By Benje Patterson*

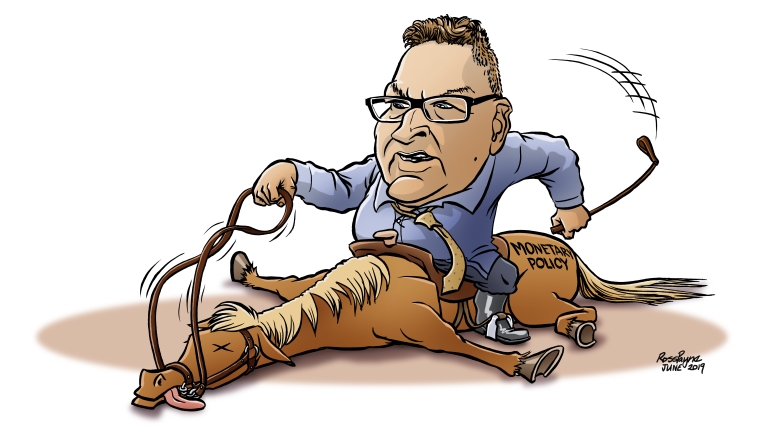

The Reserve Bank’s target interest rate, the Official Cash Rate (OCR) has been slashed to a record low of 1.00%. Against a backdrop of a burgeoning international trade war, Reserve Bank Governor Adrian Orr is worried about being left behind in an international race-to-the-bottom to devalue currencies and support exporters.

The problem now is that the Governor has become impotent if he wants to further support a slowing economy by conventional means.

Immediately after slashing the OCR by 0.50%, the main banks reduced their two-year mortgage rates by just 0.04%. A mere $40 per annum saving on each $100,000 of mortgage! Hardly enough to party at the shops with.

The reality is that the banks source a lot of their money on international markets, where the OCR is irrelevant. And even for domestically-sourced funds, the banks are somewhat constrained. Banks can’t afford to cut term deposit rates much more or their steady supply of relatively cheaper domestically-sourced bank funding may dry up.

This situation is problematic for the Reserve Bank.

The traditional theory that cutting the OCR will prompt more spending has reached its limits.

Adrian Orr has used up virtually all his ammunition. Trying to stimulate demand by cutting the OCR further from a 1.00% starting point is like taking a scalpel to a sword fight.

But just because Adrian Orr is impotent, doesn’t mean that the government is.

Take the Finance Minister Grant Robertson for example. If he really wants to pump up the economy, then he has options.

Minister Robertson could either cut taxes, or boost spending on big projects.

Spending on big projects would take a long time to take effect. Precious time that we would not have in a real crisis.

That leaves tax cuts as being the best short-term option.

And even better, would be to target these tax cuts at lower income households via a cash handout.

The idea is that these people will spend an unexpected cash windfall, which in turn will boost the bottom line of businesses around them. Giving money to the rich is less effective as they are more likely to not need the money and simply salt it away.

Minister Robertson could ask the IRD to put their fancy new computer system to work and deposit say $1,000 into the accounts of a target group.

This type of approach worked a treat for Australia in 2009, where Prime Minister Kevin Rudd gave $950 to most people. Unlike New Zealand, Australia warded off a recession at that time.

At least New Zealand is in a good starting point for considering such options. Our government’s debt is low by international standards, so it shouldn’t be hard to borrow a little more to stimulate demand should the s**t really hit the fan for the economy.

*Benje Patterson is an economist. This article first appeared here and is used with permission.

86 Comments

1 - That's very different to saying the full amount will be capitalised into rents (i.e rents increasing $20 per week). Yes, a portion will be capitalised, but nowhere near as much as you initially implied.

2 - This is a one off impulse. Overwhelming majority of rents are fixed in the medium term - so the effect will not be a direct capitalisation into market rents. Perhaps there will be a propensity for it to increase short term accommodation (marginally), but not longer term.

So. No. Rents will not increase by $20 per week.

You could be right, but you might be wrong.

Business needs more confidence to invest and spend. An infrastructure spend, to guarantee work for what otherwise would be downtimes.

There is little life in the housing market, because first home buyers cant afford the step. Even on a deposit of 5%; which I wouldn't recommend, it takes years on low wages to purchase a $500,000 home. Even allowing for kiwisaver contributions of 6% per annum on an average combined household wages, it might only accrue $25,000 in 3-4 years if you're lucky. I would suggest these average households couldn't afford a 6% contribution anyway with the high cost of living in this country. Get the picture.

Governments best investment would be labour only contracts on constructing more housing (with a focus on infill). That would allow them to negotiate better material costs, from the cartel that are ripping off smaller building companies and Joe public. The question is will they have the noose and fortitude to go down this road. Would seem a no brainer to me, and pamper to their voters.

If government doesn't disrupt the current supply chain, their infrastructure spend profits will keep going to these cartel operations; some of which are predominantly overseas owned.

I'd hope this isn't the extent of Mr Patterson's knowledge; I'd have expected such a report to come from a 6th Form high school economics class - so I can only assume it's a presentation he would make to those who have far less grasp of the dire situation New Zealand find itself in than most commentators on this site do.

I'd hope this isn't the extent of Mr Patterson's knowledge; I'd have expected such a report to come from a 6th Form high school economics class - so I can only assume it's a presentation he would make to those who have far less grasp of the dire situation New Zealand find itself in than most commentators on this site do.

I disagree. Patterson understands that consumer spending is the bedrock of the economy. He puts this understanding into a common man's vernacular so that people can understand. Also, it's not a "report."

Oki Doki.

So tell me, for starters, who is this 'targeted group' that's supposed to benefit from your consumer spending? Low, Gross Income earners; Low Net Income earners; Those with a mortgage; those without; the Old; the Young? ( give all 18 y.o Kiwis $1,000 and you'll get better spending outcomes than giving it to older Kiwis?!). It's one of the reasons we don't have 'targetted groups' It's all too arbitrary; hard to identify the right people ( stand all Kiwis over 18 in a line from the poorest to the richest and have someone pick a place in the line to signify 'That's it! No more for you', and ask the person first to miss out how they feel, and explain to them "they just missed out" or the one after that, or the thousand after that.)

It's an all or nothing suggestion, if Aged Superannuation is any guide - all eligible Kiwis should get it, for all of the foregoing reasons.

So then assume a million Kiwis of working age get $1,000. Where does the billion dollars come from? More debt ( because we don't have much National Debt? Yes we do! it's all in Private hands, and in the grand scheme of things, that make it worse!).

It's an ill-conceived, old, failed concept and one that I am sure will be given a run at some stage, just to prove how ill-conceived and prone to failure it will be, just as a naive 6th Former might advocate for.

We are headed for a painful economic reset - all of us - and no amount of tinkering at the edges will help us avoid it now.

In Australia, I think the free money given out by Rudd was for everyone. Regardless, the target is for low-income households. How that is defined is irrelevant. Also. everyone benefits from consumer spending. It comprises approx 60% of GDP. That is why asset bubbles are tolerated as they promote consumer spending. NZ is not Japan. We're not going to build highways, new airports, public transport that people want to use....even in the medium term. It seems to be that giving out cash is probably the best short-term fix. Furthermore, the govt doesn't need the money to make this happen. It can simply create it. I'm not a fan of MMT but much of what the proponents say about the mechanics is reality. The govt can simply credit people's bank accounts.

Good Lord! 6th Form Economics at ist's best - "the govt doesn't need the money to make this happen. It can simply create it."

Ok. Go ahead. And tell me what it feels like to have to fill your car up the very next time after The Government has 'created money' at - $10 per litre - because the day New Zealand does that, it's the day the NZ$ falls to, well pick any level you like around US$10 cents= NZ$1.

Hasn't it dawned on you yet that - consumer spending is THE BIGGEST PART OF OUR PROBLEM!!! Why? because (1) we aren't consuming our own goods - we import them on balance, and that eats away, every day at our livelihoods and (2) we have to borrow on a net basis to spend at the household level - leverage up our borrowings on our properties, in effect, adding to the cost of survival for ensuing generations. How good is that!

And as for " the target is for low-income households. How that is defined is irrelevant. ", you do know that any good tax accountant, or even better - a bad one!, can reduce even the wealthiest person in New Zealand's net income to $0 if they so desire? So. Do they get the hand-out because they have low net income?

Good Lord! 6th Form Economics at ist's best - "the govt doesn't need the money to make this happen. It can simply create it.

Nope. Economics as it works in reality. If you think that govts are constrained like a household or business, you probably need to bone up on economics.

(1) we aren't consuming our own goods - we import them on balance, and that eats away, every day at our livelihoods

Partly correct. Most household expenditure on non-discretionary items such as food is produced in NZ. But whether or not we consume locally produced or imported goods is beside the point.

(2) we have to borrow on a net basis to spend at the household level - leverage up our borrowings on our properties, in effect, adding to the cost of survival for ensuing generations.

Also beside the point. If h'holds "lived within their means", the economic situation would be more dire. You seem to miss the point that consumer spending is the be all and end all of economic vitality for NZ.

hmmmm

when times are tough can we assume that people are going to spend all or most of the $1K?

I'm not sure about that.

So many people are financially stretched, including myself, that much of the money will simply go to paying off debt, or just contributing to paying the bills which are already so hard to pay.

I'm not sure if the author has kids. Kids are expensive. And for many of us, even upper middle income earners like myself, it's often a pay packet to pay packet existence. For many of us, the $1000 would not be something we could justify carelessly spending on consumer goods or services.

So many people are financially stretched, including myself

Are you aware that 50% of NZ h'holds have <$1000 of cash savings? I think approx 70% of h'holds have <$10,000.

$1000 of disposable cash is quite significant in NZ. Most h'holds are living paycheck to paycheck.

Please tell us how the government specifically creates the money without creating a debt liability elsewhere.

Don't confuse the branches of the monetary system. The government, at least in NZ does not issue currency, so cannot create it. This is the job of the RBNZ..Funnily enough they also have a set of objectives which are at conflict with such an arbitrary practice.

Barring a significant change to the Reserve Bank Act and the PTA, the government cannot arbitrarily create currency.

Please tell us how the government specifically creates the money without creating a debt liability elsewhere.

By not taxing the money back from h'holds.

Don't confuse the branches of the monetary system. The government, at least in NZ does not issue currency, so cannot create it. This is the job of the RBNZ..

Wrong. The govt can spend money into the economy without the ability to issue currency. The govt creates money whenever it spends.

What?

That doesn't just create money.

Wrong. The govt can spend money into the economy without the ability to issue currency

Yes. By borrowing.

Helicopter money comes in two forms; either:

1 - From the Govt's balance sheet. In the case of deficit spending this is a debt liability.

2 - From currency issuance. This is not explicitly a ruling 'government' function in the majority of Western countries. Essentially, the Govt. has to offer up something to the Central Bank to 'issue' this currency - normally in the form of bonds. Alas - back to #1

Yes. A govt. can spend more than it receives. By borrowing.

And n'not taxing households 'back' (whatever that means?) doesn't imply money creation.

So. Not "creating" as you first argued.

Furthermore, the govt doesn't need the money to make this happen. It can simply create it.

So private banks create credit out of thin air through fractional reserve banking, yet you have real issues with the government creating currency or credit in a similar way? People worry about currency devaluation by government action, why is the same scrutiny not given to private banking credit creation!?

So tell me, for starters, who is this 'targeted group' that's supposed to benefit from your consumer spending?

Easy, give it to everyone with a Community Services Card - as they have already been eligibility assessed;

https://www.workandincome.govt.nz/products/a-z-benefits/community-servi…

"but wouldn't the tax threshold reductions that were legislated but removed by the current government have been a better long term option and benefitted all ?"

No, because those tax cuts were used to pay for the families package instead, which directly targets people on low incomes with children, whereas the way the "tax cuts" were structured, most people earning under $50k got nothing from them.

Increasing the lower thresholds would mean lower to middle income earners have more take home pay to spend and that does mean people up to $48k but not so much those over that would have been better off. Given that fiscal stimulus is needed the tax threshold increase seems obvious - benefit increases would be derived from the resulting economic efficiency. (And the tax threshold increases would have helped the lower income families on the way).

The more you earn the more you benefit. Anyone earning below the current lowest marginal rate of $14k (10.5%) would receive no benefit at all from a threshold increases proposed by National. To receive the maximum benefit from National's threshold changes a person would have needed to earn $70k or more. Do you understand this?

No, sorry I don't. https://www.tvnz.co.nz/one-news/new-zealand/budget-2017-tax-thresholds-… may not be the best source but it shows that the lower income benefit equally in dollar terms and more proportionally in take home pay. Sorry the math is simple and I do have a degree to prove it. I'm simply saying here that in a discussion over economic stimulus I think tax cuts are beneficial and a threshold increase is a way of doing that which benefit everyone... and proportionally those on lower incomes the most.

I was partially correct. You have to earn over $52k to get the largest tax saving of $1,060 a year.

I found this calculator (https://2017.budget.govt.nz/budget/2017/family-incomes-calculator/index…) which shows annual tax saving for a single person with income as follows:

(a) $12k = $0

(b) $22k = $10.77/wk

(c) $32k = $0.77/wk (as they would lose their independent earner tax credit under National's proposal)

(d) $52k (and over) = $20.38/wk

I still stand by my point the wealthiest get the best outcome under a shift of marginal tax rates as they get the benefit of all threshold movements (i.e. anyone earning over $52k would have received the maximum benefit of National's changes).

Yeah - it's the bit's in the margins (b) was 20K etc that need more calculation since the thresholds are not on K boundaries. I might look at your question (and should as it should be a trivial when beerless exercise) but it's a bit academic and not worth posting here.I didn't factor in the IETC here (should have since I've claimed it !)

They already know. Though I got the Aussie drop into my oz account even though I'd returned to NZ by then and had updated address etc. Didn't spend it since didn't need more stuff ... maybe we don't have enough spending and inflation because we already have either enough stuff and don't need more or we have too much debt depending on demographic/situation and so can't justify spending more.

If the government's goal of the spending is to detector stimulate the economy, then it's much better than a $20/week tax cut. This way people get the money up front in a lump sum and can spend it on deferred maintenance, pay off debt that's been holding them back or other bills. $20/week may easily just be frittered away and obviously a permanent tax cut costs lost revenue forever more.

On the flipside the lump sum also costs the government more.

Not necessarily, the government could introduce a tax free threshold on the first 10k earned while introducing a new tax bracket (lets say 40% on anything earned over 150k), it could be structured to benefit the poor while being revenue neutral for themselves. Numbers are ballpark of course, I haven't tried to work out what numbers would be required at either end of the tax income spectrum to achieve this.

I wonder how much magic this helicopter money is working?

https://www.workandincome.govt.nz/products/a-z-benefits/winter-energy-p…

This is NZ we are talking about, don't go doing anything sensible like the Aussies did, incase it might work! No, just do what we did last time from 2007 to 2017... force the economy INTO a deep recession by making a huge blunder of monetary policy (Alan Bollard!) that way we'll already be on the canvas when the externalities mount up and drive us even deeper into recession. Then, elect a moronic government of 'financial managers' who evicerate public spending, gut welfare support and give the wealthy a tax cut so they continue to do well despite it all. Then lie about the state of the economy for the next three terms....

Save extreme measures for extreme situations.

Labour should have ramped up spending on big projects 2 years ago - enough people could see the slow down coming, and we'd be reaping the rewards now. But like they say, the second best time to plant a tree is now. After all, capital has never been cheaper.

And if a shock hits before the effects are felt, we can look into other options (tax cuts, one-off payments, etc.)

Someone suggests giving poor the money because they spend it a la Keynes 1936. And of course no one on here likes it! Surprise! Tax system in nz is one of most regressive in OECD but heaven forfend we ask the bloody rich to pay more etc. the feeble tax base here is why infrastructure is so long in being done

If the government wants to stimulate a bit of inflation it is dead simple. Lower the unemployment rate by removing employers access to cheap immigrant labour. That will absolutely stoke wage increases and price rises. All that lowering interest rates has ever achieved, is over investment and speculation in non productive assets including property. Thereby strongly impoverishing workers who will accordingly spend less. This is exactly the script that we have witnessed over the last 11-12 years. i.e. totally counterproductive. More of the same will only make matters worse. Definition of madness - keep on doing the same thing while expecting a different result. But then again the financial powers may be more interested in enriching the financial elite. I cant think of any other logical or sane explanation. This Labour government is even worse than National as they reversed National's regulations requiring employers to try to find Kiwi staff before importing staff.

When I was a student I got summer work with hay carting contractors in OZ. Hard work but movie star wages.

Now if Kiwi firms models cant attract locals with wages attractive enough to cover the back breaking work they do then those businesses need to close. Paying the minimum wage isn't good enough for the short term employment away from families staying in camping grounds.

The government needs to resist these crocodile tears such as below and just let the fruit rot. If its across the board wages for this type of work will rise.If you look across NZ we are being invaded by cheap immigrant labour whether it be pickers, taxi drivers, petrol station workers, truck drivers - you could go on for ever. The efect on NZ workers is disastrous, not just on their employment opportunities but also on house costs....

https://www.stuff.co.nz/national/politics/115937485/strawberry-price-hi…

As an aside how can these companies pay minimum wage yet also cover flights, accommodation etc for overseas labour yet can't offer better rates to kiwis?

Agree. When I was a high school kid I worked as a rousey in a shearing gang. I was paid 10 shillings an hour. Both a long time ago and a lot of money then. If you go to the statistics department web site, that equates to somewhere between $60 and $70 an hour today, and remember I was only a kid. You would have no trouble getting mature adult staff at those rates today. Of course what has happened since is that our economy has moved to one based on asset speculation, so farm prices have increased well beyond the point where they can both afford to make a profit and pay a fair wage. At the end of the day both the farmers and their staff have been enslaved by the banks in the asset price speculation money go round that governments of all colours are doing everything that they can to support.

My father was paid the equivalent of $36 an hour for picking fruit. And provided with a dorm to sleep in, because orchard owners knew there was no way they'd attract seasonal labour if folk had to then find accommodation to rent.

Orchard owners have no idea how good they've got things today, being coddled by the state freeing up cheap, exploitable labour.

Why do we need stimulus? Yes growth is dropping, but we are at capacity. The problem isn’t that we lack demand it is the we lack the means of production to meet demand.

Also, the exchange rate has dropped quite a bit since the OCR cuts? So that will provide stimulus for exporters and make all those expensive TV shows filming in Auckland.

The government taking on debt to fund inefficiency stimulus projects is pointless. If unemployment was up I’d be all for it.

Also, one of the reasons we have to horde money is our low retirement age and ageing population. Maybe they should raise the age of Nz super and give out money saved at the same time.

If the housing crisis had been addressed over the past 10 years rather than ignored there wouldn't be such an issue. With lower housing costs we'd have more to spend or save. Rather than talking about helicopter money we need to solve the structural economic failures in our economy. But as a nation we get what we deserve.

Here's a better stimulus idea.

GST cash back for a limited period of time, say three months. Only available to claim the cash back if you have a Community Services Card (meaning you are already pre-qualified as in need) and on provision of receipts. So, you save up all your receipts for three months and then submit them to IRD for your return.

They have sales tax cash backs in many US states.

I agree, the economy isn't dire but there are many individuals and families struggling. GST at 15% is a killer regressive tax for low income households, particularly those with children. Take for example, school uniforms - around $400 per child - $50 dollars of which is tax. Multiply that by three children, and its a week in groceries for some. And on that $150 in groceries you might buy with your refund, you've paid a further $20 dollars in tax.

GST at 15% for low income households is far more punitive than you think. We would need far less tax transfers (WFF and the like) if we just refunded these individuals and households the GST on their spending.

In terms of who picks up the tab on the taxation shortfall - no one! Existing appropriations (expenditure) just stay as they are and the government either ends up with a surplus or a deficit. I think we've been running surpluses for some time anyway, and the point in NZ is that our government debt is relatively low in comparison to our OECD counterparts.

You have to be joking. Such an intensive policy would have huge overheads and I'd bet that even with free money on the table over 50% if people eligible would not claim, primarily from not being aware of it, but also simply because they didn't save the receipts or it was too much hassle to do.

If you assume poor people spend almost all of their income anyway, and you know what the average income and housing costs (no GST applies) are, then you could calculate what the tax cut should be able just do that without all the paperwork.

Nationals "independent earner tax rebate" that they brought in with their first round of tax cuts was a huge boon to the parasitic tax refund industry, since huge numbers of eligible people never applied for it they were due tax refunds at the end of the year which the parasites could leech off of. Unless you make things easy, the people you're trying to help will simply miss out.

over 50% if [sic] people eligible would not claim, primarily from not being aware of it, but also simply because they didn't save the receipts or it was too much hassle to do.

That's opinionated thinking, and I'm unsure based on what. There are many social service agencies that are helping those really in need on a weekly basis. These NGOs and WINZ would be fully aware of it and would encourage people struggling on low incomes and benefits to collect their receipts. They could also assist these individuals to file their claims with the IRD. The IRD already processes hundreds of thousands of GST claims from companies - so the process is already embedded in the organisation.

The other thing about such a scheme, is that after a time it would become apparent where income (be it from work and/or benefit/tax transfer) is being spent on non-GST re-claimable items, such as pokie machines, illicit drugs, and other cash purchases. And perhaps one would prohibit expenditure on alcohol from being re-claimable.

800,000 community service card holders. $1000 each on a debit card. Must be spent on goods. Cannot be used to withdraw cash directly from ATM. Could even make it retailer specific like ASB True Rewards or similar.

Less than a billion to give the economy a kick in the ass. Not now. But when it's really needed. Yes there would be jiggery pokery and some general F'ery. But the majority of the money would be spent on goods and bloody quickly.

community service card could be better targetting,I am sure there are a few imposters that have them as it is based on income not assets.but it is an option and that is what the article was about as we are running out of them.endless waffling and dicking about will get us nowhere.

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.