The country's banks are telling the Reserve Bank that they expect mortgage borrowing is going to remain "subdued" over the next six months.

The RBNZ has released its latest six monthly credit conditions survey of 15 New Zealand registered banks, including the five largest banks. The Survey period covers credit conditions observed between October 2022 and March 2023 and asks how banks expect conditions to evolve over the next six months.

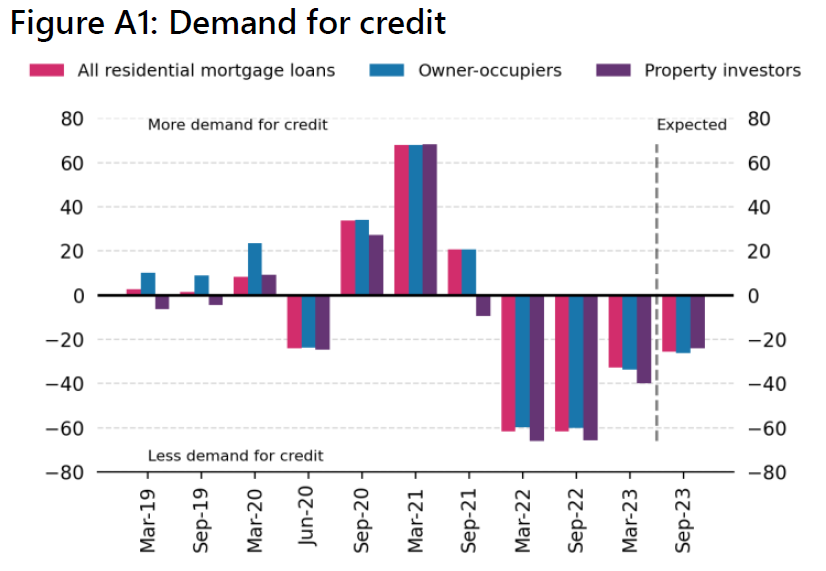

Mortgage business has dried up in a big way for the country's banks. RBNZ figures for January and February showed that new mortgage commitments in those two months totalled just $6.6 billion compared with $10.4 billion in the first two months of 2022 and a whopping $14 billion in the first two months of 2021.

In its summary of comments from the banks, the RBNZ said that the banks were reporting that soft demand was the result of higher interest rates, perception that house price will fall further, and uncertainty around the outlook for economic activity.

The banks reported that the slowdown in mortgage borrowing "was broad-based across all types of buyers and most regions".

"Banks noted a series of major headwinds dampening household demand, namely rising mortgage rates, a higher cost-of-living, and rising building costs," the RBNZ said.

"Demand for lending has also been soft due to declining house prices and the uncertain economic outlook domestically and globally.

"Over the next six months, mortgage demand is expected to remain subdued, as the same underlying factors remain present, including high interest rate environment, speculation of further fall in house price and weak economic outlook. Borrower sentiment will likely tend towards more caution due to the fast-changing housing market conditions," the RBNZ said.

The current economic environment was seeing most banks maintain a conservative lending approach, with affordability assessment using higher assessment rates than seen in recent years.

"Banks have been willing to accommodate requests for conversion from Principal and Interest to Interest Only, to provide relief to customers facing rising debt servicing costs and living costs," the RBNZ said.

The RBNZ said that the banks were also reporting that credit demand for commercial property has "significantly reduced in the past six months and is expected to be subdued in the near term".

Again, the rapid interest rate and inflation rise and falling property prices are contributing to a low demand market.

"On the development side, cost inflation and supply chain delays are still prevalent. It has also become more difficult for customers to achieve minimum qualifying presales in the current housing market downturn," the RBNZ said.

"Property yields have not shifted as materially as interest rates have risen and there might be a sustained correction of property values over the next six-to-12 months as sellers have to alter price expectations to align with purchaser return requirements.

"The Auckland floods and Cyclone Gabrielle have had significant impacts on a number of the banks’ customers, and solutions were initiated to assist these customers. The extent of the impact and the solutions required are difficult to assess at this stage."

The banks are reporting that credit availability for commercial property has been tightened over the past six months. Banks continued to be quite cautious around lending to new commercial property clients owing to the deterioration in the economic outlook.

However, banks appetite for investment grade lending remained for prime office, industrial and retail assets with non-discretionary tenants (supermarkets/large box retailers). This trend is predicted to continue.

"In general, banks have not changed their lending standards and funding is available, but many customers cannot meet existing standards because of rising interest rates and falling demand. However, most banks have eased their interest coverage requirement in line with the rise in interest rates. There has been some signs of customer serviceability stress given high interest rates, low profitability, and housing market uncertainty. Banks were willing to work with clients under stress," the RBNZ said.

The country's banks have reported that credit demand has been "generally subdued" across all business sectors.

66 Comments

That parrot is not "subdued", it's just resting....

Property yields have not shifted as materially as interest rates have risen and there might be a sustained correction of property values over the next six-to-12 months as sellers have to alter price expectations to align with purchaser return requirements.

Pretty much everyone - buyers, banks, valuers, mortgage brokers, accountants, Blind Freddy and Real Estate agents all understand the situation, just waiting for the sellers to come out of denial now.... This is going to be a massive shift. You can understand why this could be as big as subprime in the USA, there are going to be some huge commercial real estate markdowns...

Yes this paragraph caught my eye as well. Didn't think they would openly say this, despite it being the elephant in the room.

My "Hone and Aroha" suggestion has good company.....

IO: Didn't think* they would openly say this

Why on Earth not? We have been discussing this recently. Yields are important, always have been. Banks always consider yield when considering mortgages.

* my emphasis

by Zachary Smith | 25th Apr 23, 7:57am 1682366253

IO: Didn't think* they would openly say this

Why on Earth not? We have been discussing this recently. Yields are important, always have been. Banks always consider yield when considering mortgages.

* my emphasis

Because the bank is saying they are terrible.

Indeed. Those standing grasping their debt laden party bag are slowly waking up to the fact that they are the risk patsy standing up with no seat. The music has stopped, stop looking for the next sucker...you are it.

Yield matters, it really does. Every day that goes by, and every rates rise, it matters more and more.

4 decades of falling interest rates have confused investors to thinking that they could run negative geared/loss making property investments work because the capital value of the houses was going up around 7% p.a. on average. Actually, they were handsomely rewarded for running 'investments' that never made money on yield, but instead capital gain.

If they're still loss making on yield in the current environment, and making no capital gain (or falling), as the cost of debt is no longer falling, then it could be a big wake up call for many (perhaps an entirely new paradigm will be required - one that they've never required in their adult/investing lives - 'leverage is good' could turn into 'leverage is bad').

What makes you think long run average interest rates won't continue to fall?

Because we hit 0% and bounced - and broke a 40 year pattern in the US 10 year treasury yield (we're going sideways now - unless you think the 10 year treasury yield is going to be -10% in 10 years time? And if so, who do you think will be buying these bonds? And something very bad has happened - like the USD no longer being considered a global reserve)

Even if we flat line in interest rates from here, the damage is done. Cash flows will need to grow aggressively to offset the change in discount rates - and yet if they do grow aggressively, they will show up as very high inflation, which will cause central bankers to raise interest rates even higher/faster.

We may go back to 0% rates again if/when recession hits - but like what we've seen it could be another speculative frenzy which causes even more inflation - a repeat of what we've just had that has caused too much debt chasing to few real assets and that quantity of debt can't be serviced by the productivity/income that society/economy.

Nothing to worry about. The 2008 crisis in the U.S. was caused by lending at low teaser rates to borrowers who could not afford to make their payments when interest rates eventually rose. New Zealand is different. Oh wait, no its not.

What is the best way to short the NZD?

FX Margin trading tho I think if you just new look at a position via an option.. www.saxo.com

At 7% it's 35k interest payments on a 500k mortgage. And that's the amount earned once A full tax is paid on it.

It's no joke mate to buy a house at the current prices.

If it's not hit the crazy borrower's of last two years, it will very soon like a bullet train at 350kmph.

Wait on the sidelines to see the damage. ( carnage)

Tax brackets are static, inflation up, interest rates have doubled and business revenues starting to fall. negative welath effect kicking in as people realise their house was only ever worth 50% of what they were told last yr. And there is no big boom or free cash for a few years.

Chippy has helped by paying everyone in public service, retirees and beneficieries more money and motivating the smart ones that still arent happy to flick off to Aus and pay them taxes, support their public services and infrastructure maintenance - and make them money for their retirees instead. Except of course those that dont want to work who can continue to bludge here.

Hangover from too many years of economic and political stupidity.

Tax brackets are static, inflation up, interest rates have doubled and business revenues starting to fall....

Great comment OSE. Someone's thinking.

It is not true that the government is splashing out on public sector wage increases. They are only giving inflationary increases to those who don't work for it.

"Private sector ordinary time hourly earnings increased by 8.1 percent, to $36.43.

Public sector ordinary time hourly earnings increased by 4.7 percent, to $45.12."

https://www.stats.govt.nz/information-releases/labour-market-statistics…)%20increased%204.1%20percent

A good macro view from Howard Marks in a recent interview - 'We are undergoing a historic sea change'

Aligns with my view that if you think the past 40 years are going to be representative of the next 40 years, you could be suffering from recency/confirmation bias in your thinking.

The math of the ‘prices double every ten years’ nonsense was always fundamentally flawed.

It works if the cost of capital ALWAYS falls over the duration that debt is held against the property as it covers the loss between the discounted future cash flows (earned from working in the real economy) and the 7% p.a. capital gain/required return.

Price = Cash flow / discount rate (required return)

It doesn't work (actually it gets very messy!) if the discount rate/interest rate is stable or rising. Hence why I would agree that yes house prices have doubled every 10 years in recent history (i.e. recent decades)....but before that (previous 100 years) they appreciated at or around the general rate of inflation....why? Because houses could only appreciate at the same rate as the productivity of society (i.e. wages earned), and not via central banks playing god and dropping interest rates from 20% in early 1980's, to 0% in the early 2020's. All that does is steal cash flows from the future to elevate asset prices (and create more debt) to levels that can't be sustained by productivity of the economy. Fools paradise.

Exactly

Perfectly stated.

A real time proxy of this can be viewed using the TLT fund (ishares 20+ year treasury bond ETF).

iShares 20+ Year Treasury Bond ETF (TLT) Stock Price, News, Quote & History - Yahoo Finance

Unless interest rates drop again - the value of this index will remain 30-40% below the market peak until cash flows (yields) can grow fast enough to offset the change in discount rate. Same situation could play out in the residential property market. Real world examples in NZ:

Summerset Group Holdings Limited (SUM.NZ) stock price, news, quote & history – Yahoo Finance and another:

Ryman Healthcare Limited (RYM.NZ) stock price, news, quote & history – Yahoo Finance others:

Property For Industry Limited (PFI.NZ) stock price, news, quote & history – Yahoo Finance

Goodman Property Trust (GMT.NZ) stock price, news, quote & history – Yahoo Finance

The math of the ‘prices double every ten years’ nonsense was always fundamentally flawed.

The sheeple were duped. Didn't ask themselves the question "but what if they don't?"

Someone needs to educate Nikki Connors about this.

Your 45 years aligns wit the Peter Ziehan view that we have just had the best 75 years of all time and that it has ended.

Our leaders need to read his book

Also aligns with Dalio (as well as the 4th Turning Theory by Strauss/Howe)

My view is that when enough great thinkers are in alignment with their views, its best to take notice.

Also aligns with Dalio (as well as the 4th Turning Theory by Strauss/Howe)

On my tablet right now

Its a terrible read. Over 1000 pages and most of the time he gets sidetracked waffling on about roman, dutch etc history. Could have summarized his views in a few chapters. Instead he wrote a boring book. Most our our leaders wouldn't have the patience to read it.

You are talking about the fourth turning not Ziehan here I take it?

End of the world...Peter Zeihan. Great bedtime book. Over 1000 pages of boredom. 1/4 a page per night will put you to sleep. Better than sleeping 💊

I've been keeping an eye out for industrial workshop space in Wellington over the past few years.

A lot of new tilt up concrete complexes have been completed but they were selling for $10000 per square metre!

Will be interesting to see how this corrects, can't be many businesses starting up at the moment that can afford that much for space.

A lot of those businesses that bought spanky new premises on tick will struggle big time now.

Borrowing and supply side costs rising and revenues/margins falling at once. Not to mention their key staff will be looking for pay rises to offset their own increasing costs.

Businesses have had it easy for a looong time. Easy revenue stream and really low costs.... i reckon quite a few will hit the wall over 12 months or so.

Nothing to worry about. Small business are far more exposed to competition and only employ 30% of the workforce. Many of them are exposed to any turndown in the construction industry. Family homes are often used as collateral for business lending. What could possibly go wrong.

Nothing to worry about. Small business are far more exposed to competition and only employ 30% of the workforce. Many of them are exposed to any turndown in the construction industry. Family homes are often used as collateral for business lending. What could possibly go wrong.

Why does nobody around the water cooler get this?

All those who were hoping for a crash will be annoyed. Turning on the immigration tap while interest rates are cut next year will see another surge in house prices. Interest rates in the 4-5% mark will be more than palatable for most people. Longer-term interest rates are already under 6%.

Leveraged up are we?

Haha, there are a lot of leveraged up investors on this forum playing the victim.

Nah I bought my house three years ago for $500k in a very modest area. Just keep seeing people dribbling on about house prices with very little reality. The desirable places will see prices surge as soon as interest rates fall. It’s simple supply and demand.

The prices already surged, well past sensible or fundamental values. Now the sure thing ain't so sure no more, you think the masses are going to jump right back in? a bunch of them just got ruined, and more to come. The RBNZ dares not back off now and when a time comes when they can, we won't be seeing stupidly low rates for another 30-odd years.

I look forward to reviewing these comments in 18-24 months.

I agree, pretty predictable really. Throw in a few more wars, catastrophic climate change that's already happening and watch the immigration figures go through the roof, hopefully things don't get so bad in the rest of the world for at least another 10 years that we have to start dealing with illegal immigration as well.

All those who were hoping for a crash will be annoyed.

So you're saying it's not yet a crash right now?

When property prices do eventually bottom out, how long will it be before once again the gains exceed the prevailing rate of inflation? If they continue lagging behind, then they're still falling in inflation adjusted terms. I remember those days when the Spruikers harped on how capital gains exceeded the inflation rate right up till the day it all popped. The story line will change about how "inflation adjusted" is a poor measure and no longer applies - lol!

They haven’t crashed when they’re still above pre-pandemic prices.

...in a years time when they've fallen heaps more the definition of a "crash" will once again be moved. Prior to Nov-21, those who predicted anything like a 20% drop were called out for wanting a crash and would be bitterly disappointed. Call the current downward trend what you want but some might argue what we are yet to pay is the price of folly. If we don't sooner, then later we surely will :)

Ah so not a crash for *you* yet.

No not yet. Right now for the growing number of financially pressured, there are still relief options. Many who still have some equity are more likely to get interest only relief/payment holidays on offer from banks. This can only go on whilst the equity exists, but its steadily declining. When the distressed selling starts, unemployment takes off, companies fold then its game on. Much like the fun ride up, I think the longer this slide in prices endures the more psychologically reinforcing it becomes.

I havent commented on housing for a while so here goes. We are, or are very close to, near the bottom. I'm not saying they start rising, but the falls are generally over bearing in mind the lagging effect of data.

Many of you are over-thinking it, handicapped by your cognitive bias. We are now at $5k+ per sqm for a mid spec reno. There is considerable value in our housing stock. Chronic labour shortages, near peak OCR and immigration will support all but the most leveraged. I can see rents taking off within a year as well. Take a look at the ugly mess in Sydney, 100+ queing to view flats.

Also the overwhelmingly negative view of 99% of contributors is another indicator it's time to buy.

I'd say the rate of price falls has perhaps bottomed (at around -14% p.a.):

Median house price growth | interest.co.nz

It generally takes around the same amount of time for a trend this like to reverse back into positive growth territory as it took to bottom out. New Zealand could be different (as we are always told) so you could be right. I just wouldn't bet a deposit on it yet.

6-12 months from now might be a great opportunity to buy if you're sitting on a deposit (prices near a bottom and interest rates flat/falling).

I think you are being a bit premature.

I think price falls for the rest of this year at the very least. But the rate of decline will slow. I think there’s about another 5-6% of price falls at the national level.

I don’t think we will have anything like the rental logjam that Sydney has had. Still plenty of new houses to be finished in the next 4-5 months, and the immigration inflow will slow and possibly reverse.

Also the overwhelmingly negative view of 99% of contributors is another indicator it's time to buy.

Get amongst it my friend. Remember, DGM in itself is not contrarian. But then again, the betting on propadee is still very much the narrative in play. Too much is at stake.

Tent cities around Bondi and the Northern Beaches still not emerging yet, but don't discount the possibility.

I forgot to mention the Interest readers contribution to the property market - repealing Labours interest deductability legislation. The co-governance/3 Waters boogie man is going to bring home the bacon.

I forgot to mention the Interest readers contribution to the property market - repealing Labours interest deductability legislation. The co-governance/3 Waters boogie man is going to bring home the bacon.

I hear you. It's going to be a socio-economic swamp for quite some time.

handicapped by your cognitive bias

After 20+ years of a housing boom the bias is firmly in the other direction.

Te Kouti. I'll oppose this ...

My observations... using logic and more key indicators than so called fiscal gurus

The experts are continually wrong.

-OCR will keep rising until Orr sees 3%. His .5% last time showed his intent

-Inflation will rise next quarter to 10%% as winter fuel /energy prices rise, fruit and veg suply diminishes during winter.

-Retail spending will drop as people hunker down

-Lowering demand v raising supply across housing, New cars, large ticket item's etc

Many visible discounted house sale prices increasing daily

-Residential Construction falling

-Unemployment rising and some big layoff numbers coming .eg- universities, builders,

-Low immigration in v high leaving rate ( Aussie)

- Government will raise wages hugely in key areas to maintain people in health, education, etc... which inturn will, make the private sector raise prices to compete which inturn raises the Government and private debt which raises inflation

- the boomer spend up cannot continue " there are only a certain amount of motorhomes , e-bkes, expensive restaurant meals, ... they can afford before the chickens come home to roost . Even at 6% TD return

Government inaction on constraining costs will see a major economic blow out which will result in desperate government job and spending cuts ? As per post GFC earn national had to fix the Clark blow out ( remember the billions still owed on student loans loans)

I could go on all day about income v costs and why house price will fall, buy just take a breath and smell the roses!

They are about to wllt and die!

This article shows that the amount being borrowed for house purchases is 40% down from the same time last year and over 50% down from 2021.

So if you have 50% less borrowed money available for buying houses.... What will happen to house prices? (Which is fueled purely by borrowed money).

Macro exam question for Treasury and RBNZ economists...

As crazy as it may seem, imagine ALL of the following economic conditions are true:

- Cost of living has risen a lot - predominantly due to sustained increases in the prices of key imports like petrol, diesel, plastics, fertiliser, metal

- RBNZ has decided that the solution to expensive imports is to reduce consumer demand for them... so they've hiked interest rates by 500 pts in 18 months

- Households and businesses are now paying off debt faster than they are taking it out

- Transaction account balances are dropping quickly as people move money into savings / term deposits

- Consumer spending is plummeting because people can't afford to buy as much as they used to and mortgage costs have doubled for hundreds of thousands of kiwis

- Govt have decided it's a good time for frugality - taxes and other receipts now outweigh spending, despite the Crown paying banks $7 million per day (on settlement account balances)

- Median earnings have flatlined (falling in real terms) - it is now clear that any real wage growth was over a year ago

- Oh, and there is an election in 6 months time

Write two short resignation speeches for the Minister of Finance and Reserve Bank Governor where each explains what they got wrong and what they wish they had done differently.

Heres ChatGPTs attempt

Write two short resignation speeches for the New Zealand Minister of Finance and Reserve Bank Governor where each explains what they got wrong and what they wish they had done differently.

Resignation speech for the New Zealand Minister of Finance:

Dear fellow citizens of New Zealand,

I am here today to tender my resignation as the Minister of Finance. I have come to this difficult decision after much introspection and reflection on my performance in this role.

I must confess that I got some things wrong during my tenure as the Minister of Finance. I failed to anticipate the full impact of the COVID-19 pandemic on our economy, and I regret not being better prepared for the challenges that it presented. I also underestimated the severity of the housing crisis and did not act swiftly enough to address it.

Looking back, I wish I had taken a more proactive approach in these matters. I should have been more open to alternative solutions and sought advice from a wider range of stakeholders. I also wish I had placed greater emphasis on creating a more equitable society, where every New Zealander has the opportunity to thrive.

I want to express my sincere apologies to the people of New Zealand for not meeting their expectations, and I hope that my resignation will give the government an opportunity to appoint someone who can better serve our country's needs.

Thank you.

Resignation speech for the Reserve Bank Governor:

Dear fellow New Zealanders,

I am here today to announce my resignation as the Reserve Bank Governor. It has been an honor to serve in this capacity, but I feel that it is time for me to step down and make way for someone who can better lead the Reserve Bank in the future.

In retrospect, I have come to realize that there are some areas where I could have done better. For instance, I failed to adequately address the risks posed by the housing market, which has had adverse effects on our economy and society. I also wish I had been more proactive in addressing the growing concerns around climate change and its impact on our financial system.

I regret not taking more decisive actions to address these issues, and I want to express my apologies to the people of New Zealand for not fulfilling my duties as Reserve Bank Governor to the best of my abilities.

I hope that my resignation will give the government an opportunity to appoint someone who can steer the Reserve Bank towards a more sustainable, equitable, and resilient future.

Thank you.

"Property yields have not shifted as materially as interest rates have risen and there might be a sustained correction of property values over the next six-to-12 months as sellers have to alter price expectations to align with purchaser return requirements"

This is further evidence that rents are stagnating behind inflation. Landlords can't pass on the additional cost to the already tapped out tenant. Its no wonder the number of reluctant Mum and Dad landlords continues to expand unabated.

I remember being at high school and competing in the high school share trading competition. My accountancy teacher was top notch. i read jones on property and all the others....at uni just before the 1987 share crash nothing made sense, you could just not make jones calculations work on yield.... off i went to the UK and mode some dosh, returning in 2002 I put down 50k on a Ponsoby villa and financed 410k at 5.8% for 5 years $585 pw rent did the trick. yield based investing will return, it ALWAYS does, no asset class can live on cap gains as a basis for future gains... be patient grasshopper.

Agrees. If the comments of the speculative on here are anything to go by, the spec community will hold onto their fading paper gains untill their last breath. The banks are to blame as well for supporting this behaviour.

But hay...you don't want your meal ticket to fail do you...?

Westpac now stress testing at 9%, if you are holding the bag you are the bag holder.... its all down from here until you can find a greater fool

Wow. For 6 months in 2021 ANZ were testing at 5.8%, I wonder what Westpac's test rate was. Less than 2 years later, 9%.

A stress test of 9% will protect today's borrowers, but what of those who were tested at 5.8% ~2 years ago who will be coming out of a fixed mortgage with rates higher than they were benchmarked for. Gross incompetence from the banks.

https://www.interest.co.nz/personal-finance/118188/anz-nz-ceo-antonia-w…

Look no further for the reason behind 90+% of mortgage applications failing...

Median incomes simply can't afford median house prices at 9%.

The cost to own @20% down is almost *double* the cost to rent a similar home (priced at $800k and up)

5hen politics is no longer a mission but a profession, politicians become more self-serving than public servants

When politics is no longer a mission but a profession, politicians become more self-serving than public servants

When politics is no longer a mission but a profession, politicians become more self-serving than public servants

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.