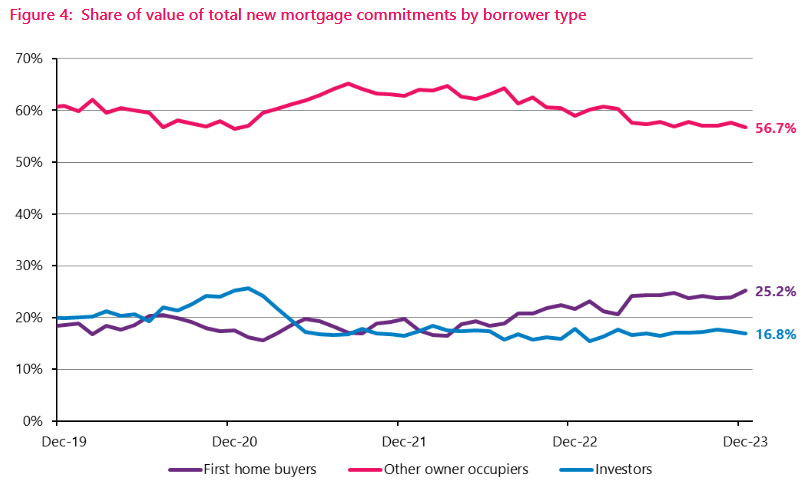

They've been threatening to do if for a while now, but in December the first home buyers cracked the quarter share mark of the total new mortgage advances as they took up a record monthly share of mortgage money.

This is according to latest Reserve Bank (RBNZ) figures.

The $1.335 billion advanced to the first home buyers in December 2023 gave the FHBs grouping a 25.2% share of the total monies advanced, up from 23.8% in November and representing a high water mark in a data series that's now been running since 2014.

However, it needs saying that the overall total in December of $5.304 billion was as soggy as the real estate data for the month had suggested it would be.

The December total was up on the $5.121 billion figure for December 2022, but that figure was actually the lowest December total since 2017.

Additionally, according to RBNZ's seasonal adjustment the December 2023 figure was down by 2.2% when compared with the November 2023 figures. And to give further context, the December 2023 total compared with a total of over $7.9 billion advanced in December 2021 and over $9.6 billion in December 2020.

Just recently there had been some signs of the long dormant investors not so much awakening, but certainly opening one eye - perhaps in anticipation of the ultimately realised National Party success (and therefore investor friendly policies) in the October election. However, in December investors' share of the overall advances dropped to 16.8% from 17.4% in November.

The $894 million advanced to investors in December 2023 represented the smallest numerical amount advanced to that grouping for a December month since the beginning of this data series in 2014.

It had been a long established pattern that investors out-borrowed FHBs - at times by a much as a four-to-one ratio - but now since April 2022 the amount borrowed by the FHBs has exceeded that by the investors every month.

In terms of historical levels, in the 2014-15 period the FHBs at times had an under 10% share of monthly mortgage figures, while at around the same time the investors on occasions took over a third of the total advances.

It will be interesting to see if confirmation of policies such as the reintroduction of interest deductibility, along with the strong recent increases in rentals, do prompt renewed interest from investors in coming months.

Perhaps the December 2023 month may prove to be the high point for FHB in terms of overall share. Time will tell.

14 Comments

Nice to see motivated, younger people getting into their own homes - despite current interest rate levels.

TTP

Or financially sentence themselves to a 30 years term..

Well, at lest they're done paying after 30 years, whereas if they rent, they pay forever.

Well, at least they're done paying after 30 years, whereas if they rent, they'll pay forever.

Correction a first home buyer can be a new migrant, business or older generation of which we have had a boom, hardly young but many are cashed up and need a place to live as well. Sure we are still selling out our younger generation but look on the bright side we can just import people from another one.

Great news, I hope the trend continues - and I suspect it will provided prices continue a downward trend.

Not so sure. The market appears to be bottoming to me. Not that that means I expect it to take off (NPS-UD, MDRS, AUP, blah, blah, blah...)

I can't be certain until after a) the summer rush, or lack thereof, and b) maybe the first OCR cut and the indications of when the next ones are.

Just quietly, if the latest version of the Chinese flu; the E-grande strain, to be followed by the C-Garden strain; do a Lehrman's ... then all bets are off and you'll be 100% correct. I currently think that's quite a remote chance. A kind of Omnicron outcome is more likely IMHO.

What’s more telling is the deadness in the investor segment rather than anything to do with FHBs.

With just a 2-3% return, it’s a no brainer. Bank TD’s are where the fish are biting.

And it may stay dead if the NACTF accept the extremely good economic argument that 100% interest deductibility unfairly advantages property 'investors' over own-occupiers and decide to leave interest deductibility at 80%. (Ah well. I can hope for fairness even if I don't expect it.)

Investors are poised, waiting, in the wings.......

When interest rates start coming down, there'll be plenty of activity from them, HouseMouse.

TTP

Investors would be crazy to buy in Auckland average house cost 1.2 million most it would rent out for is 900 per week out of this take out expenses could have 750 left, while 1.2 million in term deposit at 6% 1380 per week. Not sure what juice you are drinking but I think a trip to a financial advisor should be in order if you cannot see best investment choice

Have decided it's time to move. House will be sold first before a new one is looked at. I see it as a complete waste of time trying to buy conditional on sale of own home.

Mate with several rentals has decided to sell all. One gone, next has just hit market. Several more to come on a as they sell. Must be a number of boomers like him who are taking the gains, sick of tenant issues and have decided cash (and for him gold) is a better option.

I'd say more opportunity coming for FHB's.

Good timing and good plan, Rastus. Being cash buyer is music to many a ear.

If the latest version of the Chinese flu; the E-grande strain, to be followed by the C-Garden strain; starts moving across the globe you may have many to pick from. Good luck.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.