation can damage asset values and investors should be wary, even gold investors, warns the World Gold Council

16th Oct 21, 12:15pm

6

Even mild stagflation can damage asset values and investors should be wary, even gold investors, warns the World Gold Council

The World Gold Council examines how gold reacts in a rising interest rate market and what could be in store this time

9th Oct 21, 9:52am

1

The World Gold Council examines how gold reacts in a rising interest rate market and what could be in store this time

Adan Perlaky sees lower rates and yields driving increased portfolio leverage, with the spread between junk bonds and risk-free assets back as low as just before the GFC

25th Sep 21, 10:46am

7

Adan Perlaky sees lower rates and yields driving increased portfolio leverage, with the spread between junk bonds and risk-free assets back as low as just before the GFC

The World Gold Council reports that a strong consumer demand recovery and Q2 gold ETF inflows were not enough to offset heavy Q1 outflows

31st Jul 21, 1:39pm

9

The World Gold Council reports that a strong consumer demand recovery and Q2 gold ETF inflows were not enough to offset heavy Q1 outflows

Adam Perlaky says the long-term strategic rationale for a gold allocation remains. Inflation expectations remain higher, which has historically been good for gold

26th Jun 21, 9:46am

2

Adam Perlaky says the long-term strategic rationale for a gold allocation remains. Inflation expectations remain higher, which has historically been good for gold

Gold has had one of the most stable volatility profiles during and post the pandemic and the current gold derivatives market provides opportunities for gold exposure independent of an investor’s bullish or bearish stance

6th Jun 21, 12:35pm

6

Gold has had one of the most stable volatility profiles during and post the pandemic and the current gold derivatives market provides opportunities for gold exposure independent of an investor’s bullish or bearish stance