Financial adviser, Darcy Ungaro, invited interest.co.nz journalist, Jenée Tibshraeny, to discuss all things government debt on his NZ Everyday Investor podcast.

The pair talked about the Treasury signalling there's room for government spending to do more to support the economy beyond COVID-19, in this structurally low interest rate environment.

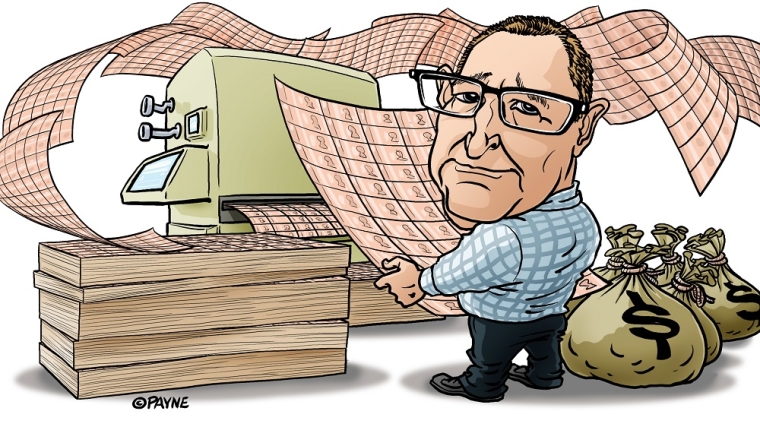

They talked about how government finances are different to personal finances - at least in the sense most the debt issued by the Government during the COVID-19 crisis is owned by the Reserve Bank (RBNZ) thanks to its Large-Scale Asset Purchase (LSAP) programme.

The RBNZ has bought around $53 billion of the $66 billion of New Zealand Government Bonds (NZGB) issued over the past 15 months:

Darcy and Jenée also discussed the difference between inflationary pressures coming from supply chain hold-ups and high oil prices, versus inflationary pressures coming from a hot housing market. They wondered how much sustainable economic growth - stemming from productivity and business growth - there was.

They talked about how the RBNZ is expected to tighten monetary policy - perhaps by slowing its weekly bond purchases before lifting the Official Cash Rate, as ANZ strategist David Croy suggests.

They considered behavioural economics and how people might not respond to an interest rate hike rationally.

They discussed how on the one hand people might keep borrowing and investing on the belief the housing market at least is too big to fail, and will ultimately always be propped up by the government and central bank. But on the flip side, Jenée wondered whether the first Official Cash Rate hike in seven years would scare people, and have a particularly large chilling effect - especially as mortgage holders consider their abilities to service increasingly large bundles of debt.

Darcy and Jenée talked a bit about how the RBNZ wants to have debt serviceability tools in its macro-prudential toolkit. Jenée mentioned how the RBNZ is under political pressure, as the blunt monetary policy and financial stability tools it's been deploying don't always align with government policy.

You can listen to the podcast below:

6 Comments

Looking forward to listening to this, but remember, kids - every time you forget to label your axes, a puppy dies.

Fair point. I've added axis titles to the graph (snipped from a bank note). Best keep those puppies alive.

Don't worry, they were virtual puppies, supplied by your friendly local MMT kennel.

Only one in four is underwritten.

They talked about how government finances are different to personal finances - at least in the sense most the debt issued by the Government (NZGB) during the COVID-19 crisis is owned by the Reserve Bank (RBNZ) thanks to its Large-Scale Asset Purchase (LSAP) programme:

A comment from Michael Reddell - ex RBNZ economist.

One of the incidential curiosities of the bond purchase programme is that at times like this you hear a great deal of talk about how it is a wonderful time to borrow and the government can lock in very cheap long-term funding. And yet what do really large scale central bank bond purchase programmes do? They transform the liabilities of the Crown from quite long-dated to increasingly quite short-dated, exposing the Crown (us as taxpayers) to really substantial interest rate risk. Perhaps at the end of all this the Reserve Bank will have $50 billion of government bonds, with a representative range of maturities. On the other side of its balance sheet, it will have a lot of very short-dated (repricing) liabilities – all that settlement cash (see above). Whether the Bank eventually sells the bonds back into the market – which hasn’t happened a lot in other countries – or holds them to maturity, the interest rate risk doesn’t go away. It isn’t obvious what public interest is being served by skewing the Crown’s (net) debt so short term. Perhaps interest rates will never rise again……but that won’t be the view many people will be taking,

I would genuinely be interested in an explanation of how those short-dated liabilities create an interest rate risk. Surely this is just cash sat in settlement accounts earning the commercial bank zero or negligible interest (at a rate that is under the control of RBNZ)?

A great discussion.

A bit scared that government and broader public thinks that printing money is somehow ok because it is a debt to ourselves, in that the consolidated balance sheet eliminates it. While true (assuming the debt is repaid and not rolled endlessly) it doesn't mean that it is somehow a magical solution without implications for inflation (a tax on savers) or distorting financial markets, incentives and asset prices.

I also think that inflation is in effect a way of debasing debt, so its a debt jubilee in stealth.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.