New Zealand's amazingly resilient employment market has once again shattered all expectations in the June quarter - seemingly giving the Reserve Bank little option but to raise interest rates when it next reviews these in two weeks.

Economists were quick to seize on the figures as showing that the RBNZ needed to act, and fast. The new 'norm' of predictions is that the Official Cash Rate will be hiked from the current emergency setting of 0.25% to 1.0% by November. The OCR was at 1% before the RBNZ cut it in March 2020 in response to the rapidly escalating Covid crisis.

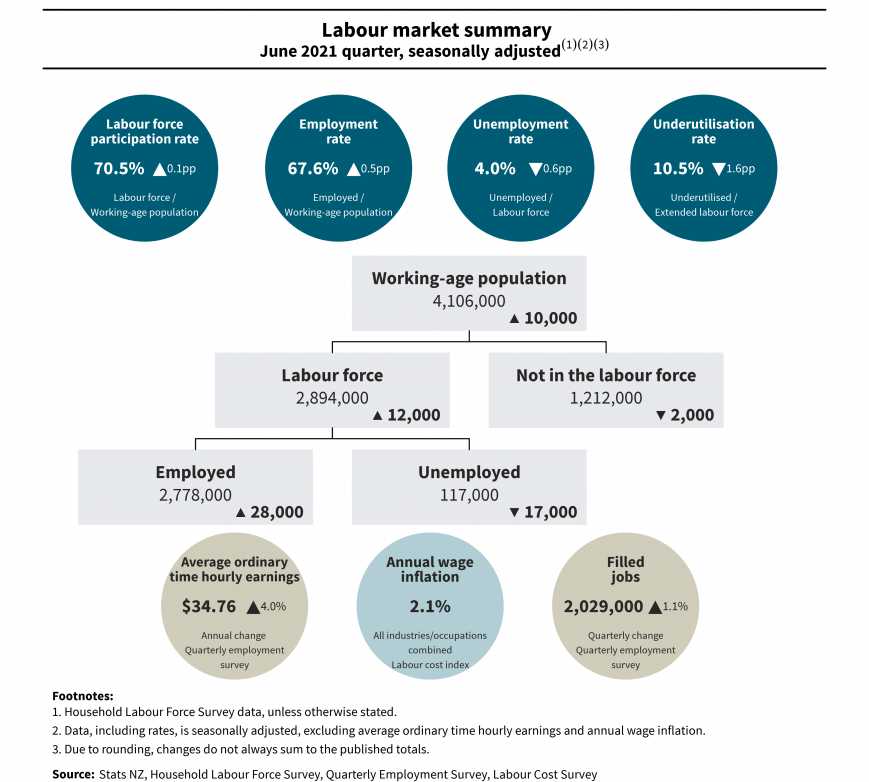

Statistics New Zealand said the unemployment rate plunged to just 4% in June, from 4.6% (revised down from the earlier reported figure of 4.7%) in the March quarter - that's way better than the average economists' forecasts of a 4.4% rate and the RBNZ's forecast of 4.7%.

Additionally, the measure of 'underutilisation', which the RBNZ has been paying close attention to, also dropped sharply in the latest quarter to 10.5% from 12.1% (revised down from the earlier reported 12.2%).

The 'participation rate' rose to 70.5% from 70.4%.

The increasing heat in the labour market is fuelling pay rises, with private sector wages gaining 0.9% in the quarter, for an annual increase of 2.2%. This is ahead of many economists' forecasts, and slightly up on the 2.1% the RBNZ expected.

Kiwibank chief economist Jarrod Kerr said: "Today’s report all-but confirms a rate hike from the RBNZ in August. Strap yourselves in."

The RBNZ decision is on August 18.

A rising tide

Kerr's expecting to the see the RBNZ hike four times over the next year to 1.25%, with another hike to 1.5% likely by the end of 2022.

"All lending rates have risen and will continue to rise from here. If realised, the four-plus RBNZ rate hikes will see mortgage rates closer to 4%, with sub-3% rates evaporating quickly."

Capital Economics Australia and New Zealand economist Ben Udy says the latest figures confirm the expectation of a rate rise on August 18.

"If anything, the strength in the labour market creates a risk that the RBNZ hikes rates by 50 basis points rather than our current expectation of a 25 basis point rise."

ASB chief economist Nick Tuffley said "the sheer strength" of the NZ labour market over the June quarter indicates the RBNZ is "likely to lift the OCR [Official Cash Rate] relatively swiftly over coming months".

"We now expect the OCR will increase by 25bp in each of August, October and November, reaching its pre-Covid rate of 1% by the end of this year."

ANZ economist Finn Robinson and chief economist Sharon Zollner said they now also expected the OCR will be raised at the August, October, and November meetings.

They've added in two more hikes in February and May for good measure, "bringing the OCR to a terminal rate of 1.5% by mid-2022".

Economy 'becoming quite overheated'

"Today’s data shows we’ve flown past full employment, and the economy is becoming quite overheated," they say.

"The RBNZ needs to hike the OCR promptly to get on top of this. We now expect faster hikes this year, but have tweaked our OCR endpoint down from 1.75% to 1.5% in light of the RBNZ’s recent announcement that they will further tighten macro-prudential policy.

"The faster unwind of the 75bp Covid OCR cuts also at the margin implies a lower endpoint will be needed to do the job of cooling the economy. With household debt at record highs and 80% of mortgage debt floating or fixed for less than a year, we don’t doubt the Reserve Bank’s ability to get traction."

Robinson and Zollner said given the strength in latest wage data, "we think that’s only the beginning of strong wage rises this year".

Balance of power shifts

"The balance of power in the labour market has shifted markedly towards workers over the past year, and this is showing up in employees’ bank accounts."

Some of the employment figures detail:

- For men, the unemployment rate fell to 3.8%, down from 4.6% last quarter.

- For women, the unemployment rate fell to 4.3%, down from 4.6%.

The seasonally adjusted number of unemployed people fell to 117,000, down 17,000, or 12.4%. This is the largest quarterly percentage fall since the Stats NZ's Household Labour Force series began in 1986.

- 12,000 fewer men were unemployed.

- 5,000 fewer women were unemployed.

Unemployment

Select chart tabs

120 Comments

Great news all around: higher average hourly wages, lower joblessness and underemployment, greater workforce participation and lower NEET.

The decision to reopen borders to RSE workers was timely with more MIQ places for 'skilled' workers coming soon.

Reopening migrant floodgates to prevent the economy from overheating will be the policy choice before opting for the nuclear option of normalising interest rates.

Great news all around: higher average hourly wages, lower joblessness and underemployment,

And what's the trade off? The purchasing power of the currency that most earn has been decimated. It's more profound at the lower end of the food chain. The sheeple are just not aware of how and why.

In case you haven't noticed, the destruction of middle NZ's purchasing power has been in-progress for years. High migration and market policy failure has allowed zombie businesses to thrive by crowding out high-value enterprises, undercutting local wages and remaining capital shallow.

And yet the price of everything from a latte to a 3-bedroom houses has doubled in a matter of a few years.

In case you haven't noticed, the destruction of middle NZ's purchasing power has been in-progress for years

Yes. I was aware.

Working age main benefits are back to where they were in June of 20 at 350k. In June 2019 we are at 291K, June 18 at 273k

How man billions have been spent to achieve this?

Inflated good news picture due to massive stimulus that a few more MIQ spaces and more taxi drivers will not sustain.

"Reopening migrant floodgates to prevent the economy from overheating" Is that the best option you can offer? Been there done that many times and look where it has taken us! What about increasing GDP per capita and productivity. We need to let competition for labour weed out the low productivity businesses and industry and drive reallocation of resources towards high productivity industries in the economy.

I think the comment was tongue in cheek. The quote marks around ‘skilled’ should have given it away.

:) Fair call. Unfortunately the New Zealand Initiative and ACT types would be in full support of increasing migration to suppress wage growth.

If you have read any of Advisor's previous comments, I think you'll find your both on pretty similar wavelengths.

Yes, that end of town supports these type of policies, because they know the profits are largely privatised while the costs get socialised.

I thought this was an excellent bit of observation from Gary Hawke’s 1981 The Oxford History of New Zealand ( via Croaking Cassandra):

Ironically, the success with which full employment was pursued until the late 1960s led to frequent claims that labour was in short supply so that more immigrants were desirable. The output of an individual industrialist might indeed have been constrained by the unavailability of labour so that more migrants would have been beneficial to the firm, especially if the costs of migration could be shifted to taxpayers generally through government subsidies. But migrants also demanded goods and services, especially if they arrived in family groups or formed households soon after arrival and so required housing and social services such as schools and health services. The economy as a whole then remained just as “short of labour” after their arrival.

croakingcassandra.com/2021/07/07/some-economic-effects-of-immigration

It's ridiculous, you can't keep an economy running red hot like this forever, inflation will be going through the roof before long, it's mishandling by the RBNZ and by the government directing the RBNZ to use anything under the sun other than raising interest rates.

They need to raise interest rates now.

".....nuclear option of normalising interest rates".

Are you serious! The OCR was pushed through the floor as an emergency option to combat the threat of a global pandemic. It seems that was an overreaction now but whatever your view we are most certainly no longer in that place but a certain segment of society now seem to feel that rates should stay forever low because it suits their agenda! The unadulterated, self serving greed of some people is mind boggling.

It's a shame HTML doesn't have a sarc tag yet. It would clear up a lot of this confusion. But I guess it's more funny that way.

Sarcasm or not, still gives people an Avenue to get their point of view across so all good.

Arrrh Nah! 354,000 still in receipt of a benefit. When 1hr equals employment and those that can't work for medical reasons are captured in the available to work benefit known as the 'Job Seeker' benefit'. This is where all these numbers fall over.

The real figure for unemployment is the total number still in receipt of a benefit which is, 11.3% as of this June quarter.

Orr: OCR shall not be raised come what may. I will be consulting about DTI in October and I will wait and watch and see when I can implement it. Least regrets while Rome, I mean NZ burns.

And when we do implement it, we'll give you six months notice so if you've missed out on a property so far, we'll give you this last chance before the changes come in.

Adrian Orr and the government plan of never raising interest rates is getting beyond a joke, it's nothing other than incompetence.

The OCR will be raised this month.

The banks have already priced it in and rates have changed, so there will be little impact initially.

But it will reaffirm the RBNZ is starting to normalize rates which means further increases will be priced in.

So effectively the banks will be doing the work ahead of RBNZ announcements

Well, Well, Well - if the NZ economy isnt overheating I'll eat my hat.

Orr can talk as much as he like about LVR's and DTI's - but there is now no excuse left but to raise interest rates. Either that or face the very real consequences of stagflation.

Agreed, stagflation is something I'm more concerned about at this stage.

Well, Well, Well - if the NZ economy isnt overheating I'll eat my hat.

It's not overheating, If it were, incomes would be off the hook. Anecdotally, they may be rising for some specific specializations.

Annual inflation rate in New Zealand jumped to 3.3 percent year-on-year in the second quarter of 2021.

The increasing heat in the labour market is fuelling pay rises, with private sector wages gaining 0.9% in the quarter, for an annual increase of 2.2%.

Annual inflation rate in New Zealand jumped to 3.3 percent year-on-year in the second quarter of 2021.

If "overheating" means out-of-control inflation (in the expansion of the money supply), then I'm happy to refer to it as "overheating."

Yawn. The only reason inflation is at 3.3% is because we were starting from such a low point at this time last year.

It's really not overheating.

Nonetheless, negative real wage growth is pitiful. Whose well-being is being addressed by any government policy?

I agree 100%. No excuse whatsoever for not raising interest rates immediately, and significantly so.

As a start, the OCR must be raised to 1% in two weeks time. There is no excuse left for not reversing the emergency cut done last year.

Not doing so will simply mean welcoming a long and destructive period of stagflation. Time to action now, it is already almost too late.

Every data they were trying to forecast has failed this year. Clearly, their forecasting tool is not effective during this pandemic. It also validated that RBNZ's monetary policy is way lagged behind now. This doesn't look good.

They are so far behind the 8 ball it's not funny. Unemployment below NAIRU and inflation pushing the top of their target band. Meanwhile interest rate settings are still at their emergency levels. I now think OCR will be 1% by Christmas - even at that level, substantially below neutral.

So this is why they opened up for the RSE workers, not enough unemployed to keep inflation in check!

Everyone is on the sickness benefit these days - increase of 12,200 people on the sickness benefit since July 2020. About 20,000 more than July 2019. Thats how you hide unemployment.

Beware of the base effect. The problem with relying solely on the unemployment rate as a determinant in policy setting is it's a very crude indicator. It does not account for the number of hours worked, the amount received through that work and those who don't want work.

Long term seasonally adjusted real wage growth, labour participation, under-employment and productivity should be considered as part of monetary policies with equal weights to avoid being mislead by unemployment rates.

I think it would be Nobel worthy effort for anyone who can come up with a hedonic economic indicator to better measure employment in relation to the economy.

Higher interest rates hits the poor the most. Think twice.

"Higher interest rates hits the poor the most. Think twice."

Your comments frequently serve your own interests and disregard the truth or the interests of others. Low interest has ruined the chance of a future for many poor and the middle class, especially the young.

Between having a job and buying a house, it's the job that enables the future.

Keeping working hard, young serfs, the asset class need your wealth!

What a future.

Delusional perseverance defines your contributions

Rates are not going up.

Rates going up would precipitate a sudden dislocation.

Reserve Bank mandate is stability.

So a steady decline in living standards, and increase in inequality, for years and years and years, is what they will choose over raising rates.

> Reserve Bank mandate is stability.

Do things seem stable to you right now?

> So a steady decline in living standards, and increase in inequality,

Is inequality not increasing already? I struggle to see how it could get any worse.

Things are stable in the sense that the finance world cares about - the value of assets is not falling.

And yes, I think inequality is going to keep getting worse; and the only actions that could change that trajectory are politically impossible because they would lower asset prices.

So realistically, we become Brazilified - a wealthy minority living in gated communities, cowering in fear of their disenfranchised compatriots. This *will* be accepted instead of effective limits on speculation, because we’re a nation of children with no concept of how history progresses in these situations.

Well put

So realistically, we become Brazilified - a wealthy minority living in gated communities, cowering in fear of their disenfranchised compatriots

Yes. The only thing I will say about Brazil is that the favelas are not located in areas with as miserably cold climatic changes as NZ. Other things to worry about like water sanitation and dengue fever.

So true. Protect the price of financial assets, funnel wealth to the already wealthy, and ensure continued employer power over the peasants - never mind the toxic inequities and the rampant destruction of the environment. It's a recipe for disaster.

I don't know if reduction asset prices is politically impossible, or only just believed to be politically impossible. Personally I have $2,000,000 in assets, and would not shed a tear if that value went down to $200,000 tomorrow, what difference would it make to me? lower insurance premiums? My, and other peoples children would have a reasonable chance to buy their own home? House repairs would be cheaper? Seriously the only thing I would loose is the warm fuzzy feeling of being a millionaire. But maybe I am strange, its quite possible.

two more years of Jacinda and Orr --- why are you struggling -- there is 4 years of overachieving in making things worse to judge by

The problem is that leaving interest rates where they are has consequences of its own in terms of stability. Rasing interest rates by too much may be catestrophic for some, but trying to defend artificially low interest rates will eventually bankrupt the country. They're not going to let that happen either.

Is the 0.9% quarterly wage gains inflation adjusted? If not wages aren't going anywhere.

Boom. Great call.

Immigration is very targeted at the moment to support primary industry, if inflation continues on a tear the Government WILL open up the border to vaccinated workers. This will put out any remaining embers of the hope for greater than inflation wage growth.

To be fair greater than inflation wage growth should only be warranted when productivity is increased.

Real wages are actually falling with inflation running higher than income growth. This is the silent tax caused by excessive money printing. It's our standard of living falling in real time statistics, right here, right now.

and if your a retiree using term deposits the news is even worse as your only getting a 1% return on a term deposit

1% before tax.

RBNZ 'printing money' made no difference at all to inflation, which has been caused by demand exceeding what globally disrupted supply chains can deliver.

made a heck of a different to asset prices and has massively increased inequality because of it -- and with 40billion+ in the current account -- slightly overdone i would say

QE increased the price of *financial* assets (bonds directly, shares etc indirectly). To be fair that is exactly what QE is designed to do - hold up the price of bonds, and therefore keep market interest rates low (yield curve control).

BUT, the housing bubble is the result of low interest rates + buyer confidence (inspired by Govt commitments) + easy access to finance + ridiculous tax settings that drive investment into property (and inelasticity of supply).

The $40bn in the current account is disconnected from QE too. All that QE does is swap Govt debt in the form of cash for Govt debt in the form of bonds (securities). You can see this very clearly in the RBNZ balance sheet: https://www.rbnz.govt.nz/statistics/r1. The Bonds that RBNZ has purchased are under 'Securities - large scale asset purchases programme' and the cash that has gone into the commercial bank's settlements accounts is sat under 'Deposits'.

thank you and some points noted for my learning - that said the point that QE is supposed to hold prices up is different to teh effect of massively increasing them -- teh QE really drives lower interest rates and made access to finance way to easy -ergo QE is the drivign factor in house price rises -

Is the 0.9% quarterly wage gains inflation adjusted? If not wages aren't going anywhere.

They're going backwards. You're using the 'officially sanctioned' CPI as the measure of inflation. You're being conned.

Where do these fictional numbers come from? A look at the actual number of people receiving benefits (from MSD data) shows there isnt a single benefit category where there are less people receiving a benefit than in 2019. The number on the sickness benefit has jumped hugely, not just from 2019 but also from the same time in 2020.

https://www.msd.govt.nz/documents/about-msd-and-our-work/publications-r…

It's not being compared to 2019, but to 2020 (one year ago), the MSD graphs you linked to show a big jump in 2020 due to covid which is being slowly reversed. Comparing to 2019 is problematic as we had around 100k migrants that year and the MSD graphs are all absolute numbers, not percentages like the ones quoted here. Do note that the unemployed number decreased by 17k in the stats release, which isn't too far off the 15k fall in JS recipients in the year to July.

Check the chart above that shows unemployment numbers over the years, and you will see that the unemployment rate is supposed to be lower than what it was in 2019. This is despite the absolute numbers showing that this is a load of rubbish. Any fall in the number of Jobseeker is because everyone is transferring to the sickness benefit, which is still up 12,200 people since July 2020. Must be all that "long covid" right? Or just the slack Labour Govt making it so easy for everyone to rort the benefit system these days.

They're not measuring the same thing, stats reports about 10k more people unemployed than in June 2019 (due to population growth), your link shows maybe 30k more on the JS benefit over a similar period. Are there ways you can be employed as per stats, and on the JS benefit? Probably

In July 2019 4.5% of the population was on Jobseeker. Currently its 6%. Yet the Labour Govt is determined to pitch this as a win. Just goes to show you there really are lies, damn lies, and statistics. The Labour Govt is clearly hiding the real unemployed numbers.

The number of people receiving a benefit and the number unemployed are not well correlated, plenty of ways to be unemployed but not get a benefit. (have a working partner being the most common)

Yes, but in that case the number of unemployed would be HIGHER than the number receiving unemployment benefits, not lower.

In the Household Labour Force Survey (where Stats' unemployment data is from) the % is of the working-age population defined as the whole population aged 15 years and over, excluding visitors and people in prisons/institutions. It is the % of people over 15 who are seeking work (including aged over 65).

More generally, working age refers to the population aged 15-64 years. In MSD data, the unemployment benefit rate refers to the percentage of the estimated population aged 15-64 who are on a benefit.

The denominators are thus very different in the two data sources you are comparing.

Because the focus of this government is being nice to all the people with their hands out for one reason or another, whether it's an apology for enforcing the law against people that were breaking the law in the 70's or anything else.

This would include the rampart corporate welfare since forever?

Got to have strong businesses if you want to pay as much tax money out to various people as this government wants to, they are on the spending spree from hell, or does money grow on trees in your world?

Not sure this has really changed rate expectations. NZD/USD and NZD/AUD up less than 0.5%? Will be interesting to see if the swaps move.

Isn't that 0.5c bounce immediately after the announcement reflecting the markets view that NZ OCR increase are now more certain

Sure. But there's not much there, well less than 0.5c. A bit more certain, nothing like a dramatic change.

The wage news is very positive. Wages growth has a long way to go to regain ground on house prices over the last two decades. Hopefully the reserve bank will hold the throttle to the floor for the rest of the year and really push wages along. Higher wages mean more investment in businesses (e.g. automation, mechanisation etc.) which will improve productivity.

But inflation is running higher than wages so people are going backwards and keeping interest rates low will likely make that worse. The housing market would also keep going strong so why invest in business? There are no incentives to innovate and be productive anymore, just use the banks money for tax free capital gains. Property is squeezing out our future prosperity (I quite like that line, it should be used as a protest banner!)

what do you think 10% wage inflation year on year for a decade or so will do to the economy....even if the RBNZ managed the impossible and kept interest rates down?

Hopefully inflate away the debt.

Great. Plenty of alternative opportunities for Nurses wanting to escape.

Always has been, Australia: https://www.nzherald.co.nz/nz/nz-nurses-and-midwives-welcomed-across-th…

Covid is making that difficult at the moment. That option has to wait.

Perhaps thats the real reason why Jacinda closed the borders. Stop everyone trying to escape.

Imprison the nurses and bus them to the hospitals in chains.

It constantly amazes me that the RBNZ can move so swiftly to drop interest rates, but are so sluggish to react when the emergency rates are left in place too long and start causing more harm than good.

Reserve Bank may have a more important mandate-same as The FED. Keeps rates low enough long enough to allow Sovereigns to refund their countries respective debt as historically low interest rates given the amount of new debt they are taking on. US$25 Trillion at 1% versus 3% is US$500 Billion a year difference to the annual budget. Same theory would apply in NZ. And real estate can only inflate to the degree that enough people can service-or qualify for higher mortgages. Seems we may be getting there without an increase in rates.

You think sovereign states are interested in repaying debt? I am not sure why they would, if inflation starts to get uncomfortable print more money.

Real estate has quite some way to go before serviceability is an issue at these rates.

https://thekaka.substack.com/p/dawn-chorus-why-rate-hikes-wont-stress

ASB chief economist Nick Tuffley said "the sheer strength" of the NZ labour market over the June quarter indicates the RBNZ is "likely to lift the OCR [Official Cash Rate] relatively swiftly over coming months".

"We now expect the OCR will increase by 25bp in each of August, October and November, reaching its pre-Covid rate of 1% by the end of this year."

Hmmmm.. Go Early, Go Fast? Go Deflation

I would love to see further breakdown of the 'Not in the labour force' numbers. It's nearly 30% of the working age population! Surely not all of these people are parents of young children, students, people with disabilities etc? Add the shown unemployed figure to this and its 1,329,000 or the working age population not in work.

Put another way, the NZ population clock currently sits at 5,134,977, meaning around 2.3 million people (45%) aren't in work. Does anybody know how this compares to other developed countries?

The number is quite normal by international standards. People not in the workforce include

1. Retirees - so a large proportion of those over 65.

2. Stay at home Mums and Dads- not all families are dual income.

3. People who are currently ill or disabled and have temporarily or permanently left the workforce.

4. People who have left the workforce to care for others ie elderly parents or sick/disabled children or sick partners / brothers/ sisters etc

5. Everybody under the age of 18 and uni students who dont work.

As said above it is ~30% of the working age population that aren't working. Seems unlikely that 30% of the population fall into one of these categories:

2. Stay at home Mums and Dads- not all families are dual income.

3. People who are currently ill or disabled and have temporarily or permanently left the workforce.

4. People who have left the workforce to care for others ie elderly parents or sick/disabled children or sick partners / brothers/ sisters etc

Maybe you missed this one:

6. People who are bludgers

So ~70% of us work for ~45 years paying ~30% tax and then expect ~30 years of NZ super / healthcare / rest home / etc, and the other ~30% don't work at all and expect their entire life to be paid for. No wonder governments all around the world are in debt!

I don't think you realise thewanderer that in the Household Labour Force Survey (where your numbers are from), the working aged population is defined as the population aged 15 years and over (not those aged 15-64).

Your 30% not working quoted thus includes all retired people, as well as students, unemployed, the rentier class etc

You've used the entire population number there, can you come back with the population minus children and those of retirement age (yes, many are still working, but 65 is retirement age)

(a) 4% unemployed and 10.5% underemployed does not equal full employment economy.

(b) the excitement about the Reserve Bank having to increase the OCR comes from those ideologues who want to keep a low wage economy going

here is a great article (from 2018) that explains full employment. In quick summary the idea of full employment is that so few workers are available that companies need to begin raising wages to attract help.

https://theconversation.com/what-is-full-employment-an-economist-explai…

Wages in NZ have gone up almost 1% for the quarter (this is really really high - average wage increase in the last decade has been 0.3-0.5% a quarter) and companies are saying they are having to counter-offer with higher wages to keep employees. So effectively there are not enough available employees in the market and employers are having to lift wages to attract help- hence we are at full employment,

Full employment means only frictional unemployment and no underemployment.

NAIRU is just a discredited concept to ensure there is a sufficient army of the unemployed to keep wages down and profits up.

So we can have massive inflation in assets (namely housing) for years on end, destroying hope and future quality of life prospects for younger generations, but as soon as labour shortages start to put pressure on wages inflation we'll crank up interest rates to put a stop to it? Sounds about right.

Reading the whiny comments on the need to raise the interest rates actually helps brighten the day- when you realise the same people who complain about low interest rates are also the ones complaining about low wages.

Hearing about people struggling makes you happy. Got it.

Without motivation, man loses his purpose in life.

Struggle is good.

Yeah ok, bet you're not in that camp

Reading your whiny self centred comments on the need to keep interest rates low makes me laugh.

"Won't somebody think of the poor?! Get in quick!"

"Reading the whiny comments on the need to raise the interest rates actually helps brighten the day" You are funny! Why are you so scared of raising interest rates? You think interest rate only can go down but can not go up? You'd be dreaming. No such thing as a free lunch.

Can't have the plebs finally getting the upper hand now can we? Mustn't let them rise above their station.

Have a look at ANZs plotting for house price affordability in the link and then plot annual wage inflation of 2.2% against 24% annual house inflation.

https://www.interest.co.nz/news/111536/anz-economists-estimate-it-would…

Still think the economy is going gangbusters?

Yes. Because the housing market is the economy.

“However, we just don’t think it’s feasible for growth in house prices to significantly outpace income growth for much longer, as at the end of the day someone has to pay the rent or service the mortgage sitting behind such exorbitant house prices."

Sharon Zollner, ANZ.

Now you may think that default risk dosnt exist but even the banks arnt quite so foolish as to think that.....nor the RBNZ or Gov. who realise that ultimately even they cant underwrite it.

And covid is the new monetary policy.

Lets hope that China can get on top of it's Delta Strain outbreak and/or the Chinese vaccines offer enough protection against hospitalization and deaths. Otherwise the supply chain disruptions that will come down the track will be ugly for everyone's predictions.

So does this mean that the government and the RBNZ did all that work these last 12 months for naught? All that low interest and QE printing could've been avoided and we would've ended up in this similar position?

The calls for interest rate rises are reaching fever pitch - but a minor change will make zero difference. Mortgage debt servicing costs as a per cent of disposable income have not been as low for decades, and the handful of people who might feel the squeeze and reign in some spending won't make any difference to aggregate demand. And, the idea that real businesses choose not to borrow / invest when the interest rate is a bit higher has been disproven time and time again (yet economic models are still based on this theory).

It would be great to dissect the 4% to ascertain why they are unemployed.

Unsurprisingly, based on historic trends, Maori and PI unemployment is I think 7.8%.

In the current climate it would be worth working with some of these longer

term unemployed to get them into work rather than taking migrant labour.

You can lead a horse to water...

Many people know how to work the benefit system down to the last cent they are entitled to receive. If you do the math of a low paid job and the transportation costs then your better off being unemployed and getting paid to do nothing. This also gives you the maximum amount of time to pickup some cash paying side hustle. I have been out of work a couple of times but it took ages to find out even some of the tricks, if you have been unemployed for years and mix with other unemployed you learn much faster. You can pickup additional benefits I never knew existed or was never told about. Its an artform and you would be shocked at what can be "Claimed" on a benefit if you can keep your bank account on a near zero balance .I'm not saying its a luxury lifestyle but then neither is some minimum wage job.

Do you have any data to back up your bigotry?

It is not "working" anything to avail yourself of what you are entitled to, that space is reserved for those obtaining what they really are not.

Remember when we had the unemployment benefit, the sickness benefit and the invalid's benefit. We no longer have one of those.

Remember on the job seeker benefit there are those that used to be on the sickness benefit, which was ditched some years ago, so I doubt there is a true picture there, and sadly there will be the unemployable and people deemed to close to retirement to get many jobs on offer.

All those jumping up and down about people "getting a job" should be celebrating right now, they listened to you.

I'm calling it BS!

With 354,000 still on the main benefit. 4% is BS. In total its 11.3%.

Screwing with the figures to maintain a better forecast and outlook scores from the international markets and financial institutions will eventually get called out when 'they' have a proper look at the books.

So I guess tourism isn't that big of an impact to the GDP afterall.

I've never seen such amazing numbers. Maybe we should just continue to keep the borders shut, since we are achieving record breaking GDP, house prices, and also now low unemployment! Seems to be that we have the perfect situation, so why ruin it by letting people in/out.

Keep the borders closed!

4%?, this is what they mean:

What they mean is there's 1.212 million working aged people they don't count.

Less the 800,000 retirees the stats department say exist, that's still over 400,000 people. And some of this is sensible. Stay at home parents, those on an extended break, students and so on. So these are people who rightly should not be counted as unemployed, because they are not looking for work.

But there's a whole other cohort of people in that 400,000 people who should be working, but just aren't. So for instance, a young guy who spends all day on the couch playing video games and says "There's no jobs out there" or those who have really tried hard to secure a job, but can't get one and so have given up.

Anyone who hasn't been for a job interview for 4 weeks is considered to be 'not actively looking' so isn't considered unemployed. There are literally hundreds of thousands of people in NZ in this situation.

And the 'employed' ones are those who work 1 or more hours a week. Yes, if you work 1 hour, you're considered employed.

This is the 'U3' measurement of unemployment. It's one of 6 measures from U1 to U6. It's the one most governments quote because it makes the situation look really good. When it isn't.

We need to get the 100 or 200 thousand people of working age, who should be working, into work. However hard that might be. Leaving them to form a feral underclass is not an option for a good country. We end up paying for this in all sorts of ways: Homelessness, crime, courts, police, hospitalisations.

So don't believe the nonsense headline percentage.

We still have approximately 320,000 adults that can't or work work on state assisted lifestyles.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.