ANZ economists say they are seeing evidence of "typical late cycle" behaviour starting to show in the economy - but believe that this time around New Zealand can avoid the boom-bust pattern of previous cycles.

In their weekly Market Focus the economists cited as visible 'late cycle' signs: Rising household credit, deteriorating savings, housing market excesses, a tightening labour market with skill shortages and some signs of a pick-up in non-tradable inflation.

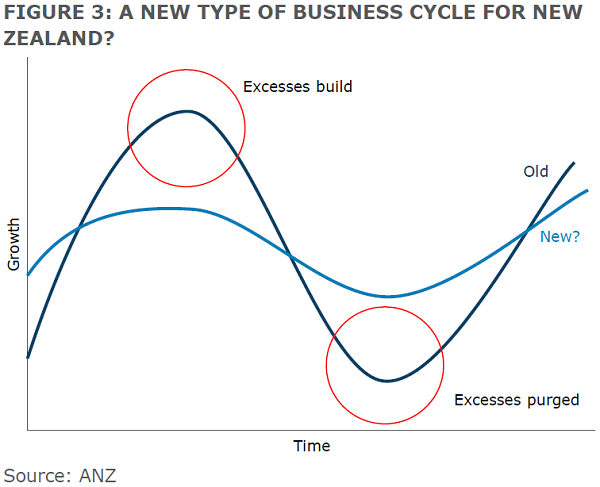

They pointed out that previously the New Zealand economy has tended to show "hi-beta" characteristics, namely big booms in the economy, but big falls too.

"While real GDP growth has averaged a respectable 2¾% per year since 1990, there have been peaks of close to 8% and troughs where the economy has contracted at a 2½% annual rate over that time. Big swings and a volatile business cycle have been par for the course."

They said that part of the traditional cyclical nature has reflected the fact New Zealand is a small, open, agriculturally focused economy, dependent on the global backdrop.

"But it also reflects the tendency for the economy to build up significant internal imbalances late in the economic cycle, which then ultimately require purging.

"Imbalances can make the economy even more vulnerable in periods of economic uncertainty. Recall that the New Zealand economy headed into both the Asian Financial Crisis and the Global Financial Crisis with weak structural metrics (a large current account deficit, deteriorating household saving, housing market valuation excesses, credit growth running north of 15%, and strong domestic inflation pressures), in effect making the economy far more susceptible to a turn in the international scene. In fact, the economy had already dipped into recession in 2008 before the full brunt of the GFC even hit."

So, given that backdrop, they posed the question of whether New Zealand was now heading for a repeat of the boom-to-bust economy.

"We would argue not," they said.

There will be "swings and roundabouts", they said, and the current strong momentum across the economy won’t last indefinitely. Natural handbrakes to growth (capacity and credit moderation) will eventually see things soften.

"Our point is simply that amidst all the cyclical indicators, close attention needs to be paid to structural ones too. It is when they get out of whack that pressure mounts for some purging. New Zealand has clear signs of deterioration in some areas, but not the breadth we’ve seen in past cycles, and on numerous levels, including policymakers and the finance sector, we are seeing important differences.

"This gives us more confidence that when a turn in economic performance does come, and it will, the ‘landing’ will be mild, unlike previous experience of rapid swings. Or put another way, it puts New Zealand in a far better position to handle swings in the global economy, which is where key challenges reside."

Key factors the economists have pointed to as making things different this time are:

►Despite the current housing market largesse, New Zealand's external position is contained, with the current account deficit, at 2.9% of GDP, below its historical average, net external debt, at 56% of GDP, far lower than its peak of over 80% in 2008.

►The RBNZ is "actively taking away the housing punchbowl" via LVR restrictions and the spectre of debt-to-income limits. With over 93% of new residential mortgage lending now done with at least a 20% deposit (compared with less than 70% in 2012), the financial system is sounder.

►There is little in the way of a shadow banking sector to be seen with household non-bank lending only $5.9bn, and growing at just 1.9% y/y. At just 2.4% of total household lending, it is down from over 9% in 2006.

►There is a shortage of housing, with the economists estimating a shortage of close to 20,000 in Auckland. Some of the areas where the market can be most vulnerable to a correction when the cycle turns (i.e. sections and apartments) are now where more supply is most needed.

►Banks are now restraining credit at the top of the cycle. "That’s a hard thing to do but entirely appropriate if boom-busts are to be averted." The financial sector is far more focused on making the numbers add up: matching deposit growth with lending growth.

►Inflation is low, and set to be for some time. The economists see little urgency for the RBNZ to lift interest rates, and when it does, it will be slowly. "The latter is key. Given the build-up in household leverage, even small movements in rates are going to pack some punch."

21 Comments

File this article and read it in 3 years time... could be interesting

Lol yes, "this time it's different..."

Because ... reasons.

And maybe magic.

By the time the next correction occurs Auckland's competing cities - Brisbane, Sydney, Melbourne, Hamilton, Tauranga - will have spent the best part of a decade building homes and office space 20%-150% faster than Auckland. So to suggest there will be a "shortage of housing" is unmitigated BS. By the end of this boom there will be an oversupply of modern housing in every part of the Australasian Market., apart from Auckland (and the same goes to a lesser extent for office space). Auckland will have a shortage, but everywhere else will have an oversupply.

What makes you think the demand in Auckland will stay constant post boom? What makes you think the opportunity to pay high rent in a depressed town is one that a corporate entity or young person will want?

When the boom ends, I suspect everyone who does not own property in Auckland will leave. They will go to places with lower rents, better housing and more jobs.

Auckland will stop having extremely high property prices and start having prices akin to Adelaide.

It's happening now. Those with well-paid transferable jobs and no housing are already leaving. From my contacts in banking, IT and health, several colleagues have left for cities with lower costs - primarily to Christchurch and Tauranga with a few to the provinces.

Cripes, seems as though the BNZ is looking to precipitate a bank run by those recently in receipt of excess, unsecured, recently fabricated O/N bank liabilities after completing a residential property sale or two. Read more

I just shifted some cash from an ANZ bonus saver to BNZ bonus saver since BNZ had the better rate. Now they're the same. I wish the bank could do me the courtesy of sending me an email when the rate changes.

I was thinking the same thing, too

The one positive that I agree with is this time the lending criteria is being tightened into a rising market rather than a falling one which has happened in the past. I expecting weakening in the property market at some stage over next 3 years but don't expect the bust in the same way as before. Singapore and Hong Kong are in the midst of a contolled correction in their housing markets but there are no obvious signs of underlying stress in the banking sector. No doubt a few individuals feeling poorer though.

The lending criteria in NZ is nowhere near that of the strict standard of Singapore.

NZ regulation of investors is still extremely weak compared to good practice in Asia (Singapore and Korea), particularly if you take into account the low elasticity of supply of the NZ market.

The LVR limit for investors in Singapore is 20% for larger investors (compared to 60% in NZ),

plus they require a 25% cash down payment (no collateralisation with other properties) ,

plus tenure of loan is limited depending on age of investor.

plus tenure of loan cannot extend beyond 30 years.

NZ has tightened from previous extremely weak or non-existent credit control, but not to a sufficient degree, and too slowly.

May be avoided this time.... but not the next time... and that one might be a doozy..

reminds me of Gordon Browns speeches in the late 1990s' where he said that the labour party had done away with the boom/bust business cycle.

https://www.theguardian.com/politics/2008/sep/11/gordonbrown.economy

I'm reading / hearing a few nasty things about imbalance in the Sydney / Melbourne property markets.

I think a collapse in the bubble in these markets is the biggest risk in collapsing the NZ market.

And trust me, if Aus was to go down, we would too

These economists should pull their heads out of the dark place they have them and take a broader look at the world we live in. We are a trading nation, not just a branch office of real-estate-gone-wild dot com. The world is tipping into deflation, demand having been paralysed by debt. I would suggest another type of curve needs to be added to the graph.

'Its different this time'...never gets old!

As far as I can tell ... the modern business cycle is, largely, a function of the credit cycle...

One mans spending is another mans income.

there is a point where borrowers decide to pay down debt.... This tipping point is kinda profound, even thou it seems benign ... at some point the debt burden kicks in... the debtor loses a little confidence and decides to pay down debt.

Borrowing brings forward tomorrows consumption.... repaying debt requires a double whammy...

ie. No longer bringing forward tomorrows consumption...AND... actually consuming less today.

This has a marked effect on aggregate demand.

As far as I know.... It is impossible to avoid this tipping point.... At best it can be delayed ... the longer it is delayed the more malinvestment , and the bigger the downturn , ...when it happens..

gets more complex.... as NZ is very much open to the "Global World'.... so what happens in the Big wide world has a huge impact on us..... We are far less self reliant and far less robust in our ability to handle global shocks... I think..

Having said that.... right now ..the sun is shining...

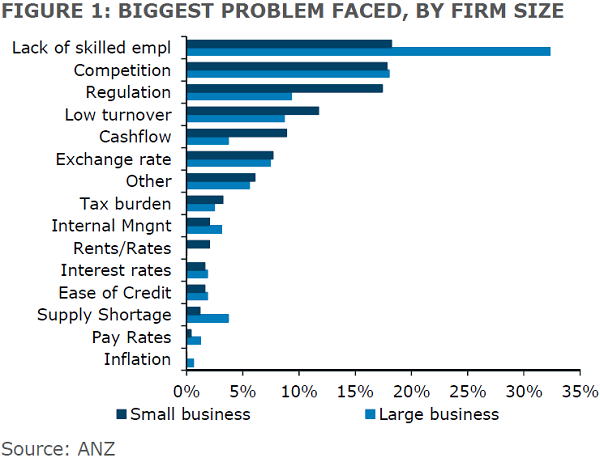

Figure 1 is quite interesting.

It highlights some good flaws in the market, on its lonesome.

Possible 'tipping points':-

Largest global scale financial bubble in history (inevitable sovereign bond sell off)

Syria - military escalation USA v Russia

Disintegration of the euro zone

Deutche Bank

China's slowing economy

Economic costs of increasing cyberterrorist

Referendums in Europe

Japan's deteriorating financial condition

Weak Italian Banking sector including many other banks within EU

The world has never been in a more dangerous place but yes, the sun is still shining.

Should we assume that the market has already accounted for the USA electing an a-hole (Trump or Clinton)?

Recent history shows us that no matter what the precursor (oil shocks, GFC, Asian Markets etc) every 10 years or so the amorphous market corrects. 1977, 1987, 1997, 2007, ....2017? August and October being popular months. Now might be a good time to go short!

The graph of business problems highlights a few interesting things . One that large business is far better off than small business on most counts. Secondly, there are reported massive skill shortages but absolutely no pressure on wages. Perhaps getting some pressure around incomes would help on two fronts one to entice people into jobs and two to help build some pressure around inflation.

Sharemarket down 8% over the last week, nobody seems to care(except me with shares)

Any system that exhibits oscillatory cyclic behaviour like this is not in control. Sure a lower peak to peak amplitude is better. in a physical system this sort of response is indicative of a system with too much negative feed back and insufficient damping. In our economic system to much negative feed back could be interpreted as the Reserve Bank over reacting through the OCR/inflation model. Right now is a case in point. The RB is planning to apply one or two more cuts at the point when many of our indicators are starting to point to more buoyancy. Taxes could be interpreted as a form of friction or damping. The stimulus of low interest is resulting in asset bubbles. These in large part are not taxed, so there is very little friction or damping to this form of growth. Apart from the other benefits of a CGT, it would also provide more stability in our economy.

While boom and bust cycles suit the investing/speculating sector, they are damaging to the economy. Just recently the construction sector were complaining how hard it is to manage their bushiness in this environment. This also applies to much of the rest of the productive economy.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.