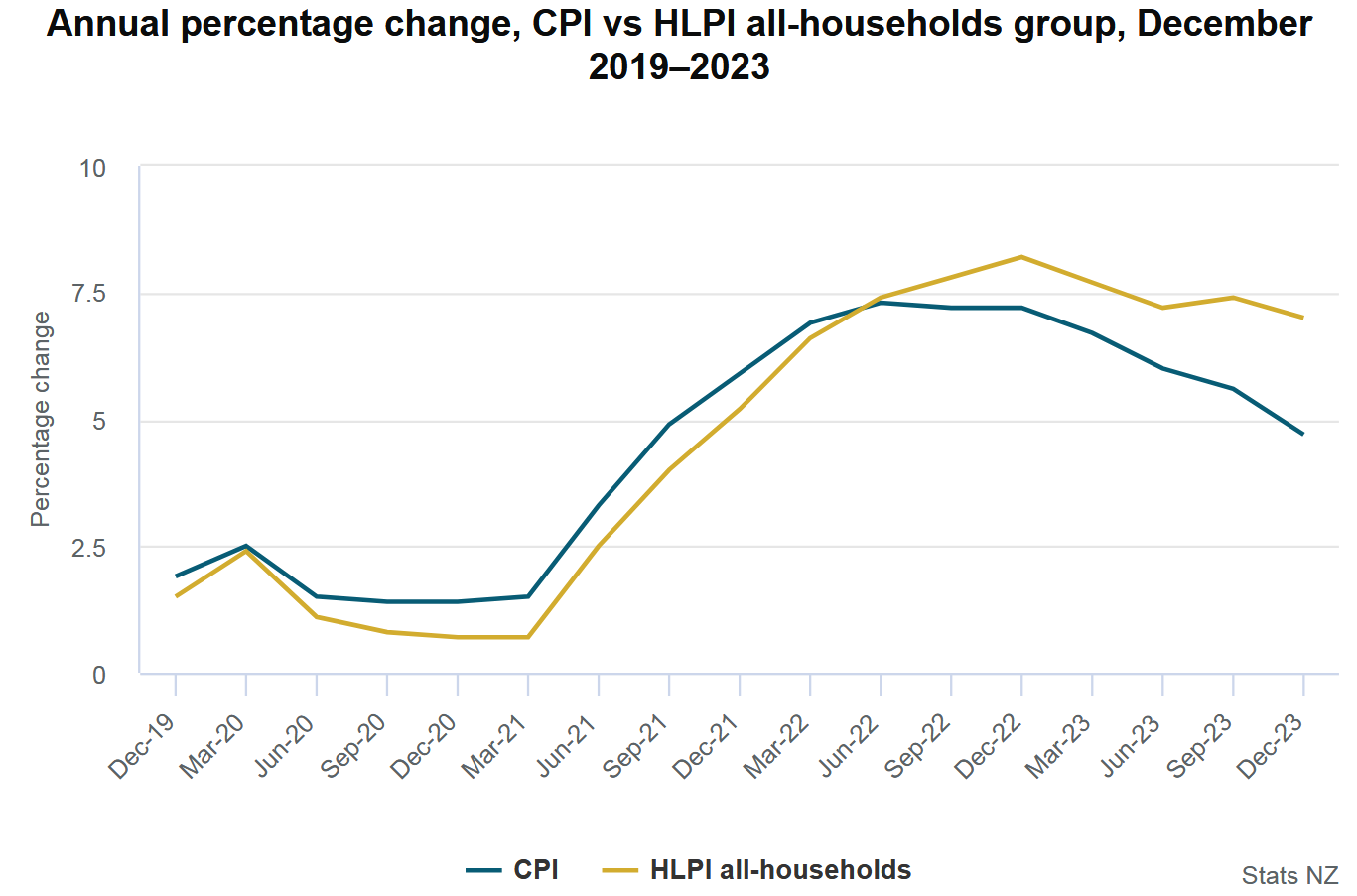

The cost of living for the average New Zealand household increased by 7.0% in the 12 months to the December 2023, way more than the official rate of inflation of 4.7%.

Stats NZ has just released its latest household living-cost price indexes (HLPIs), which differ in composition from the officially recognised measure of inflation, the Consumers Price Index (CPI).

The CPI for the December quarter showed inflation of 4.7%, down from 5.6% as of the September 2023 quarter.

The HLPIs increase of 7.0% for the year to December was down from 7.4% in September.

A very significant difference in the calculation of the HLPIs versus the CPI is that the HLPIs includes interest payments, while the CPI does not. Instead the CPI measures housing as the cost of constructing a new home.

And in the 12 month period, average households faced a 31% increase in interest costs, according to Stats NZ.

As Stats NZ's consumer prices manger James Mitchell explained, "inflation, as measured by the consumers price index, eased more than the cost-of-living over 2023. This is because our cost-of-living measure includes different ongoing costs that aren’t included in the CPI, such as interest payments, which have increased by 31% for the average household over the past 12 months".

Each quarter, the HLPIs measure how inflation affects 13 different household groups, plus an all-households group, also referred to as the average household. In contrast, the consumers price index (CPI) measures how inflation affects New Zealand as a whole.

Stats NZ says the two measures of inflation are typically used for different purposes. A key use of the CPI is monetary policy, while the HLPIs provide insight into the cost-of-living for different household groups.

"For each of the [13] household groups, the cost-of-living increase was above 6% for the 2023 year,” Mitchell said.

"This compared to the 4.7% inflation we saw over the same time.

"Groups with a higher proportion of spending on mortgages had interest payments as the largest annual contributor to their cost of living. For groups that paid less in interest payments, their cost of living was still being driven by food and housing costs," Mitchell said.

Stats NZ said aside from the interest payments increases, other key contributors to the rise in cost of living were private transport supplies and services (such as petrol) increased, up 9.0% and rent, up 5.1%.

28 Comments

As per the mighty JFoe, the counter productive nature of hiking interest rates to try and control inflation!!!

But would we really be better off with 0% OCR and house prices to infinity?

Long term: no.

Short term: no, unless you're already wealthy.

You aren’t getting my perspective are you Jimbo.

As I have said before, why do we have to be so binary on things? It’s a very crude and simpleton way of viewing the world.

I definitely think they needed to hike, but not as high as they did. I think the sweet spot would have been an OCR around 3.5%.

" the counter productive nature of hiking interest rates to try and control inflation" - doesn't that apply to any rate increase, whether it be to 3.5% or 5.5%?

Are you saying monetary policy doesn't work, or that the RBNZ have simply overcooked it?

A bit of both. It’s a very crude tool. Yes I think they overcooked it. And of course, critically, they massively overcooked the cuts in the first place.

Best to ignore strawman arguments.

Hopefully most posters recognize them for what they are (i.e. foolish) and move past them.

@houserodent - I think/reckon …😂

If only there was somewhere between 0% and 5.5% that we could have the OCR...

0.25% 😘🤌

re ... "But would we really be better off with 0% OCR and house prices to infinity?"

People in Japan aren't too bothered by something very close to what you describe.

But oddly - House prices haven't moved to infinity. (They are beginning to move now. Why? Because i-rates might move up. Weird, huh?)

Japan has very different demographics (declining population) and a very different regulatory environment for housing, so it's not really comparable to NZ

JFoe is not wrong.

Note the fact that the HLPI line stays above the CPI line well after the CPI peaks.

If one accepts the HLPI as recording the true consumer price index (I do), it can be seen that from the graph above that even more money is being sucked from pockets due to the lag effect from OCR rises. The lag being fixed 1, 2 and 3 year mortgages. To say nothing of the time it will take retail banks to pass on OCR cuts when they come and how they usually pass on less than the full OCR cut.)

Interest.co.nz doesn't have (or I can't find) a graph that overlays the OCR with 1, 2, 3, etc. year fixed rates. But you can do see this 'bank lag' lag by using this graph of the OCR and this graph of fixed rates. Choose periods where the OCR is falling.

Add the lags together and people should be able to imagine the effects of a high OCR stay well after the OCR is first cut. (As an aside, I hope ComCom is looking very carefully at how NZ retail banks calculate break fees in NZ vs the USA and other more developed markets.)

Oil tankers don't turn on a dime. And neither do economies.

Many of these rising costs are by monopoly / duopoly organisations. eg Council rates. You have no choice to pay these and no control over these, and they have no incentiives to keep costs down.

Every election for councils is dominated by keeping rates down.

Deferred maintenance and a big bill to pay to address it is the result.

Just like I said on here a day or so ago the way we measure inflation is wrong. Your highest outgoings are not even in the CPI and real inflation currently is twice as high.

The CPI is just one measure of inflation (consumer prices), there are other measures like this one, each has its own purpose.

Likewise people say the unemployment rate is a bad measure because it only measures people actively looking for work, but it is a very good measure of how easy it is to find employment which is its purpose.

Well that just leads to the question of what the CPI's true purpose is.

Is it something that reads low so banks can inflate asset prices through lending while the reserve banks of the world say everything is fine because inflation is low?

Shadowstat suggests that "inflation" is closer to 15% in the US (probably similar here - all we know is that it's understated as much as possible).

Inflation right now is well above 1980s levels.

JC - interesting data series from Shadow stat. Similar to NZ, where changes to how CPI is measured since the 1980s have also “depressed reported inflation, moving the concept of the CPI away from being a measure of the cost of living needed to maintain a constant standard of living.” However the CPI is still used to set benefit rates and often wage increases too.

JC - interesting data series from Shadow stat. Similar to NZ, where changes to how CPI is measured since the 1980s have also “depressed reported inflation, moving the concept of the CPI away from being a measure of the cost of living needed to maintain a constant standard of living.” However the CPI is still used to set benefit rates and often wage increases too.

The US CPI methodology is constantly being rejigged for all kinds of reasons. Those who take an interest are quite aghast at how it all works.

By choosing to use an artificially low metric to try and run the economy has obvious problems. If you are setting the OCR based on something that doesn't even include what mortgage rates are doing to 1/3 of the households out there you are just asking for trouble.

The RBNZ uses the CPI because it (supposedly) doesn't include the effects of mortgage interests rates (but it actually does).

And they are ONLY organisation that should use it.

The CPI should only be used by the RBNZ and no one else.

(Alas, dumb politicians wrote the CPI into much legislation. Or was it changed after it got into the legislation? I forget. But you can guarantee the change was made without Joe Public ever grasping the implications!)

its a bit of a scary stat really as it is the average household and IIRC correctly around 1/3 of households have a mortgage

The solution to this is obviously more expensive housing forever.

And the price of oil is slowly rising again. 10% up from December lows. Price of oil flows into the price for everything. New Zealand is importing/consuming around 1.6 billion barrels of petrol and diesel combined per quarter. Each 10c per litre rise in fuel costs sucks 53 million a month.

7% for household expenses in 2023 they say?Luxury..

Try 15-35% for insurance premiums and local authority rates in 2024 as a starter.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.