New Zealand's unemployment rate might have hit its highest level in over eight years in the March quarter.

We'll find out if it did in the coming week when Statistics NZ releases its suite of labour market figures on Wednesday, May 7.

What we will hopefully also find out is whether there are signs from the data that we are now at, or at least close to, the peak of unemployment.

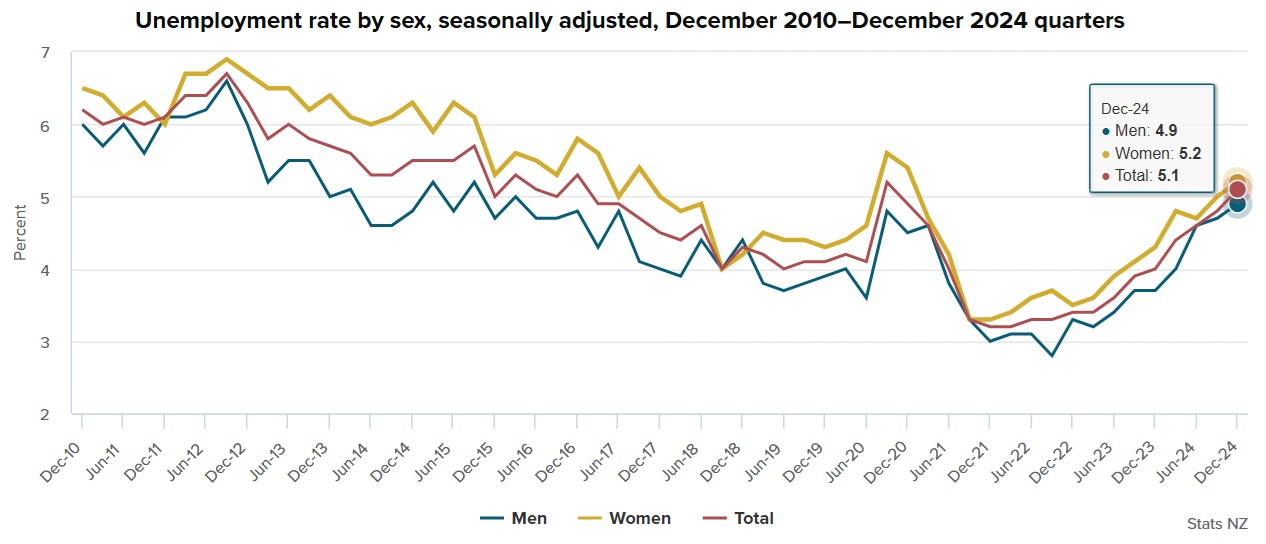

As of the December 2024 quarter our unemployment rate was at 5.1%, having risen from 4.0% at the start of the year and a cycle low point of 3.2% in March 2022.

The rise since the early months of 2022 has come in the wake of the interest rate rises prompted by the Reserve Bank (RBNZ) as it hiked the Official Cash Rate from 0.25% in October 2021 to a peak of 5.5% by mid-2023 in response to an annual inflation rate that hit a high of 7.3% in mid-2022.

With the OCR having now been dropped to 3.5% since August last year, and inflation now sitting in the RBNZ's target zone of 1% to 3% (the rate was 2.5% as of the March quarter), the economy is starting to (slowly) perk up again.

But as economists always point out, unemployment is a 'lagging' indicator that tends to start rising late in the economic cycle and then start dropping as the next one is already under way.

Hence the expectation that the unemployment rate probably lifted again during the March quarter.

During the pandemic disruptions in 2020 our unemployment briefly spiked to 5.2% (in the September quarter of that year) before dropping quickly as a combination of a quickly recovering economy and closed borders put a squeeze on the labour market.

In its most recent set of forecasts (in the February Monetary Policy Statement) the RBNZ picked that the unemployment rate would reach 5.2% for the March 2025 quarter and that would be the peak. It's forecasting only a gradual recovery, however, and still sees the unemployment rate being 4.9% at the end of this year and 4.5% at the end of 2026.

Other economists, who have had the benefit of seeing later data than the RBNZ was looking at when it made that February forecast, are saying the unemployment rate could have hit 5.3% in the March 2025 quarter.

If so, that would be the highest seen in this country since the December 2016 quarter.

Here's a Stats NZ graph that highlights where we've been in recent years and where we are at the moment:

At time of writing the most recent data available from Stats NZ on employment was the Monthly Employment Indicators (MEI) for March, which showed that in the month there was a 0.2% rise in filled jobs. That followed a flat February result and a 0.1% rise in January.

Those figures aren't scintillating by any stretch, but they are better than we were seeing last year when at one point the MEI recorded seven consecutive falls in filled jobs.

The source of the MEI, which comes from IRD data, is quite different to the unemployment figures, which come from Stats NZ's Household Labour Force Survey.

Nevertheless, the MEI figures have tended to be a good pointer toward the likely future direction of the unemployment figures. And the latest MEI figures therefore suggest that a peak to the unemployment rate may not be far away.

Not growing fast enough

Westpac senior economist Michael Gordon, who's forecasting a 5.3% unemployment figure for the March quarter, said in his preview of the labour market figures that while the number of jobs appears to have stabilised in recent months, they’re not growing fast enough to meet population growth.

"We expect it will be later into the year before we see jobs growing fast enough to absorb the growth in the labour force, which means that the unemployment rate probably hasn’t peaked just yet."

Commenting on the RBNZ's pick of a smaller rise in unemployment to 5.2%, Gordon said he suspected the RBNZ was overestimating how quickly the labour market will respond to the broader upturn in the economy.

"...Typically it’s one of the more lagging aspects of the cycle. That said, if next week’s results are more in line with our forecasts, we don’t think they would have a great deal of influence on the RBNZ’s thinking. We expect another 25bps [basis points] cut in the OCR at the May 28 policy review."

ANZ senior economist Miles Workman, who also forecasts a 5.3% unemployment rate, notes in his preview of the results that other than Budget 2025 (out on May 22), the labour market release is the last major piece of domestic data ahead of the RBNZ's May 28 Monetary Policy Statement.

'Could end up playing second fiddle'

"However, given how much turbulent water has flowed under the global economic bridge since [the first quarter of the year] came to an end, it’s fair to say that the signal on the labour market’s trajectory could end up playing second fiddle to changes in the RBNZ’s outlook if they choose to centralise some of the possible impacts of the global trade and confidence shock coming from US tariff policy.

"That’s not to say the starting point won’t matter. Rather, we’d just highlight that a positive surprise on the day (eg a tighter labour market than expected) may be more than offset by a more pessimistic growth outlook, while a negative surprise could instil a greater sense of urgency to lean against US-induced economic headwinds."

ASB senior economist Mark Smith, who is forecasting a 5.2% unemployment figure, said in his preview that he expects the labour market will remain soft for much of 2025.

"Overall employment levels are expected to remain flat until an economic recovery unfolds later this year. Firms are likely to remain somewhat hesitant to take on new staff given the unsettled and uncertain economic outlook. Low growth in the working age population and a likely discouraged worker effect should keep labour force growth low, which will dampen the unemployment rate. The peak unemployment rate – in the low 5’s – is expected to be historically low, but there are a number of moving parts to this," he said.

Labour cost growth to slow

Smith said labour cost growth is also expected to slow as inflation cools and as firms seek to contain the wage bill. More moderate 2025 increases in the minimum wage (just +1.5% from April) and sub 3% inflation should see private sector labour cost growth approach 2% by the end of 2025, consistent with core inflation settling close to the 1%-3% target midpoint.

"With inflation comfortably within the 1-3% target band and with monetary conditions still restrictive, the weak economic backdrop necessitates further OCR cuts. We envisage an additional 75bps of OCR cuts over 2025 as the RBNZ pivots from acting to slow the economy to supporting it. Given concerns over inflation resurfacing we expect the RBNZ to proceed carefully, delivering cuts in 25bp increments (starting in May)," he said

"Developments in the labour market are pivotal for the medium-term inflation outlook and the RBNZ will want to see labour market conditions subsequently improve, with the unemployment rate needing to move into the 4%-4.5% Goldilocks zone. If not, more monetary policy support may be needed."

*This article was first published in our email for paying subscribers first thing Friday morning. See here for more details and how to subscribe.

3 Comments

Luxon and his team seem unable to stop the worsening economic conditions let alone engineer the recovery that they've been promising us for a while now. Their economic policies seem to be from an outdated playbook or they're just out of their depth.

Begs the question would Labour and the Greens be any better. My feeling is no.

They're either waiting to set themselves up for a second term and making big announcements before the next election, or they will simply keep up tottering along the recession and be voted out. Ridiculous considering if the former is their plan, they are purposefully witholding action to stabilise the country and unemployment in the name of currying political favour.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.