It's the information you've possibly been waiting for.

And it's suitably eye-opening.

The Reserve Bank has introduced a new data series called New Residential Mortgage Lending by Purpose, which will now be run every month.

The great thing about this series is that while it is debuting this month with data for July 2023, the figures go back all the way to 2017, so there's time to see some trends.

The RBNZ has, helpfully provided a summary of some of the key points, along with a number of graphs, some of which I'm reproducing here.

I know from writing articles about other RBNZ monthly data series that a common question among readers is: Yes, but are these all 'new' mortgages and what about people topping up, or moving lenders?

Well, here we go. We need ask no longer.

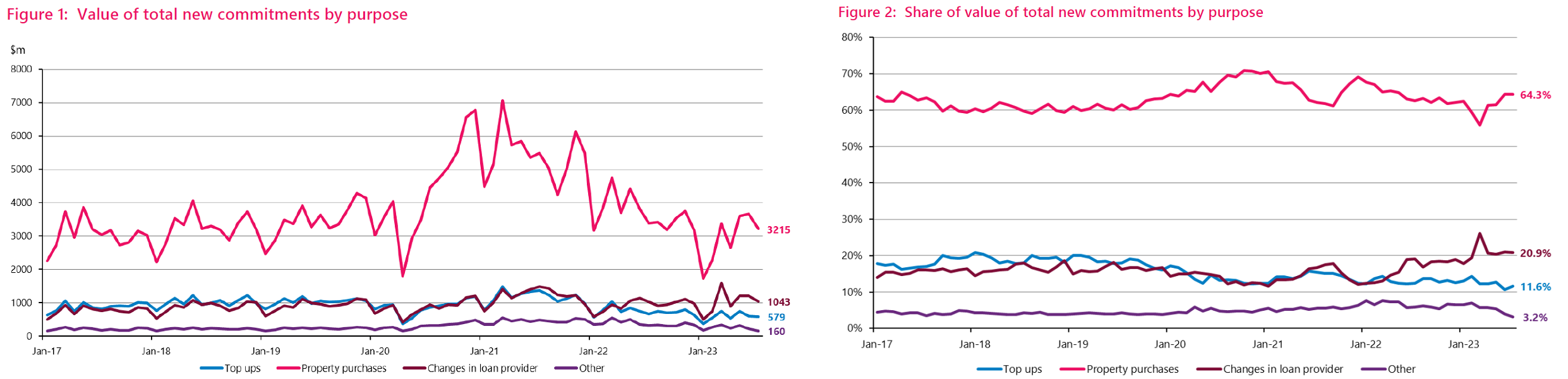

For those who wondered, yes, 'top-ups' have been a hugely significant part of the monthly mortgage figures, as have people swapping lenders. (To get the best out of the two graphs below, click on the little magnifying glass logo on the top right of the right-hand-side graph).

Until very recently, top-ups made up more than half of the total new mortgage commitments by number, which surprises me. It might not surprise you.

It was only in June of this year (remember this data series goes back to 2017) that for the first time the number of mortgage commitments that were for top ups was actually smaller than the number of mortgage commitments that were for house purchases.

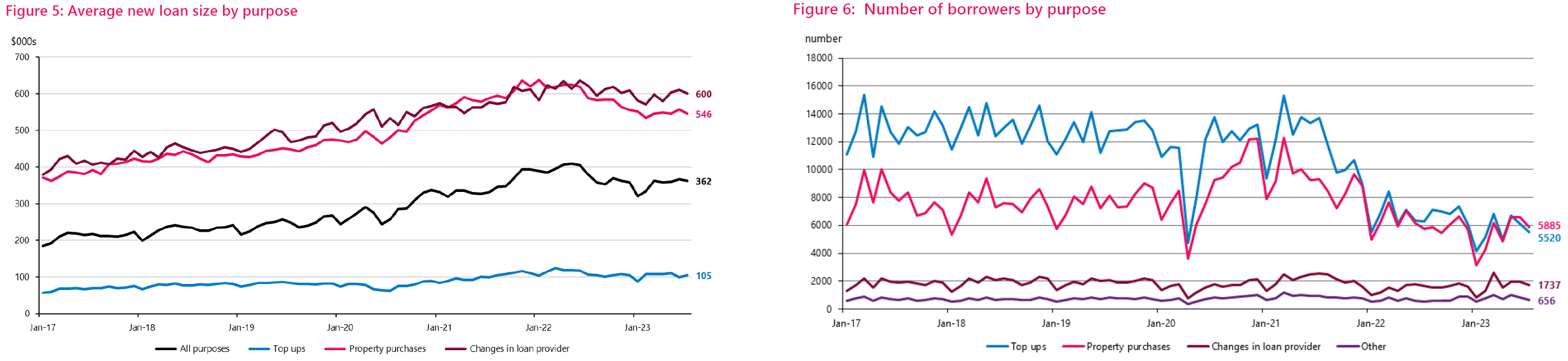

And this was again the case in July 2023, when by number there were 13,795 new commitments, of which 5886 were for purchases of houses, 5520 for top-ups, 1737 for changing lenders and 656 'other', which includes among other things bridging finance.

If we go back two years, to July 2021, of a total number of mortgage commitments of 26,573, some 13719 (over half) were for top-ups. If we look at July months going back to 2017, the percentage of commitments that were for top ups has ranged between 40% (the latest July) and 55.1% in July 2018. In terms of mortgage commitments to actually buy a house, that's ranged from 32.3% in July 2018 to 42.7% in July 2023.

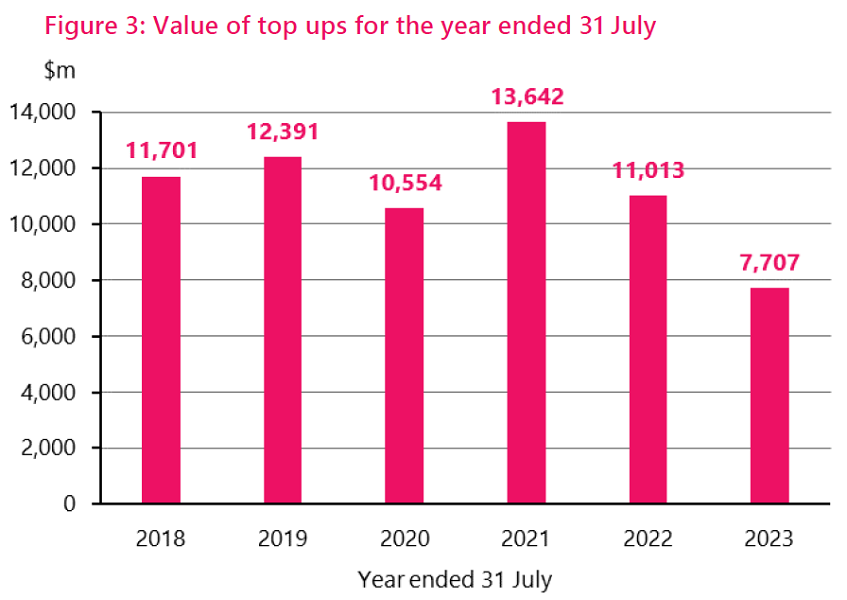

In dollar terms the amount for top ups in July 2023 was just $579 million, which is 11.6% of the $4.997 billion advanced during the month. And yes that's the lowest percentage in terms of July months in this data series, although up from the all-time low of 10.7%, which was recorded in June 2023. The highest figure for July months was 18% in both July of 2018 and 2019. If we go back to July 2021, when there was a grand total of $8.818 billion borrow, some $1.365 billion of that was for top-ups.

In terms of the average size of those top ups, in recent times they've been averaging over $100,000. (Again, click on magnifying glass logo to see full-sized graphs).

This below graph demonstrates just how much, relatively, the idea of using the home as an ATM is, for now, losing favour.

While top-ups have lost their lustre, what has become more popular - and no surprises really given the current high interest rates - is swapping mortgage lender.

In July 2023, just over $1 billion (20.9% of the total mortgage monies advanced) represented mortgages that were shifting lenders. That's the highest percentage for a July month going back to the start of this data series. And yes, the number of mortgage commitments shifting lenders (1737) is also at a high for a July of 12.6%.

So, there we go, there's much more that could be said, but it will be interesting to track these figures month by month.

What we probably can say is that the latest trends show both the impact of the falling house prices and the rising mortgage rates.

Clearly, grabbing a mortgage top-up when the price of your house is going up would seem more logical, while equally, moving your mortgage lender when rates are high and banks are competing for the business would appear sound logic.

One interesting point to make about this new data series is that it gives us a clearer picture of how prevalent the first home buyers are at the moment when it comes to new purchases.

We know from the mortgages by borrower type series that the RBNZ also produces that in July 2023 the FHBs, with over $1.2 billion borrowed, made up a new high share of the total mortgage money committed of just under 25%.

But, interestingly, if we look at the new data series, we can see that of the $4.997 billion total advances during July 2023, just $3.215 billion was for house purchases.

Based on that then, the over $1.2 billion borrowed by the FHBs actually made up nearly 40% of the total advanced for house purchases.

We will for sure be tracking these new figures, which are another welcome addition to the RBNZ's burgeoning collection of crunchy mortgage data series.

29 Comments

Have home loan tops-ups lost their lustre or is it just the fact that people no longer qualify for a top-up? (CCCFA, no equity available with decling house prices etc...)

Or Kiwis being forced to live within their means instead of using home equity as a slush fund to buy stuff they cannot afford otherwise.

Winter hols to Fiji or Queenie; the new spa pool; kitchen reno to increase the "value".

Does this top up data include all the new green lending/healthy homes lending, or is it simply that the new solar systems, insulation/double glazing based renovations, and EV purchases that used to be done with a top up simply been shunted outside this reporting?

Would be interested to know this too.

I'm looking at using one of those facilities to upgrade the family wagon to a new PHEV vehicle. Outside of that, there's nothing else I'd consider topping up the mortgage for (unless somebody can develop solar panels that work well on a two story townhouse)

Free money will lead to more imports of expensive cars, which will unfortunately worsen our trade deficit.

Short term only, considering these loans are only available for EVs and PHEVs, so while they might cause a bit of a spike in the short term, in the long term it lowers the ~$900,000,000 per month of oil product imports.

And even then, it only increases in the short-term if people upgrade cars they otherwise wouldn't have, or upgrade to higher $ value car than they otherwise would have. If they buy a base model Tesla instead of a mid to high end Ford Ranger it decreases both the short and long term trade deficit.

Do tesla use ground up Unicorns in their wheel bearings or is it grease? Are teslas hydraulic brake lines full of hopium, or do they use brake fluid ?

Oil is your friend.

Do you spend $100 - $200 per week on grease and brake fluid? Those things are inconsequential compared to the amount of petrol an ICE consumes.

I'm just pointing out there is no escape from oil and the virtue signaling is boring.

The sooner ev's get whacked with a high level of rucs the better. I like nationals idea of dropping the excise all together and charging everyone rucs.

At between 2 - 2.5 tons they are overweight pigs.

A Tesla model 3 weight is 1611kg to 1847kg

Yes, bring on RUCs for all, and increase them to $100/1000kms for all light vehicles. Might be able to afford some decent roads instead of this road to zero bollocks.

Thanks for pointing out the blind ignorance of the EV haters, all the Tesla models currently on sale in NZ come in under 2 tons in all configurations. Mine is apparently 1750kgs, lighter than any current Ford Ranger model.

Given most EVs come in at under two tonnes, I assume you're arguing that trucks should be paying 20 times that rate for their 40 tonne+ laden weights?

Big difference between buring oil and using it say for lubrication or making plastic.

It's a shame we don't manufacture electric vehicles in New Zealand. Massive profits going to American, Chinese, and German companies. Kiwis will be forced into buying new EVs, as petrol cars gradually become outlawed. No cheap second-hand imports from Japan either - students and low income families etc will be forking out $20,000 minimum.

Now if only someone could overlay the top up data with Ford Ranger sales, I would bet on there being a correlation coefficient of 1.

Looks like the property ATM's are running out of steam. Think of all of that home equity cash that isn't flowing into our economy now to purchase new cars, boats or conduct renovations.

Falling prices and higher rates. Rates that show all intention of being higher for longer. More likely people that are selling up the jetski, the boat and heaven forbid, the bach, to reduce debt.

Falling prices and higher rates. Rates that show all intention of being higher for longer. More likely people that are selling up the jetski, the boat and heaven forbid, the bach, to reduce debt.

Perth after the mining infrastructure boom wound down. Jetskis and high-end motorbikes going for a song online.

A "top up" is a remortgage, eh?

More of an add-on to an existing mortgage.

I think 'top up' is slightly confusing and euphemestic.

If I top up my savings account or my petrol I add something in.

With a mortgage top up you are taking something out (credit) .

Its adding to the amount owed, ie i need another 30k for a new car etc..... Restructure is extending term etc..... if the total amount owed increases its a top up. NZ has been living on the capital gains from housing for a long time, surtees boats etc often bought this way and sold 3-4 years later for little loss and at low interest rates low cost of ownership, things have changed now and this type of deal does not look good at 7.5% plus bigger haircut on the sale of a 90k boat..... I hope this property recovery continues and in a years time we are down another 20%

That is going to hurt the construction industry, as I imagine that a large percentage of those top ups was going to home renovations. Either that or we have been idiots out buying jetskis...

Over covid there were 3000 swimming pools being built a year, the long term norm is around 1000 a year. The pain is coming.

Don't worry, a big mortgage with rising rates tops itself up, no jetski/marble vanity/pizza oven needed.

If the bubble reversion ever ramped up in a meaningful way, reverse mortgages would dry up IMO. The cash-strapped boomers with everything wrapped up in the house would be between a rock and a hard place.

CCCFA means you can't get them these days.

I don't understand how changing lenders contributes to new lending?

Wouldn't it net out to zero between the new loan being taken out and the old loan being discharged?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.