Non-performing bank loan figures are continuing to surge, according to the latest monthly figures from the Reserve Bank (RBNZ).

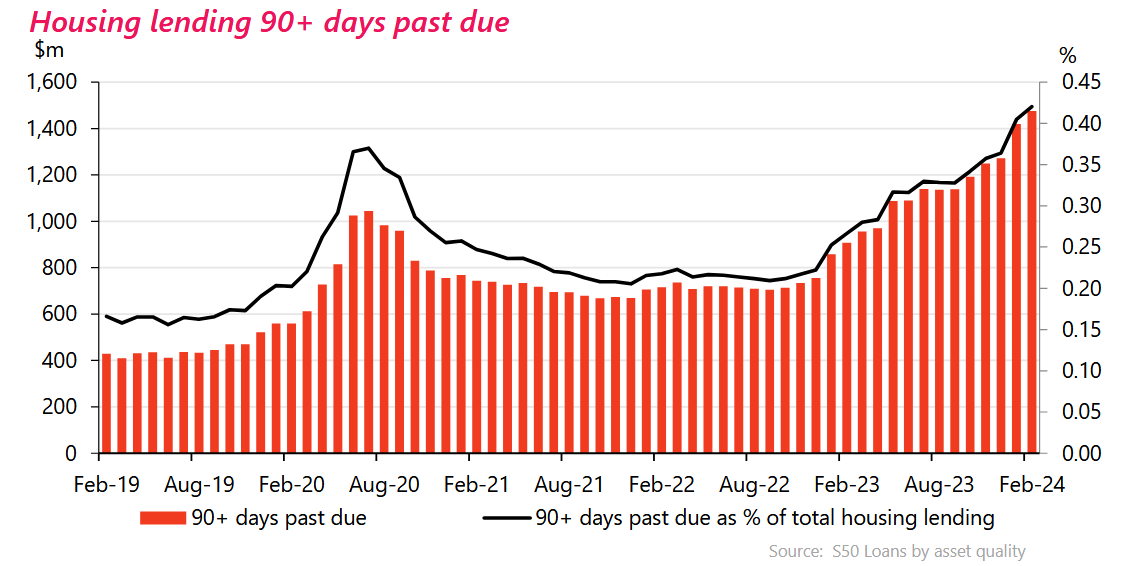

The figures for February show non-performing housing loans rose by a further $42 million (2.5%) to a total of $1.72 billion.

In the past 12 months the non-performing housing loans figure has increased by some $696 million.

The non-performing housing loan ratio, at 0.5%, is at a 10-year high.

It is however, still well below the kinds of highs seen in the aftermath of the Global Financial Crisis, when the ratio got up to 1.2% between 2009 and 2011.

Within the housing non-performing loans figures, the specifically impaired figure actually dropped in February to $244 million from $259 million, but the 90-days past due figure rose to $1.476 billion from $1.419 billion in January.

The system-wide non-performing loan figure - IE for all the banking loans, which have a grand total of $559.6 billion - has risen above $4 billion as of the end of February.

This was after a total $236 million increase (6.2%) during the month, bringing the non-performing loan (NPL) ratio up by 4 basis points to 0.72%. That's the highest level since the pandemic blip in 2020.

The system-wide NPL figure has risen by nearly $2.7 billion in the past 12 months.

While the pace of rises in stressed housing mortgages slowed a little in the past month, some of the business loan categories are continuing to see stress levels rising very quickly.

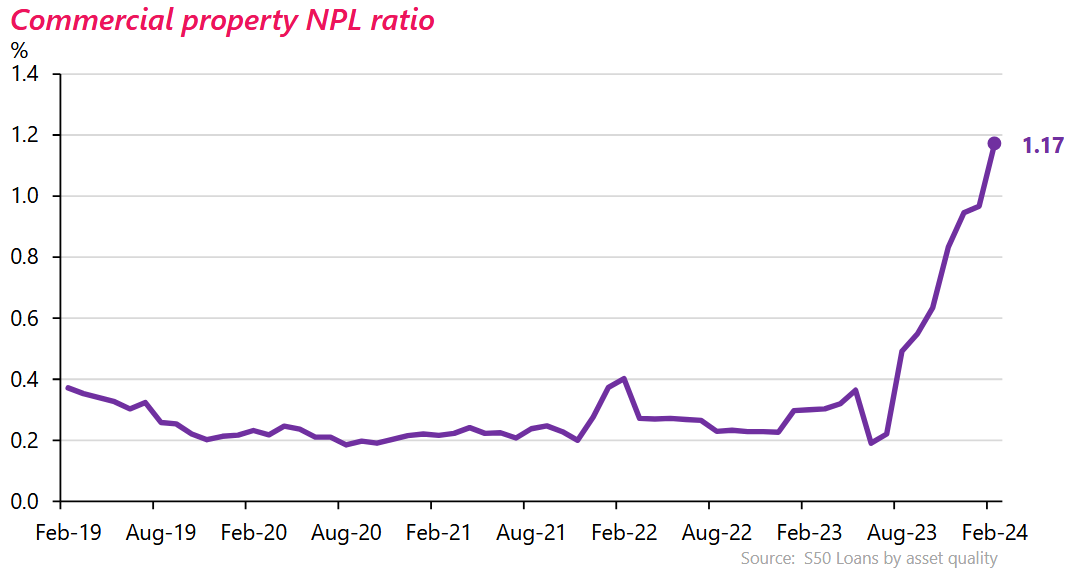

The commercial property sector has seen NPL levels increasing sharply, and the latest month has been no exception, with a $90 million NPL increase, taking the total up to over $500 million. That total has risen $373 million in the past 12 months, with $294 million of that coming in the past six months.

The NPL ratio for commercial property has now reached 1.17%.

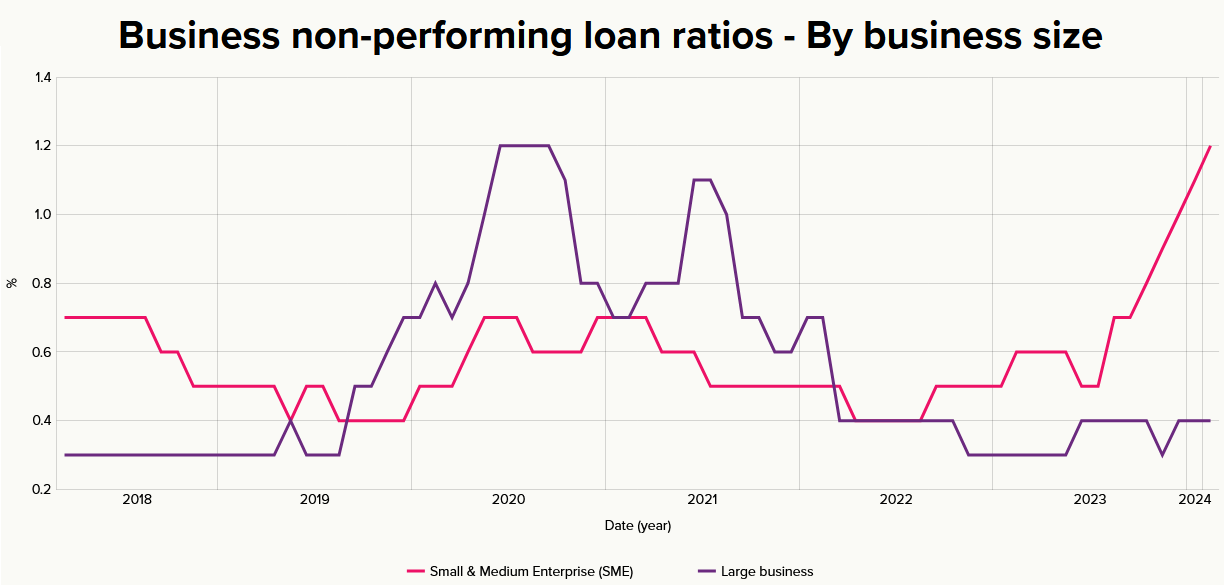

The small and medium sized enterprises (SME) sector is also battling.

SME non-performing loans rose by some $138 million (17%) in February, taking the total up to $951 million.

This total has risen by over half a billion dollars in the past 12 months, and by $386 million in just the last six months.

The NPL ratio for SME lending is now 1.23%.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

97 Comments

We are obviously only seeing the middle of the awfully effective, boat sinking, DDDebt Iceberg!

It will get much, much more prevalent and the MSM will eventually pick it up..... once the stressed are forced to fire sale every asset available and the wailing and gnashing in the media will be common.

It's coming.

Hopefully we get some anecdote articles with photos of angry people crossing their arms.

I think in the past it might have been a legal requirement for news outlets to have angry people crossing their arms.

Not quite the obligatory "arms crossed" photographic directive, but I wonder how these 4 - 5 job troopers are faring.

https://www.nzherald.co.nz/kahu/peak-ocr-pain-auckland-couple-working-f…

How do you like these charts Mr Orr.

These signal your collapsing productive sector.

Okay, the weak will be flushed out and the strong will remain.

We reward the unproductive and make it comfortable.

Today I am really tired, I am also unwell but I have to work. If I don’t, many lose their jobs.

You have punished me enough. So much, I consider giving up.

The seriously unproductive, just got a taxation deduction gift, albeit in the future in 2025/6.

Well hey, the PM and MPs have large personal property investments to think of.

Hang in there mate.

Worst case scenario, you might find something better to do.

You get 10 sick days, 4 weeks paid holiday pay and 12 public holidays if you’re on wages.

Beebop - you correctly identify the demotivational aspect of six years of ArdenHell and the coalition Govt have the enviable task of re motivating the productive whilst encouraging the deliberately non productive - with a big stick if necessary so in bound emigration can be culled without losing capacity that will shortly not be a problem as demand sinks. Govts have started well the question now is in the delivery.

Still trending up, this won't be the top

First option is "extend and pretend" or "evergreening", try to restructure to push the horizon out and hope things improve eventually. Worked during the financial crisis aided by low rates and easy credit conditions.

Second option, take a hair cut on the loan. You offer a very low rate to avoid default, you make a loss but you avoid a default.

Third option: Sell. Either voluntary or forclose and try to recover as much as possible. If you're going to do this though you need to be the first to do it because once others start the market sags meaning you'll take larger losses by waiting.

Wondering aloud.......with much more than 22,000 homeowners now behind on home loan payments - are the banks somewhat colluding (effectively price fixing, higher than the actual market) to not have these loans default to mark to the actual market (not marking their loan books to market sale price, which will go lower imho) and see the asset sold?

Tough to sell any FHBs as mortgagee sale though, poor sops duped into the NZ Housing Ponzi. Shame on Oneroof, Granny Herald and the Independant economists aka Ponzi priests!

This could have the banks eventually trading effectively insolvent in the near future, in the event of the defaulting loans moving upwards of 2 to 5% / 7%+ and the underlying asset well below the book value?.......just thinking of the next logical step, of this serious iceberg incline....

Who folds first takes the smallest losses generally.

"...know when to walk away, know when to run"

Massive emotion and self esteem issues. I reckon most will sell furniture, turn off heating and eat beans before they list.

A shame housing is such a boom bust market in nz.

Prisoner's dilemma. Fascinating to see it playout out at this level and in real-life!

Your second option if the fear of civil unrest and retribution leads to lower interest rates there is a good chance a survivable crash landing will occur, if the Bankers/Politicians and Elites keep rates higher for longer and possibly higher then they will fail to learn the lessons of Marie Antoinette and Nicolae Ceaușescu.

The data is confusing - I can't decide whether we are back in 1991, 2008 (about to plummet), or 2010 (over the worse of it). Either way, we need an intervention to avoid a completely self inflicted collapse.

I think it's biforcated.

I think it'll get worse though. I think there's going to be a global impact we haven't felt yet.

It's bad in China, you just cannot get money out of many WMP's.... take that for what its worth, most have given up hope, life savings are gone.....

JFOE - you cannot save a ponzi.... you have to get out with enough capital to enter the next one

smart money everywhere buying physical gold, your money is safer if you physically hold it

The more removed you are from control of your investments/assets, the lower down the creditors list you are.

Crowded cinema, locked doors... FIRE !

If I have my money in something, I usually want to see the path to getting paid out.

I can't see that relative to much corporate valuations.

Yup. Buy:

- Physical

- Royalty Streams like Gold Royalty etc etc

- Miners: Juniors, Producers, Developers

- ETF's

Hold them until the Blow off Top. Sell

Send capital back into an oversold Market at Rock Bottom: eg Property in 3 years?!

Repeat.

If too hard just take a gold pan to the Coast. Plenty out there in them Hills

It will get worse for sure. SME in trouble means job losses means more mortgage problem loans etc. Let the snowball effect commence. RBNZ will wonder why they are not having enough impact when they ( eventually) ease. History repeats.

Bit of a rusty memory on this one, but as far as I recall in 2010 OCR had dropped hard and the unemployment rate had already had its rise. That doesn't sound like now.

I think we are more 2008. Substantial property price falls to come. Difference being there is less opportunity for a significant decline in rates and QE any time soon.

Even 2008 is the wrong comparison in my opinion as house prices never really crashed here like they did elsewhere. I think this is the correction we missed out on.

1991 I wasn't paying enough attention so won't comment on that one.

Mortgagee listing count via search on trademe

October 2022 = 26

March 2023 = 37

February 2024 = 44

April (not the 1st) 2024 = 63

Not a linear timestamp on my small dataset but hey I'm not that invested so as to be methodical.

My favorite snack at Pak n Sav is up 20 cents or 11% tonight on last week. Hmmm.

Been doing the same thing - just watching the clock tick down.

The trend is your friend but this trend is not the friend of Orr.

We've been treated by our commercial Landord as if the party is still continuing. His words when he told us he wanted to double our rent was that it was a 'take it or leave it' offer, and that we would have to provide bank guarantees, despite the fact that we have been excellent tenants for many years (one assumes to cover their increasingly onerous banking covemants). I look forward to flipping them off at the end of the month when our lease expires, we already have alternative accommodation arranged. I expect to see this play out alot across the market. The moral of the story is that unbridled greed wins you no loyalty...our business is totally relocatable and completely unharmed.

Are they cash money or faux money?

I have seen a landlord being a prick to a 25 year tenant in AKL CBD on the waterfront, 12 months on, 2 floors no takers...... would have been easy to keep IMHO

"12 months on, 2 floors no takers"

That is how commercial landlords learn the new market reality.

The commercial landlord will be looking to keep headline rents unchanged as this affects the property valuation. If the property valuation falls, then the owner may need to reduce their debt to maintain lender maximum LVR limits. The commercial landlord may not have funds available. Look at the capital raisings some commercial property partnerships are having to undertake in order to reduce their debt levels.

Yep. All the mid market commercial property trusts using other peoples money are about to be the finance companies of the GFC.

The lies of the ponzi...

This is privately owned, was a great tenant, just stupidity all around......

"This is privately owned"

1) When was the property purchased?

2) is it leasehold?

The land lease may have been renewed at a much higher rate and the owner may have been unable to absorb the higher cost.

I wonder at the reaction of the lender and landlord to an empty property zero income and a much lower valuation, retaining the tenant at current rent may have reduce profit but still a profit - and another one bites the dust.

Scooby Doo Ruh Roh

Hold on we about to go non linear.

I have worked all my life in banking, until now...., and talking to those still in the game, it's about to blow, money shot time for DGMs

God I am glad to be out

I understand local Banks have teams wargaming the various scenarios of the NZ housing market and they are all clutching pearls and sphincters ATM.

From reduced revenues as the market has locked up on Very Low Volumes, then the Resi Mortgage stress/slowmo defaults (not yet reported as defaults) as each Bank is NOT MARKING or REPORTING TO MARKET as to truth of their currently stressed customers and next/soon as the Western World CRE crash is filtering into NZ ......

Don't worry if all the locals have given up, some guy in India now runs that .....

"I understand local Banks have teams wargaming the various scenarios of the NZ housing market"

They've been at it for quite some time now. I got to add a few scenarios to the list that they hadn't considered as either possible or likely - I explained why they were both possible, and not as unlikely, as they believed. Economic history is well worth studying. Always the same, but always different [evil grin]. To be fair tho - my added scenarios can be 'headed off at the pass' if one knows they're coming.

Care to elaborate on your "added scenarios"? Would be good to get some different perspectives on how things could play out.

I have already alluded to some of them in a general way.

Lots of noise about non productive people when the focus should be the non productive debt. Thats what is dragging down all attached to it. How long will the banks extend and pretend.

When the first bank starts to gas the unproductive its all on...

What .... like Donkey Kong?

You can have a productive entity effected by its debt and declining revenues.

Some people don't factor in negative enough scenarios. But it's also difficult to envisage how bad things could get.

A more fiscally conservative entity, isn't necessarily productive. It's likely more risk adverse, and more conservative in its approach.

We really need more risk takers, but not enough people are keen enough.

The liquidators are like honey badgers...... it's about to start..... great buying in distressed assets $1 reserve

I suspect that as defaults mount, liquidity reduces and mark to market gets in full swing there will be pips squeaking and not just the borrowers, current global unrest/protest is being ignored but it will not go away in the current climate and a mass crisis will allow the perception of those responsible to be played out in horror movie style.

Take more risk....how many more housed to paint did you buy then to fit in with your narrative.

Buying houses isn't really part of my business interests. I'm talking about actual active business. Producing or making stuff.

Personally I've had half a handbrake on since early COVID, because this isn't a stable environment, and I'm ok just turning over what I am. Much of what I do is export product, the next step up in production would require a decent capital outlay which can pay for itself, but not if there's a global slowdown, which would involve oversupply, falling prices and volumes. So rather than wager half a million dollars to double revenue and reduce input costs, I'll just sit on the sidelines.

Fact is, credit fuels a lot of business' expansion and operation. If a business is geared towards debt costs and revenues of the mid 2010s, it can be a decent business, but this environment is going to undo some of them.

in 2010 you could buy a Manurewa 800 sq m for about 310k ... i do agree we may go back to that

$699 a week rent and 7% mortgage almost cash flow positive

History in the midst of a repeat.

Learn from it and see especially from 3.30mins:

The Big Short (2015) - American Securitization Forum (10/14) (youtube.com)

We have short memories and NZ Ponzi House Traders just love Risk!!

The best buying is at the bottom of the big dip when the central banks say OH SHIT , ie OCR hits rock bottom....

Hint it may be -ve this time

"NZ Ponzi House Traders just love Risk!!"

Many believed that there was no risk in buying residential property as house prices had only gone one way for the last 50 years. They believed that house prices don’t fall by much.

At the peak

1) it was unthinkable that house prices could fall more than 10% from their peak

2) the property promoters with their vested financial interest repeatedly told them that there would be no house price crash

Then look what happened in Auckland and Wellington.

If people didn't view the 2021 and 2022 pricing of houses as being pretty extenuating and fleeting they're not very aware.

Even Cindy knew.

The politicians reckons of 2020 to 2022, we're as useless as INDEPENDENT ECONOMISTS reckons.

Many, many got price duped and did not make rational buying decisions. Unfortunately these are life changing decision's.

Thousands have done all their dough and now know the danger of rampant speculation.

The same bad buying decisions are being made now! Beware!

Now we have REAL Drops of -20 to -48% as the price got so far out of whack to the "income" the asset could earn.

"Earned Income" - a new word for some, yet a word many are becoming familiar with now......

This biggest asset price drop since the 1970s, in still in play. This almighty reset is not done yet!

It has barely started

Economists may use rbnz in future as a case study in how to avoid asset bubbles and crashes... i.e. not to drop rates too low for too long, miss the start of inflation and then have to rise the rates too fast.

They will probably also explain how the following impacted the huge crash..

- no CGT

- tax laws that favored investment in property over productive business

- a over reliance on an over paid real estate industry

- a lack of competition in many markets leading to over inflated pricing assisting inflation.

- beaurcracy preventing sufficient new house builds

Basically conditions for a perfect storm in house price and complete economic crash.

They will wonder why we didnt learn from ireland. Genius.

"They will wonder why we didnt learn from ireland"

When asked about the house price bubbles overseas, here was a response as to why they didn't apply to the housing market in NZ:

1) In Ireland, vast amounts of over-building, bank collapses and a very sharp economic downturn were enough to trigger their 50 per cent-plus crash.

2) Spain's 35 per cent slump was triggered by banking collapses, over-building, an ageing population and a long grinding recession.

3) US housing prices fell around 30 per cent in most markets through 2007 and 2008 because of an over-supply of new houses, bank collapses, higher interest rates and then a recession.

House prices fell globally in the late 1980s (although not that much in New Zealand) because of a sharp rise in mortgage rates to over 20 per cent in some cases.

Australia's house prices have fallen around 10 per cent in the last 18 months because of much tighter bank lending rules and a big increase in apartment supply, especially in Sydney and Melbourne, where prices are down by 15-20 per cent.

But none of those things have happened in New Zealand in the last 30 years and are unlikely to in the next decade at least.

Another response on interest.co.nz by a commenter:

USA - fraud and overbuilding

Ireland - economy collapse, unemployment to 16%

Spain - economy collapse, unemployment to 26%

Japan - literally the modern formative lesson on 'dont hike rates in to a bubble'. Following this lesson all major economies instead cut rates to reset yields and if needed monetize.

none of these are examples that are relevant to NZ.

Because you have not made a case for either overbuilding, fraud or an increase in unemployment to extremely high levels. Without that basis none of your examples are relevant. You have put the cart before the horse.

In Ireland, vast amounts of over-building, bank collapses and a very sharp economic downturn were enough to trigger their 50 per cent-plus crash.

If you translate 'bank collapses' into limited availability/cost of credit (an oversimplification, but hey...) then I would argue things are not so different. Yes, even the over-building bit to an extent. We could argue about that one, but I'll just say that as things get worse here, I would not be at all surprised if you start to hear noises about a 'glut' or 'oversupply'. Both houses for rent and houses for sale to continue rising in my opinion. You can quote me on that one :)

The reason for quoting past comments is to understand the narrative at the time that led market participants into choosing their particular course of action.

What were they thinking when they made their choice? What was their decision making framework they were using when they made their choice?

The current house price correction in NZ is a great case study to follow in real time to understand the narrative changes that led to the elevated house price risks and subsequent house price falls, as well as why lessons from other house price bubbles were dismissed and not applied.

Most people fail to learn the lessons from history, and repeat the same mistakes.

"If people didn't view the 2021 and 2022 pricing of houses as being pretty extenuating and fleeting they're not very aware."

Those that were aware and highlighted the risks were negatively labeled and there were repeated attempts to discredit their risk warnings by those with their vested financial self interests.

This is what some commentators on interest.co.nz were saying at the peak. They may or may not have vested interests. The point is that these commenters are unable to see the impact of their advice at that time on those highly leveraged buyers in late 2021 - 2022.

Imagine an owner occupier taking their advice at the time, using ALL their life savings (incl Kiwisaver) and taking on large amounts of mortgage debt to purchase an owner occupier residential dwelling, who is now in cashflow stress, mental stress and could lose their owner occupied home in a mortgagee sale, and now face life changing financial circumstances which result in a deterioration of lifestyle at retirement. Many have experienced a significant loss in their equity deposit (some may even be in negative equity) and facing cashflow stress.

Names omitted intentionally (but these commenters are still active on interest.co.nz)

a) 9th Nov 21, 2:38pm

"I have always looked at this from the opposing direction - the risk in not owning a property? If you do not own a property you are short, not even square, but short"

b) 9th Nov 21, 5:52pm

"Or maybe right the opposite, don't hesitate, be brave and go for it, you'll be fine"

c) 23rd Nov 21, 8:52am

"It makes absolutely no sense for a couple like this to bank a capital gain now rather than wait two years and avoid 90k in taxes. The market is not going to crash 10% in the next two years."

d) 9th Nov 21, 2:38pm

"locally, I can not see anything in the near future that would decrease these current values."

e) 14th Oct 21, 11:25am

"Shrewd investors will capitalise on perceived price weakness - cementing their position for the next market upswing.

Well located property remains a prime investment for the long term. (But you already know that.)"

f) 9th Nov 21, 6:50pm

"Odds on anyone still able to buy a house and make the mortgage repayments and has the right attitude will come out the the other side."

If these commenters did not have any vested financial self interest, then they didn't know what they didn't know. They didn't know about the extremely elevated house price risks.

1) it was unthinkable that house prices could fall more than 10% from their peak

2) the property promoters with their vested financial interest repeatedly told them that there would be no house price crash

Here is the experience of a first home buyer which was shared on interest.co.nz

"Although being FHBs we were told many times “house prices always go up” “you never loose when buying in Tauranga” etc. I often argued these statements but with a decent income, sick of renting and a couple of kids, it made sense to buy for stability - if only the stability part remained true."

A reminder of what property commentators saying at or just after the peak:

1) Tony Alexander - 19 reasons why there's no crash - December 2021

https://ndhadeliver.natlib.govt.nz/delivery/DeliveryManagerServlet?dps_…

2) Catherine Masters - July 2022

Why the New Zealand housing market is nowhere near crash point

https://www.oneroof.co.nz/news/why-the-new-zealand-housing-market-is-no…

3) Ashley Church - April 2022

Four reasons the housing market won't crash

https://www.oneroof.co.nz/news/ashley-church-four-reasons-the-housing-m…

4) Kelvin Davidson - Dec 2021

“But will prices actually fall? I’m not convinced because in the past a serious housing downturn has come with a recession, but no one is suggesting that and unemployment is low at 3.4 per cent.”

https://www.stuff.co.nz/life-style/homed/real-estate/127305870/what-lie…

5) Nov 2021 - Here's why it might be fruitless to pin your hopes on a house price crash

https://www.stuff.co.nz/business/300449314/heres-why-it-might-be-fruitl…

.

house prices had only gone one way for the last 50 years.

Pretty much. Go back just a few years more though... Had you bought in - I think - about 73 and caught the roughly 40% drop, you'd have had to wait about 20 years for the price to recover in real terms I think.

"Had you bought in - I think - about 73 and caught the roughly 40% drop, you'd have had to wait about 20 years for the price to recover in real terms I think."

House prices in real terms peaked in 1974, recovered to that peak in about 1995 (remember that this is before the impact of leverage)

Refer Figure 4, https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/publications/…

The next headache (after over-leveraged FHBs moving back with mum and dad) will be those who traded up to McMansions and now cannot afford the maintenance and upkeep for all the extra rooms. Pools, home cinemas, saunas, ride on mowers etc all add up.

Guess they'll be selling the boat, the ranger and the batch to manage it. Poor things

How many of the Bank of mum and dad who borrowed against the equity in their house in the 2020 - 2022 period to be used by their adult children as a deposit to buy are going to get caught out?

There are two groups here:

1) first home buyer adult child who may have seen that deposit shrink or even evaporate (i.e negative equity)

2) mum and dad who are left with the debt or the guarantee of a portion of the adult child's mortgage - may also have seen a shrinkage in their equity.

re ... Bank of mum and dad ... Well spotted. The risks to financial stability are mounting fast.

There are also those instances of income of boarders (that are non existent) that were included in mortgage loan applications on the advice of the vested financially self interested mortgage broker in 'helping' the borrower find a financing solution.

As well as those people who may be unaware that they have become joint and severally liable as they co-signed the loan in order to meet the increased income required to support the higher mortgage amount to purchase the property in 2020 - 2022 period.

Mortgage brokers were gaming bank lending criteria for borrowers in order to get paid from lenders.

Some observations on the bank of mum and dad:

1) The Bank of Mum and Dad plays a sizeable role when it comes to helping young home buyers on the property ladder, ranking fifth after ANZ, ASB, Westpac and BNZ when it comes to owner-occupier loans. The Bank of Mum and Dad (BOMD) has doled out a whopping $22.6 billion in financial support.

https://www.consumer.org.nz/articles/the-bank-of-mum-and-dad-is-the-fif…

2) "Mortgage brokers report around 70 per cent of first home applicants have some sort of help from what is colloquially known as the Bank of Mum and Dad (or BoMaD). Banks report a slightly lower percentage; anecdotally around 60 per cent."

https://www.oneroof.co.nz/news/pros-and-cons-of-borrowing-from-the-bank…

3) Here is one commenter on interest.co.nz

14th Sep 21, 11:25am

"Yep my sons are getting their funds from the Mum and Dad Bank, aka MAD Bank"

The non-performing housing loan ratio, at 0.5%, is at a 10-year high.

It is however, still well below the kinds of highs seen in the aftermath of the Global Financial Crisis, when the ratio got up to 1.2% between 2009 and 2011.

re references to the GFC - Worth noting that this time it wasn't the commercial sector creating the mess - it was - and is - our public institutions. And in NZ's case - the RBNZ is the most culpable.

Let's not forget that one of the RBNZ's responsibilities is to ensure financial stability.

With NPLs rocketing ever upwards - and showing no signs of a 'top' - financial stability becomes a very real issue as the contagion spreads and the dominoes start falling faster.

So what did the RBNZ do last time - during and after the GFC? Anyone remember?

This graph should jog memories: https://www.interest.co.nz/charts/interest-rates/ocr

(Worst central bank ever? Probably.)

Edit: For those that don't know, a stock market crash isn't a big deal in the grand scheme of things. But a property crash is - due to the massive sums being wiped out that effect just about everyone's wealth - a massive deal. It was the root cause of the GFC even though property prices didn't fall all that much as debt to income ratios were less in most parts of the world. (Central banks could be argued to be the true root cause as they triggered the housing slump with unnecessarily high interest rates.) Not so now as debt to income ratios are higher now than leading up to the GFC in many countries ... Especially in NZ. I'm not usually such a pessimist as I can usually see a route out of a disaster. But if the RBNZ doesn't act - and I think it may already be too late - this will turn into a massive sh1t show!

What you do have different this time though, is a lower amount of low equity lending over the past 5-10 years.

So people will take longer to bleed out/the RBNZ can attempt inflation crushing longer.

Remember the RBNZ threw out LVRs during covid? And bank's are still allowed to make low-equity loans up certain %. And many loans with mum & dad as guarantors are in fact low equity loans. And you can add quite a few property 'investors' to that list as has been noted for many years now. And let's not forget that RE values have fallen by 15-20% and those losses come out of the owner's equity and not the bank loans. With the huge number of dwellings for sale currently it'd only take a small number of destressed sales and prices could easily fall another 10% - and the number of low-equity loans grows considerably.

There are many more low equity loans out there than most are aware of.

How many?

The band of post COVID, low equity mortgages issued would be narrow, in the context of the entire mortgage market. Unlikely to be anything close to 2008.

The Banksters war gaming the scenarios of this unfolding collapse - are shisting bricks.

Even the T .A . Toad,is seeing the brick wall coming up fast, in front of his speeding Onewoof Spruikerville clown car.....

TATs all folks. Thanks for being led astray, as in paying over the odds on housing NZ, says ole Tones, as be banks his Real Estate vested interest media money.....

LOL. Banksters aren't shisting bricks just yet. That'll come later. But financial & economic modelers certainly are.

"How many?"

I am contractually prohibited from disclosing the numbers I have. But much of what you need to make a reasonable guestimate is in the public domain.

"Unlikely to be anything close to 2008."

It is assumptions like that which causes massive financial collapses. See 2008/9/10. And more recently, banks in the US making huge losses on low interest bonds that must be marked to market. Never assume. Reality has a bad habit of tearing down assumptions and making us look very foolish when we say, "nobody could have seen that coming".

All that said, with the right action (and the most likely action IMO), the worst case scenarios are unlikely to play out.

It is assumptions like that which causes massive financial collapses.

There was nearly a decade of low equity lending. People getting 110% mortgages.

Vs what, 18 months, on reducing sales volumes, and a dip in FHBs.

In the absence of additional information to the contrary, it'd appear the exposure risk to underwater mortgages is lower now than 2008.

Wrong.

With values soon to be at the 2017 to 2018 levels again, all refixing to much higher mortgage rates........many 10s of thousands will be well underwater.......and really struggling to pay over 5% mortgages.

"When it's this bad, they just have to lie"

If someone bought in 2017 with 10-20% down.

And they've been paying a mortgage for nearly 8 years.

The pricing has to fall lower than 2017 levels for them to be significantly under water.

Those 20teens borrowers all topped mortgages, getting drunk and partying on the banks good graces.

My did the banks, lavish all in sundry with whatever topups were requested!

Holiday homes, boats, SUV,s, Week in Hawiiiiiiii......

Comming home to roost my friend.

We'll soon see if no one paid any principle in the past half decade or so, for sure.

On a 30 year table mortgage the amount of principal paid back in the first years is tiny.

The wonderful bank - who ensured you borrowed as much as you could and you were grateful for it - pockets the majority of repayments as interest. (One of the reasons I harp on about focusing only on needs, and not wants, and keeping the mortgage term under 15 years or as short as you can.)

This calculator makes the above statement abundantly clear ... https://www.interest.co.nz/calculators/full-function-mortgage-calculator

(Probably one of the best mortgage calculators around for FHBs. The ones that present interest savings as lump sums don't focus buyers minds in the right place.)

Let's not forget that one of the RBNZ's responsibilities is to ensure financial stability.

To address financial stability risks, the RBNZ did try to expand their macroprudential tool box in 2016. The then Finance Minister did not approve that request.

https://www.interest.co.nz/property/85201/reserve-bank-confirms-meeting…

But a property crash is - due to the massive sums being wiped out that effect just about everyone's wealth - a massive deal.

Residential real estate reached a peak value of $1.76 trillion. It is the biggest asset class in NZ

CN. You're another gem.

Its common knowledge now that banks have removed the word default from the vocab and replaced with capitalising, topup, or no action required. Perhaps they are being nice - or is there a business rationale behind this?

https://www.stuff.co.nz/business/350236906/weak-housing-market-blamed-r…

Liquidation of this real estate related business

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.