The first home buyers (FHB) are still, well, buying, but the investors have still got other things to do.

The pattern of a year that's seeing the FHBs getting plenty of room to borrow mortgage money as others decline the offer has continued in the latest month, according to the Reserve Bank's June figures for new mortgages.

The FHBs edged to yet another record high share (in a data series dating to 2014), up to 24.4% of the total mortgage money advanced, up from 24.3% as of May.

Investors on the other hand saw their share of mortgage monies drop from 16.9% in May to 16.5% in June.

In figures, the FHBs borrowed $1.385 billion in June, while the investors borrowed just $939 million.

There may be some slight signs of life showing in the market though.

The overall amount advanced for mortgages in June was $5.686 billion, down from $6.056 billion in June last year and down from $5.859 billion in May 2023.

However, according to RBNZ seasonal adjustment the June 2023 total's actually up by 7.6%.

And perhaps another slight sign of life is to be seen in the fact that there were 15,498 new mortgage commitments in June. While that's down 4.7% from 16,258 in May, it's actually up by comparison with June 2022, by 3.7% from 14,952.

But let's be clear, we are talking about possible signs of life from a very low starting point.

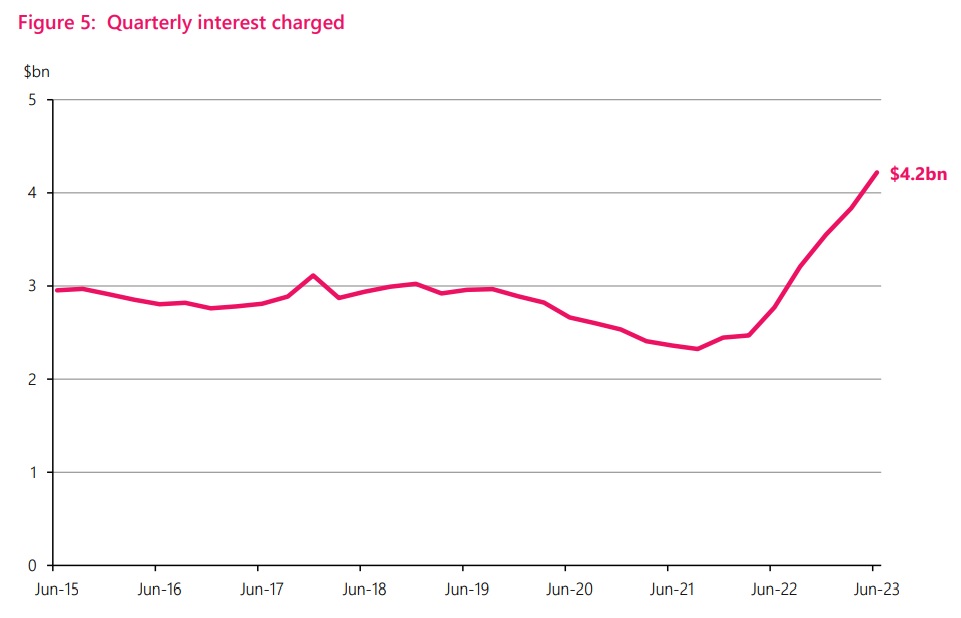

While a lot of numbers have been dropping, one number that's been going up sharply is the interest bill.

The RBNZ's separate quarterly loan reconciliation data shows that the amount of interest charged on mortgages in the June quarter crashed through the $4 billion mark for the first time since the start of this data series (2014).

For the record $4.219 billion in interest was charged in the quarter, up from $3.835 billion in March 2023 and just $2.77 billion in the June quarter in 2022.

45 Comments

Interesting. My partner and I are 35. We have been going to open homes recently and I would say at least 75% of the people we see are over 50. We are looking in the under 1m range as well. Maybe these FHBs are all looking at new developments / apartments (which we have been avoiding).

But you must realise, "It's over. The Bottom is In!". And therefore, those you see at the Open Homes are looking to exclude you from the First Home Buyer market by leveraging up their existing equity in their own home(s) before the market rockets. Sorry, but you'll just have to borrow and pay more. But look on the bright side! You'll be excluded for wee while longer, but will be able to take your pick as those that buy today, have to sell tomorrow. (The witnessed behaviour is exactly why Inflation isn't beaten, it's just gathering its breath before the real move kicks in)

No rush, the housing market has fallen 20% over last 18 months and will probably fall another 15% to 20% over next year. The people who missed out this time last year will be so happy as deposit will be more and mortgage will be smaller.

20% drop is total speculation with no evidence to back this up. Bank economists are estimating a rise of 5% in prices next year. Now this may not eventuate, but at least their guess is based on economic data they have evaluated.

You are still believing the same economists that predicted a 0-5% drop in house prices and little change in interest rates ? Not sure how clever that is. Eventually they may get it right. But now, no, prices will continue to drop probably to pre Covid levels.

Not sure about maybe 5% by the end of 2024 but there will be clear evidence the market has turned. Those that think its still going to go down next year are going to be disappointed.

There's still huge amounts of existing mortgages rolling over from low interest rates into high interest rates, for most of 2024, plus a likely increase or two of the OCR. Prices have a big delay time on interest rate changes, so we haven't seen the bottom yet at all. I'd pick for it to keep going down for around half of next year still, and then flatten for a while (maybe several years).

Yip. From what i can see our leaders have a glorious plan. They are simply shovelling immigrants into nz and into houses, probably 2 to 3 fams per house... keeps rents and house prices well propped up. The worse the economy gets the more immigrants we pump in... and if they cant afford rents.. we give the accom supplements and benefits to help...

Short term thinking.. sure.. but by the time the fuse runs out the current leaders will be long gone.

They are simply shovelling immigrants into nz and into houses, probably 2 to 3 fams per house

A sensible culture instead puts increasingly smaller numbers of people, into increasingly larger dwellings.

Immigration and wage inflation will keep house prices up. I don't see an OCR rise of 25 bps making much difference as the big banks have already factored it in.

No one should be impressed with complex datasets and modelling. With four parameters you can fit an elephant, and with five I can make him wiggle his trunk.

There is a tendency to overcomplicate things. Especially economists. When actually it’s pretty simple.

The primary driver of house prices today is affordability. Unless purchasing power changes (significant increases in salaries or banks are prepared to loan more money) kiwis simply can’t afford homes 7-10x salary and at 7% interest.

Everything else is just noise. Best case scenario stagnant house prices. But more fall’s likely.

Not *really* seeing a reduction in borrowing power from First Home Buyers (RBNZ C31). Looks like roughly 5% down on 2022. Maybe wage inflation has compensated for the higher interest rates? Or less investors (approx 40% down) = less competition and FHB have decent cash deposits?

Averages from RBNZ C31 (Total borrowed / Number of Borrowers)

- Jan 2020 - $448k June 2020 $451k

- Jan 2021 - $517k June 2021 $546k

- Jan 2022 - $577k June 2022 $588k

- Jan 2023 - $548k June 2023 $566k

Holy moly.. that interest payment is huge.. people are getting poorer by the day.. until there is capital gain on their property..

Investors won't buy until the tax rules are put back. I just put rents up by $50 per unit in a block of 3 to cover this and last year's tax increase. Pretty sure I still go backwards, so do the pensioner tenants. Lets fix this.

Why didn't you raise it by $100 per week? I know, you're being kind, right? (I know why, of course -= because current rent +$50 is better than $0 rent at all)

I'm at upper band of market rent now so that's that. The other cost increases I get to eat. Has anyone seen their insurance bills this year?

Looking around at supply dropping in most areas and immigration strong, I think there will be a quick increase in rents over the next year (unless the Greens win) so if the tax policies stick around next year I will increase again.

Not if Mah Na Mah Na do so do nothing, and he motley rabble get near the levers of power. You’ll have a rent freeze and and increased costs because you gone and bought a house you rich guy. Just cos. You will give her voters free house cos they don’t wanna work.

Investors should have saved for a bigger deposit instead of leveraging themselves to the hilt. Sure, the tax deductibility changes are not ideal but all that happened was personal mortgages were no longer deemed as a legit business expense for tax purposes.

It's you and you alone that determined how much debt you want to carry, and how much you want to increase the rent by. Reckless borrowing from Landlords clambering over everyone else to buy existing houses is what has led us to this predicament.

I didn't borrowed recklessly, others might have but I didn't. The government changed the tax settings pushing up my costs. I'm passing those costs on. For more evidence of businesses passing on costs I present: every other business under the sun.

Will be interesting to see what gives first… market rent increasing to meet new higher debt servicing costs, or investors defaulting and having to sell up. Maybe a bit of both, ie only the strong (underleveraged) survive.

And of course then will come the fabled holy ground, where renters are suddenly able to buy their houses from said failed landlords… More likely scenario, renters keep renting at higher prices, landlords pay more tax into Gov’s back pocket. Hidden tax grab to claw back Covid overspend… dressed as “solving the housing crisis”. That way, both mortgage holders and renters get to pay for the Covid party… Nice work Gov.

Yep, throw in requirements for healthy homes standards, and you've just managed to make being a landlord super unattractive, and being a tenant much more expensive.

Someone's a winner there, but it's neither of the above parties.

Well said Pa1nter, the house always wins!

Sometimes trying to get ahead financially and plan for retirement feels more like gambling… what other fiscal knee-jerks will I need to navigate over the next 25 years?!

Being a housing investor right now is lose, lose, lose. Yet many investors are still buying.

Where's the lose lose. All my properties have gone up in the last year the ones with ANZ their meteric shows from 10k on one house to 180k on another (I don't agree with it but I am not selling) I have added 2 new builds into that as I brought two old houses and have subdivided the sections and built on the back so tax deductions on that. Still tax deductions on all the old ones bar one. And with a new govt soon that most probably full deductions. So kindly tell me were I am losing averaging close onto 10 percent across the lot and that's at market value not rough or built value. I also built the 2 myself at cost. Maybe alot on here should spend more time looking and checking out than talking

I've owned lots of houses and I'm doing a new build shortly. By the time you guys work out that house prices have gone up you'll be too late.

Find the right area where there's lots going to happen and Bob's your uncle.

Being a housing investor is not necessarily lose, lose, lose. It depends on what you pay for the property, where it is, how big the mortgage, what state it's in, what rent you're getting, a host of factors.

There's areas where buying property is very canny if you've done your homework, and found out what's happening in that area.

Healthy homes is a red herring. Too many landlords saying "why should I have to pay this" and leaving it past the required date when their tenants are freezing cold and paying through the nose to run a cheap undersized heat pump, if they are lucky to have one, to try and have a livable space. Whilst I know full well there are somerotten tenants out there who never open windows and treat a rental like a dump, the standards are there for a reason. My guess is landlords not wanting to fork out to do anything to their houses as they see it as a business investment and wish not to provide a half decent living space. Oh well, thecosts get passed through via rent until breaking point as with mortgage rates until the great sell off begins likely later this year.

They claim to be businesses for tax purposes, yet balk at the idea they are held to minimum standards like other businesses.

Businesses balking at compliance costs is normal…

Actually I had a tenant who refused to have any improvements done to the house. They said “I can handle being cold but I can’t handle higher rent…”.

I wonder if same tenant was in their own home, would they be forking out for a heat pump?

what's the rush!

read the figures, investors are holding their power, there won't be many rentals available down the track. the moment the housing market gets moving again, there will be acute rental shortage.

Put rents up $50 per week while losing $20000 per month in house value with three that’s $60000 each month sound like great investment nktokyo did you not see crash coming and get out sooner.

Pretty expensive in terms of transaction cost, taxation and general hassle to nip in and out the property market every few years. The downside of an illiquid asset.

That's only if he brought at the peak he might have had them for 10 yrs. A bit like A2 milk could of brought them at 16 dollars,a share or 30 cents a share many yrs ago

I'm surprised that investors still account for 16% of the monthly sales, and nearly a billion dollars in new mortgages. Who are these people?

could well be refinancing.

Interest Bill going up. So who's better off?

I don't think we are better off as a country or society.

God save NZ

Someone on here a couple of months ago suggested introducing compulsory Kiwisaver contributions would be a much better tool to control inflation than whacking up the mortgage rates. At least people get to use this retained money at a later date.

But you'd have trouble convincing Muldoon era voters, they'll be having flash backs of "reds under the beds".

A lot of people can’t afford to put food on the table. How can they afford KiwiSaver contributions if they cannot afford to live now. Conversely, those that understand that KiwiSaver is a crock and have organised their own retirement plan free of fees and with better returns, why would they want to put money into a loser of a scheme. This will never work until the idiots in charge recognise that Australians have a far superior system that encourages participation and we simply don’t.

There are boomers in their 60s and 70s that have mortgages.... suckers!!

If someone has a mortgage at that age it is highly likely it is due to divorce and having to buy again, or possibly partner or spose passing away leaving the other to pay down the rest, or poor decision making. I wouldn't call that a sucker, more so an unfortunate circumstance that realistically nobody wants to ever be in at a stage in life where it may not be possible to pay it down by the end of their days.

The market has already turned in Wellington I am sure of it. It may not be a quick rise up but we are past the bottom now. First home buyers sitting on the sidelines in Wellington trying to time the market have missed the very bottom.

Will vary from place to place, typically Auckland and Wellington lead the way. Elsewhere you still have a couple of months to get in. Will not be a fast rise, still too many unknows with the election coming up, then again if National get in prices are set to rise. Nothing is set in concrete but it looks like the bottom to me.

But some places haven't dropped Cantubury being one ticking along just nicely

Huge amount of NZ FHBs are getting into Coomera and Upper Coomera (between Gold Coast and Brisbane). Brand spanking new suburbs being built with massive Westfield and Costco nearby.!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.