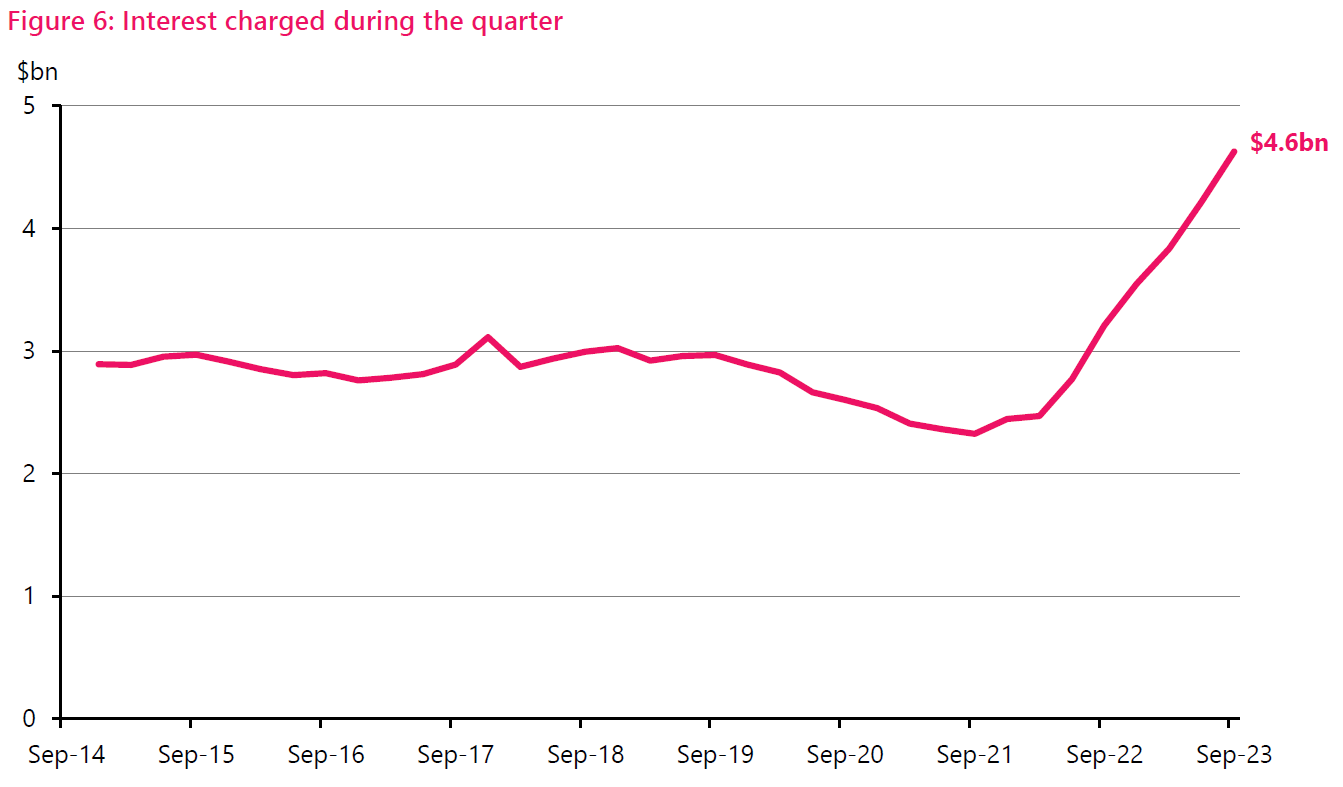

The mortgage interest bill for kiwis just hit a record quarterly tally of $4.627 billion, according to new quarterly loan reconciliation figures compiled by the Reserve Bank (RBNZ).

The new record, for the September quarter - in a data series that dates back to 2014 - eclipsed the previous record of $4.219 billion set only in the June 2023 quarter.

This is the fifth consecutive quarter of record high interest bills.

It puts kiwis on track to pay their banks well over $17 billion in mortgage interest in this 2023 calendar year.

About $12 billion was charged in 2022, and just $9.5 billion in 2021.

The September quarter 2023 figure is more than double the $2.323 billion that was charged in the same quarter just two years ago. At the end of September this year the average carded, or advertised, bank two-year mortgage rate was almost 7%. Two years earlier it was below 3%.

The figure two years ago was actually the lowest ever amount charged in a quarter. How things changed.

The amount of outstanding mortgages at the end of the September quarter was $348.707 billion.

The RBNZ in its summary of the monthly mortgage data said the increase in the value of outstanding mortgage lending (net credit growth) between 30 June 2023 and 30 September 2023 was $2.8 billion.

This is the fifth lowest growth in a calendar quarter since the records began in the September 2014 quarter.

In terms of monthly mortgage data, total monthly new mortgage commitments were $5.194 billion in September 2023, down 10.2% from $5.782 billion in August.

The RBNZ said the seasonally adjusted value fell by 1.7% from August.

This followed an 8% seasonally adjusted rise in August from July.

In terms of annual comparisons the September 2023 figure was just up on the $5.135 billion committed to in September 2022, but well down on the $6.934 billion for the same month in 2021.

First home buyers (FHBs) have remained active, with the commitments for this grouping tallying up to $1.253 billion in September 2023.

The share of new mortgage commitments to first home buyers rose to 24.1% in September, up from 23.7% in August, meaning the FHBs keep being at or near to record high shares of the mortgage money.

Investors, relatively, remain on the sidelines.

This grouping committed to $894 million of mortgages in September, which represented a 17.2% share of the total, just up from 17.1% in August.

According to the RBNZ the share of new commitments to first home buyers has exceeded the share to investors each month since April 2022.

That's a far cry from the early days of the RBNZ's loan to value ratio (LVR) restrictions that were first imposed in 2013. In those days the FHB grouping would sometimes account for less than 10% of the monthly mortgage total, while investors saw their share at times being as high as 35%.

39 Comments

all that money pouring out of the NZ economy and over the ditch ... sad state

Much of it will be paid out in interest to NZ deposit holders.

Savers get about half of the interest collected - the other half goes to bank shareholders most of whom are overseas. The data is here: https://www.rbnz.govt.nz/statistics/series/registered-banks/banks-incom…

Total profits stated there seem much lower than the headline figures that we get in the media?

Quarterly figures?

haw haw ...... doesn't matter to our us, your beloved banker - because we run the show, so you better get used to it !

And I must say, what a spiffing result, say what ol' boy, extracting as much cash as possible out of the local economy - a record month !

Anyway, can't dilly around here, you working plebs have a job to do - keep that cash rolling towards moi's direction, so get back to work ! to earn more, so you can keep up with those ever increasing mortgage payments . Our ilk has you all "wired", like a little mouse on a wheel, so keep on "moving forward" and keep that momentum up .....House prices up , mortgage P & I receipts up .....what a system ! haw haw

What have we done to ourselves. All the productive effort of homeowners and renters is being funneled to Aussie Banks, and then onto the majority shareholders like Blackrock and Vanguard group in the US. All in the name of a retirement income for the boomers, and the tax minimisation of the specuvestment crowd.

It is indeed...sad.

Blackrock and Vanguard only hold the shares on behalf of investors. I have a Vanguard total world fund that includes the big 4 Aussie banks in its index. So I am the beneficial holder, not Vanguard. The do cream off a massive 0.07% for the privilege of making my investing easier.

Excellent Smithers.

I don't care... higher for longer! Don't give two s###s about Aussie banks raping the country as long as the property owning kiwis suffer.. let them squeal! :P

It's obvious that budgeting advice nor counselling is your forte.....

Your childhood seems questionable from this comment.

Many people refinancing will find paying a million for a cheaply built 3 bedroom townhouse in Auckland on a tiny section was just a bit crazy especially when payments go from $900 per week to $1800 per week. Soon the housing market will be swamped with people trying to get out without losing to much.

Hope to see people offload debts.

But sad thing is that it's recent home owners who will fall first; and then will be some kind of easing from RBNZ.

The RBNZ doesn't matter much. We have borrowed and ponzied until the Fed is in charged. Are we feeling lucky?

"Soon the housing market will be swamped with people trying to get out without losing to much."

Seeing properties listed for sale where the buyer is selling below their purchase price where they purchased in 2020-2021 (likely to be on high leverage).

These people will lose a lot or even more than 100% of their initial equity (i.e negative equity) used to purchase the property.

This is the price all borrowers must now pay because, as a country, we borrowed on the illusion that sustainable prosperity could be earned by selling over-priced houses to one and other. We borrowed our little hearts out using an illusion as security.

What a waste.

JH is going to have a lingering and devastating effect on kiwi wallets

People were brainwashed into debt hooked by cheap money so many on here were saying rates would go over 3%, you have to laugh as many still think rates are going back down soon and house prices are going to shoot back up. With NZD tanking inflation will be here for much longer and so will higher rates, the housing price crash is already down 20% the next phase down will be much quicker.

The right thing to do was not get sucked into the false Covid market, not increase borrowing and lock the 3% rate in for as long as possible, and doubled the repayments I was making at the old rate. Everyone laughed at the time because rates were going to be zero in six months….I ignored that and fixed all the way out to almost 2027 at around 3%. Best decision I ever made.

Not too many took that option and even if they did and took out a massive new mortgage, 5 years doesn't reduce it that much so they will still have fingers crossed they don't come out the other side with rates still at 7%.

Hopefully by then you would have got some decent pay rises, especially with inflation running high.

Yes Mr Key ..increasing house prices is a good thing...for bankers!

The plan was as plain as day.

Lower rates to nothing, get the populace to borrow extra gazillions for the same old shacks and then when the bait is taken, wack up interest rates again.

So easy.

The good ol bait and switch.

by Nzdan | 14th Nov 19, 7:05am

Banks probably want interest rates to rise after a prolonged period of increasing loan book size. A bait and switch of sorts. Get everyone juiced up on low lending rates and then tighten up the vice on the balls.

https://www.interest.co.nz/bonds/102567/markets-price-lending-rate-hike…

That is how any addiction works. Get them hooked at a cheap price, then hike the price.

They will Knight you for it..

At least we have Kiwibank making some money out of this and returning it to tax payers. So not all money is heading to Ozzie owned banks.

True, any commenter concerned about money fight to OZ should switch to Kiwibank tomorrow/

$4.6 bln in interest was paid in the September quarter on home loans. This is the highest quarterly amount on record, and is more than +44% higher than the same quarter a year ago

Certainly not good for borrowers, some won't be able to sustain this increase in expense indefinitely.

It would be interesting to know by how much interest received by investors (typically bank term deposits) increased over the same period, in order to get a complete picture for money taken out of the economy.

Transformartional

And the fault for this stupidity lies squarely at the feet of our rediculous tax system that taxes income from work, production and consumer consumption but not income from the rising prices of assets. Kiwis are as dumb as dirt.

Absolutely absurd.

We are paying higher interest rates as we bid up land prices.

Totally unproductive and useless use of capital.

The risk of making property such an attractive, tax-free investment. Chickens coming home to roost.

I see no need to complain about current interest rates. At the current level of inflation, money is still essentially free, with the current OCR of only 5.5% against inflation of around 5.5%-6%. Only with an OCR over the 6% threshold would interest rates start to be mildly contractionary.

Exactly.. and that's exactly the same story in the US. The fed is realizing that current rates are not putting the brakes on, and inflation is still not dropping as expected.

Agreed 👍

Have I mentioned that temporarily increasing taxes - while introducing some new ones - can have the same effect as a high OCR on damping down inflation?

And it can work much quicker.

And it keeps the money in NZ.

And it reduces government debt.

And it allows public services to be maintained.

And it facilitates investment in much need infrastructure.

And yet dumb kiwis voted for a government that will reduce taxes? Kiwis are as dumb as dirt. We deserve every shafting we get.

A possible solution is a change to RBNZ Act that allows the RBNZ to recommend to government that taxes in certain areas and bands should be raised temporarily.

Government of course doesn't have to act on this recommendation but when they don't, and the OCR must be raised sky high, then we know who to blame. ... And that would be, not just the government, but the squealers that have top pay more tax because they're the ones driving inflation.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.