By Roger J Kerr

The NZD/USD exchange rate hit a low of 0.6875 last Christmas Eve, 24th December 2016 and bounced right back up again to above 0.7300 in early February.

Last Friday the Kiwi was sold off to a low of 0.6893 and appears to have run into major resistance from going lower and trades back up to 0.6930.

The rapid decline from above 0.72000 to below 0.6900 over this past week has not been due to a stronger US dollar, more a case of independent NZ selling on lower dairy prices. In my view, the Kiwi dollar selling interest is all but exhausted for the meantime.

The punters who wanted to downsize long NZD positions based on the falling dairy commodity prices have now done so.

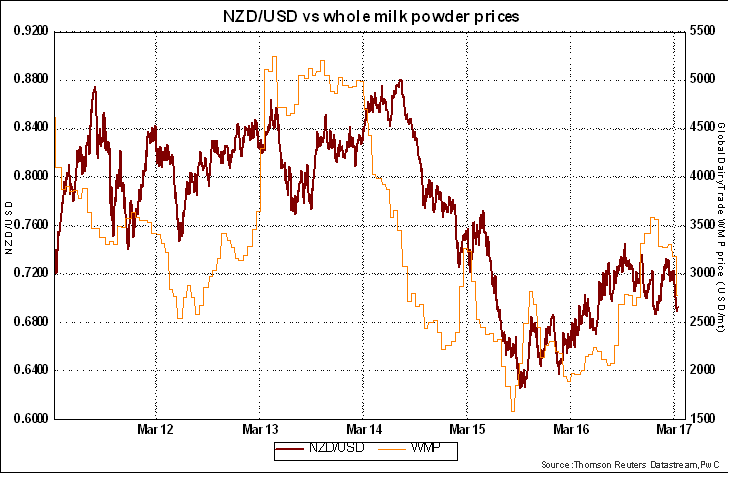

The sharp pull back in whole milk powder (WMP) prices over the last six weeks from US$3,500/MT to US$2,600/MT appears to have also run its course as the price has now adjusted to the lower Chinese demand and higher than expected supply volumes at the end of the season.

A stabilisation in WMP prices around US$2,600/US$2800/MT should see the Kiwi dollar settling down in the 0.6900/0.7000 region.

The overall correlation between the NZD/USD exchange rate and the WMP price remains strong despite some periods of divergence over the last two years.

The two prices are now back in general alignment. It would require another major sell-off in WMP to well below US$2,500/MT to drag the Kiwi dollar down to the 0.6600/0.6700 area.

That does not look likely given the now more evenly balanced demand/supply equation in the dairy commodity market.

In New Zealand the dairy market now moves into the lower volume off season until August/September, so major price changes over coming months are unlikely.

A strong December quarter GDP growth number (greater than +0.7% consensus forecasts) on Thursday this week should add to the Kiwi dollar bounce upwards from 0.6900.

Whether the weakening Kiwi dollar (on an overall TWI Basis) over recent weeks has been partly due to the potential protectionist trade policies of the US Trump administration is a moot point?

There is still no detail on exactly what the US will do on this front, however stating that they will not be bound by the rulings of the World Trade Organisation (WTO) on trade matters is an ominous sign.

Any increase in US tariffs/border taxes is not good news for an economy like New Zealand’s as we are so dependent on export and market access.

The risks facing us are not just increased costs into the US export market, but potential retaliatory trade barriers from China and Asian countries.

New Zealand will suffer from the cross-fire in such global trade wars. If the US/China relationship did develop into a full-scale trade war it would be very negative for our economy.

However, the automatic shock-absorber responsiveness that a free-floating exchange rate provides you would compensate our exporters for the additional cost of getting their goods into export markets i.e. the Kiwi dollar would depreciate due to the negative economic impact and thus allow our exporters to maintain their price competitiveness in foreign currency terms.

Last June with the Brexit vote in the UK all the pundits expected to UK economy to go into recession as a result.

That did not happen as the Pound’s exchange rate immediately collapsed 30% and subsequent strong UK export performance prevented a substantial economic downturn.

The automatic shock-absorber of a free-floating exchange rate worked very well. The same adjustment would happen in New Zealand’s case.

However, let us hope that the Trump trade gurus see sense and they backtrack on 40% import tariff ideas.

Email:

Daily exchange rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.