If the housing and mortgage markets have indeed hit the bottom, they are not showing any great sign yet of bouncing off it.

Just don't tell the first home buyers (FHBs) that. This grouping borrowed the most money last month since it had in December 2021 right at the end of the last housing boom.

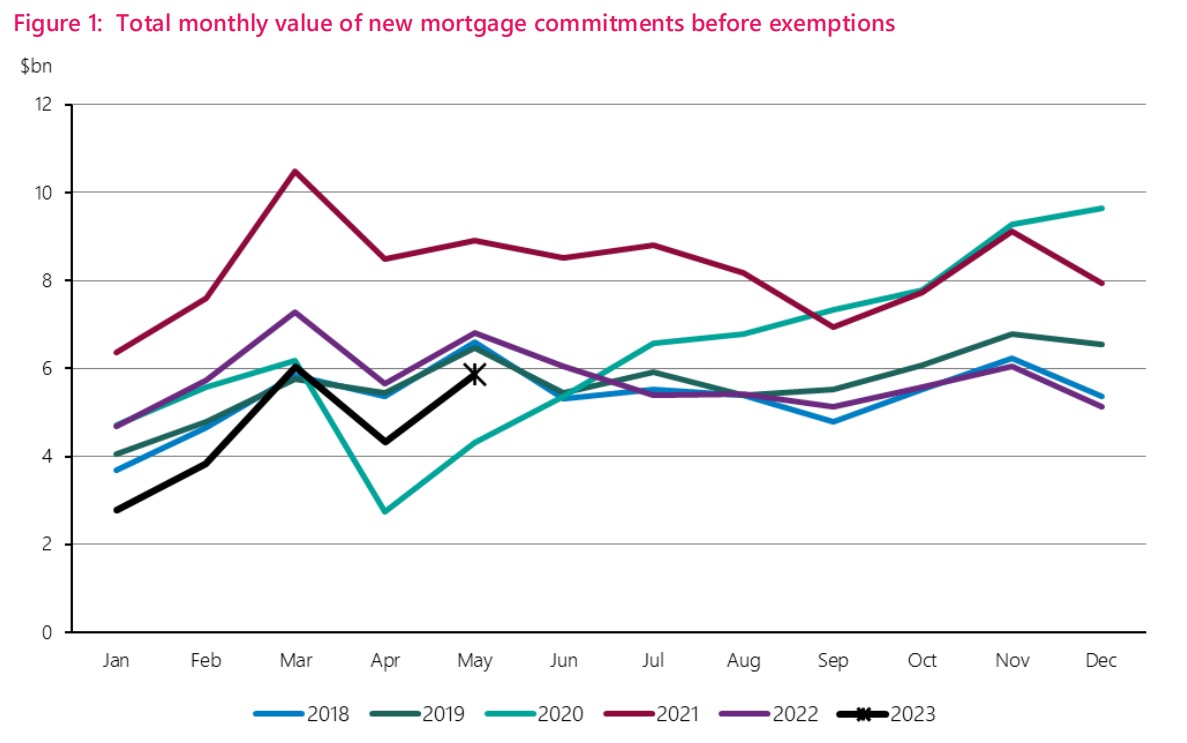

The Reserve Bank's latest figures for new mortgages show that in May the overall amount borrowed by all groupings was actually very slightly down (by 1.1%) - on a seasonally adjusted basis - the figure seen in April.

And in terms of non-seasonally-adjusted data, the amount borrowed in May was the third-worst May on record since the RBNZ started recording this data in 2013. Of the two worse May months recorded, one was in 2020 when the lockdown was still in progress and the other was back in 2014.

The RBNZ's summary of mortgage highlights for May is here.

The $5.859 billion advanced in mortgages for May 2023 compared with $6.818 billion in May last year and a bumper $8.921 billion in May 2021 when the housing market was still in mid-pandemic frenzy.

But those first home buyers (FHBs) are a staunch lot. They borrowed $1.422 billion last month, which was actually UP on the $1.314 billion borrowed by this grouping in May 2022. The figure for the latest month even compares fairly favourably with the bull market May 2021 figures, in which the FHBs borrowed $1.757 billion.

It's to be imagined that recent relaxation by the RBNZ of its loan-to-value ratio (LVR) limits has benefited the FHB grouping as the people who most often struggle to get the 20% deposit level, although the changes to the limits didn't officially come into force till June 1, 2023.

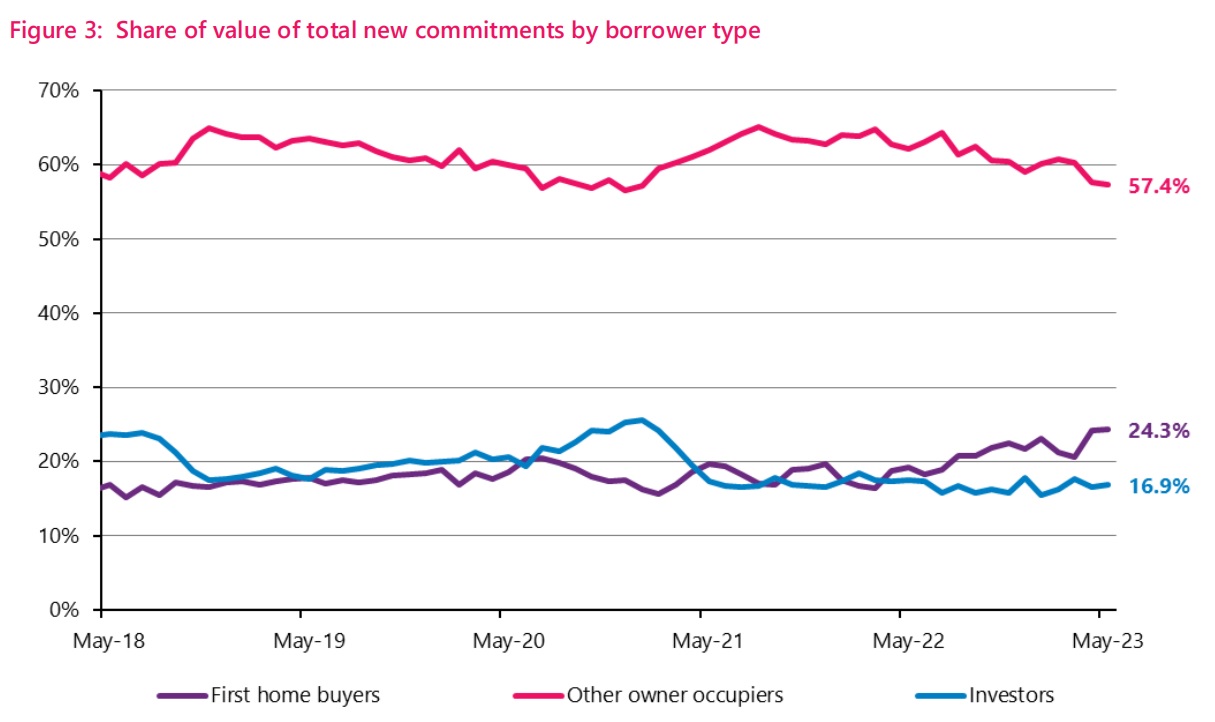

In terms of share of the mortgage spoils the FHBs hit a new all-time high last month with 24.3%, just beating the previous record set in April 2023 of 24.2%.

As might be imagined from the overall figures though, the owner-occupiers and the investors were not banging down the doors to borrow.

Investors borrowed just under $1 billion in May 2023, although their overall share of the mortgage money advanced did rise a little to 16.9% from 16.6%.

In terms of actual mortgage commitments by number, rather than value, there were 16,258 in May - which was up a lot on the 12,084 in April 2023, but down compared with the 16,693 in May 2022.

FHBs committed to 2558 mortgages in May 2023 - and this was also the FHB grouping's highest tally since December 2021.

50 Comments

That 🦜 is dead

But, but, but ……I thought green shoots were abundant!!

What BS!

Looks like you thought wrong HM.

If it stacks...it stacks. Good luck...

Good luck to all FHB. One would hope that they have the gift of time [30+ years] to work their way through it. There will always be far more people wanting to move here than want to leave here, regardless of what the interst.co post section says. It's a numbers game & we live in the margin of era. Plus, we also live next to Australia, a primary target of a lot of the world's 'movers'.

Don't panic Mr Mainwaring.

Finally a chance to not be competing with developers, investors, cashed up people from overseas, rich parents buying homes for their kids, and every other man and his dog, all the while they were being told you are only worthy in society if you own your own home.

So yeah not surprised they are taking the opportunity while they can. And good on them. If it all crashes down they can get bailed out like everyone else does in this country.

You did notice that owner-occupiers account for 60% of new borrowing? Sure, some of these will be trading up. But some will be in the groups you identify that compete with FHBs. Be careful interpreting these stats. (That said, I wholeheartedly agree with the sentiment of your post.)

"First home buyers still propping up the mortgage business" For some time now they've been doing this in the midst of declines. One has to ask the question, are some of them starting to wonder if they've been sucked in? With anemic investor activity likely to continue for some time to come for reasons such as incoming DTI we shouldn't seriously expect FHB's to put a sustainable pricing floor and price recovery in the near future....

Good to see more FHB's getting their own home, well done!

No room for positivity on here mate.

Yep, very sad.

Yvil, Zwifter, you'd come across as more sincere by adding in "as long as the benefits of doing so aren't overwhelmed by the still developing risks"

One only hopes that buying a first home with a huge debt load can still be a positive life changing event for the FHB.

Do you both agree?

You own a home for the long term. In 5, 10, 20 years, families who bought today will not even remember the drop in values of today, it will be totally insignificant. They will simply be happy to live in their own homes, and by then, they will have repaid a good portion of the mortgage.

....yes - yes, very sincere. The Landlord Bank owns the home. House valuations are still stretched.

Other factors are now coming into play such as spiraling rates and insurance costs. Like tax, these are unavoidable and only serve to further stress household budgets that for many are at breaking point. Anyway, you're on record several times stating things are going to get a lot worse from here.

edit

Yes, I do think things are going to get worse. I also think if a FHB wants to buy a house now, then good on them, it will make very little difference in 20 years.

Can you not see that these two ideas are not mutually exclusive?

You seem to imply that FHB should wait until the market has bottomed but that's impossible to time, the bottom will only be known several months after it happened.

"I also think if a FHB wants to buy a house now, then good on them, it will make very little difference in 20 years."

Yvil, I think this is why people on here think you're full of shit. You have no objective way of knowing whether buying a house now will make very little difference in 20 years.

Seemed a pretty reasonable statement.

After 20 years of home ownership, it'd be immaterial to most people what point of a market cycle they bought a house in.

That is only if you think of the price. They have to make it to 20 years of ownership. If inflation keeps chugging along, in 20 years they could still be scarred by the drudgery of making interest payments at high rates while inflation refuses to come down.

If you had 20 years of high inflation then presumably your income would increase to such a level it'd mitigate the percentage extra you paid for the house.

That said assuming 20 years of high inflation is a bit of a long shot to abstain from owning a home, assuming you wanted to own one.

the quality, size, spec, features of your house are surely different though. A 1 million buy now gets you a much better place than a 1 mill buy back in 2021 ... so therefore there is a long term impact. Sure you are in a house, but it's not as good as one that you might have been bought 3 yrs later - so your argument doesn't stack up

re ... "You have no objective way of knowing whether buying a house now will make very little difference in 20 years."

A spreadsheet based on past scenarios capturing all the relevant parameters (prices, maintenance costs, i-rates, inflation, GDP, FX rates, etc.) will provide this. You should try it. You'd be amazed. It works because residential property is massively predictable in that 'past behaviour' is much the same as future behaviour.

And, sorry Yvil, the difference between a buyer buying the same type of property in the same place at the peak and the bottom is massive after 20 years. It has all to do with compounding interest and the present value of money.

re ... "... FHB should wait until the market has bottomed but that's impossible to time, the bottom will only be known several months after it happened."

And that is the time for FHB to buy. Property markets are quite dissimilar to share market stocks in this regard. Property markets seldom have a 'false bottom' so most 'bottom turns' are most likely to signal a bottom. That, of course, does not mean an immediately return to significant growth. Once again, property markets can stay flat following a bottom for considerable periods. Usually measured in years.

And once again - people should not overlook the 900lb gorilla in the room - the MDRS & NPS-UD which have both removed considerable artificial restraints on supply.

Yes looks like rising interest rates coupled with Labour policy is having the desired effect. More FHBs in homes.

Indeed !

Now they just need to introduce mortgage interest deductibility for owner occupiers.

???? For owner occupiers there is no income to try to use interest as an expense to offset.

No income? My wife and I both have jobs, we're net tax contributors. I wouldn't mind being able to offset my PAYE against the interest costs on my mortgage, resulting in a tax refund each year.

Arguably, the mortgage is an expense that puts a roof over our heads. Try going to work ("deriving an income") each day living under a bridge.

There are not more first home buyers now. In May 2019 there were 2,760 FHB. Even in the middle of the 2020 lockdown there were still 1,768 FHB. There were 3,205 FHB in May 2021. The 2,558 FHB in May 2023 is still less than 2019 and 2021. But don't let actual numbers impede the misuse of statistics.

I was going to ask why Greg had omitted the 2021 figures on first home buyers. Disappointing if this was a deliberate attempt to skew the narrative.

“Home” buyer rather than “house” buyer.

Not all about money.

It IS all about money when you are struggling. Daughter's work colleague bought her first home 3 months ago with her partner. They are really struggling as he got his hours cut in his forestry job a month after they moved in.

Struggle Street

John bank's euphemism for life being a sh1t show

Just goes to show how financially illiterate many young New Zealanders are. Now is the exact time you want to be a renter - rents are far lower than mortgage payments. And with rates and insurance going up 10%-30% this year it will stay that way for some time. If they had any sort of financial acumen they would continue renting while socking away cash for a bigger deposit later. That way if they lose their jobs in the upcoming recession they won't end up being forced to sell their house for a loss.

Some people make life decisions based on other factors than whether renting is cheaper than buying.

Rents should be quite a bit cheaper than buying.

This sort of comment shows how narrow sighted some on this site can be. We just bought a family home... mortgage payments are substantially cheaper than our rent, and the property size is substantially larger too. Plus I can actually do stuff around my own house rather than mind someone else's lawn. We sold a year and a half ago and have been sitting waiting and watching. With a young family there is only so much waiting you want to do before life wants to carry on. Especially as school age starts getting closer. I have a degree in finance and have spent 12 years in a financial profession. I would not consider myself financially illiterate.

So you are not the first home buyer to which the comment relates..

I imagine running the numbers on your place with a 10% deposit looks very different.

Yeah, the "I sold a house a year and a half ago when prices were at their peak insanity and then recycled my huge capital gains into another property after a 20% price fall" doesnt make you the normal First Home Buyer. Try running the numbers again with a 5-10% deposit, most of which is from raiding your Kiwisaver.

Assume you are selling up and going renting as "now is the exact time you want to be a renter"... That way if you loose your job in the upcoming recession you will have lower rent payments than mortgage payments.

Interest rates and recessions have zero impact on me. However, if I were currently renting and had only scraped together a 5-10% deposit I would not be buying a house during a period of 7% interest rates and falling house prices. I would be saving like mad over the next year or two to get my deposit to at least 20% and waiting for interest rates to drop and for house prices to at least stop falling. That is the financially sensible thing to do in the current environment.

Now is the time to buy when interest rates are high and house prices have taken a hit.

Will prices be higher or lower next month?

Are interest rates high?

Have house prices really taken a hit?...they are still above the silly pre-covid prices..

Its not the time when apparently affordability of a couple fulltime + part time earning 85k+30k, no kids is 320k

NZ is officially deleveraging. Interesting times ahead.

Indeed. Just because negative leverage has not occurred for some time, doesn't mean it cannot. Fun times for the interest only ponzi players as their debt to equity numbers surge the wrong way.

The debt remains the same....almost a song lyric.

it makes sense since house prices have dropped, then mortgage sizes drops too. interesting thing is that the total mortgage level is lower than 2018 and 2019.

I'd say it's below normal level now, and if know what that means.

For new borrowing sure. All those farming interest only on existing debt, especially in the last five years, will be significantly under pressure.

Total mortgages on interest only peaked in June 2020 at $75B and has since dropped to $58B in 2023.

- Bank: "How long would you like to go interest only for?"

- Investor: "The longest, 5 years?"

- Bank: "You do realize that when you come off interest only that....."

- Investor: "Yeah yeah just give me the money"

5 years later: "W-w-w-w-what the banks are screwing me, they didn't tell me payments on P & I would increase based on the remaining loan term".

I've owned lots of properties, I'm going to build a new house in an area that's going to boom..... pretty sure of that. I've recently bought 2 acres there and got a massive discount.

The bell doesn't ring when it's time to buy, but I'm sure it's very close.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.