Sources: World Gold Council; Disclaimer

This content is sourced from the World Gold Council.

How to value gold for maximum portfolio impact

Gold does not directly conform to the majority of the most common valuation methodologies used for equities or bonds. Without a coupon or dividend, typical models based on discounted cash flows, expected earnings, or book-to-value ratios, struggle to supply an appropriate assessment for gold’s underlying value. This presented an opportunity for the World Gold Council to develop a framework to better understand gold valuation.

What is the Gold Valuation Framework (GVF)?

GVF is a methodology that allows investors to understand the drivers of gold demand and supply and, based on market equilibrium, estimate their impact on price performance. GVF powers our web-based tool, Qaurum, which allows users to assess the potential performance of gold under customisable hypothetical macroeconomic scenarios provided by Oxford Economics.

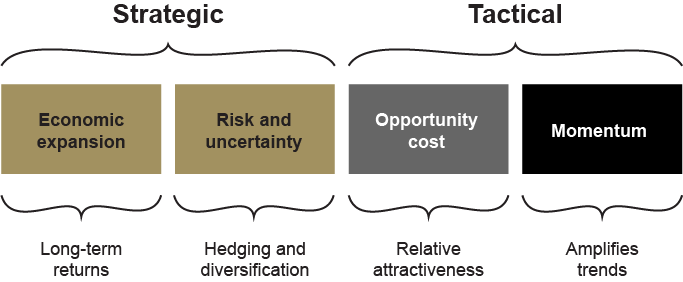

Our analysis shows that the price performance of gold can be explained by the interaction of four key drivers:

For more information on long- and short-term drivers of gold, visit the data section on Goldhub.com.

Gold can enhance a portfolio in four key ways:

Inflation, supply-chain concerns and COVID uncertainty remain at the forefront for investors in 2022

Inflation was a prominent global theme throughout 2021 and is still a key input into 2022 investor decisions. While many central banks (CBs) felt the uptick in inflation levels was temporary on the back of COVID’s impact in the first part of 2021, this consensus shifted in the latter part of the year. Some CBs now acknowledge that inflation is here to stay for longer and are expected to raise rates in 2022. Conversely, other countries like China, India and the ECB are expected to continue accommodative policies.

Meanwhile, supply chain bottlenecks caused by the pandemic have not fully dispersed. It is true that governments proved reluctant to respond to the recent spike in COVID cases with formal shutdown measures of the sort that disrupted economic growth over the last two years, but new variants could change this behaviour, and a resurgence of supply chain disruption – across multiple sectors from technology to shipping – could negatively affect economic growth and create additional inflationary pressure.

While the market expects rates increases and a strong US dollar -- a negative for gold price performance -- real and nominal rates should remain at historically low levels.

Our analysis shows that gold has performed well into CB hiking cycles and has been an effective inflation hedge. Coupled with healthy jewellery and CB demand, and the potential for market volatility in a vastly changing world, the strategic rationale for gold in a portfolio – particularly as a portfolio hedge -- remains compelling (see 2022 Gold Outlook).

ESG considerations

Over recent years, investors have increased environmental, social and governance (ESG) considerations as part of their investment process. For example, in a MSCI survey of 200 institutional investors managing around $18 trillion, 73% planned to increase ESG investment in 2021,2 and in a survey of 800 individual US investors by Morgan Stanley in October 2021 79% were focused on prioritising sustainable investing3. This increased emphasis on ESG reflects growing pressure for businesses to actively watch and manage ESG risks. It also supports the position that good ESG performance can lead to better long-term financial performance.4 The shift towards a greater integration of ESG objectives within investment strategies has important implications for gold, which investors expect to have been responsibly produced, and can play a role in supporting ESG goals and managing associated risks within a portfolio (Focus 2: Gold as an ESG investment).5

The increased relevance of gold

Institutional investors6 have embraced alternatives to traditional investments such as equities and bonds in pursuit of diversification and higher risk-adjusted returns. For example, the share of non-traditional assets, such as hedge funds, private equity funds or commodities, among global pension funds increased from 7% in 1998 to 26% in 2020 – this figure is 30% in the US.7

Gold allocations have been recipients of this shift. Investors increasingly recognise gold as a mainstream investment; global investment demand has grown by an average of 15% per year since 2001 and the gold price has increased almost seven-fold over the same period.8

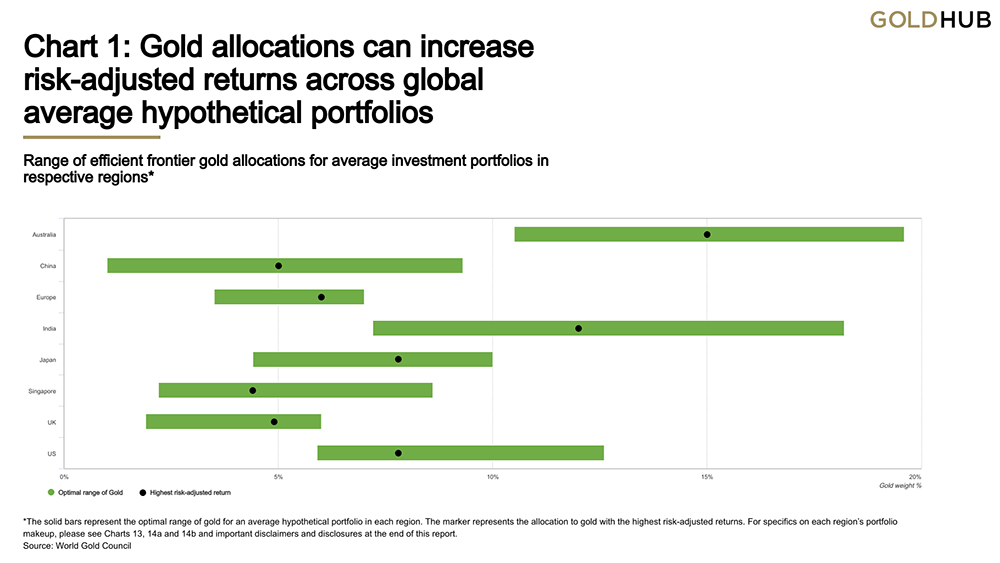

Our analysis illustrates that adding between 4% and 15% in gold to hypothetical average portfolios over the past decade, depending on the composition and the region, would have increased risk-adjusted returns.9

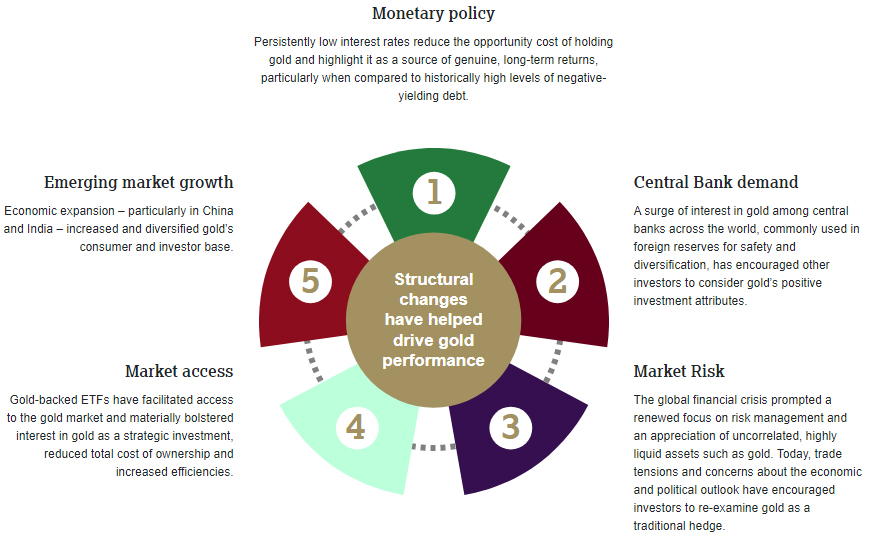

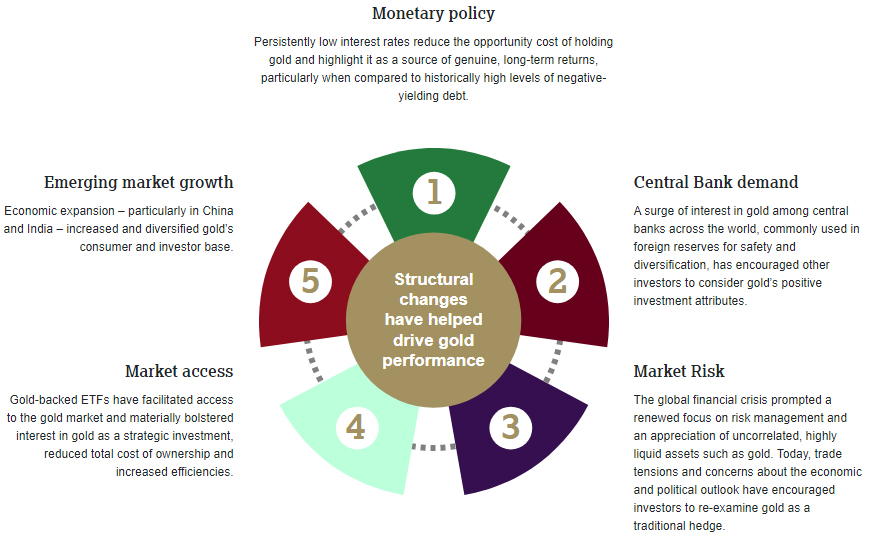

Gold performance has been strong in recent decades, supported by key structural changes

Sources: World Gold Council; Disclaimer

Footnotes

1Oxford Economics is a leader in global forecasting and quantitative analysis and a specialist in modelling. Visit Qaurum for important disclosures about Oxford Economics’ data, as well as a detailed description of the available scenarios; the assumptions underlying and data used for each scenario; and its respective hypothetical impact on gold demand, supply and performance.

2MSCI Investment Insights Report 2021

32021 Sustainable Signals Individual Investor, Morgan Stanley, January 2021

4Refinitiv, How do ESG scores relate to financial returns, August 2020.

5Gold and climate change: Current and future impacts, October 2019.

6An institutional investor holds and/or manages assets for clients in larger, pooled portfolios often represented as mutual funds, banks, brokerages, hedge funds, etc.

7Willis Towers Watson, Global Pension Assets Study 2020, February 2020 and Global Alternatives Survey 2017, July 2017.

831 December 2000 to 31 December 2020.

9See Chart 13 for more details behind the composition of the hypothetical regional portfolios. Based on 2001 – 2021. In addition, refer to important disclaimers and disclosures at the end of this report.

![]() Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

Our free weekly precious metals email brings you weekly news of interest to precious metals investors, plus a comprehensive list of gold and silver buy and sell prices.

To subscribe, log in or Register, and sign up in your Account page. It's free.

Comparative pricing

You can find our independent comparative pricing for bullion, coins, and used 'scrap' in both US dollars and New Zealand dollars which are updated on a daily basis here »

According to the HUI Gold Index, it has risen by 26% over the past 5 years and by 70% since Jan '03.

The NZX50 has risen by 70% over the past 5 years and by 539% since Mar.'03.

The figures for say Nasdaq or the S&P500 would present an even starker contrast.

If I had wanted diversification from the stock and property markets over recent years, I would have had much better results from cryptocurrencies.

A gain of just 70% over the past 19 years is pathetic. Why would anybody want to hold it?

The HUI Gold Index is an index of gold mining companies, it does not replicate/represent the price of gold.

The USD price of gold was $338 in Jan 2003, today it is $1835. This equates to a 433% return over the period.

https://tradingeconomics.com/commodity/gold

Granted, the last 5 years have been poor for gold. But let's see where we are by the end of 2022... I believe that conditions have turned in gold's favour.

I got them from that index.

The NYSE Arca Gold BUGS Index is a modified equal dollar weighted index of companies involved in gold mining. BUGS stands for Basket of Unhedged Gold Stocks. It is also referred to by its ticker symbol "HUI". The HUI Index and Philadelphia Gold and Silver Index are the two most watched gold indices on the market.

In Jan. '03, the index stood at 139.66, rose to 607. 73 in Sept. '11 and has since fallen back to 256 today.

I freely admit to having little knowledge of the market as it has never interested me. I now see that the index refers to gold mining companies, not the price of gold itself. Why is there is disconnect between the two?

Granted, the last 5 years have been poor for gold.

Depends what you mean by poor. Looks like it's been tracking inflation.

2021: -3.51%

2020: 24.43%

2019: 18.83%

2018: -1.15%

2017: 12.57%

Why hold? You are about to find out.

The fact that governments are stock pilling gold should remind us all of the importance

https://www.statista.com/statistics/267998/countries-with-the-largest-g…

theglc,

But just what makes it important? It doesn't earn anything and indeed incurs costs to store and it doesn't back their currencies, so again, why is it important?

NZ hasn't had any gold since 1991-I have an email from the RB to that effect- so what effect has that had on our credit ratings? None to my knowledge.

Gold will continue to be a sought after commodity and a store of value- unlike Crypto junk.

Gold will continue to be a sought after commodity and a store of value- unlike Crypto junk.

I think you're a bit out of touch. Gold-backed digital assets (what boomers would call 'crypto') such as PAXG and PMGT are quite popular.

J. C.

Lots of questions. How do you know a digital asset is gold backed? Who pays for the gold? Where would it be stored? Cryptos are highly volatile so what happens if the price doubles overnight? Is there a contract to enforce a doubling of the gold holding-irrespective of the price?

What happens if the crypto price halves-must half the gold be sold-irrespective of the price?

How do you know a digital asset is gold backed? Who pays for the gold? Where would it be stored?

In the case of PMGT, the gold is in custody at the Perth Mint. The gold is allocated by the Perth Mint, but unlike an ETF. It's 100% accounted for and the token can be exchanged for physical gold. The token's value is equivalent to the price of an ounce of gold. But it is also fractionized. For ex, I can give you PGMT0.5 (equivalent of 0.5 ozs of gold).

PAX is similar to PMGT, but it is not an established mint nor does it have govt backing.

By the way, news from Russia

Russia can legalize cryptocurrency mining and stablecoins backed by gold under government control, a high-ranking member of the Russian parliament has suggested. The statement comes after Bank of Russia proposed a wide-ranging ban on the use of cryptocurrencies, and their trading and mining.

https://news.bitcoin.com/russia-may-allow-crypto-mining-and-gold-backed…

I think you two are almost talking the same thing. Gold backed crypto has potential..unlike a backed by nothing BTC crypto.

See my comment above and what Russia is suggesting about gold-backed tokens.

Gold is never any good for NZers, the price rotates around the USD, the only winners are the traders in the US.

Gold can be priced in any currency, including NZD.

Exter's inverted pyramid applies.

Crypto has to be a ponzi scheme. You can never own it. You may have the right to trade something that can only exist in a vastly complicated echo system. You can never put it in your pocket and walk away, should there be a global meltdown. Gold is the ultimate portable property. Its greatest strength and its greatest weakness..

I believe gold, the hard stuff, not paper is worth having but limited to max 10 % of one's investment portfolio. 5% is about right for me and traded in USD, not NZD. There are one or two "agents" in NZ who will accept USD payment so no fiddling with the NZ forex rate. The only problem with local agents is the premium above the gold price. Using a specialised overseas bullion company holding the hard stuff I believe is the way to go.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.