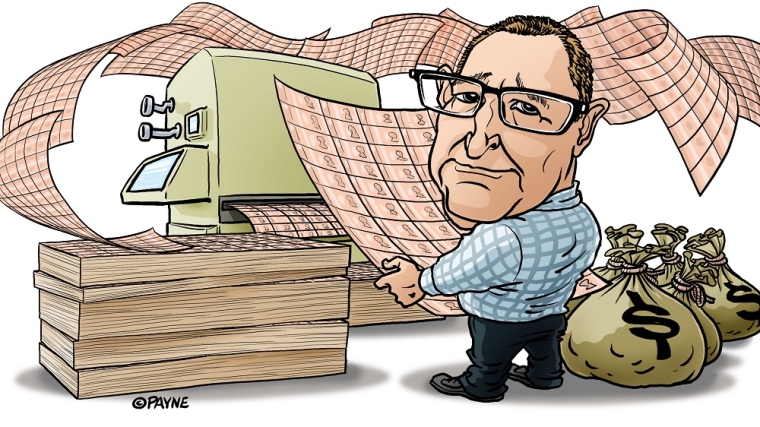

Finance Minister Grant Robertson is encouraging the Reserve Bank (RBNZ) to publish more research on who has benefited, at whose expense, from the central bank slashing interest rates.

But, Robertson can’t say whether he would have done anything differently to address the side effects of the RBNZ lowering the cost and increasing the supply of money, had the central bank last year given him more information on how this would affect different groups in society.

Robertson told interest.co.nz that because the RBNZ operates independently from the Government, there isn’t a formal mechanism, like a Regulatory Impact Assessment, through which it's required to detail the impacts of its policies.

“I guess that’s something that could be considered,” he said.

Nonetheless, in his just-published annual Letter of Expectation to RBNZ Governor Adrian Orr, dated March 9, Robertson said: “To support an informed public debate on the distributional consequences of the Reserve Bank’s monetary and financial policy actions, I encourage you to publish further research on the impact that your policies have on distributional outcomes in New Zealand…

“Looking ahead I am particularly interested in effective co-ordination of fiscal and monetary policy, the distributional consequences of monetary and financial policy actions and addressing access to affordable housing.

“An effectively functioning housing market is a critical component of a sustainable and inclusive economy and promotes the maintenance of a sound and efficient financial system.”

The Letter of Expectation Robertson sent Orr in April 2020 - just after the RBNZ cut the Official Cash Rate to 0.25% and launched its quantitative easing programme, didn’t mention housing or the way the benefits of loose monetary policy are spread across soceity.

Research being done after the fact

Both the RBNZ and The Treasury are now doing research on the distributional impacts of the unprecedented moves the RBNZ made to keep inflation and employment buoyed in the face of COVID-19.

The RBNZ has started this process by considering international research on the matter and looking at the impact loose monetary policy has on the bond market.

It hasn’t properly started looking at the impact on New Zealand’s largest asset class - property.

It said, in its Statement of Intent, it would publish more research within the next 18 months.

The Treasury said it plans to publish research “in coming months” on how New Zealand’s housing assets are spread across people with different levels of income and wealth.

“One interesting preliminary finding is that all income deciles hold a similar proportion of their wealth in housing assets (higher income deciles have higher overall wealth and higher housing wealth, but the two types of wealth are held in roughly the same proportions across all income deciles),” said Dominick Stephens, who is on secondment as Treasury’s Deputy Secretary and Chief Economic Advisor.

Maintaining a social licence

While the RBNZ is on track to meeting its inflation and employment targets, it, The Treasury and Robertson are acutely aware low interest rates have sent house prices even further north and reduced savers’ incomes.

Former Prime Minister and Finance Minister Bill English is even among the RBNZ’s critics, having a go at it for supposedly overcooking its response to COVID-19.

However, the RBNZ has been clear from the start of the pandemic it’s taking a “least regrets” approach, and would rather risk overcooking than undercooking its response.

The central bank has also noted it’s simply doing what it’s required to by law, targeting inflation and employment.

Secretary to The Treasury, Caralee McLiesh, came in to bat for the RBNZ in a speech last week.

“Lower interest rates increase employment, benefit borrowers and asset holders, and reduce returns to savers. The net effect on total wealth and income inequality is an empirical question we cannot yet fully assess,” she said.

“What we do know is that monetary policy is a broad tool that is not well suited to managing distributional impacts - this is the domain of other policies including fiscal, regulatory and social policy.

“But greater transparency and communication - without transferring accountability to the RBNZ - can help. Recent changes to the monetary policy remit aim to improve policy coherence in this way, and we continue to coordinate with the RBNZ on these and related matters.”

Fiscal policy could do more in the future

McLiesh spoke in detail about how fiscal policy, or government spending, should play a greater role in supporting the economy beyond the COVID-19 crisis, especially in this structurally low interest rate environment.

Robertson said it was too early to specify how The Treasury’s shift in thinking - which he supported and encouraged - would translate into policy.

86 Comments

I wonder if Grant could use his advanced cognitive faculties to take a wild stab in the dark at who the winners and losers might be...

Gobbledegook vs Catch-22. What a wonderful world of words, reports, consultations, and neverneverland this bloke lives in. Actually it is quite simple and cunning tactics. Create a smokescreen, a long rolling lasting one, and when it clears the subject matter might well be on the back pages, overtaken by who knows what. Reading this column can fully understand why Dagwood Bumstead thought his boss Mr Dithers was so absolutely useless. But then again that question “who has benefited.” In other words please identify all them potential sectors as tax target.

OMG - sick of Grant 'I need research' Robertson. We all know if there is research done it will be conveniently non conclusive...

He obviously failed the courses in common sense and basic reason.

To be fair, he's probably still getting the research on that...

He needs research to do the research..

no research needed really lol..

Here are the definitive conclusions.

people who own properties that are exempt from capital gain tax are winners.

people who rely on benefits and cash income are winners.

the rest are very much losers.

Biggest winners - asset holders, didnt have to do a thing, especially people that owned more than 1 house

Biggest losers - prudent savers especially the elderly.

Just give some BALANCE here, do we really still need OCR 0.25 now??

Given that home ownership rates are high amongst the elderly, for most of them its swings and roundabouts. For those diligently saving for a home, its just a big kick in the teeth and in the backside for good measure.

The elderly tend to be asset rich cash poor. Poor savings returns have pushed many into poverty.

Try existing in Auckland on a pension with feckless Phil's phenomenal rate increases.

Whilst the elderly may own houses I suspect there will be plenty of reverse mortgages on the go as the elderly try to survive

The elderly have the lowest poverty rates of any group in NZ. I would like to see data to back up the claim that low interest rates have pushed many into poverty. Im not saying some elderly don't have it tough, but elderly people in NZ who own a home and get the pension are not likely to be in poverty simply because of those two facts alone. And if as you say they are doing it tough in Auckland, they can easily free up several hundred grand by moving to just about anywhere else, and don't have the same labour market constraints as younger people.

Not sure the default expectation for elderly should be "sell up and get out" given that moving outside of cities takes them away from family, access to medical care and convenience of things like buses and other accessibility issues.

There's a middle point, I think, which is 'building more inter-generational housing' e.g. five bedroom, separate home and income/granny flats like NZ used to build prolifically in the 1970s. But now you're talking almost $2m for something of the sort. But at least it would allow families to stay together rather than just pushing the elderly out into the satellite towns to die alone.

I totally agree - it shouldn't be the default expectation for the elderly to 'just move'. (Though it shouldn't be for young people either!). Im just pointing out that a person on super who owns their own home is better off than a hell of a lot of people simply because of those facts. If we're concerned about kiwis who are doing it tough, pensioners are just about the last group of people who we should be worried about as a group, policy wise. In general, pensioners have the lowest poverty rates and highest level of disposable income out of any demographic. (Of course there are some pensioners who are struggling - but if you own your own home, you're very unlikely to be in that group).

Depends on rates increases. Accidentally owning a $2m home you bought 50 years ago on a cabinet makers single income isn't likely to leave you much money after rates on said house

Our house + granny flat retails at $525,000.00inc gst - excluding land. Includes basic lawn, 150m2 exterior concrete, heat pump, carpet & tile to floors

You would expect them to have lower rates having worked for longer and had the opportunity to save and retire debt.

People say this sort of thing as if it's a tragedy, but i find it tiresome. If you are asset rich, you are rich. It's just a way for people to hoard wealth and cry poor. Reverse mortgages should be widespread. The "tragedy" is elderly kicking around by themselves in large houses with a big section - these should really be freed up for families to live in.

"Reverse mortgages" is just pushing the costs of policy failures that push up living costs onto the people who can no longer benefit from inflation-driven earnings - not that many people get inflation-driving earnings these days.

But go-off, I guess. Taking your argument to the extreme, we should just ship all the elderly to the coldest part of the country and let nature do its thing.

Assets accumulated over a lifetime but.

xing,

"people who rely on benefits' are winners is your definitive conclusion. Based on precisely what research/evidence do you reach that conclusion? Answer-none, just your prejudice.

18 months seem like a reasonable time frame for such massive research endeavour.

Quoting Donald Rumsfeld, "...as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns- the ones we don't know we don't know.”

Be quick.

Donald Rumsfeld - such a titan of philosophers - did he knowingly know what was said to be known helped unknow the knowledge of his knowledge that the known was known to be unknown.

I'm surprised Robbo hasn't established another working group.

“One interesting preliminary finding is that all income deciles hold a similar proportion of their wealth in housing assets (higher income deciles have higher overall wealth and higher housing wealth, but the two types of wealth are held in roughly the same proportions across all income deciles),” said Dominick Stephens, who is on secondment as Treasury’s Deputy Secretary and Chief Economic Advisor.

Hmmm....

The proportion of people living in their own home was the lowest in almost 70 years at the time of the 2018 Census, and homeownership is becoming much less common for younger people, Stats NZ said today.

Census data shows that homeownership peaked in the 1990s at 74 percent and by 2018 had fallen to 65 percent of households, the lowest rate since 1951. However, homeownership rates appear to have been more stable between 2013 and 2018.

Which begs the question:

Wealth effect or wealth illusion? The other therapeutic effect of lower-for-longer interest rates is the wealth effect. By driving up the value of future cash flows with lower rates of interest, all manner of assets – stock, bonds, and houses – increase in value and, thereby, can stimulate our marginal propensity to consume. More simply put, the imperative was to make rich people richer so as to encourage their consumption. It is not so hard to imagine negative side effects.

There are the obvious distributional effects between those who have assets and those who do not. Returning house prices in California to their 2005 levels may be good for those who own them, but what of those who don’t?

There are also harder-to-observe distributional consequences that flow from the impact of lower-for-longer interest rates on the value of our liabilities. This is most easily observed in pension funds.

Consider two pension funds, one with a positive funding ratio and one with a negative funding ratio. When we create a wealth effect on the asset side of their balance sheets we also drive up the value of their liabilities. Lower long-term interest rates increase the value of all future cash flows – both positive and negative. Other things being equal, each pension fund will end up approximately where they started, only more so.

The same is true for households but is much more ominous, given the inequality of wealth with which we began the experiment. Consider two households: one with savings and one without savings. Consider also not just their legally-defined liabilities, like mortgages and auto-loans, but also their future consumption expenditures, their liability to feed and clothe themselves in the future.

When the Fed engineered its experiment to promote the wealth effect, the family with savings experienced an increase in the present value of their assets and also an increase in the present value of their liabilities. Because our financial assets are traded in markets and because we receive mutual fund and retirement account statements, we promptly saw the change in the value of our assets. We are much slower to appreciate the change in the present value of our liabilities, particularly the value of our future consumption expenditures. [emphasis added]

But just because we don’t trade our future consumption expenditures on the stock exchange does not mean that the conventions of finance do not apply. The family with savings likely ends up where they started, once we consider the necessity of revaluing their liabilities. They may more readily perceive a wealth effect but, ultimately, there is only a wealth illusion.

But what happened to the family without savings? There were no assets to go up in the value, so there is no wealth effect – real or perceived. But the value of their future consumption expenditures did go up in value. The present value of their current and expected standard of living went up but without a corresponding and offsetting increase in assets, because they don’t have any. There was no wealth effect, not even a wealth illusion, just a cruel hoax.

https://realinvestmentadvice.com/the-wisdom-of-peter-fisher/

Robertson research question pretty much answered in those links.

I've been a loser. Joined the workforce during the GFC with 50k debt, now when I'm ready to settle down and buy a house prices have sky rocketed out of reach. And I'm still paying tax to support super for people who have done next to nothing to support me. Thanks team.

B-b-b-b-but they paid taxes all their life. Which entitles them to $20k per year non-means tested, or over $350k if they live to the average life expectancy of 85. Put into perspective, it'll take 43 years of PAYE from a $50k wage earner to fund this. Never mind they can carry on working while claiming this welfare.

We have an external sales rep approaching 65, preoccupied with side hobbies for the last 5 years courtesy of the full personal use company vehicle. An extremely lazy, entitled git. He'll stay on when he hits 65, taking the pay rise courtesy of his fellow tax paying colleagues while giving them the middle finger if they want to move up.

He'll still pay tax at a higher rate. If he's not performing thats a management failing and a governmental one for failing to address it.

Whilst I don't necessarily agree with the concept having known plenty who have done the same, that's the concept as originally designed. Those who have haven't had the benefit of a lifetime in kiwisaver.

Two things have happened since the pension was conceived.

1 Kiwisaver mandates an employer contributes wherein historically that wasn't the case.

2 The left wing numpties who decided that you then couldn't discriminate based on age and retire people at 60 originally but now 65.

Now I'm a believer in human nature so the behavior you get is the one you incentivise as is the case here and as is the case where many on welfare continue to add children both for income purposes and to improve the place on the state house waiting list.

Wow imagine the extravagant life a couple + kids can live in Auckland with this incentive?

The Supported Living Payment goes from a minimum weekly net payment of NZ$211.46 for single 16- and 17-year-olds to a maximum payment of NZ$435.50 for a married couple, de facto couple or a civil union couple.

Agree but faced with the alternative of a single benefit? Yet there are many making that choice it seems.

As I say the behavior you get is the one you incentivise - whether it makes sense to others or not.

With an average rent above $500 for a home without crippling overcrowding and severe leaks that is not going to be an extravagant lifestyle, especially not when the supported living payment requires them to be so severely disabled and suffering severe medical costs on top of living costs just trying to get by. They would not even have the funds for a life saving necessary GP visit and that is a real concern because once on the path of diminishing health and poverty it is very hard to get off that path and even harder to find work. Especially when so severely disabled doctors and specialists have decided you would be unemployable permanently for years.

See the effects heart attack or stroke causing paralysis on labour workers without additional medical care or income to provide for basic needs post hospital discharge (and note only one person in any family can be classed as disabled not both even though both often have disabilities only one person is seen in a couple as the primary disabled one). In fact there was a case today about a man not provided or assigned basic medical support by the needs assessor, including no bathing nursing or meal support, the family being homeless, the other partner while also disabled trying to work infrequent hours due to medical condition and the paralyzed partner dying of sepsis. Or how about that other case of the homeless double amputee in emergency accommodation but not provided access to a bathroom, no toilet access, no medical or nursing support assigned by the needs assessor, being forced into a single room single bed with their son due to not being able to be seen as an individual and WINZ stating they must share the bed with the son in law. Due to the lack of nursing & bathing support and lack of access to a toilet died of sepsis. Case after case of disabled people so severely impaired they cannot work and have conditions that require basic medical aid and being denied simple things like access to a toilet because that is only for the rich politicians and jetsetters flying in for 4-5 star accommodations. Then people disabled by illness dying a degrading death and the death and cause of death being ignored as complications. If only NZders could sue the govt for discrimination and lack of basic medical care and extreme malpractice in the NZ disability sector.

Lets look at the benefits of a lifetime in Kiwisaver - assume (for ease of calculations) that you earn 100k for every year of your 45 year working life. Thats $3500 a year (employer contribution @ 3%, plus govt top up). Assume annual returns of 5%, thats about $230k. That's just about the same as the amount gifted to asset owners by government policy in the last year - and I didn't even take into account that the employers contribution was taxed. So the lifetime benefit of kiwisaver doesn't compensate at all for the benefits the 65 year old has enjoyed from decades of wealth transfer policies organised in his favour.

I totally agree.

You can't blame investors, in fact many KS portfolios will contain property, but you can blame the policies of successive governments. This one in particular chose to trash interest rates causing investors to look elsewhere. Without the capital growth, 3 % rental returns tripled a bank deposit offering and during covid whilst citizens were returning looking for accommodation. Couple that with the relative insecurity of money in the bank or shares during a financial catastrophe, anyone with cash probably saw it as the safest haven.

It's a perfect storm that's destroyed FHBs. I'm picking many will leave for Australia in fact I hear the Aussies are recruiting her now.

Just as a tactical matter, I wouldn't complain about the pension. Any changes to it would be phased in - so what of course would end up happening is that baby boomers would be fine. Its the people coming up behind who have already been hit by student loans and stupid house prices who would be told once again that once its their turn for something we actually cant afford it any more and now you have to save for your own pension out of the meagre sum you have left after paying rent on the investment property that Mum'n'Dad Boomer 'needed' to supplement their non-means tested super.

Agree - Super needs to be means tested; raised to 67 and you have to have paid taxes in NZ for 20 years to receive.

Arohahaha

Millennial panty bunching?

Can't say I don't understand the anguish but it's always useful to blame others for you situation.

There's really no use in being bitter. Those enjoying the situation are only doing what they're legally entitled to do.

"There's really no use in being bitter."

Political apathy and allowing ourselves to be walked over is why we're in this situation.

But sure, let's do more of that and just allow Boomers to get on with what they're "legally entitled to do" because there is no changing that.

I'm not saying that.

Successive governments have refused to address it purely as its an election loser at present.

You cant blame people for doing what is most advantageous for them.

Voters have this particularly human trait of voting for whoever promises to put the most in back in their pocket.

Don't tell me you're any different. You aren't happy the elderly can do this and you can't and you want it changed.

BTW I'm not on a pension and don't own a rental. I defend anyone's right to act in a lawful way. You can't blame them however the fault lies at the feet of those who can change things

Just a friendly reminder that the government’s new hate speech laws mean that boomer bashing in online forums will be able to net you 3 years in jail.

Think of the savings in living costs

Think of the savings in living costs

So tell me why they've skyrocketed out of reach?

Irrational exuberance

More like the safest bet during covid for capital preservation and FOMO generated by the MSM publicity.

Not every pensioner owns a rental. Many are renters themselves with the same issues but no hope of improving their incomes.

Oh and ill conceived govt policies.

Irrational exuberance

It was harder in the Boomer times MW - so they keep mumbling?

Yep. I had a lovely 22.5% mortgage interest rate increased and announced on my honeymoon. Any lending then was difficult to get. We had to save for a minimum 3 years to qualify.

Save for 3 years, oh the humanity, interest rates peaked at 20% in 1987, down to 15% 1991, then dropping to under 7% 1994. Oh and you could buy a home for 3x your income...sounds terrible?

No I said the minimum was 3 years before you could even access finance.

Things are different now but I have a great deal of sympathy for those trying to get onto the property market now. The market is a shambles as a result of the polixies of successive governments.

If doing nothing is a policy

Vote for change, keep voting that way until it happens.

I think you'll find plenty of people voted for change. The failing is in centrist do-nothing government with no inclination towards progress and no interest in accountability.

In other countries, whole governments resign on principle. Now you basically have to assault someone to even get stood down on an interim basis.

We are a laughing stock.

Here we go again - blaming a group who have not control over the current situation. MW or Loser whichever appellation you wish to go by, why blame those on Super? Why not look to the politicians who have shafted every generation that has come along? Piggy Muldoon killed the Govt Super scheme which Sam Stubbs has recently written about, that if he hadn't, NZ would today, be one of the wealthiest country's in the world per head of capita, and we wouldn't have to worry about the superannuation commitments. Do the electorate ask for that to happen at the time? NO! So don't blame them! Too many commentators in these forums are extremists, all or nothing. But the areas we look at and discuss are seldom all or nothing, if ever. Try to consider that when commenting, and put some thought into what you are saying! Blame the politicians for screwing us all, retirees to the youngest generations, because it is their incompetence that gifts the next generations with the mess that they have to live with and try to fix!

From the Sam Stubbs article - "I have seen two examples of the awesome power of advertising in modern politics. One was the “Labour is not working” ad which vaulted Margaret Thatcher into power in Britain, the second was National's "Dancing Cossacks"’ campaign, portraying New Zealand Labour’s Superannuation Scheme as creeping state socialism. It was a major reason National won in 1975."

https://www.stuff.co.nz/business/money/300327451/the-worst-decision-by-…

National campaigned on removing the super scheme. IT WAS A MAJOPR REASON THEY WON IN 1975. The electorate absolutely asked for super's removal and generations thereafter are paying for it.

Agreed, but in that day and age you have to ask; was the National Party's advertising/political platform an accurate representation of what that super scheme was? I suggest it wasn't. I suggest it was a gross distortion if not out right lie, totally encapsulated in political ideology but the general public would not have had any means of determining this (no internet, and the average standard of education wasn't particularly high).

Today information is much more readily available, and people can easily access many opinions on the meanings of various policies and political statements. Essentially this means that potential newer generations of voters can go to the polls, much more informed and prepared.

Funny though, that their decision making process still seems as flawed as it was in the 70's?

Assuming your debt was student loan, the taxpayers (including the boomers) paid 80% of your higher education costs. This will enable you to earn more over your lifetime than they ever did.

However, look to Robertson to thank him for the rampant house price inflation. He dropped interest rates to unfeasible levels, and started the massive free money that kicked this off, in theory to make asset owners richer and protect your job. We could debate their motivations and competence later. And just as a good kick in the teeth, he will ramp up your tax rates once you use your higher education to earn a good income to pay for said debt.

All the while, giving lots more to those not working.... Thanks Millennial_Woman

Looks like your 50K was poorly invested. If you would had put up that 50K into a house deposit during GFC, where real estate was experiencing a deep discount, you would have been a very rich woman by now.

I don't think you understand how Student Loans work, CWBW. You can't just ask the government to give you money to invest how you like.

And yes, in hindsight everyone who stayed at school past 16 would have been better off leaving school and doing whatever it took to buy as many houses as possible as young as possible. That's actually a pretty shitty state of affairs, and not something that was obvious at the time most of us millennials started our educations.

If neither the Reserve Bank or Government can tell us what the consequences of OCR movements are surely the Reserve Banks shouldn't be adjusting the OCR? Best return it to some nominal value (5% or so) while that research is undertaken.

Valid.

If rates moved 1% and house prices dropped 10% that might help.

10% is not enough. We are amidst a very real crisis here. Once we lose our best to Aussie we won’t get them back. And who will be left to care for the elderly who pulled the ladder up firmly behind them?

What's the point of more research when he wouldn't have acted on it anyway so why would he react to it now ? It would be hilarious if it wasn't costing some people a house.

It just kicks the can down the road the same as so many other issues by a govt who has no clue.

The total value of all loans on houses (including rentals) is now less than 20% of total house values - the *lowest* ratio since at least 1998. The interest payable on the $300bn of home loans is now around $10bn per year. In 2016 it was much *higher* at around $15bn per year (on 'just' $210bn of loans).

My point here is that whilst borrowing is this cheap, house prices will continue to rise. If Govt wants low interest rates and smiling middle class voters, they will have to take action to reduce the credit money that commercial banks are happily printing for eager borrowers and investors.

now less than 20% of total house values...

Values can change...the debt won't. A very large and rising risk out there. Just look at latest personal debt levels.

"Finance Minister wants more research done on the winners & losers of low interest rates, but can't say whether having this info last year would've seen him implement different policies"

REASON :This....... do not want to accept that they failed and now only economy is housing economy.

Low interest rates create negative real interst rates.

If bank deposit rates are 1% & inflation is 6% then you lose 5% a year having money in bank. You are a loser.

If mortgage rates are 2% & inflation is 6% you gain 4% per year from borrowing.

If you have no debt but have all your money tied up in real assets. You break even

Except officially inflation is a lot lower. If inflation was 6% when they need to raise interest rates to counteract inflation, to keep it in the required guidelines. Otherwise the low OCR is just fueling the inflation.

Doesn't matter what inflation is officially. What maters is what it is in reality. The market works out what it is anyway & acts accordingly. Cue surging property prices in the last year as people realize their bank accounts are being plundered by our modern day pirates Orr, Ardern & Robinson.

Except the market isn't allowed to work it out, thanks to the RBNZ deciding what interest rates need to be.

Your never a looser with money in the bank. Perhaps one day you will figure that out.

I don't know if your comment is satire or you are a fool?

Shouldn't they have done the research BEFORE reducing the interest rates to near zero? Otherwise why did they reduce them, if they didn't know all the knock on effects. Surely they can see what the effects have been. If they want to bring down house prices, which I don't think they do, then raising interest rates is needed, and increase supply. It doesn't need yet another expensive enquiry to tell them what they already knew.

I am seeing in some towns asking prices dropping, and have been told by agents that investors have dried up. I was the only one interested in some houses when normally they have many.

But the US was doing it . . .

Why does Homer Simpson saying "Doh!!" come to mind?

Every debt farmer, I mean investor, is a winner. Everyone else...not so much. All low wage renters are massive massive losers. Yet Labour fiddles while their core voting block is all but murdered.

As long as the core voting block actually remembers in two years time....

He's looking for the stable door after releasing the horse, which bolted and bought a house..........

Ironic that Robertson is suggests that not having an RIA mechanism for the reserve bank is challenging, when they disabled and ignored the RIA mechanism for COVID, Oil and Gas ban et al. And then they ignore them if they don't match their ideology anyway.

Robertson will go down as one of the worst finance ministers ever.

Withdrawing the need for RIA, hiding debt in other government agencies, many unintended consequences of knee-jerk policies, targeting section of the the population such as "illegitimate" ute drivers or investors, pillaging the COVID fund for political projects and items that do not relate to the health emergency (i.e. cameras for fishing vessels coming out of the environmental job creation fund rather than the operating allowance).

At the moment everyone is blind to it because Jacinda, but things will become more apparent in hindsight.

Sorry to say this, but this really makes me sick. I would rather see them saying "We know low interest rate benefits the assets owners, but we still go ahead for our economy". I don't understand what exactly of research needs to be done. To most people, the findings should be pretty obvious. Also even this justifies lower interest rate last year, but what about removing LVR? Was it something to do with stimulating business and economy?

I hoped to hear that (eventually) too. Maybe with the quantifier of "we didn't expect low interest rates to benefit asset owners so strongly"

I wonder if the explanation is - Labour has two pillars to its voter core. The first wants the poor to be provided for but will happily accrue the benefits of their existing wealth and assets. The second would be the poor people themselves, who don't have the time or skills to understand that low interest rates are benefitting everyone else except them. Labour do not want to spell it out any clearer.

I think the only research been done at the RBNZ & Treasury is who is going to roll the next joint!

There's too much smoke in the room, so much so, nobody can see what they're doing so they're just making it up as they go. Just like a stoner would do as well.

RBNZ "....it would publish more research within the next 18 months" . 18 months !!!! Before the ink is dry the report would be outdated. What research is needed on a matter which is public knowledge?? May as well say they could not care tuppence for the matter.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.