By Matt Nolan*

There is nothing like inflation to get a good headline - and as part of that it is almost obligatory to throw some shade at the Reserve Bank of New Zealand. So what is going on, and are we right to be so furious at the RBNZ?

You’re probably thinking that this is another attention seeking economist ready to criticise the RBNZ about what is going on with the growth in consumer prices. Fair guess, especially because I think those economists tend to have some pretty good points. However, I think the implementation of the dual mandate and the actions taken by the RBNZ have been generally appropriate given the balance of risks.

But my personal comfort doesn’t match what people say to me. I keep getting calls from people worried about the value of their retirement savings and individuals who are trying to work out if they should be bargaining for a wage increase between pay rounds.

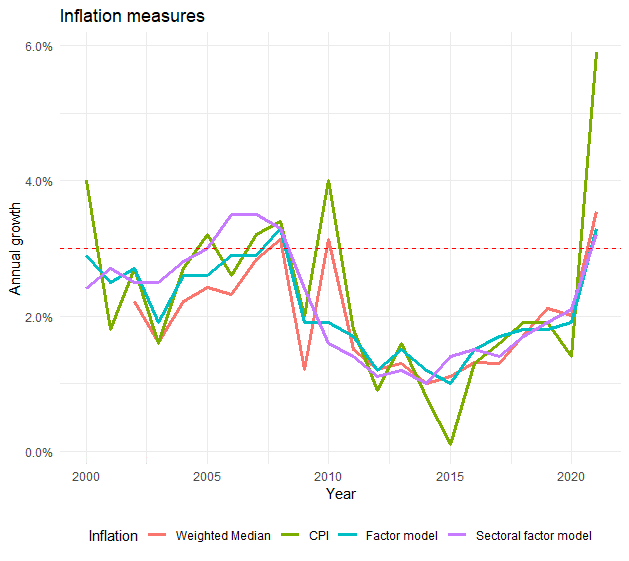

So how can we explain all the inflation measures shooting up above the top of the RBNZ’s target band in this graph without panicking?

Let’s start by working out our own little narrative to try to figure out what is going on?

So should we panic?

There is no need for panic, and I believe the RBNZ forecasts of where we are going - insofar as forecasts are always subject to hard to pick errors. Let me explain why.

Covid, the Russian invasion of Ukraine, and the related supply chain shocks are a “temporary” bad income shock for the New Zealand economy. Fiscal and monetary policy have been focused on alemorating the effect of these income shocks, and providing a credible path for managing overall demand when the shock reverses out. With uncertainty about the size of the shock, part of this has translated into a sizable lift in prices.

In that situation what would we expect to see happen with prices in the future?

We have a central bank that is targeting future inflation - not the price level - so when things start to open up again they don’t intend to let the ticket price on goods and services fall in so far as they’ve perceived what is going on.

What does change going forward is that income growth should rise sharply.

Current real wage growth is very negative, and with monetary policy accommodating the price shock (prices don’t fall, they just stop growing so quickly). With unemployment low and workers noticing that the buying power of their current pay has dropped, the dollar value of wages will be pushed up over the next couple of years - even with inflation falling.

However, things are never quite that simple. In the end, the price of some products that have shot through the roof - i.e. international air travel - will return back to earth. As that process happens overall price growth may come in lower than the Bank expects. With unemployment in New Zealand now very low, some degree of weak consumer price growth could be a consequence. Here the Bank will continue to project that inflation will return to 2%, but the amount wages will need to rise to buy the same set of goods and services will be a bit lower.

In both cases, if this is the nature of the economic shock facing New Zealand we would expect sharp reductions in the rate of growth in consumer prices and a recovery in real wages over the next 2-3 years.

The RBNZ is taking actions to ensure that this adjustment is as smooth as possible by managing the level of demand for New Zealand goods and services. They are doing this by setting monetary conditions (both interest rates and bond purchases) in such a way as to return inflation to its expected level and prevent unnecessary unemployment.

Put this way there is no need to panic - the spike in prices, even if it is relatively broad, is based on how the Bank and broader government policy has responded to a temporary income shock in the economy. The reduction in income isn’t nice, but it isn’t due to monetary policy - it is due to all of the horrible things happening right now!

For monetary policy what matters is that people don’t start to expect and “price in” inflation that is unrelated to current supply-chain disruptions. This involves clearly communicating outcomes in price and wage growth that would be consistent with this adjustment, so that people bargaining in the economy have a clear idea whether they are bargaining for a real wage rise or just keeping up with a rising cost of living.

It is time to make this clearer

Whether you think New Zealand monetary policy is expertly managed or you believe that it is being run by three-monkeys in a trench coat there is one thing we’d probably agree on. The communication about the spike in consumer prices has been poor.

The February 23rd MPS release just stated that the official cash rate was now 1% and that headline inflation would go back to 2% “over the coming years”.

If you aren’t following every release by the RBNZ you’d never pick up that this was a 25 basis point increase, you’d have no understanding about why inflation would fall from its current high levels, and you wouldn’t be clear whether that means the current high prices we’re all struggling with are here to stay - in such a world it is easy to feel a bit panicked.

The Bank has continued to communicate as if this is the “status quo” and that this is a simple update. The truth is that current headline inflation offers a significant risk of unanchoring expectations that requires more than an update on the latest set of house price forecasts - it requires an economic narrative and explanation about the future path of policy and economic outcomes.

Once a quarter forecast documents are not sufficient - we need speeches, and more direct public focus on how the Bank expects the economy to get back to around 2% inflation in the medium term. This should be the absolute priority of a central bank - and the plethora of nice-to-have projects should go on hold until they are able to perform this core function.

When I read the February 2022 MPS I don’t see a document linking monetary policy and economic projections to tell a narrative about how the RBNZ achieves its mandate. I see a series of disparate graphs with cookie-cutter text next to them.

When I scroll through the speeches made by the RBNZ, there has only been one speech on the monetary policy outlook in recent years - a very short speech on February 25th this year. It can be summarised as “trust us, and don’t increase your expectations of inflation please”.

There are two types of communication that are delivered by other central banks which are arguably absent in New Zealand - the communication to financial and economic professionals about how policy functions (i.e. this from a recent Fed Speech) and the communication with the public about what is expected to happen with prices and wages, the risks around this, and how this has changed. When clearly explained individuals can then use this for their own price and wage setting behaviour.

Both of these forms of communication matter as they help the public understand what is coming - thereby managing inflation expectations.

So in New Zealand, when wage growth picks up, how does the RBNZ currently communicate that? What part of increased rising wage growth is a transitory response to recent price pressure, and what increase would point to risks of a wage-price spiral? If inflation is more persistent, what actions will that trigger from the Bank? Get out and explain this to the rest of us!

Currently the Bank is far away from their target and unless us in the public can understand why, and how the RBNZ is going to get back to target, we can quickly turn around and start expecting inflation to persist forever. I already have friends pushing for large wage increases based on this very concern - and if this growth is then met by firms pushing up prices this is the very inflationary pressure that it is a central bank's job to prevent.

It isn’t the dual mandate that is a problem, and it isn’t the operationalisation of monetary policy through money and credit markets. It is the lack of active and open discussion about why things are happening with consumer prices.

I don’t agree with the shock headlines out there from New Zealand journalists and economists bemoaning the failure of the central bank and out of control inflation - given the mandate and current policy settings. However, if the RBNZ can’t improve its communication about what is likely to happen then the unanchoring of expectations will lead to a situation where these other economists are right, and my defence of the Bank is wrong.

*Economist Matt Nolan is a research manager at e61, an Australian not-for-profit economic research institute, and blogs on the TVHE website.

87 Comments

Interesting how each time inflation has trended the way it has recently, it has resulted in a market crash. Dotcom and 2008. Will we see a repeat? (Or is it already happening with NASDAQ down about 20% already).

Yep. History repeating.

It's revealing looking back at NZ from 05-08.

OCR hiked and hiked, mezzanine finance sector collapsed around 06/07, building consents and development fell off a cliff, all pre GFC.

It's all going to happen again.

Just far more debt this time and unprecedented levels of stimulus injected (fiscal/monetary) before the crash and not after. Leaving very little room for RBNZ to save the likes of the housing market this time around.

Yep.

I guess, however, the RBNZ could take the OCR negative this time?

Always a possibility. It will assume that we have deflation here and that the energy and food inflationary issues have been resolved (which appear to be outside the control of the RBNZ). If we have proper stagflation, and deflation doesn't arrive, we really are in a squeeze.

Hope not. It'd give too much power to the already powerful banks. If you think $6B profits is obscene look what'd happen if the OCR went negative? Fancy being charged for having bank deposits? Try operating in cash? The system is set up today that makes the banks central to almost everything we do. Their absolute power is gobsmackingly frightening!

Must be why they've been closing their branches. So people can't get out there with pitchforks.

Watch for bank executives' profiles disappearing from LinkedIn. That'll be a canary in the coalmine.

Very little?

None.

This is atop an energy issue from which there is no - and was always going to be no - way out. Boiled down, the RB are about costing forward bets on energy-availability. I doubt they have a clue, but that's what they've been doing. Whereas ome of us were tracking the underwrite - and hollerin'.

Just far more debt this time and unprecedented levels of stimulus injected

Yes exactly, this will not be "just like any other downturn/recession". We have been using the word "unsustainable" for many aspects of our economy for a long time hoping we would never see the set of circumstances we are now faced with. This is not an "It will blow over soon and everything will be back to normal' scenario.

Nah. No need to panic Adrian has it all under control

Inflation, as measured by the CPI, needs to catch up with house price inflation…… It has a good way to go yet. 🤣🤣

TTP

TTP I think house inflation is on way down and will reverse back to 2018 prices.this will help in bringing down inflation. Once interest rates move up from emergency rates back to a normal level we could go back to a stable house market but 40% too 50% off today’s prices. This would take it to around a place where average wage earners can afford to buy house. At this point speculators should be blocked out from housing market.

The contrarion view to this is that house prices have a long way to fall to be in alignment with CPI and economic growth (you know where incomes are generated to justify the prices of any asset).

Correct. Economic fundamentals will reassert themselves, sooner or later.

Tim's panic membrane listens but refuses to hear

Tim is like Controlled Opposition. He knows he can no longer fool the general public into buying, so he focuses on trying to control how low the narrative and prices go down from here. And that applies also at work with keeping his agents and other staff onboard. I wonder if Tim will top up those weekly commission paycheques ?

i hope you meant that word play. very good if you did

Seems likely. Tide out, swimming naked and all that.

I remember end of 2006-2007 mortgage rates were at almost 10%. We had a significant buffer to soften the blow back then. Not this time.

Yes, history repeating itself. Economy is fundamentally cyclical in nature, regardless of the highly dangerous meddling by central banks. I am getting very close to the point when I will be tempted to start purchasing quite a bit of shares, especially in the sectors recently plummeted. Probably the market has another 10-15% to go down before it reaches a new balance, but it is just so easy to miss the mark when it comes to trying to time the market.

I am waiting on the shares sideline too, but I think it's still far too early to.jump back in. I am.pretty confident it's still got quite a way to fall.

I wonder if it's demographics too. The baby boomers shifting out of shares and rental housing as interest rates rise. back to safe and secure. How big a tide is a general shift out... how long before the next tide comes in?

When you look at how central banks define inflation and the one tool they have to control, to me it's clear that they are actually engineering recessions and this is born out by the results. Increasing rates only adds to the costs placed on the economy by inflation, inflation effectively works like a tax or does the same thing as an increase in interest rates, it reduces demand. So increasing rates only adds to the burden placed on the economy in the same way as the straw that broke the camels back. Once you have a recession, demand destruction accelerates thereby creating some slack in the economy allowing prices to fall.

Yep the yield curve is telling us exactly what is coming. This article above is not just wrong, it's so wrong I'm tempted to save it somewhere to laugh about it in 18 months time. The consequences of the Russia situation are huge and clearly escape this economist on his Farros shopping trip. Google petro dollar there is a hint - if a new bloc start trading outside of USD ww3 is inevitable and potentially the falling of an empire. Back in 2020, given already rising geopolitical tensions, China and Russia agreed to ditch the U.S. dollar for bilateral trade settlements. Do not assume anything at this stage of the war.

WW3 in never "inevitable".

Mixed quality article. Some good points.

But it's too gentle on the RBNZ. They were right to do what they did at the onset of covid, but were far too slow in reversing tack.

It's a 'don't look here, nothing to see, move on by' piece of huckstering. From a person trained in flat-earthing (economics).

Compare that to this:

https://www.odt.co.nz/opinion/editorial/australia%E2%80%99s-%E2%80%98bi…

"It would be great if all the things ailing us and the planet — a pandemic, wars, climate change, pollution, loss of biodiversity and so on — could be put on hold for a bit. That would allow us some breathing space, and provide us with the chance to think more clearly about what needs to be done and in what order.

Unfortunately, and obviously, that is not the case. We have to forge ahead as best we can, tackling all these major issues at once. Failure is not an option, as they say."

Finally, someone in the NZM is getting it. But it ain't the above writer.

Quite, powder. Most of the ordinary Economists have been wrong most of the time. It's a bit like the NZ Soccer and League teams, occasionally they win, and you hear about that success, and watch the replays for 30 years or so.

Hey PDK -- i think you might find that the war is a real boon for renewable energy -- which in itself is not the be all and end all for climate change and sustainable living -- but its a start! ---- no matter how it ends and how long it last -- you can bet every last dollar that the EU nations will already be startign a headlong rush to renewable energy sources --

History shows that war is the biggest driver of technological advances and changes in society -- not all good i grant you - but it may well concentrate the best minds on the major issues - and combined with the fallout of covid pandemic -- lead to significant structural changes -

cheers

So what you seem to be saying is the RBNZ need to communicate more of what they think and want to happen and the general populace will then believe them and ignore their own reality.

Ok.

Well I shall just inform low income families they just need to stop eating for a few years until inflation returns to an acceptable range.

I actually think inflation returning is a result of demographic changes across the OECD workforce and don't believe we will return to a low inflation environment.

The problem with inflation affects everyone very differently so anyone writing an article that's financially well off has trouble seeing the big picture. Things are about to get dire for half the population and unless your debt free and stacked with cash the impact is going to be harsh.

That's why when Jacinda and Grant were quizzed on inflation they didn't see a issue with it. No everyone has their meals paid for and delivered in their workplace and chauffeur driven vehicle.

So much for their supposed core constituency, the poor...

Friggin phoneys

Or a condo in Maui.

Just keeping perspective.

Nothing wrong with a Condo in Maui powder, Laihaina Town is a lovely place. And you can go to Fleetwoods, have a cold one and chat with Mick Fleetwood!

Unfortunately FCM, quizzing Jacinda and Grant is a waste of time. Neither have the knowledge or skills to discuss inflation in a meaningful way. Pre-prepared sound bites is as good as you will get.

Someone hand grant an economics textbook pleeeeease! A high school one would probably do

It hits the bottom the hardest. One example, cheapest pasta at my supermarket has changed from 89c to 1.29c - an increase of 45%

Minimum wage just went up 6% thought didn't it? That will buy a lot of pasta.

Until landlords go: Next years proposed rental increase + ($1 per hour x 40 hours) = new rent increase.

Trouble is they've created a situation of low unemployment (which they naively believe is a sign of their successful governance) but in actual fact represents a labour shortage. Any moves to raise wages now will send inflation further through the roof. The incompetence of this government is astounding. Someone please hand grant robertson an economics 101 textbook

Not necessarily a labour shortage, as a shortage of investment too. Companies have had the luxury of outsourcing investment in upskilling to either immigration or student debt, rather than taking people and training them as was the norm 30 years ago. They want experienced people but few of the others...but without nurturing a pipeline there's less loyalty and more prospects for workers to switch companies to increase their wages.

100% agree. I wholeheartedly agree with education + attitude to work as being key determinants of future productivity and innovation. Our educational results have worsened and the gap between good and bad is what continues to create poor, gangs and a large prison population. But worse is the lack of training by owners and managers in their organisations. The lack of management skill in NZ is terrible. The lack of investment in plant is terrible. And the investment in workers is terrible.

Its not something new, business owners in NZ are lifestyle owners. They dont aim to grow the business past a certain size where they can be comfortable. Until this culture changes nothing will change.

Now the tertiary eduaction market focused on training employees is weak in NZ. I think this is a really an are where some government / education sector partnership could actualy lead to employees becoming more productive.

Lol Carlos, being "stacked with cash" is the dumbest thing you can do when there is rampant inflation. You do realise that inflation allows borrowers to pay lenders back with money worth less than when it was originally borrowed, which benefits borrowers? The idea is to invest in assets that retain their value at the same rate as inflation. Funnily enough, since the 60's, house prices have kept pace with inflation spikes, bar for once, I think it was in the 70's during the oil price debacle.

Being stacked with cash will provide plenty of opportunity over the next wee while. Fire sale season is underway

Absolutely!

I'm waiting on the sidelines with cash ready for shares purchases.

And FHBs with cash really do now have the opportunity to be.... (*cringe cringe*) 'Savvy'. If you have a stable job, are basically ready and willing to buy anyway, then you might be able to snatch a bargain this year. If I was in that situation I'd be aiming for a purchase around about June / July, at a price circa 20% down from peak value.

Good luck Rastas, you should have been buying inflation defensive stocks before inflation skyrocketed. You've got to make what you've lost already before you even start.

Agreed Carlos except fo the "stack of cash" which is devaluing at a very fast pace. Right now, if you can afford it, it's wonderful having a big fat mortgage. Example I pay 2.89% interest for another 2 1/2 years and my mortgage is reducing faster through inflation at 6, 7, 8 …% than through my repayments

How much has the capital value of the property dropped in the last 2 months?

And how much more is it likely to drop in the next 2 months?

At least cash in hand erodes slowly. It dosen't crater away in a catastrophic manner.

Was thinking the same thing but couldn't be bother saying it. Those FHB who recently purchased on low LVR might now be close to negative equity with rising interest rates and inflaiton chewing away at weekly wages.

Doubt they are loving their big fat mortgages.

Exactly.

Yvil has evolved in his investment thinking, but he's still got a way to go.

So you guys still don't understand the difference between a house and a mortgage? Unbelievable!!! Your house will devalue wether you have mortgage on it or not, can you really not understand that?

Its not devaluing at a very fast pace, it totally depends on what you spend it on. I personally was glad to get out of debt and basically retire at 48. Taking on a huge mortgage just because the interest rate is less than inflation so your "making money" on the difference just doesn't compute in my mind, sorry. I preferred to get out of the "System" that is designed to keep you like a mouse on a wheel, people have been so conditioned to it they simply don't know when to get off it, even when they could. Once you have enough chips you have won the game and you cash out, money is buying me time and time is priceless.

Hi Carlos, how much cash do you need to opt out of the system and retire in your opinion?

It entirely depends on what your future annual spend is going to be Moa. If you want flash houses, flash cars, a condo in Maui and first class travel around the world it will be more. There are dudes out there that will do a presentation to you showing you where you are and what you need to do to get to your target annual income. Engage one of them.

Be careful thinking that inflation is working in your favour because you have a mortgage. Inflation only works for you if your asset is increasing in value therefore eroding your debt and offsetting the impact of inflation. If you bought at or close to the peak of the housing prices (for which inflation hit much earlier than the measured CPI inflation ) then interest rates and the cost of living caused by inflation will hurt you. Even more so if the housing market then tanks

This is a huge part of the problem.

Look at ECAN down in Canterbury, proposing a near 25% rise in their ECAN rates.

25% extra on your ECAN bill is no biggie when you're some overpaid, underworked paper-pusher earning $250k PA with zero consequences for blowing your budget. At the end of the day the increase you propose is not a big hit to your wallet.

The problem is that the extra few hundred dollars per year is brutal for those on fixed incomes, lower incomes being chewed up by petrol rises, grocery bills and so on.

I'd have far more respect for the people making these decisions if they had the stones to say that they literally don't care for the poor when making these decisions, as opposed to paying some spin doctor to claim that - in fact - a 25% rate rise is somehow good for people.

Better to be punched in the face than stabbed in the back.

I disagree with the fundamental premise of the article- that the current inflation is due to supply chain/Ukraine issues. Those are adding to inflation but are not the root cause.

The root cause is that CBs have gone all in on the wealth effect to ameliorate a lack of organic growth. Super low rates have flowed into ‘safe’ assets rather than productive businesses, because no one can see the opportunities for organic business growth with current demographics. Thus huge growth in nominal wealth, ie asset prices. Thus more demand from the ‘wealthy’ for the same pool of resources, thus inflation. The only escape valves are inflation (reducing the living standards of the poor) and/or destruction of nominal wealth through a crash in real estate, equities etc. I’m rooting for the latter, but cognisant that the entire managerial class is on the other side of this equation.

brisket,

I agree strongly with your first two sentences in particular.

The author, through his starting assumption, is off the mark. And that is a fundamental flaw that most economists have been making.

My own judgement some two years ago was that to protect my retirement savings I had to rearrange my affairs. The bank and fixed deposits were not the place to have money. The challenge was to get an investment mix that spread the risks but retained liquidity and some cash flow.

I am firmly of the view that there is never any point in getting into a panic because that leads to enormous stress and flawed decisions. But the path ahead does involve pain one way or another for many groups in society.

KeithW

Two points made that jumped out at me -

"Covid, the Russian invasion of Ukraine, and the related supply chain shocks are a “temporary” bad income shock for the New Zealand economy".

Wrong. These type of events will keep coming and on their own may be very long lasting.

"However, things are never quite that simple. In the end, the price of some products that have shot through the roof - i.e. international air travel - will return back to earth"

Completely overlooking that oil produces everything and can only go up.

Brisket's points are sound however what is the first question a bank asks any SME borrower - what security do you have.

It's all very well criticising property investment but starting a business has a negative expected value so is it any wonder people pile into property?

Surely it might help if we had LVT on the unimproved value of land balanced by a precipitously lower company income tax rate. Encourage hard productive work rather than sitting around on our ass-ets.

Which is why low interest rates signal a real growth problem. In the past there were many ways to invest productively even if you had to pay 10% interest. Low interest rates are a sign that no one really expects growth to return. But we have equities and RE priced as if decent growth is inevitable -- and that nominal wealth is fungible for real money, at least until the SHTF. Which is why a RE/equities crash could fix inflation, because it will reverse the wealth effect and reduce demand.

Keith, another very good post!

Well said. This article is just a variation on the “inflation is transitory” theory without providing any new evidence or explanation as to why.

This line of thinking has not been borne out in reality and time and time again the date inflation will return to “normal” has been pushed back

Excellent comment!

Quite right Brisket. When one prints money, that is pretty much the definition of "inflation". You are inflating the money supply. Now if you print money, and don't have a corresponding lift in production, then you get price inflation as bad money goes after few goods. Claiming it is "temporary" has been debunked in UK and USA. Even Yellen of the Fed in the USA, who propounded that nonsense initially, has backed away from it now.

Essentially, there are three scenarios for current Government. (1) they are just playing politics. (2) Lying or (3) too stupid to know what they are talking about. I give them the benefit of the doubt and opt for 3.

Economists will say that CBs haven't been printing money, and technically they're right.

But they don't need to, to create inflation - they just need to provide excess liquidity and keep rates unsustainably low. There are so many financial entities that need something to invest in that gives better returns than negative-yielding gov't bonds, that that money will be put wherever provides the best, safest recent returns. There's no better way to engineer a bubble, because that's a self-reinforcing loop. So we've papered over the cracks of pre-existing low growth and Covid by creating an artificial demand spike while supply has been stretched. In retrospect, hideous inflation should be the obvious outcome; stagflation even, because the already low-growth environment now has more debt added to it.

The money supply increase in NZ has been eye watering the last few years. At the very beginning it was filling the hole left by covid related lack of economic activity, then once that hole was filled it was just a lot of extra tokens chasing fewer and fewer goods. And of course the goods and services were decreasing as the supply chain crapped itself, people were sick, isolating or in lockdown (across the globe) and NZ decided to go on a building boom, creating more and more demand that had a knock on affect to other markets. Skills, staff and material shortages all over the supply chain both domestically and internationally. Oh and not to mention various shipping routes just decided NZ wasn’t worth the bother so stopped visiting NZ ports entirely!

Kind of a perfect inflationary storm. The energy/commodities shock that the Russian invasion has triggered is adding fuel to an existing inflationary fire. But there is also no reasons to assume somehow geopolitics is going to calm down quickly or only short term.

brisket,

I disagree with the fundamental premise of the article- that the current inflation is due to supply chain/Ukraine issues. Those are adding to inflation but are not the root cause.

Very well said indeed! (I made the same point to someone else this morning). It's surprising that an economist cannot see this

Panic...probably. Inflation is literally burning down parts of NZ. Mr Orr continues to do little insulated by his ivory tower and fat Govt salary. Options, burn down the whole economy with inflation, or rip open the current pin hole in the property balloon, making it a big tear.

What to do indeed. Pick your legacy.

Maybe the author should re-read this paragraph:

"For monetary policy what matters is that people don’t start to expect and “price in” inflation that is unrelated to current supply-chain disruptions. This involves clearly communicating outcomes in price and wage growth that would be consistent with this adjustment, so that people bargaining in the economy have a clear idea whether they are bargaining for a real wage rise or just keeping up with a rising cost of living."

When I go to the supermarket, I don't say to the supermarket "oh I won't buy bread this week as it's too expensive and I aren't getting paid more and I know the high price is just temporary" and the supermarket does not say "the price is high because of supply shocks and it will definitely lower later, don't worry". I buy bread, because I have to. Expecting people to collectively acknowledge that it's temporary and therefore not to buy things at inflated prices or to be paid more to afford to live is some sort of delusional economist thinking.

If you include the behaviour part of the equation: Everyone knows prices only ever go up and so should wages to match it. And in a tight labour environment, workers are going to damn well demand more to pay for necessities, essentially baking in inflation. Other arguments, to me, are overthought delusions. People aren't complex enough to have to worry about such arguments, they just need to be paid more if stuff costs more, it's quite simple.

The rest of the article fails this simplicity test. It echoes of angry economists demanding the real world fit their narrative and their models, which has never worked in the past and will fail to work this time.

"What does change going forward is that income growth should rise sharply."

This is a simply heroic assumption, especially if income growth is Real rather than Nominal.

Whole article seems surreal: excuses for CB and a tone of optimism which IMHO ignores FF, EV raw materials pricing, sanctions, reserve currency questions, blacklists and non tariff barriers to trade.

It's jingoistic poster stuff: keep calm and Buy the Dips....Chilli hummus for me.

The Value of Money.....

For me, this is the clearest way to look at the whole CPI/inflation thing.

This is the perspective that allows one to discern the efficacy of the whole inflation targeting policy framework.

Why do we use a basket of goods ( CPI ) to define the value of money ?

If we used gold or Houses or land etc... how would the value of money look.?

If a Country prints alot of money...how does that impact on the value of that money ?

Have Central Banks been prudent , over the last 30-40 yrs..???

Ray Dalio discusses this perspective.

https://www.linkedin.com/pulse/changing-value-money-ray-dalio/

>Why do we use a basket of goods ( CPI ) to define the value of money ?

>If we used gold or Houses or land etc... how would the value of money look.?

Money is a medium of exchange, why would you not measure its value against what you can exchange it for? Land should certainly be included though, considering how essential it is for well, everything.

There certainly would be value in measuring it more directly against the value of labour. Given that is what we all swap for money in the form of employment. And it seems to make much more sense to me to measure the change of cost of living by measuring what you get from working vs what you spend to live.

No - money is an assumed medium of exchange in the future.

If the future cupboard(s) is/are bare, the assumptions were misplaced; nothing to exchange = no money value. If the future cupboards are increasingly not as full as yesterday.......

Not really true PDK, money is money but DEBT is money now to be paid back in the future. Once your debt free your no longer in the loop, trust me things are totally different and so is your perspective, it changes like it or not.

soothing words,expect more from brokers and fund managers.dont sell now!

NO.

As NZ queen said it is not crisis because she can afford whatever she wants.

It will be a crisis only if she feel the heat of, it till then kiwis deal with it (don't want to say sk it up)

The RBNZ is taking actions to ensure that this adjustment is as smooth as possible by managing the level of demand for New Zealand goods and services. They are doing this by setting monetary conditions (both interest rates and bond purchases) in such a way as to return inflation to its expected level and prevent unnecessary unemployment.

Before she ascended to the Chairmanship, Vice Chairman Yellen in April 2013 spilled the beans:

The crucial insight of that research was that what happens to the federal funds rate today or over the six weeks until the next FOMC meeting is relatively unimportant. What is important is the public’s expectation of how the FOMC will use the federal funds rate to influence economic conditions over the next few years.

In case she wasn’t being absolutely clear, she follows the above with this beauty:

Let’s pause here and note what this moment represented. For the first time, the Committee was using communication–mere words–as its primary monetary policy tool. Until then, it was probably common to think of communication about future policy as something that supplemented the setting of the federal funds rate. In this case, communication was an independent and effective tool for influencing the economy. The FOMC had journeyed from ‘never explain’ to a point where sometimes the explanation is the policy. [emphasis in original transcript]

And still to this day the public thinks QE is money printing. Link

We were living in a very expensive country prior to our current inflationary environment. Costs were rising steadily with price gouging common place and hidden inflation (reducing package size but charge the same) rife across all sectors. A lot of these businesses were doing 'very well thank you very much'.

The model is why make some money when you can make more money, always maximise profits. Of course when cheap money is flowing like wine its all good, people didn't really care.......some debt or more debt who cares right?

Now we have 'real' inflation and the gougers are still gouging, they will just use inflation to carry on with the model. The only time that will stop is when people realise that a coffee and slice of cake in a cafe is not worth $20.00 and that money can buy actual food to feed the family or pay the power bill. I feel we are rapidly approaching that point.

The only time that will stop is when people realise that a coffee and slice of cake in a cafe is not worth $20.00 and that money can buy actual food to feed the family or pay the power bill. I feel we are rapidly approaching that point.

Very true. Our spending on these sorts of things has plummeted and it's a perception problem not an affordability one. No, a wee slice of ginger crunch is not worth $6 to me, sorry. A coffee is only occasionally worth what I might pay for it, and I'll pick and choose very carefully who I support and have some loyalty in that.

Let alone all the places that sell "stylish" made-in-China knickknacks and clothes for made-in-NZ prices...

These businesses will need to increasingly rely on folk who have received too much free money from houses they bought cheap thanks to earlier generations' efforts to boost supply. No one else will be buying.

Indeed, lunches in Wellington city for instance have doubled in price in about 2.5 years. That's not my imagination, I can see it looking back on my bank statements for buying exactly the same thing. Instead, I bring lunch from home if going in to work at all these days.

Same thing for going out - used to cost us about $60-70 for medium level meal, snacks and a movie. Now it's more like $110-130, even going to the same places. So we eat out less, watch less movies, park/drive less, all echoed by people around me. So this is the new normal.

It certainly is the new normal.

And it's going to erode, pretty quickly, the viability of whatever is left of the hospitality sector.

Here's a rare good article from Stuff. S. Eaqub suggesting the war will give an 'out' for Mr Orr in terms of OCR hikes. I think he would have found 'outs' regardless.

https://www.stuff.co.nz/business/opinion-analysis/127990152/painful-eco…

Rubbish like that and they say he's an economist?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.