This week’s guest Top 5 comes from Jarrod Kerr, chief economist at Kiwibank.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

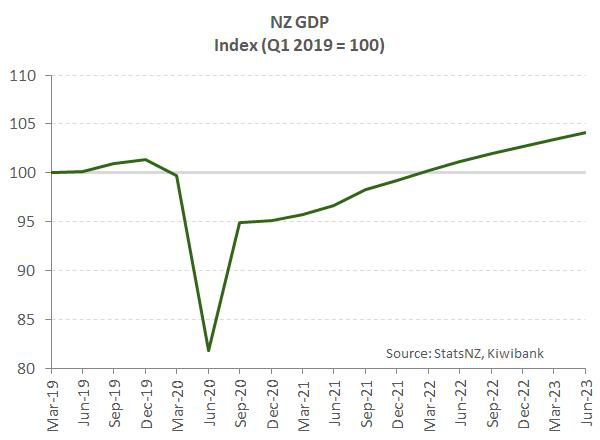

1: The V for victory led us all to upgrade our initial lockdown forecasts.

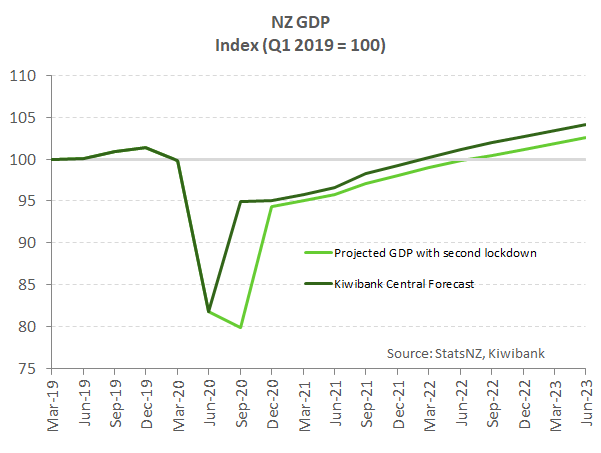

A few weeks ago, we took the opportunity to upgrade our forecasts. We have been surprised at the economic resilience. We’re currently on a V shaped recovery. Albeit a V that looks like it was drawn by a 5-year old. Outsized fiscal and monetary policy responses have helped. Nevertheless, damage was done during the initial lockdown, and we continue to see unemployment rising above 9%. Forget the unbelievable employment stats of last week.

One thing we have learnt, is businesses are adapting fast and we’re entering this new lockdown with better ‘know how’.

See Icy climb: our forecasts are tweaked higher on a whiff of optimism.

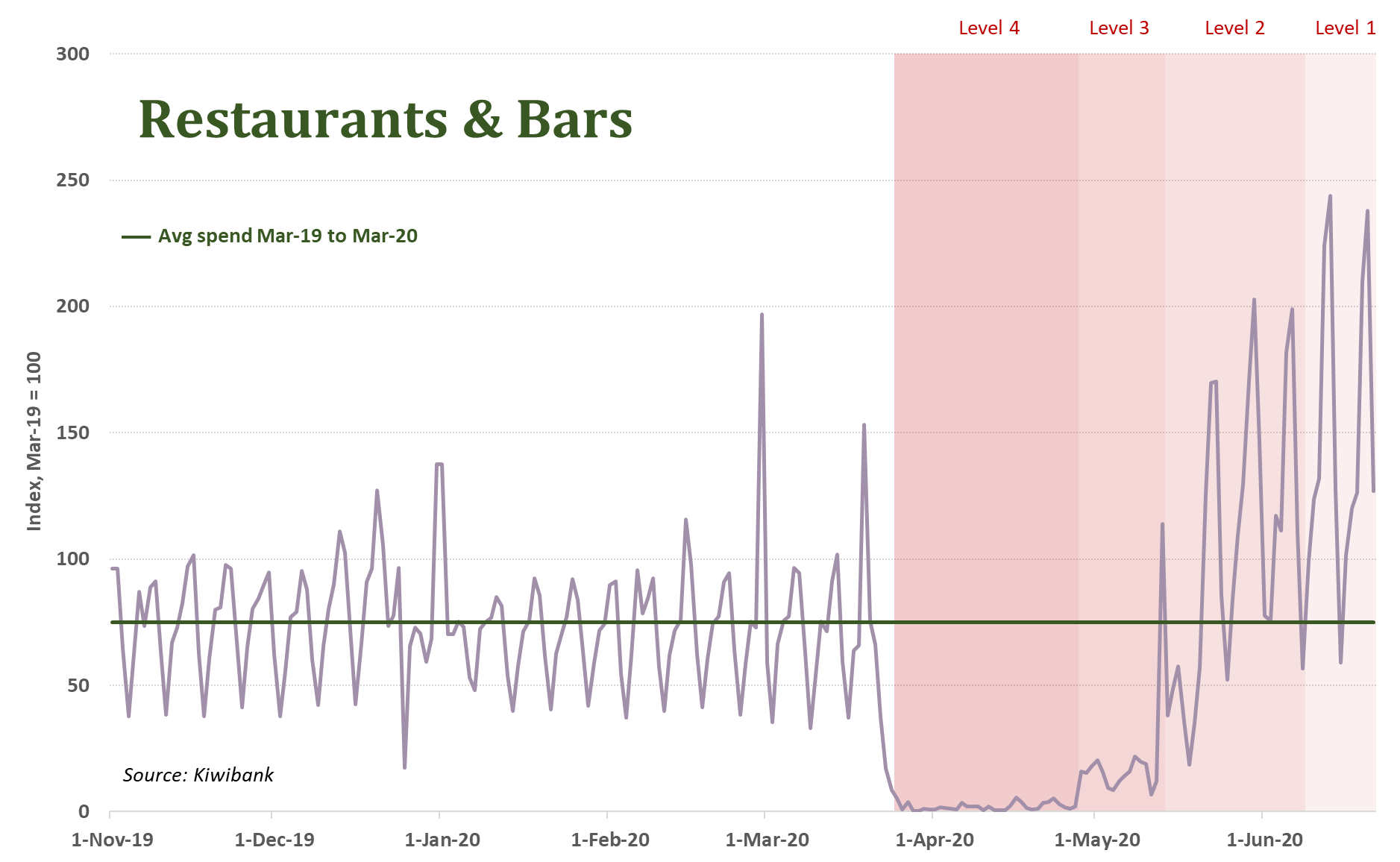

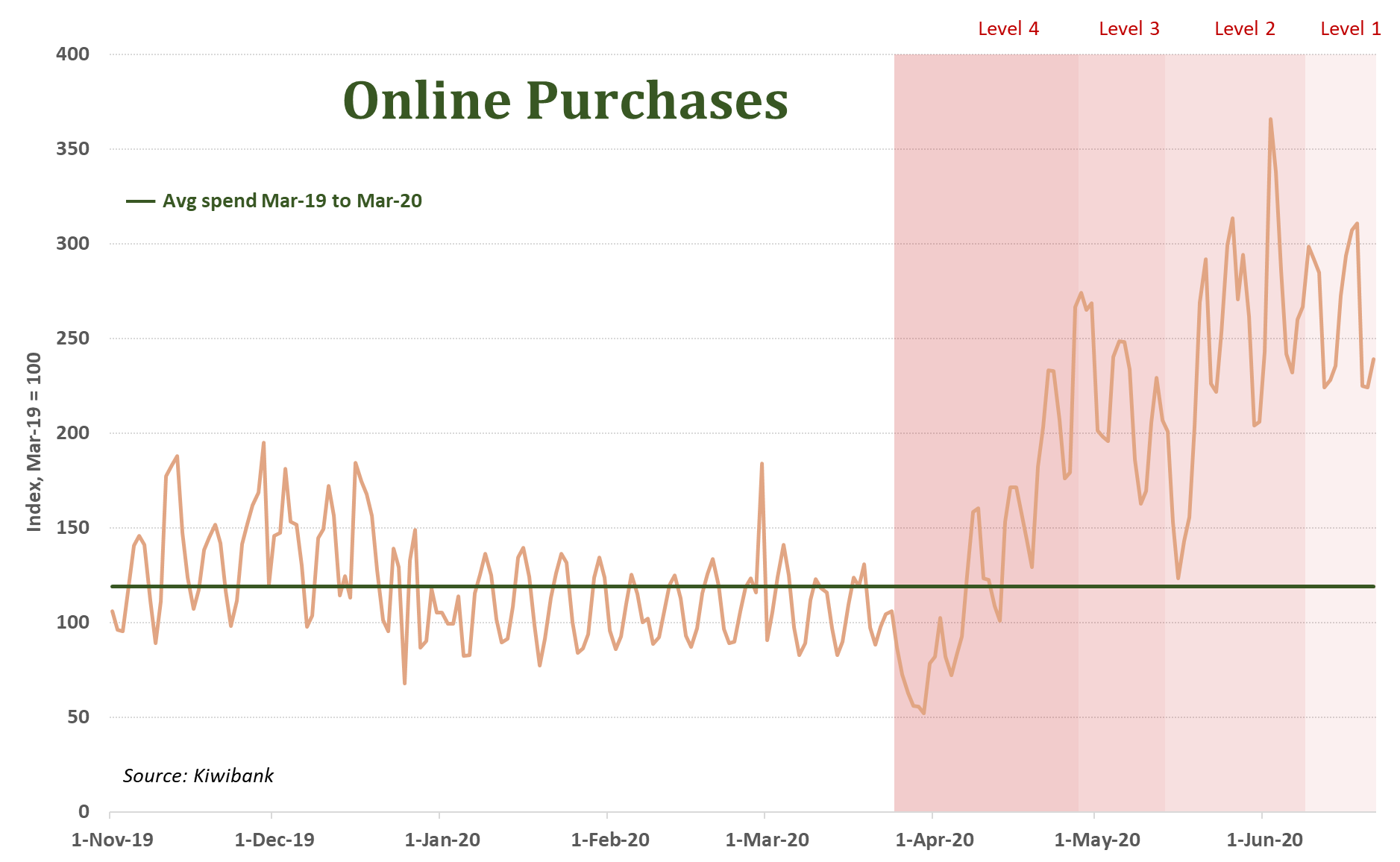

2: Our transactional data remains elevated and above pre-Covid levels in many areas.

Our internal (transactional) data has given us reason to be more upbeat on the rebound into the third quarter (see our data insights). Our initial lockdown was bookended by spikes in spending. Lines snaked outside supermarkets as we stocked up, ready to bunker down. During lockdown we spent less, and average bank balances started lifting. Once out of lockdown, the data shows a clear release of some pent-up demand (and spending of lockdown savings). In fact, the level of spending is roaring with most categories of spend above pre-Covid levels. And we have clearly embraced technology. Online shopping has seen a structural shift (an acceleration in an already well defined trend) higher. And we’re using cash less, and contactless cards more. We expect to see a similar pattern around spending if the current (Auckland) lockdown is extended. We will isolate, then come out swinging.

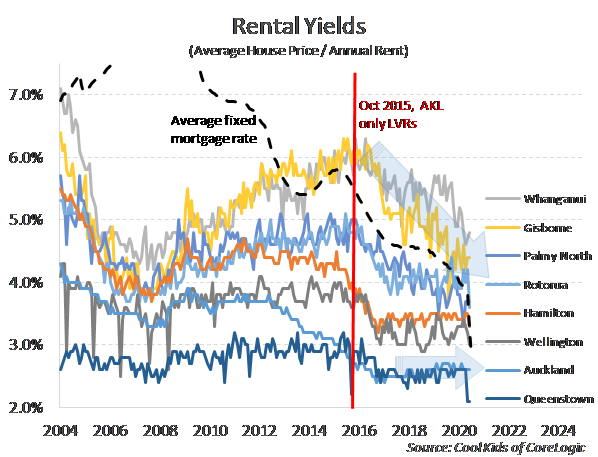

3: The housing market has proved to be remarkably resilient, with record low rates.

We now expect a shallower correction in house prices of 6%, down from 9%. With short supply persisting, our projected house price falls should meet strong resistance. The regions have fared far better than expected. Covid lockdowns barely affected farming, and the ‘working from home’ trend is fuelling demand.

There are 3 strong foundations supporting the housing market:

- The housing market has a chronic shortage;

- Mortgage rates are at record lows;

- Population growth will continue, after the disruption.

Annual house price growth has already returned to the pre-Covid rate of +9% year-on-year. That’s an amazing bounce back. The +6,000 house sales were the highest tally for a June month in four years. And realestate.co.nz recorded a whopping 20% year-on-year spike in listings in July.

A regional breakdown shows some regions are faring better than others. Because measures taken to combat Covid-19 have had a disproportionate impact on the economy. Farming was considered an essential service. And farmers have fared well with strong output and solid prices in dairy, meat and other essential products. Regions of the “old economy” have weathered yet another storm (and drought).

Whanganui/Manawatū, Wellington and Canterbury are the star performers coming out of lockdown. Each region recorded surprisingly strong rebounds in house sales and prices. Waikato, Taranaki, Christchurch, Bay of Plenty, Hawke's Bay, Gisborne and Northland are also doing remarkably well, all things considered. Whereas Queenstown, Rotorua and Auckland are more affected by the locking out of international tourists.

Interest rates drive investment decisions. The big attraction of the regions, for investors, is rental yield. Deposit rates have tumbled well below 2%, and mortgage rates have fallen well below 3%. In a lower for even longer interest rate world, rental yields play a greater role in the decision to invest in property. The regions typically offer a higher yield to the major cities, with Whanganui, Gisborne, and Invercargill conspicuously above 4%. Most of the regions sit comfortably above 3.5%, and compare nicely to Auckland’s 2.6%. Queenstown is going through a difficult adjustment. Rents are falling. Previously lucrative Airbnb accommodation is now offered for long-term rent, and at a time when tourism-related employment is in doubt. Corelogic’s latest data show a sizeable drop in rental yield to just 2.1%. House prices are falling, but rents are falling faster.

The supply of homes has increased sharply. But we’re still falling short to the tune of 80,000 houses. The impact of Covid-19 casts a long shadow over the construction industry into 2021. Commercial property looks likely to bear the brunt of the adjustment.

2020 Property Insights: The Covid correction may cure, as the chronic shortage continues.

4: But another prolonged lockdown could see a double dip W, actually an unflattering U.

Auckland is in lockdown, level 3. The rest of the nation is in level 2 but feels like level 2.5. As economists, we spend a fair amount of time presenting at conferences. Unfortunately, the Build NZ conference was cancelled immediately, and other conferences over the next few weeks have also been postponed or converted into webinars. We’re all erring on the side of caution. We’ve also heard of conferences and events being canned in the capital. Anecdotes from restaurants and bars, outside of Auckland, have customers cancelling bookings. Resorts and tourism operators in the regions next to Auckland (Northland, Waikato, BoP, Gisborne), have told us they’re losing bookings for this weekend and next week. Aucklanders are preparing for a few weeks of level 3 (or 4).

All our forecast assumptions had excluded another lockdown. Another prolonged lockdown is clearly a downside scenario. A 3-day lockdown would have a limited impact on Auckland, and therefore national, activity. But another lockdown of 2-4 weeks is likely to have a significant economic impact. The need to adapt, work from home or move online, will again be thrust upon businesses.

We all love using V shape recovery versus a double dip W terms, but... Due to the timing of the current lockdown, it will impact our third quarter rebound (after the massive second quarter decline). That’s the second half of the V, or middle part of a W. So, we’re actually more likely to get a rather unflattering U-shaped recovery (not a W).

Based on some loose assumptions around a 4-6 week lockdown (from now), our current V shaped recovery turns into a U and it takes us another 6-9 months to fully recover into 2023 (currently estimated for 2022).

So what do policy makers do now? Well the Government simply extends and ramps up existing measures. That spare $14 billion will be soaked up quite quickly. And depending on the length and severity (of which we have no idea), increase its response fund. The fund will involve more debt issuance. And the RBNZ will keep buying the Government’s bonds to ensure interest rates are negligible – or even negative! Yes, the RBNZ has flagged negative rates and term lending to banks.

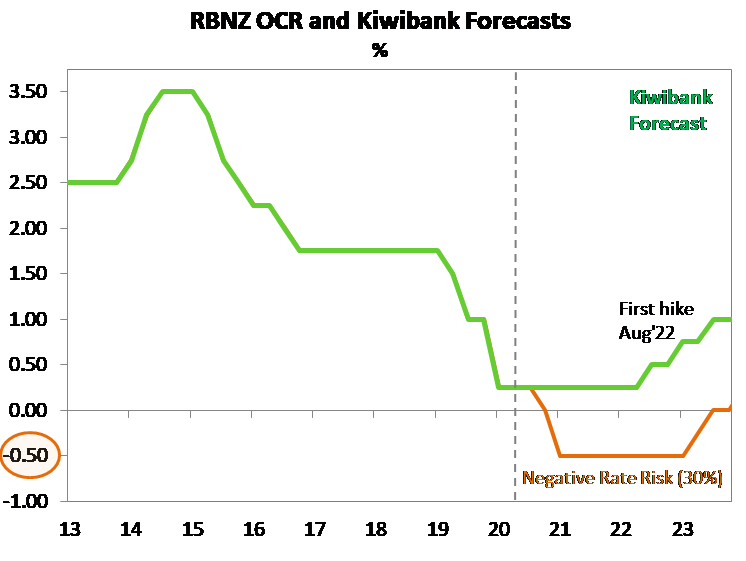

5: Interest rates would be slashed as the RBNZ would cut the cash rate into negative territory.

We have long argued that the next best option for the RBNZ is a Bank Term Lending (funding for lending) programme. A term lending facility would be a sure-fire way to reduce all retail rates (deposit and lending). We were surprised, however, to see the RBNZ push the idea of a “package” deal with a negative OCR. “Combining a negative interest rate with lower lending rates to banks… to lower all retail rates” - Christian Hawkesby. Wednesday’s RBNZ MPS positioned a negative OCR alongside term lending to banks as a package to fight downside risks. At face value, a negative OCR (say -25 basis points or -50 basis points) could see a term (wholesale) funding rate for banks below 0% from the RBNZ. In such a world, retail rates would NOT fall negative, but closer to 0%. We could conceivably see retail deposit rates well below 1% (and closer to 0%), and mortgage rates closer to 1%.

Given the RBNZ’s willingness to go negative, the risk of negative rates increases every day we’re locked down.

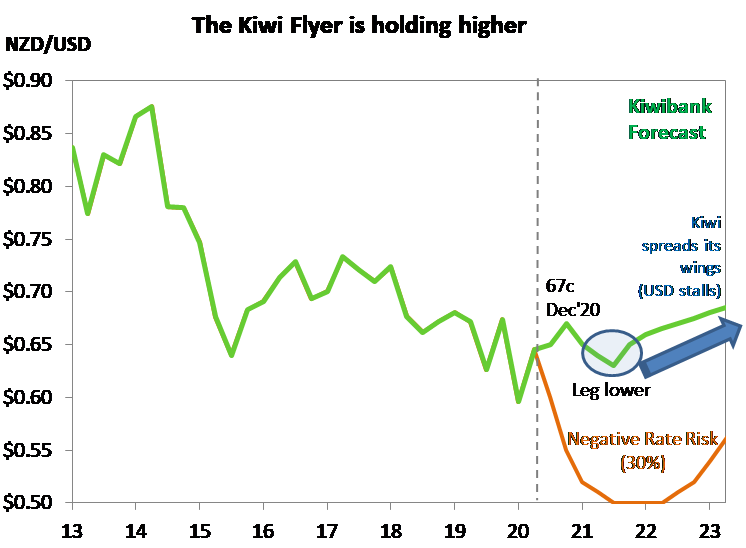

In the process of smashing interest rates expectations to, and now through, 0%, the Kiwi currency took a welcome hit, and would continue to decline if implemented.

30 Comments

So living in an economy painted by Miro or Dali, further lockdowns , whether now logical or motivated by political necessity will only ensure the RBNZ , whether starting before or after March ,cuts by another 100, and with the banks now at the behest no longer primarily of their shareholders but government and its Reserve bank will be advised to provide mortgage rates in the mid 1s and house prices will need to rise , lest Orr will chop and chop.

Well if house sales continue to defy economic gravity and do well and then there's no real reason for interest / mortgage rates to drop any further. Though that's entirely dependent on how well we can continue keep out the coronavirus.

The US has just gone through it's 170,000 virus deaths at the moment.

Volume of house sales are low on an historical basis, and although the monthly REINZ headline data is reasonably robust, it is based on unconditional sales ,in an extraordinary time frame. Nor is the REINZ data ever adjusted for total housing stock. With mortgage deferrals set to continue, and potential sporadic lock downs I see gradually lower new listings, lower sales, less credit growth , lower OCR, lower mortgage rates and higher prices . Those with equity will benefit disproportionately, particularly in terms of opportunity. Although we personally care about NZ house prices and particularly its overall housing "wealth ", we are more interested in the movement of bond yields , underscored in large part from the reliance upon the very same real estate.

#4 - The excluded assumption - of more minor WuHuFlu outbreaks - is frankly astonishing, given the experience of the rest of the world, of the lackadaisical attitude to border 'security' and the woeful tracing capability as evidenced by the tiny uptake of Da Gubmint 'app' - available only on later Android and iOS versions. And the implication that the $14b is gonna be soaked up in the rush to buy the election ease the pain of the economic shutdown for the Team of 5 Million, begs the obvious question - what about the Next outbreak, and the ones after Them?

$14b here, $14b there, pretty soon it adds up to Real Munny. Or is it that, being as how we're lending it to ourselves (somehow, still cannae get ma head around this), we can just wash, rinse and repeat ad infinitum?

An economist on the AM show today said that the Banks were flush with funds so my question is why should we be printing money

Good question. And why do we keep hearing that 50% of h'holds have <$5000 in cash savings? I know it's only slightly relevant to funding, but just wondering.

It is open to serious question whether Orr is following his mandate with this reckless policy.

Part of the mandate is "promoting a sound and efficient financial system". Zombifying the whole economy with a complete mis-pricing of risk, creating asset bubbles that would be unsustainable in a normal rates regime, and pressing the banks into eating into their own buffers in order to sustain the housing Ponzi scheme goes exactly in the opposite direction.

It is not a question of changing the law, rather it is a question of changing the leadership of the RBNZ.

Fritz they're hardly going to crow about it when they're covertly moving their capital under the nose of the CCP but look at the timing, sudden movement in the Auckland market which has already been mentioned even in today's property articles; Quote from REINZ: "July sales in Auckland up 30.3% compared to July last year, which was also the best July month for sales in five years". And if you want more evidence, all you need do is to look at the auction results for Auckland and take note of who is the successful Real Estate Agent are, bet you'll notice a trend.

Before the virus came along, Orr was already slashing rates in order to stoke another housing bubble.

I have no problem with rates being slashed if a DTIs and similar constraints are in place to prevent out of control speculation on housing.

All the brakes have been removed. If Jacinda wasn't just as compromised she would be making his head roll.

I was very pleased to see Adrian Orr finally use the "D" word publicly yesterday in his interview with Jenee T .

Its the first acknowledgement that Deflation is, or is possibly about to be, a problem

The first step in sorting out a problem is acknowledging that you have a problem

Deflation is the spectre that actually haunts modern central bankers. Much of economic theory they were taught is based on analysis of the Great Depression but they don't have a consensus of what caused or cured it, their are dissenting schools and opinions that move in and our of favour. Inflation they are not *as* scared of, because they have bullets in the gun to shoot that particular beast. But they have very limited weaponry against deflation at this point.

Thanks Jarrod, and David. Having become jaded by kiwi economists jumping the shark, parroting some perceived official narrative unreflectively, never adjusting in response to changing circumstances, oblivious to the unintended consequences of their pet theories or, most commonly, just turning into property spruikers, it's great to see someone who says it as he sees it, adjusts openly, told engagingly. Long may it continue.

“Housing shortage”

Wish I did not have to keep staring this but...

There is not a shortage: people who need a house cannot afford one and hence will not buy because what is produced for market is out of reach. Need for houses to rent is not same as demand (real buyers) who do in fact buy because they can afford to. The 80000 figure is a lazy product of a maths calculation which works out consents in last few years and compares to est pop rise and uses that to work out a “shortage”. Of what? Is crucial distinguishing question NOT asked or answered. If pop could afford places and pop is up in Auckland by 200000 in last 7 years, then why were sales in 2019 lower than in 2009??

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.