We've got a lot less keen on using it - but yet more of us are hoarding it. Cash, that is.

The Reserve Bank (RBNZ) has just released the results of its 2021 Cash Use Survey

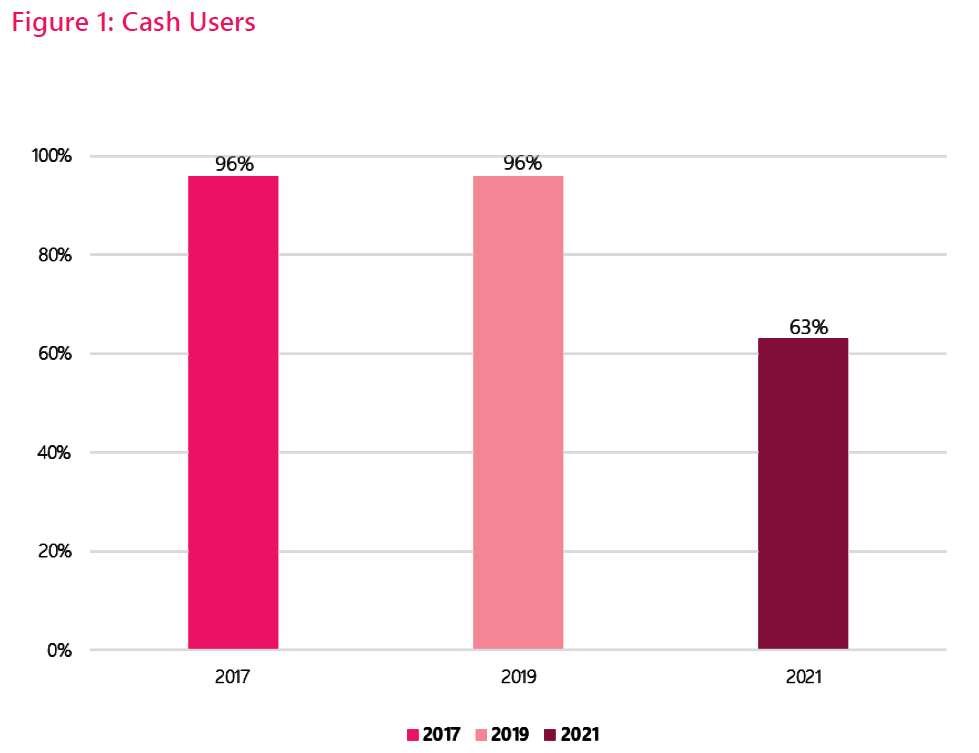

It shows that while nearly all of us were using cash in 2019, now it's just about two-thirds of us.

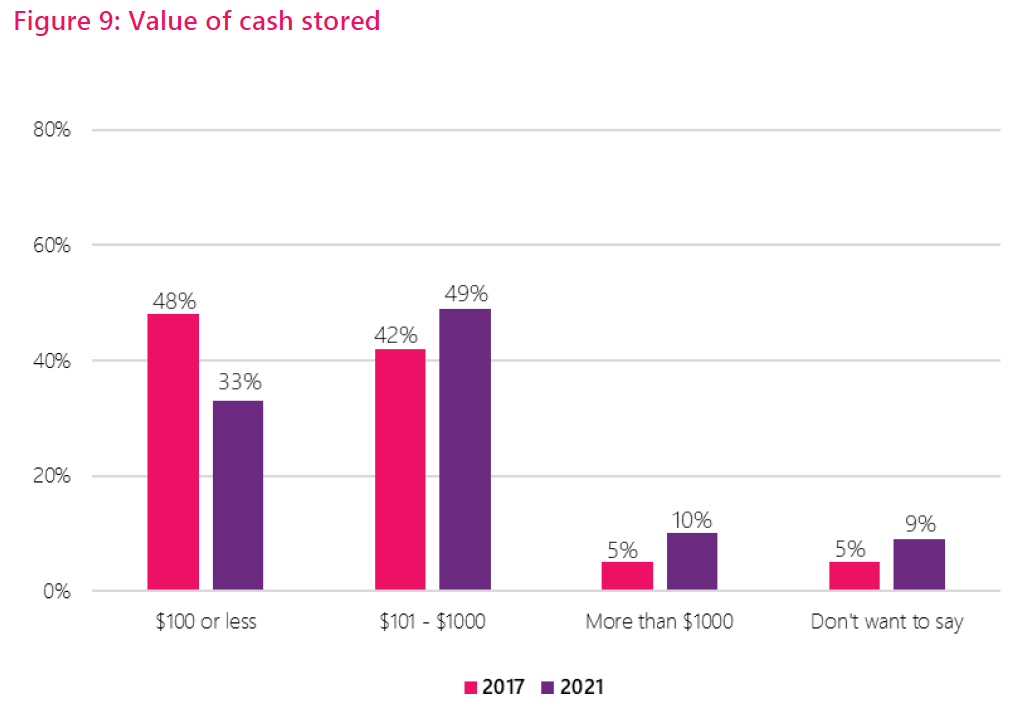

However, the proportion of us that have some cash stashed away has increased markedly, from 37% in 2017 to 46% in 2021.

The latest survey follows similar surveys conducted in 2017 and 2019. It's the first one since the start of the pandemic in 2020 and while there are lockdown specific questions in the survey, it doesn't seem to address the question directly of how many people might have permanently changed their cash usage patterns since the pandemic started.

(I say this because I, for one, DID change completely as of March 2020 from always having cash in my wallet and frequently using cash to never having or using cash. In response to a query with them, the RBNZ pointed out to me this work they published in 2021, which does indeed reflect a strong impact from the pandemic in terms of fewer people using cash)

RBNZ head of money and cash Ian Woolford says the drop in usage of cash was from 96% (that's people using cash at least sometimes) in 2019 to just 63% in 2021.

He said the proportion of Kiwis who appear to "rely" on cash remains steady at about 6%.

He says as with previous surveys the latest one shows that cash users are more likely to be older, poorer, living rurally, or Māori.

"Meanwhile, it is clear that having some cash stored away is increasingly important for many of us during times of uncertainty with the percentage of us doing so rising from 37% to 46% from 2017 to 2021," Woolford says.

According to RBNZ figures, there was about $8.9 billion of cash in circulation as at January 2022, compared with only about $7.3 billion of cash in circulation as of January 2020. And this is despite the drop off in the usage of cash since then.

The survey found that about a third of the people who never used cash had some cash stored. It also found that the amounts being stored had increased.

‘Access to money quickly’ and ‘emergencies’ were selected by 60% of respondents as reasons for storing cash. A similar category ‘I feel better for the unknown’ was the third most popular, selected by 41%. Saving for unplanned spending (28%) and saving for specific events (22%) were the fourth and fifth options respectively most. Keeping savings private and lack of trust in government were each reasons selected by around 5% of cash users.

"Our latest survey suggests cash users are finding it more difficult to find places to deposit cash, while ATMs and supermarkets are the main source of withdrawals," Woolford says.

"Having cash available, accepted in store, and readily deposited are key to both well-functioning local economies and communities where everyone is included. Closing bank branches, fewer ATMs, and reduced or removed cash services offered by banks contribute to falling use and difficulties."

The RBNZ is currently consulting on ways to improve the cash system and support cash use and acceptance.

"We encourage people to review our Cash System Redesign consultation paper, and will welcome all points of view. The consultation paper was published last November and closes for submissions next Monday, 7 March 2022,” Woolford says.

The Cash Use Survey 2021 was completed using a 'mixed method' approach, with respondents provided with the options of completing the survey online or on paper. The survey was live from 16 August to 24 October 2021, during which time completed questionnaires were received from 3107 respondents.

20 Comments

I always found having your weekly discretionary spending in cash was a good way to make sure you did'nt over spend. Once it was gone, it was gone, Paywave is a curse for many who do not have the discipline in sticking to a budget.

I was cashless for years until I had young kids. They still need cash for all sorts of things.

- Tangible pocket money

- Tooth Fairy

- School lunches

- Gold coin fundraisers

- Lollies/ice cream from the dairy

While the amounts weren't huge, it became quite the task to ensure we had enough low denomination currency in the house.

Personally I find cash in the wallet is hopeless, you have no record of where it went. I use a credit card primarily for everything and its paid off in full every month and you get free stuff with the points. Perhaps it requires the maximum amount of discipline but its the way to go. Contactless Paywave is the way to go but not everyone has it.

Cash is great when you want to be discreet, like a surprise present for the wife. Probably simpler for the black market too. Normally though, I use airpoints visa for as much as possible, especially business expenses if I can. It adds up over time and they don't expire. It's a lot better now than it used to be, but there are still a few places that still don't take credit.

Diversity in all things, is a good thing

I understand that aspect of tracking.

BUT what do you do when the power goes out and you've run out of beer? Even unchilled beer is better than no beer in a natural disaster

At almost 77,I come from a generation that used cash regularly, but like David, that stopped abruptly in March '20. I now use Paywave wherever possible, but right now we have taken cash out in case we both have to isolate and need help from friends to get food.

If we don't use it, I imagine much of it will go to the grandchildren.

Yes I'm in my 70s. My advice is not to stash cash around the house in too many secret places in case you get alzheimers.

RBNZ don't need to worry. The cash is being used. Just not via official channels.

With all the AML precautions around crypto isn't much use in ol' EnZed, as it can never be cashed in and is way to volatile for a lot of the goods and services to realistically utilise.

Keep the cash under the bed. WW!!!

Already swift being blocked, so i think this is just a start.. More to come?

The magic shoebox of cash. Safe from any wobble in the banking system. Perhaps this will be popular again as the banks continue to close branches and rip out ATMs.

Are IRD going to be relaunching their dob in a cash tradie campaign again?

I still like having cash on me. I find it easier to budget and am amazed at how many times I go into a shop to find their machines are down - cash to the rescue.

Electronic payment infrastructure just isn't quite resilient enough to fully replace cash yet. Recall Kiwibank had weeks of issues last year for example. The major issue with cash now is that large denomination notes are near unusable, still...maybe inflation will make Rutherford popular again in coffee shops.

I often get mocked as an old man because I use cash for things such as groceries to stay on budget, I’m 48 years old! Funny thing is I am mortgage free and all that mock me have mortgages >700k with rising interest rates. I’m happy with old.

To be useful to the system, you must have debt.

In that case I have been useless for years now. Somehow it feels a lot better being useless tho.

Old and useless, even better.

Maybe people would feel more comfortable depositing cash if they wern't grilled about where they got it and the respective limits were lifted at least in line with inflation.

For example, back in 1970 when the Currency Transaciton Reporting was introduced in USA, the $10,000 limit at the time now equates to $72,460. And yet they are now trying to lower that limit ot $600!!!!!!!!!

Talk about overbearing controll much.

And NZ is heading down that path at an alarming rate.

More than one shop around here refused to take cash during the pandemic.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.