The Reserve Bank (RBNZ) is widely expected to deliver on another 'almost-promise' and lower the Official Cash Rate (OCR) again in the coming week.

At its last OCR review on July 9 the RBNZ took a pause from from six consecutive cuts since August 2024 that had taken the cash rate down from the cycle peak of 5.5% to the current 3.25%. However, the accompanying statement from the RBNZ's Monetary Policy Committee (MPC) made clear this was just a pause and not a stop.

The statement said this:

If medium-term inflation pressures continue to ease as projected, the Committee expects to lower the Official Cash Rate further.

In the raised eyebrow world of nuanced RBNZ-speak, the above phrase pretty much says: 'Next up comes another cut, if we don't get a nasty surprise in the meantime.'

So, here we go. That next review is upon us and on Wednesday, August 20 we get to find out if the OCR will be dropped from the current 3.25% to 3.00%.

Very probably it will be. The markets will be surprised if it is not, which could send wholesale interest rates and the Kiwi dollar haywire. And it's unlikely the RBNZ will be wanting to create such ructions at the moment with our economy so delicately placed.

Aside from the very obvious focus on whether there will be a rate cut, the coming week's review will be of great interest because this one (as happens every second review) will be accompanied by a new Monetary Policy Statement (MPS) - the first since May. And it will contain all the commentary, charts and graphs and - vitally - new sets of forecasts.

As ever, the main magnetic feature in this MPS will be the RBNZ's new forecasts for the likely future level of the OCR.

The devilishly difficult detail

I've not really gone into detail explaining these forecasts before, so, this time I will have a go. They are not as straight forward as you might imagine.

Because the forecasts are based on quarterly averages and the figures produced don't adhere to the reality that the RBNZ moves in 25-point lumps, these forecasts always leave a certain amount open to interpretation. That's why you can see different economists and indeed writers each putting a slightly different slant on where the OCR may end up. It's not just that some of us can't read figures.

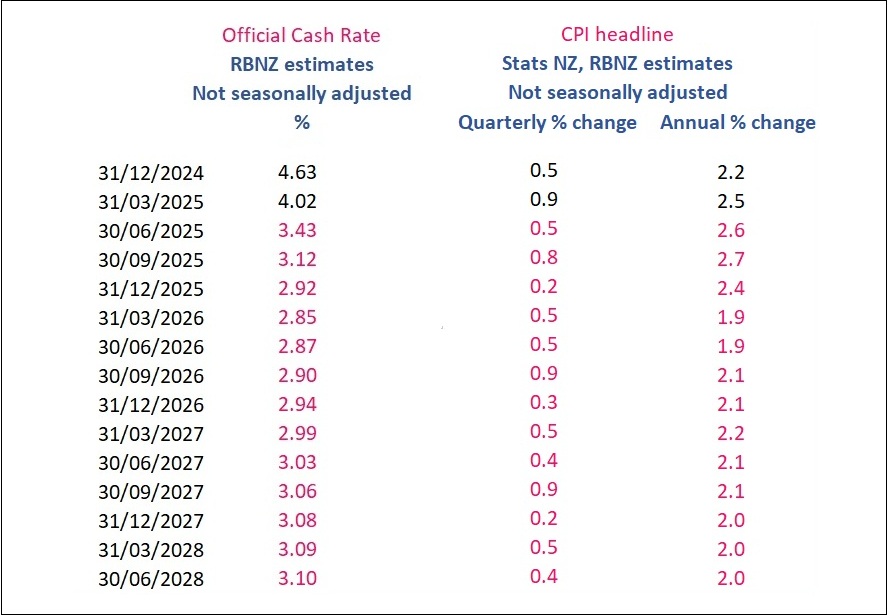

I include here the last forecasts for the OCR and the Consumers Price Index (CPI) headline inflation figures - both quarterly and annual. These figures are taken from the spreadsheet supplied by the RBNZ as part of the background material for the MPS, rather than from the MPS document itself, because these figures are not rounded and that actually makes quite a difference to how the OCR projection can be interpreted. Figures that are a projection appear in pink.

What we can see is that as per the May MPS the RBNZ was projecting a quarterly low point for the OCR of 2.85% in March 2026. Now, the OCR won't go to 2.85%. It will either be 3.00% or 2.75%. Since 2.85% is closer to 2.75% than 3.00% the RBNZ is ascribing a bigger possibility (a 60% chance) of the OCR ending up at 2.75% than 3.00%.

So, the big question on August 20, once we've found out whether the OCR has actually been cut or not, is whether the odds have changed of a further cut or cuts. And also whether the timing has changed - particularly whether any cuts might be sooner than was earlier forecast.

What might we expect in the new forecasts?

Well, the expectation will be for a lower 'terminal' OCR figure and yes, probably also for the timing of this to be brought forward. The markets will be surprised if the RBNZ doesn't forecast a lower OCR this time around.

But the RBNZ will also be conscious of not letting the markets run away with things. At time of writing (and this changes daily) the wholesale interest rate markets were pricing a low point for the OCR of 2.72% in May of next year.

If therefore the RBNZ were to, for example, show a low point in its new projections of 2.70% by the end of this year, the markets would start seeing it as a near certainty that there would be another OCR cut in October (to 2.75%). The markets would likely respond to this by then assessing a greater chance of a further cut or cuts beyond that one and therefore repricing the OCR down again to closer to 2.50% or maybe even below that. That means lower wholesale rates and these lower rates may then feed into further mortgage reductions.

So, the RBNZ effectively has to decide whether it's comfortable with the idea of the markets pricing in future OCR cuts or whether it wants leave its options totally open.

But maybe we are putting the cart before the horse. Why in any case should we be talking about more cuts in future?

Okay, well, there's the two conflicting forces at play at the moment. There's inflation on the one hand and then on the other there's an economy that's supposed to be recovering, but appears to have not yet taken that message on board.

Priority number one for the RBNZ will always be inflation. It is charged with achieving inflation within 1% and 3% and specifically it targets 2%.

Inflation has started moving up again. The RBNZ forecast (as you can see at right on the table above) that the annual rate would move up to 2.6% in the June quarter from 2.5%.

However, after making those forecasts the RBNZ was the recipient of a lot more high frequency data that suggested inflation really was on the move. And it said this on the subject in its July OCR review:

Annual consumers price inflation will likely increase towards the top of the Monetary Policy Committee’s 1 to 3 percent target band over mid-2025. However, with spare productive capacity in the economy and declining domestic inflation pressures, headline inflation is expected to remain in the band and return to around 2 percent by early 2026.

Now, the message I take from that is that the RBNZ was pretty much conceding its 2.6% inflation pick for the June quarter was a bust and it was expecting a figure maybe significantly higher (say 2.8% or 2.9%).

However, when the June quarter figures duly appeared on July 21 they were softer than virtually everybody expected. And the 2.7% rate was not so far from what the RBNZ had picked back in May.

Yes, the inflation figure probably will go higher. There's more mileage seen yet in the spike in food prices for example. But the RBNZ doesn't look likely to be surprised from here by any developments on the inflation front. And it expects the spike will be short-run, and it expects the impact of tariffs to be ultimately deflationary.

Conflicting forces at work

Okay, so, if we decide inflation won't be too much of an ongoing problem, does that just mean the OCR should just be left where it is?

Well, that's where the other 'conflicting' force comes in. The economy appears to have had another setback in the June quarter (we won't see GDP figures for the quarter till next month). And we, the public, do appear to be quite grumpy. And this is not conducive to us all rushing out and spending up large and boosting the economy.

Apart from the June quarter inflation figures, the other major data release since the last OCR decision on July 9 was the unemployment figures out on August 6, which showed the unemployment rate in the June quarter rising to 5.2% from 5.1%. That was bang on the RBNZ's forecast, lower than the market expected, but with underlying details that really weren't wonderful. The participation rate dropped, for example, effectively meaning some people had given up on getting a job. Once people count themselves out of the workforce in this way they count themselves out of the unemployment figure - so, the figure doesn't go as high as it might otherwise. That 5.2% figure was in reality worse than it looked.

It's said often enough that unemployment is a 'lagging' indicator and it tends to be rising at the tail end of an economic cycle, when things are already starting to look up in the economy at large. But there's no doubt at the moment in the middle of winter, when people have been dealing with interest rates higher than they want, when food prices keep going up, when house prices apparently don't, well, unemployment's just another thing to get grumpy about. And to worry about. We are down.

I won't go into huge detail about what all the recent high frequency lower-level economic data has been saying, although the ANZ economists have done a nice job of wrapping up much of it in their OCR preview. So, have a look at that.

But in essence, the high frequency data's telling us that both manufacturing and the service sector (the latter making up about two-thirds of GDP) have been contracting, retail spending's struggling, house prices are flat or even falling a little, and so on.

On the face of it, everything says cut interest rates further. But if it was that simple...

If we assume the RBNZ does cut the OCR to 3.00% in the coming week, it will mean the cash rate has been reduced by 250 basis points since the start of the cuts in August 2024 (when the OCR was on 5.5%). That's a lot. But the impact of the reductions is not immediate. It takes time for example for people to roll over on to lower mortgage rates. So, they don't feel the OCR cuts straight away.

The question for the RBNZ then is to what extent are the cuts already made 'working' and to what extent is the impact of those still to be felt? Clearly, if we are to believe that what we are seeing in the economy at the moment is 'as good as it gets' after 250 basis points of cuts, then more reductions are warranted. But the RBNZ has to make the call of how much impact is still to be felt.

Sure to rise - the overcooked hiking cycle

I thought the RBNZ 'overcooked it' when rates were on their way up to 5.5%, simply because it was hard to work out in real time whether the hikes in rates were actually working as intended. The worry is that everything kind of catches up at once. I think that happened on the way up.

And it could happen on the way down. So, if the RBNZ does just bite the bullet and take the OCR below 2.5% as some would argue it should, well, does that then cause the economy to overheat again? Look, we appear to be a heck of a long way away from such a situation at the moment. A heck of a long way. But we've had the boom and bust thing before, particularly when it comes to our housing market.

So, it will be no surprise if the RBNZ remains cautious. The best guess then is that, yes, there will be a cut in the coming week, and the RBNZ will leave the door open for the possibility of at least another cut. But it will keep its options open.

We'll have to wait and see if the 'June swoon' we've just had proves to be the bottom of the cycle...or whether our economy has just hit the bottom and will continue to bump along the bottom till it gets more OCR help.

I guess as long as the RBNZ takes each OCR as it comes things aren't too complicated. The decision in the coming week is straight forward. Deciding what should be done at the following OCR review in October looks devilishly complicated. But maybe by the time we get there the options will be pretty clear too.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

30 Comments

I think instead of two small cuts they should make one bigger one. Warm weather around the corner. Get people feeling more confident. Housing isn't going to run away on them again with DTIs in place.

Whole article?

I don't mind paying for Interest.co and some good overseas financial news sites......but the Herald is normally BS with Onewoof Property biased (Buynow and often) puffpasty pieces.

Will Liam now be in witness protection and be attacked by the Onewoof cabal? - for telling the hard truth. Good to hear of one honest financial journalist.

Best that he parks his car securely. The underwater and overleveraged REA crowd can be vicious.

Yeah agree 0.5% cut is the way to go. Won’t happen though.

I agree. Leave OCR for now. Let the dust settle. Everyone take a breather

IMO I don’t think house prices are quite yet at the level of where current interest rate settings are - they are still pricing a little higher from the Covid era. So if this is the case and like JKey said the other week our economy is all about house prices then we won’t really pick up until the house price decline is arrested. So given wage pressures are dead this will have to come from lower repayments rather than higher incomes. Hence we will need lower rates. Govt ain’t gonna help with this one Not sure if they don’t want to or don’t know how.

"...given wage pressures are dead..." ?

- Private sector wages increased 2.6 percent over the year.

- Public sector wages increased 4.2 percent over the year. (remembering also the PS Average is over $100k pa)

https://www.stats.govt.nz/information-releases/labour-market-statistics…

I'm extrapolating rather than interpolating. Wage pressure comes from labour demand of which there is very little.

The RBNZ knows we’d be better off with 3% inflation and no recession compared to 2% inflation and recession/depression. But they can’t officially say that. Hence they have to predict the CPI returning to 2% even if they don’t think it will. They need a better mandate that acknowledges this tradeoff.

It should be apparent by now 2% inflation is the "target", but the RBNZs decisions have a degree of discretionary consideration. It's not like there's a clearly defined set of parameters the OCR rises and falls with.

One of those considerations is smashing economic sentiment, free up money too quickly, you run a higher risk of inflation returning. We had an economy running on a decent degree of mania during COVID, along with supply shocks we had people consuming at a crazy rate. When offered cheap debt, people will invariably borrow to the max, which is never a resilient financial approach. The psychological impact of higher rates should bring a degree of rationality back to the economy.

The RBNZ will tolerate a sustained low growth period as long as it can. Stats are turning negative but nothing is close to free fall, should the economy suffer an actual shock, then the RBNZ will likely start up the stimmies again.

If it were done when 'tis done, then 'twere well it were done quickly.

2% is a certainty IMO. Things are tough out there.

Apart from death, nothing is a certainty, not even taxes.

If Labour wins then taxes are a certainty

More in store

spot on

History is often the best predictor of the future, and looking at past RBNZ cutting cycles, they've always cut more than initially projected. This time won't be different, it's just a matter of when, not if, we see deeper cuts.

Even with a 0.25% cut bringing the ocr to 3%, we're still at 12x the covid lows of 0.25% = that's really tight with way more debt to service.

Looking at real rates

- 2022Q1 -> ocr 1.0% - cpi 6.9% = -5.9% real rates (massive stimulus)

- Current -> ocr 3.25% - cpi 2.7% = +0.55% real rates (rarely seen since GFC)

These positive real rates are choking the economy. In a balance sheet recession with falling asset prices and high debt levels, everyone with debt is paying it down, especially the big players with deep pockets who are trying to build cash reserves if possible rather than spending. The irony is everyone is doing the "right thing" by paying off debt, but when we all do it at once, it tanks the economy. These cuts won't quickly turn into spending.

And all this before Trump's tariff tsunami (a once in a century event) hits our shores. When it does, the deflationary spiral comes with it.

The Fed won't be able to save everyone in the US when this hits, let alone everyone outside. Sure, they will wheel out the QE bazooka thinking "this will fix it!" Post-GFC they threw literal trillions at it and inflation barely moved. Now the hole is way bigger. Japan has been stuck in deflation for 3 decades despite unlimited QE, but somehow this time will be different?

What makes this time different from the GFC is the level of tariffs we haven't seen since Smoot-Hawley nearly a century ago, and the deflation and global depression that followed. Plus this time China won't be riding to the rescue like they did post-GFC. They're too busy fighting their own battles and will be exporting deflation to the rest of the world instead.

Hard to see it not all ending in the same place, the only real variable is how much custard you can squeeze out of each kitten. Maybe it's longer if you're still able to maintain or grow your population, but we'll soon find out.

they may want to keep a bit in hand in case the US enters recession

Spot on!

Hmmm.....inflation is picking up. RBNZs sole mandate is managing inflation within the target band. More cuts would highlight that mamdate as BS, and that they are just a political tool of foreign banking interests.

See what happens.

Higher rates will lower peoples food inflation, like people can not eat...

The worry shouldn't be inflation in a debt based economy.

Think about it, after the world spent trillions during COVID plus massive supply chain disruptions, inflation peaked at ~9% in the US and ~7% here in NZ. That's it. That was the best shot inflation had.

Now with a war in Europe and chaos in the Middle East, oil has actually dropped from $120+ to around $63. The drops will keep coming and it won't be long before we see a 5 handle, maybe even 4 handle on oil. Inflation is falling with it.

Add in tariffs we haven't seen since the 1930s (which crushed trade volumes, destroyed company profits, and sent unemployment through the roof), collapsing oil prices, and countries desperately dumping cheaper products (watch China destroy the auto industries of few countries with their EVs) and you've got a deflationary cocktail brewing.

Just like central banks were too slow to see inflation coming in 2021, they will be too slow to see deflation coming in 2025. Like deer in the headlights, they will freeze up until it's too late. Another policy mistake in the making.

The real risk isn't prices going up, it's the debt DEFaults = debt DEFlation spiral that comes when everyone tries to pay down debt at once while global trade collapses. But sure, let's keep fighting yesterday's inflation battle while tomorrow's deflation tsunami builds offshore

"That was the best shot inflation had."

Perhaps...if you conflate inflation with CPI.

what will CB do, they will print hard.... its the only playbook they have....

once rates go -ve

game changes

We already have debt defaults all over the show. Banking is just doing an extended and pretend for the stupidly in debt. Shouldnt the system be allowed to reset and clear out the over leveraged, yes that will financially smash some. But as the person who took that risk and bank that supported and profited, take their medicine?

Why should the rest of us be punished thru inflation instead?

Bank motto: The house always wins, better luck next time

I agree. Inflation is dying a quick death.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.