So, 'Kiwisaver', the retirement savings scheme, is continuing its transformation into 'House-deposit-saver'. Kiwisaver is becoming Kiwiraider.

Yes, that's right. The young of New Zealand are flocking to convert their future retirement nest eggs into heavily mortgaged houses, by withdrawing funds from Kiwisaver and using this as a deposit for a first home.

I think this is a problem and a problem that's likely to get worse if not tackled. But I don't think there's an easy solution either.

We do know that in a flat if not falling house market first home buyers are becoming more and more prominent.

As the official RBNZ figures indicate first home buyers are now forming an increasingly significant portion of mortgage borrowing.

Given how the FHBs withered away after the introduction of the Reserve Bank's loan to value ratio (LVR) 'speed limits directed at banks from 2013, this resurgence of the FHBs now can be viewed as 'good' news when looked at in isolation.

However, two sides to every coin and all that. The official Kiwisaver withdrawal figures give you a pretty big hint as to what is fuelling this FHB activity. And that's potentially not good news at all in terms of the future.

I opined on this subject as long ago as nearly three years ago now.

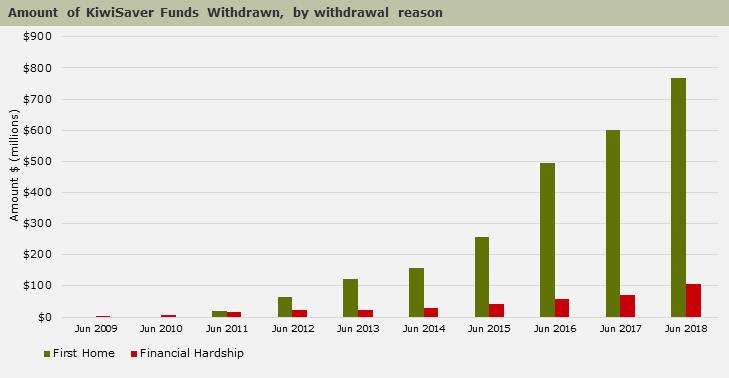

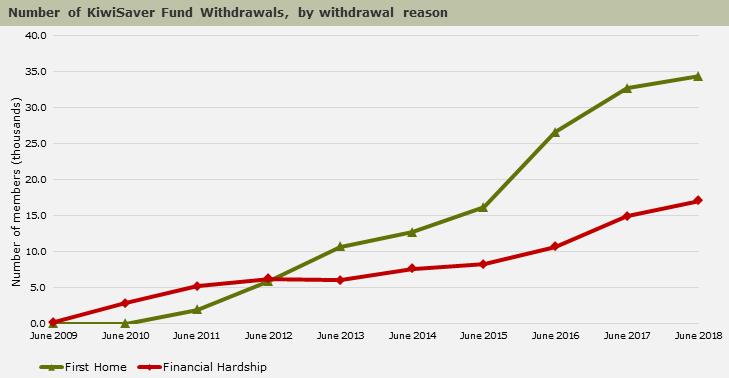

Since then all that's happened is that more and more young Kiwis are raiding their retirement savings to buy a house. The trend to withdraw Kiwisaver funds to buy first homes has increased.

KPMG's head of banking and finance John Kensington last week questioned whether this growing trend of young Kiwis raiding their Kiwisaver accounts to buy houses might have negative future consequences.

"Given [that] Kiwisaver is designed to be there for retirement, it does beg the question of whether this trend of many young Kiwis using Kiwisaver now for a home deposit is just pushing the problem of retirement affordability down the track for future generations," Kensington said.

Those comments by Kensington were made in relation to the March quarter of this year.

I can go a bit further forward than that.

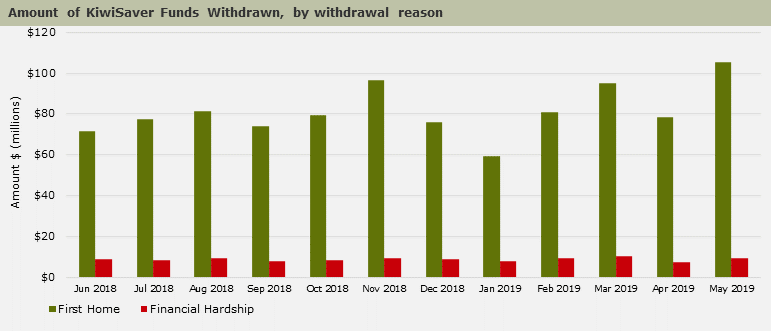

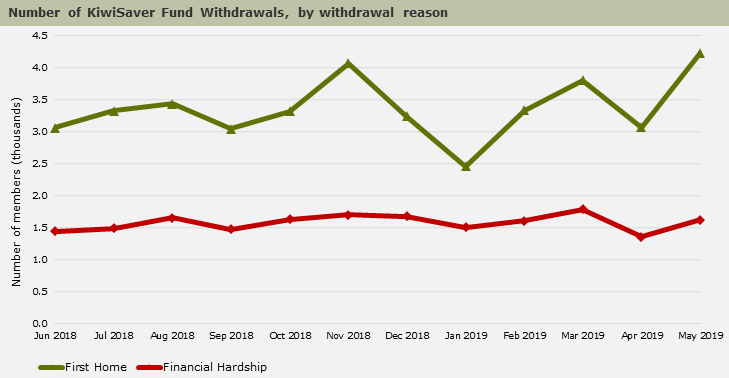

In fact the two months after the end of the March quarter have seen more increased activity around withdrawals from Kiwisaver accounts.

The most recent month for which figures are available is May 2019.

The official Kiwisaver figures show that in May some $105.6 million (up 18.1% from $89.4 million in May 2018) was emptied from Kiwisaver accounts to buy a first house. Some 4230 account holders (up from 3950 in May 2018) made these withdrawals.

That means, on average, the amount of money withdrawn was a touch under $25,000 per account.

If you assume two people both doing this, then there's $50,000 towards a house deposit. With a 90% high LVR mortgage, there you go, into a $500,000 house. Maybe.

In the year to June 2018, a grand total of $873 million was withdrawn to use for house buying.

But, hey, you ain't seen nothing yet...

In the 11 months to May 2019 this figure has already been surpassed, at just under $905 million.

The FHBs are averaging a bit over $82 million a month in withdrawals in the 11 months to May.

So, the June 2019 year is likely to see a total of just under $1 billion withdrawn. At the current rate of growth, the $1 billion will be easily exceeded next year (to June 2020).

The impact of all this can be seen by going back to those Reserve Bank monthly mortgage figures.

The FHBs surpassed the investors in mortgage borrowing in May for the first time since the RBNZ started publishing this data in 2014.

Borrowing by the FHBs totalled $1.15 billion in the month, which was a new monthly high total. Of this, some $480 million was for high LVR (above 80%) mortgages.

Okay, if we then put the $105.6 million of money raided from Kiwisaver accounts in May into the mixer and start doing some sums, we can see that even applied as deposits on houses with 80% LVR mortgages our $105.6 million could raise over $400 million in mortgages.

But of course we know that $480 million of the total mortgage money advanced to FHBs in the month was for high LVR mortgages.

Right then, if we play around with the math a little more and say all those high LVR mortgages were 85% (and clearly some would actually have been higher) then this would get us $565 million worth of houses. That's made up of $480 million of mortgages and $85 million worth of deposits.

So, in theory all of that $480 million of high LVR mortgage money could have been borrowed against deposits that were raided from Kiwisaver accounts - and there would still be $20 million of Kiwisaver money left over. So apply the $20 million remaining into 20% deposits and we could borrow another $80 million in 80% LVR mortgages. That would give us $665 million worth of houses, and an eye watering $560 million of mortgages.

Kiwisaver funding half of the FHB house purchases?

Therefore, I reckon the KPMG estimate that something like half of FHBs' total deposits for buying houses is possibly being sourced from Kiwisaver accounts looks about right. In fact it might even be slightly conservative.

So, yeah, something like half of the FHBs are getting into their first homes courtesy of money that was supposed to be put away for retirement.

Well, is this actually a problem?

This of course is where we get into the interesting and highly subjective area.

And the commenters reading this will already be gagging to say, if they haven't already: "But buying a house is a much better way to save for retirement than Kiwisaver!"

And the point is that history shows buying a house is a good investment towards a retirement. So, who is to say to someone that wants to raid their Kiwisaver account that they shouldn't?

But it is putting all your eggs in one basket.

The idea of Kiwisaver is that you can diversify your risk.

Now, however, we have thousands of young Kiwis tipping all or most of their money out of their Kiwisaver accounts and into a house. How long will it take them to get back up to speed again in terms of their Kiwisaver savings?

The fact is that there is a risk if we, perish the thought, do get a big housing bust in this country, that thousands of people who might have been otherwise insulated through Kiwisaver are knocked back by instead putting it all on the house.

Kiwisaver propping up the housing market?

There's a couple of other thoughts that form here too.

First is, to what extent is the housing market at the moment being propped up, in terms of prices, by young people raiding Kiwisaver accounts?

We can see from the figures what impact the raiding of Kiwisaver funds is having on the overall mortgage statistics.

How would the housing market be looking if these young FHBs were not finding deposits from Kiwisaver and so therefore were not buying houses now?

Might the overall housing market be softer than it is?

Is this raiding of Kiwisaver accounts in fact helping to keep prices artificially raised?

Undermining Kiwisaver?

The second point that comes to mind is, to what extent is all this withdrawal activity undermining the original purpose and intent of Kiwisaver?

Is there any point in having a 'Kiwisaver' as such if people simply treat it as a housing deposit scheme? The retirement scheme that you dip your hand into just as soon as you can.

When I wrote on this subject three years ago, I wondered if there was another way to do all this. And I still do wonder that.

Is there a way in which young wannabe FHBs can use the savings in their Kiwisaver accounts as collateral for house deposits without having to pull the lot out of their accounts?

Would we be better to offer people the option of 'splitting' their Kiwisaver contributions - with some going into an account that can be accessed for a house deposit, while the rest goes into a 'don't touch this' account?

Ideas need considering

I note that there have already been suggestions made of a 'rainy day fund' within the Kiwisaver scheme. Clearly these sorts of ideas have got to be considered.

Look, this issue was identifiable as a problem three years ago.

Since then, to my knowledge nothing's been done to address the issue and in the meantime more and more people are doing this.

And the assumption is that as the amounts in Kiwisaver accounts do grow then so more and more people will look to raid their accounts.

We don't want everybody pledging everything on the house. This country is arguably already far too dependent on the health of its housing market.

In an ideal world as many of us as possible would by retirement age have our own freehold houses - and other retirement investments as well. Diversification. And that surely is what Kiwisaver was about.

There's room for us being able to achieve both property ownership and a portfolio of investments, but I think this situation with Kiwisaver needs urgently addressing.

It's a growing issue and nobody so far as I can see is addressing it.

Government needs to look at it

I suggest the Government needs to look at this and review the purpose of Kiwisaver, what the money's being saved for, and how Kiwisaver members can and can't access money.

Is there another way, independent of Kiwisaver, that the young would be able to access to get deposits for houses?

We need to look at this issue as a matter of urgency.

Otherwise we are going to end up with a retirement scheme that's stocked with IOUs.

And that's where KPMG's concerns about simply pushing retirement affordability down the road come in.

Kiwisaver is supposed to help fix these problems. The risk is it could actually worsen them if it is purely used as a house buying scheme - with all those eggs going into that one basket.

44 Comments

Thanks David

These problems were known from the moment using it as a house deposit was mooted.

But needs must. The Ponzi scheme that is house buying needed feeding and still does.

This is why National backed the changes to allow people to put their hand in the biscuit tin.

Yep, just look at the spike in withdrawals from when that occurred.

Those 3.4 house per MP portfolios have to be inflated somehow, you know.

Will people get their Kiwisaver back up to speed after a house drawdown on the account? No. What people are missing out on is the compounding gains. Compounding gains need as many years as possible for the effect to growth into some reasonable amount for retirement.

I am cautious about a rainy day portion. In the US they take out a loan from their 401K account. This sells assets to pay money to the person (which they need to set aside the tax for this too as the account is tax exempt). Then the person has a loan from their 401K which charges about 4% interest.

While this seems like a legitimate response many people draw their entire account to spend on stupid purchases. Then they fail to repay the loan to their own account. Also the 4% usually means they are missing out on much larger gains. No drawings except emergencies needs to remain in place.

Also when people buy a house they suddenly find they have a lot of outgoings now they have a mortgage, rates and various expenses moving into a house (you need all the appliances and furniture which were provided by the landlord or flatmates). It's not so bad if you target a mortgage at 33% of net income. Terrible if your household income drops or you borrowed the deposit.

People need to save their emergency fund separate from a regulated account that should not be allowing drawings.

In terms of compounding gains the internal rate of return on a home purchase is bannans so overall they are probably doing fine on a returns view of things; more likely than not they would be doing better than a person who did not end up owning a home. Secondly you do not need as many years as possible, you need enough years, this figure varies from person to person and it can certainly still be consistent with using kiwisaver to buy a first home.

I suspect that there are going to be a lot of people that neither have enough years or enough of a balance. A further problem is the risk of still having mortgage payments past retirement age (assuming the low inflation environment continues).

So yes, it can be consistent with buying a home. Are people actually working this out? I'm pretty sure 95% of people won't as their goal is to have a home and not a retirement account with a sufficient balance at retirement and during retirement.

I dont have stats on it so im not sure but a lot of young people are using KiwiSaver to buy their first home. The price is constrained to 600K, with a 540k loan. If the couple is 25 then id suggest thats an absolutely colossal win for them and the country. Id guess most people using kiwisaver to buy are in their 30's, late to the party, but even after emptying the fund they will have about 30 years to build it up, ample time.

I really think the problem is not that you can use kiwisaver to buy a home, i think thats a good idea, but rather it should be mandatory to kiwisave and at a much, MUCH higher percent of income.

The percentage of income would be much lower if people saved for a house deposit separately. So perhaps we are approaching a similar idea in different ways.

Certainly we both agree people need to save more :-)

"The price is constrained to 600K, with a 540k loan. "

Eh? where did this come from? There are no constraints i'm aware of except for leaving the $1000(?) govt start up contribution in.

KiwiSaver runs two deals, the first home withdrawal which has no limits, and the first home buyers grant, which has income and house price caps along with minimum deposits but is worth up to 40k for a couple. I dont know the stats on the relative uptake but in my limited exposure I see the grants been used by young people.

Laminar, Your point is well made, but there may be 2 wrinkles

1) current interest rates and returns are much much lower than historic norms (and reducing) so we could see a long period of minimal returns that affect the ability to recover over 30 years especially if interest rates migrate to zero

2) the main thing I suggest is that this deposit money now supports a $600,000 ish FHB floor in the market say. If this was floor was removed, what would lower end prices be? and for me this is the issue, less borrowing for my kids and much less pressure on them.

Laminar, Your point is well made, but there may be 2 wrinkles

1) current interest rates and returns are much much lower than historic norms (and reducing) so we could see a long period of minimal returns that affect the ability to recover over 30 years especially if interest rates migrate to zero

2) the main thing I suggest is that this deposit money now supports a $600,000 ish FHB floor in the market say. If this was floor was removed, what would lower end prices be? and for me this is the issue, less borrowing for my kids and much less pressure on them.

where else are young people going to get a decent return whilst saving for a house, no point putting in a bank you are going backwards at todays interest rates.

kiwisaver is an easy way for our young to invest in international equities to get a better return without all the road blocks cullen put in the way.

I know many that are now upping the amount they tip in get a deposit together for a house, then will decrease the amount later back to save for retirement.

yes it will affect what they have saved for retirement but if they have a mortgage free house they will be better off

and yes I have no doubt it is helping hold up the lower end of the market

What about those that get a 30 year mortgage who are older than 35?

Their income will increase a lot over those 30 years so they'll be able to pay down their mortgage sooner and/or still be able to save for retirement. If they don't save anything then they'll have problems regardless whether or not they used Kiwisaver to buy a home.

The views of KPMG's Kensington last week masquerades as being in the interests of savers when in reality it is in the most definitely in the interests of fund managers.

It alarms me that this view is being given traction by this article.

The reality is that there are life stages, and for responsible young people, saving for and buying a home is - as it should be - their first focus in providing security for themselves and their (potential) family. Saving to provide for retirement is a subsequent goal and issues related to compounding interest over time is just simply scaremongering.

Most importantly, what Kensington and this article overlook is the reality is that if KiwiSaver funds could not be used to buy a first home, then most young savers would not opt into KiiwSaver in the first place. The risk of deferring would mean high risk that many would not opt into KiwiSaver at a later time.

I have no doubt that Cullen and his working party when designing KiiwSaver reflected on the experience of the old Government Superannuation Scheme for public servants which clearly proves this point. The Scheme was solely intended as a savings scheme for retirement. The reality was that - and I hope Kensington and Hargraves take careful note - the majority of savers opted out of the Scheme to buy their first home and for many if not a majority did not opt back in despite having opportunity to do so. I know this, as I had a managerial role in the public service - with responsibility for pay matters - for what was a supposedly educated professional staff but only a small handful of those who would have been eligible still had their GSF scheme despite very attractive provisions (a 6% employer contribution) and being compulsory to join as a youth. (And this happened despite there being a separate dedicated First Home Owners Savings Scheme for a period from the 1970s.)

I welcomed KiwiSaver in its current form as it addressed this issue as I believed it would encourage long term saving including that for retirement.

As much as the fund managers would wish, KiwiSaver was not designed solely as a retirement scheme. It was a saving scheme, with provisions for saving to both buying one's first home - with bonuses provided - and retirement. This article with its bias for fund managers - while claiming to be in the interests of individual savers - makes me bl**dy angry.

Hear hear, hit the nail on the head.

Fantastic comment.

Another outstanding post P8, great to have you commenting on this site

Thanks - appreciate the comments.

I like to think I am old enough to know enough to both know that that there is a hell of a lot more that I don't know, and that what I know is that I am not always right.

Cheers

printer8,

Seldom have I seen so many complimentary replies as you have received for your lengthy post above. However,what I want to comment on is this post. Voltaire said; "Doubt is uncomfortable,but certainty is absurd". Even better in my view is what Benjamin Franklin said in 1787 at the signing of the new Constitution; "For having lived long,I have experienced many instances of being obliged by better information,or fuller consideration,to change opinions even on important subjects.which I once thought right,but found to be otherwise. It is therefore that the older I grow,the more apt I am to doubt my own judgement,and to pay more respect to the judgement of others".

Intellectual humility is a great gift and you clearly possess it.

Your point makes more sense when one remembers that a majority of the KS funds are invested through the Banks.

Easy pickings for them to add to their bloating profits ?

printer 8 - nail on the head

"It's a growing issue and nobody so far as I can see is addressing it. We need to look at this issue as a matter of urgency." - What is the issue? It is a one off drawing generally by younger people when funds are generally low for a long term investment that will give them a better return. Dont forget to include the government contribution.

Once in a home FHBs are then able to target their retirement savings plan.

"We don't want everybody pledging everything on the house. This country is arguably already far too dependent on the health of its housing market."- Ok you are free to opt out of home ownership if you think it is a bad idea.

What about when a large portion of these FHBs are in their mid 30s or older. Certainly the case amongst several of my friends, those that didn't get hand-outs from family. Several have recently or are shortly planning to buy, and all AFAIK will clean out the kiwisaver to do so.

Pragmatist - "What about when a large portion of these FHBs are in their mid 30s or older."

What about them? If FHB's have waited until their mid 30's or older to buy a home that is their choice, one advantage is that their deposit should be larger? Maybe they should have chosen to do their O/E and home purchase the other way around?

Yes, it was my choice the price of a house doubled in the time I was at university and pursuing my professional qualifications. Maybe boomers shouldn't have strangled supply and jacked up immigration for their own benefit? Nah it's smashed avo or some other shit.

For the record, the furthest I've been from home is Adelaide, when a flight to Melbourne got diverted due to bushfires. So maybe that counts as an OE? I don't know. Either way, everything is millenials' fault, right?

How true but the question is does any government thinking of long Term or without vote bank politics

richard 1965

Sorry. I must be a bit thick..but can you expand or re-write that to make your point clearer?

I don’t actually mind people withdrawing from KiwiSaver for the first house as long as it’s their first house. National I recall loosens things a bit in favour of people who got divorced or something.

The age is probably the variable to track. Ideally people do it in the late 20s/early 30s. The later the withdrawal the greater the loss of saving opportunity.

With a bit more thought, the rationale for allowing people to withdraw for a first house is surely to avoid disincentives to join. If people couldn’t withdraw for a first house there would be a strong incentive to buy a house before joining KiwiSaver. However, you can still argue that based on this withdrawals should be limited to the persons contributions and not allow employer/govt withdrawals.

What is happening with policies like KiwiSaver and kiwibuild is they get hijacked but a social assistance agenda. The purpose of KiwiSaver is to aid saving for retirement, the purpose of kiwi build is to build more houses efficiently.

When you say ‘how can we modify KiwiSaver to make it easier for young people to get into houses’ you are mucking up the policy process.

I have no regrets cleaning out my Kiwisaver for a house. 2 years later, my 25% deposit is now almost 50% equity, mortgage payments are only $200 per week.

It is just commonsense for people to buy a home for their own occupation for several reasons.

If they don’ t it suits property investors, if they do it increases prices so being in property as an investor just makes sense.

Kiwisaver is a great idea for many as they can not save for day to day expenses let alone retirement.

Hopefully the sharemarket will not crash one day as it will have huge ramifications for those nearing retirement.

You give terrible advice. Made me laugh, keep up the good work.

Grendel, what terrible advice have I ever given?

I can tell you that my advice is sound as it gets, and have several people that have taken my advice, and are now so greatfull and better off financially than returns on any KiwiSaver account.

"Otherwise we are going to end up with a retirement scheme that's stocked with IOUs."

My retirement scheme having an IOU is a much more attractive proposition than trying to use an IOU for warm, affordable accommodation for myself and whatever offspring I may spawn. Guess which one is more of a pressing concern? It's not the money I can't access until I'm 65.

You can't blame FHBs from accessing their KiwiSaver Accounts for a deposit for their own family home- it's all well & good for all of us who lived through home owner ship accounts & had the ability through it to get our first homes.They have to jump through various hoops & start resaving for their retirement, otherwise rent for life?

Owning your own home is arguably the most important part of retirement savings. Even buying 5 years before retirement is still in my opinion worthwhile.

It's a fair comment that everyone pays a mortgage, either your own or the landlords. At least buying has the effect of locking the rent (apart from interest rate risks) at today's pricing.

I know there are those that say we're going to have a house price crash and maybe we will but the house price trend will almost certainly continue upwards over the long run.

KiwiSaver isn't being gutted it just isn't as high as some fund managers would wish.

We had the forerunner of the HomeStart Grant a few years ago where people were helped into their first home with no deposit.

But in August 11 2013 John Key announced “International experience shows it’s risky to lend 100 per cent of the value of a first home. So in expanding these schemes, we are assisting these people to put together a deposit, but we are also requiring them to have an initial stake in their asset as well.”

Ignoring the fact that many NZ'ers in the past got their first homes with government assistance (remember capitalising family benefit?) and that the children of the wealthy continue to this day to get into their own home with no deposit through guarantees and gifts.

I wouldn't have been able to buy my house late last year without the use of kiwisaver. We'd already put off having kids so that we could pay down student loans, get married and have a brief overseas holiday for our honeymoon. Lived pretty modestly too. Happily cleared out our kiwisaver to get a decent deposit and made sure we could afford repayments on a single income when a baby would eventually come along. This was a deliberate move from the start and has always been part of our financial strategy since we first enrolled in kiwisaver. Still got 35+ years of work to build up the savings again. Sure we won't have the same compounding interest, but we do have a warm, dry home for our new born and don't have to put up with rent increases. I think we've made the right call.

Great stuff, sounds a lot like our story 2 years ago when we bought. My wife stayed at home for 15 months before she got sick of it and went back to work, and as you say not having to put up with rent increases or potentially being turfed out at the end of the tenancy is well worth it. Being able to use Kiwisaver meant that we could reduce the size of the mortgage and subsequently the payments to a point where we can live comfortably on one salary.

Totally agree. When people compare renting with ownership, they do not take into account a lot of non-financial benefit (or difficult to quantify) benefits of home ownership. While you are renting, there is no guarantee that the landlord will renew your tenancy. Sure, if you are a one person flatmater, then that is no a huge issue. But if you have a family with young children, lots of stuff etc each move costs a good amount of money as well as a lot of time lost on looking for another place, application, viewing, etc.

With the current short term oriented model for renting, it is very important from a quality of life perspective to buy a house as soon as you can if you have long term plans (e.g. a family with a permanent base). The short term rent model only benefits those who want to be very mobile.

Our most basic needs are food, water, warmth and rest. Two of these require housing. Ask yourself this - if you were 35, needed to save over $100,000 for a deposit on a house would you want to use your KiwiSaver? It would mean that by 60 you would be freehold on a 25 year mortgage and still could have saved for retirement over the 25 years with probably another 5 to 10 years to ratchet this up.

Alternative is to wait and be at the mercy of rent inflation which frankly if you did this 25 years ago I doubt you would have thought the average rent would be $600 a week! The pension doesn't cover this but would be ok if you owned your own home.

Plus, no guarantee that future pension won't be means tested and this usually starts with the amount of cash you hold rather than a home. Personally if I was 35, wanted to start a family and get into my first home I'd raid that piggy bank.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.