Although it’s still early days, economists say they expect annual inflation to fall to around 2.8% and that the Official Cash Rate (OCR) is still on track to be cut by the end of the year.

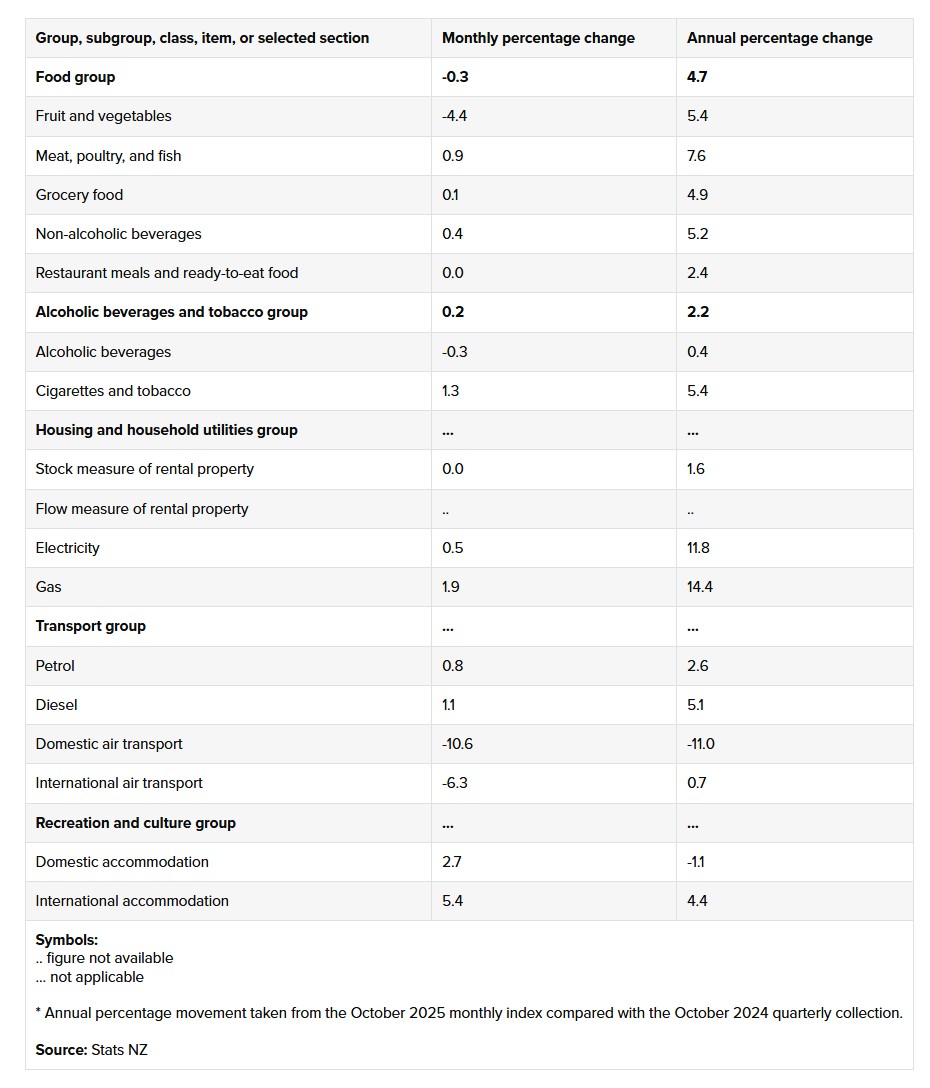

These predictions come as Statistics New Zealand’s Selected Price Indexes (SPI) show annual food prices jumped 4.7% in the year to October driven by a 4.9% annual rise for the grocery group. This was followed by meat, poultry and fish which rose 7.69% annually.

In September, annual food prices rose 4.1%.

Statistics NZ’s SPI is a monthly series that features about 47% of the contributors to the quarterly Consumers Price Index (CPI) - NZ’s official measure of consumer inflation.

The SPI includes monthly data on things like food, alcoholic beverages and tobacco, rental housing, utilities, transport and accommodation services.

Food prices make up about 18.5% of the CPI and rent now makes up just over 11% of the CPI so the SPI is a good early guide to what inflation is doing.

‘No obstacles’ to OCR cut next week

The Reserve Bank (RBNZ) is charged with maintaining inflation between 1% and 3%, and it specifically targets 2%.

While annual inflation, as measured by the consumers price index (CPI), is currently on the higher side of its target at 3%, the RBNZ's Monetary Policy Committee expected this.

The fact this inflation figure was initially expected, coupled with an expectation that inflation will slow next year has led economists on Monday, to reaffirm their forecasts of a drop in the Official Cash Rate (OCR) by 25 basis points.

This would take the OCR from 2.5% to 2.25% at the next review on November 26.

ASB senior economist Mark Smith says despite October’s SPI having stronger than expected food prices, the underlying measures point to further easing when it comes to inflation.

“Much of the upward surprise looks to be a consequence of rising costs (energy prices have soared) and/or global catalysts rather than pointing to a lift in domestically-generated inflation," says Smith.

“We expect annual inflation to end this year at 2.8% and there are good reasons to expect inflation to move towards 2% from next year, with the large margin of spare capacity being the key disinflationary driver."

While Smith says they expect this 25-basis point drop, “the path of the OCR beyond that is conditional on the economic outlook”.

“With few non-monetary policy tailwinds on the economic horizon, the risk is that the OCR moves lower as the RBNZ moves to actively support the economy. This will depend on inflationary pressures being contained.”

Westpac NZ senior economist Satish Ranchhod says the new SPI data doesn't presents any obstacles to another RBNZ rate cut.

Ranchhod says: "We’ve revised our forecast for December quarter inflation to +0.3% and +2.8% for the year to December. Those estimates are both down 0.1 percentage points from our earlier forecast."

The latest SPI figures “showed greater than expected softness in travel costs, which can be volatile on a month-to-month basis and will warrant close attention over the coming months”, Ranchhod says.

“However, we also saw softness in other areas. Most notably, rental inflation has been very weak.”

Prices for eggs and coffee rise

“The price of milk has increased by 91 cents per 2 litres over the last two years. Eggs were up 8.8%, and coffee was up 12.4% over the same period," Statistics NZ’s prices and deflators spokesperson Nicola Growden says.

“Those who enjoy eggs and coffee in the morning may have noticed them becoming more expensive.”

The average price for milk was up 13.5% annually, at $4.78 per 2 litres and cheese was up 30.1% annually, at $12.71 per 1 kilogram block.

Instant coffee was up 25.5% annually at $7.88 per 100 grams, while fresh eggs were up 18.5% annually - at $9.88 per dozen.

The average prices for milk and cheese represent the cheapest available option for each, according to Statistics NZ.

Monthly food prices fall by 0.3%

Compared with September, October saw a monthly food price decrease of 0.3%, with the fruits and vegetables subgroup was the only group to record a fall, which contributed to the overall decrease.

“Vegetable prices fell 10.7% this month, with salad items such as lettuce, tomato, and cucumber becoming cheaper. This is the largest monthly price decrease for vegetables since November 2021," Growden says.

“Although fruit and vegetable prices have fallen overall, the price for fruits such as kiwifruit and apples have increased by 48.4 percent and 7.1 percent respectively.”

Growden says this is the first time this year that food prices have fallen in consecutive months.

The average price for lettuce was down 31.9% monthly at $4.60 per 1 kilogram while capsicums were down 26.2% monthly at $13.79 per 1 kilogram while cucumbers dropped 21.9% monthly to $8.57 per 1 kilogram.

Food prices index

Select chart tabs

Electricity and gas prices increase

Growden says there have been 11 consecutive months of price increases for both electricity and gas. In the year to October, electricity went up 11.8% and gas rose 14.4%.

Monthly prices also increased - electricity was up 0.5% and gas was up 1.9% in October.

Rent prices

The stock measure of rental property went up 1.6% in the 12 months to October.

Transport

Petrol increased by 2.6% annually and diesel also saw a 5.1% jump.

When it came to domestic air transport, there was an annual 11% decrease while international air transport was up 0.7% annually.

Alongside this, domestic accommodation dropped 1.1% while international accommodation increased 4.4%.

Here is the detailed SPI information as supplied by Statistics New Zealand:

12 Comments

Woolworths instant coffee powder (my favourite) only $2.99 for 100g.

Buyers should resist paying too much for things.

Maybe it’s time to address the GST component. No GST on basic food items in AU, and no VAT on almost all supermarket food in the UK. If they are capable of having exemptions, why can’t we?

I'd rather we just keep the status quo than see supermarkets get bigger margins via removal of GST. They would simply drop prices by a little, but not the full amount to rake in more profit.

That's a big assumption, and it would also be very easy for the government to monitor. Perhaps you need to apply to be a GST free food retailer and the government can revoke if they believe you are taking the piss.

We could do it, but it would lead to a more complex situation. That means higher compliance costs, and more legal challenges as products try to shoehorn themselves into the tax-free brackets.

The question isn't whether it's possible, it's whether it's worth the inefficiencies or if there's a better way to achieve the same.

Sadly, the politics of removing GST are much more appealing than the small change to lower tax brackets and welfare payments which could similarly compensate low earners a handful of dollars a week. A year down the line everyone has adjusted to the new income, but the high grocery prices are still in their faces several times a week.

The issue is that when NZers go overseas, or when foreign people come here, they are shocked at how expensive our food is (15% is quite noticeable). Then it makes the news and we spend crap loads of time and money blaming everyone other than the tax man.

Taking the GST off food would also help remove the regressive nature of the tax.

It could also be argued that the removal would benefit the wealthy and middle earners than the low earners as it takes less of their disposable income. either way, in speaking to friends and family in Germany, UK, USA recently it doesn't sound like NZ is that bad apart from the products we export and get fleeced on the international pricing aspect.

The main differences I remember when moving here from the UK is the margins on processed food. Stuff like a tub of hummus or pesto, might have been a pound or so over there but you'd be lucky to get it for $5 here. The veggies and meat were relatively similar.

Yes I vividly remember the traffic light packets of capsicums with the green one from the UK, the Yellow from the netherlands and the red from spain. Then there was the isles of processed crap at the entranceway, all heat and eat meals in non-recyclable plastic that costed a pittance. No wonder the Scots love their neeps and tatties.

Will put pressure on further OCR cuts.

This is further bad news for the Nats. I wonder if there is a point where Luxon is sacked, its looking ugly for them: https://www.stuff.co.nz/nz-news/360887932/cost-living-tops-kiwis-concer…

Monthly prices also increased - electricity was up 0.5%

Interesting given that electricity has mostly free lately. Right now in South Island $0.025/kWh. With the demise of Flick there's no way for the man in the street to tap in to the spot price any more.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.